Approaching The Final OpEx Friday Of 2025: December 18 Stock Market Preview

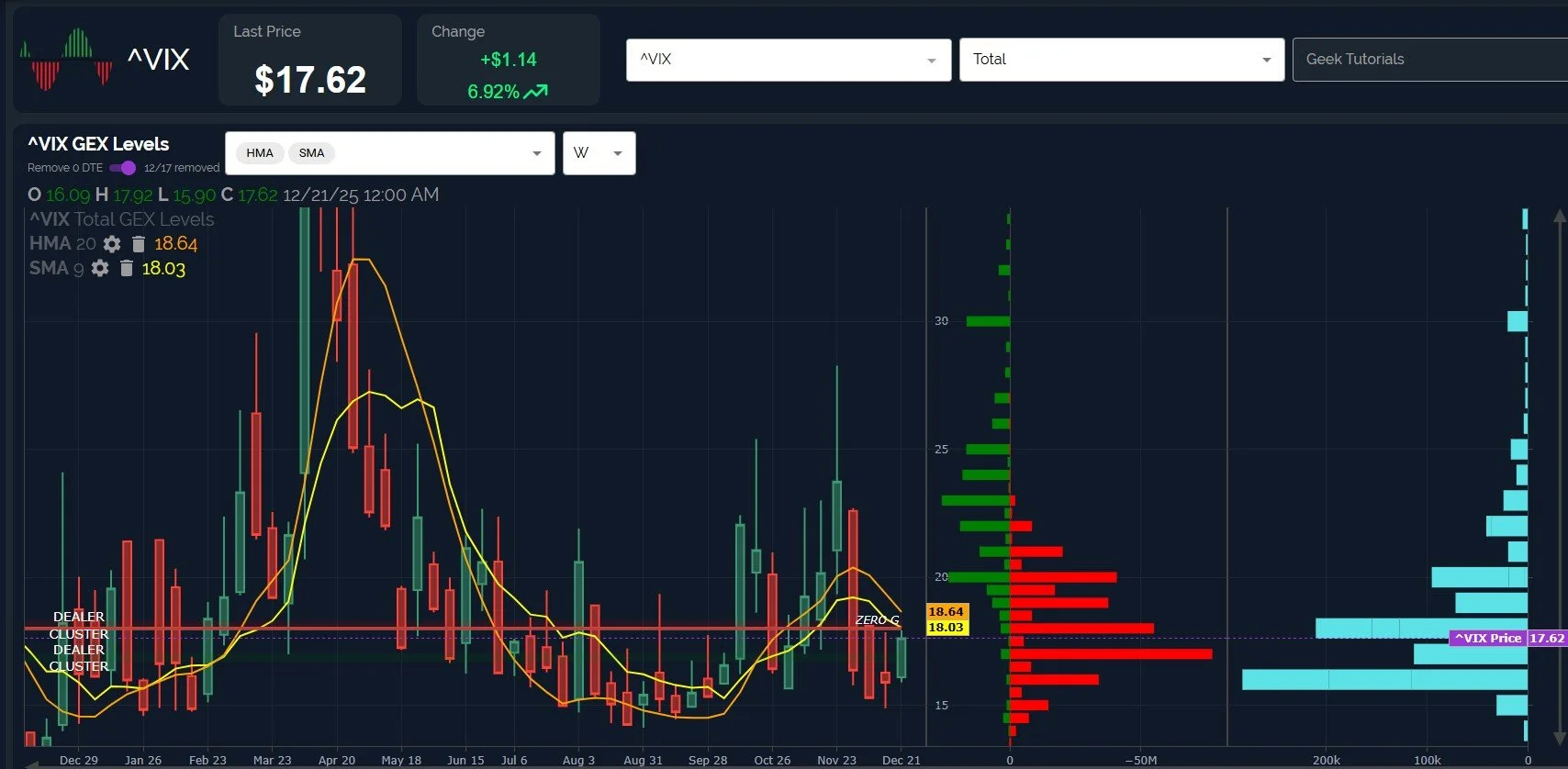

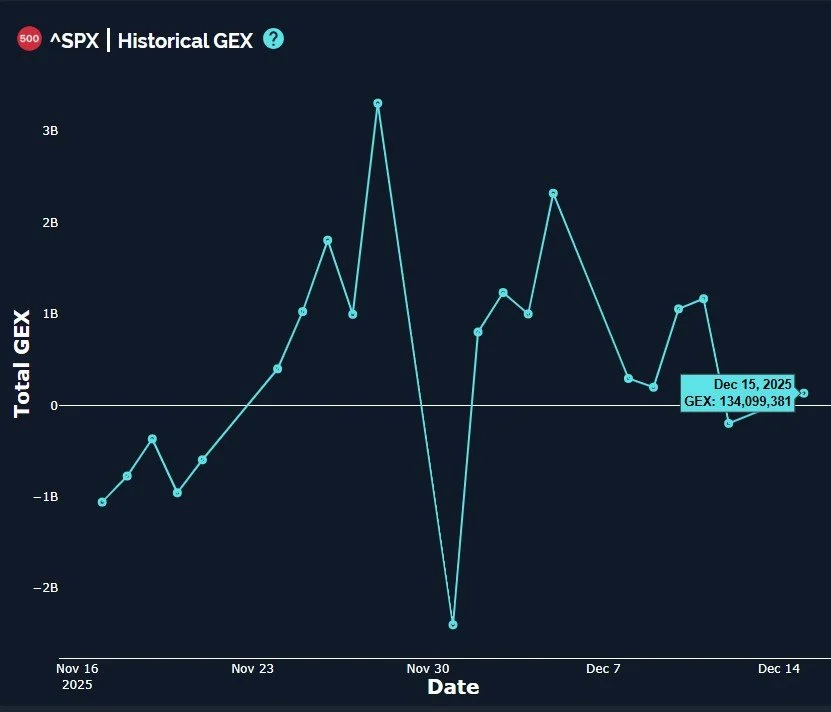

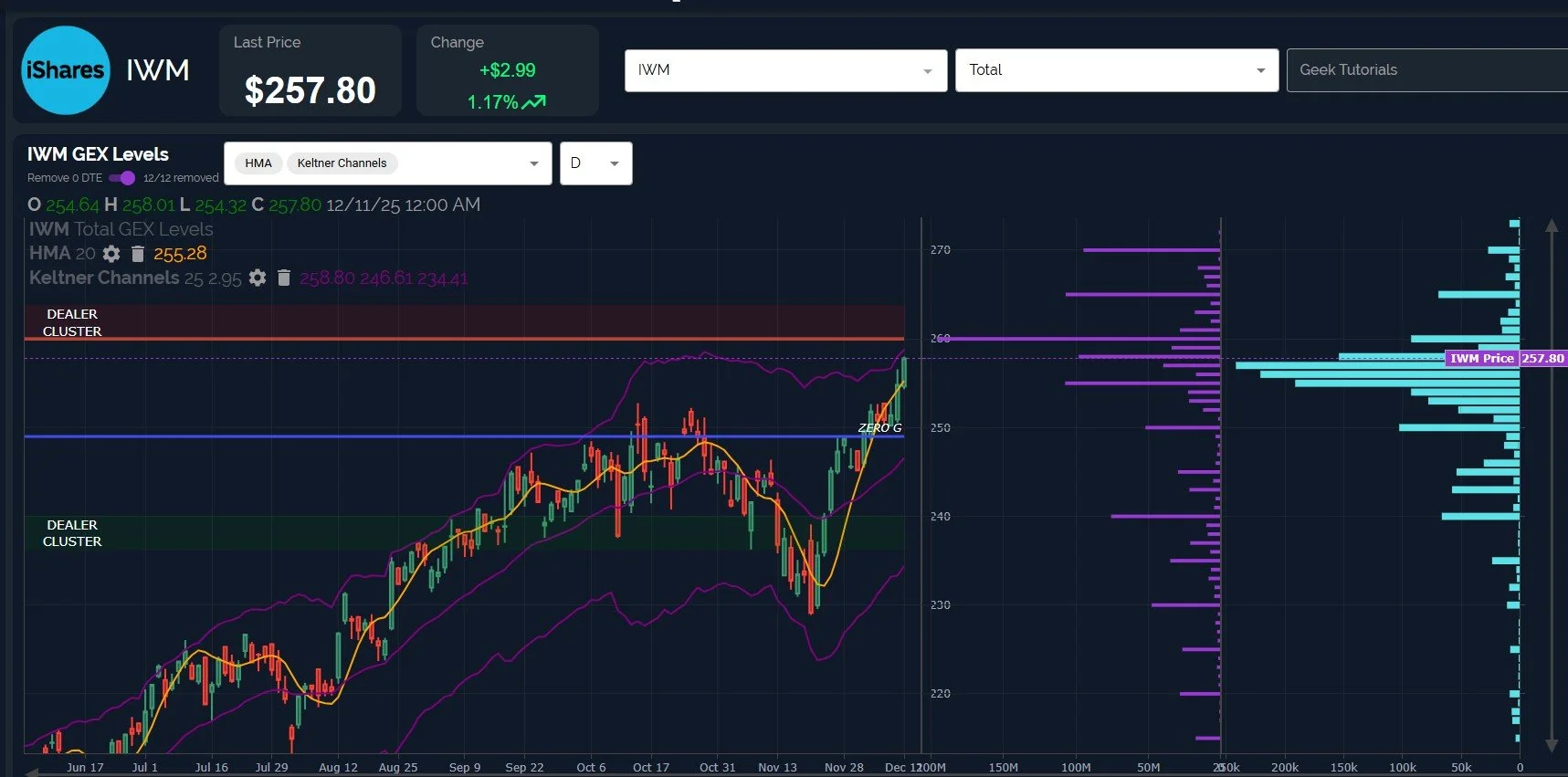

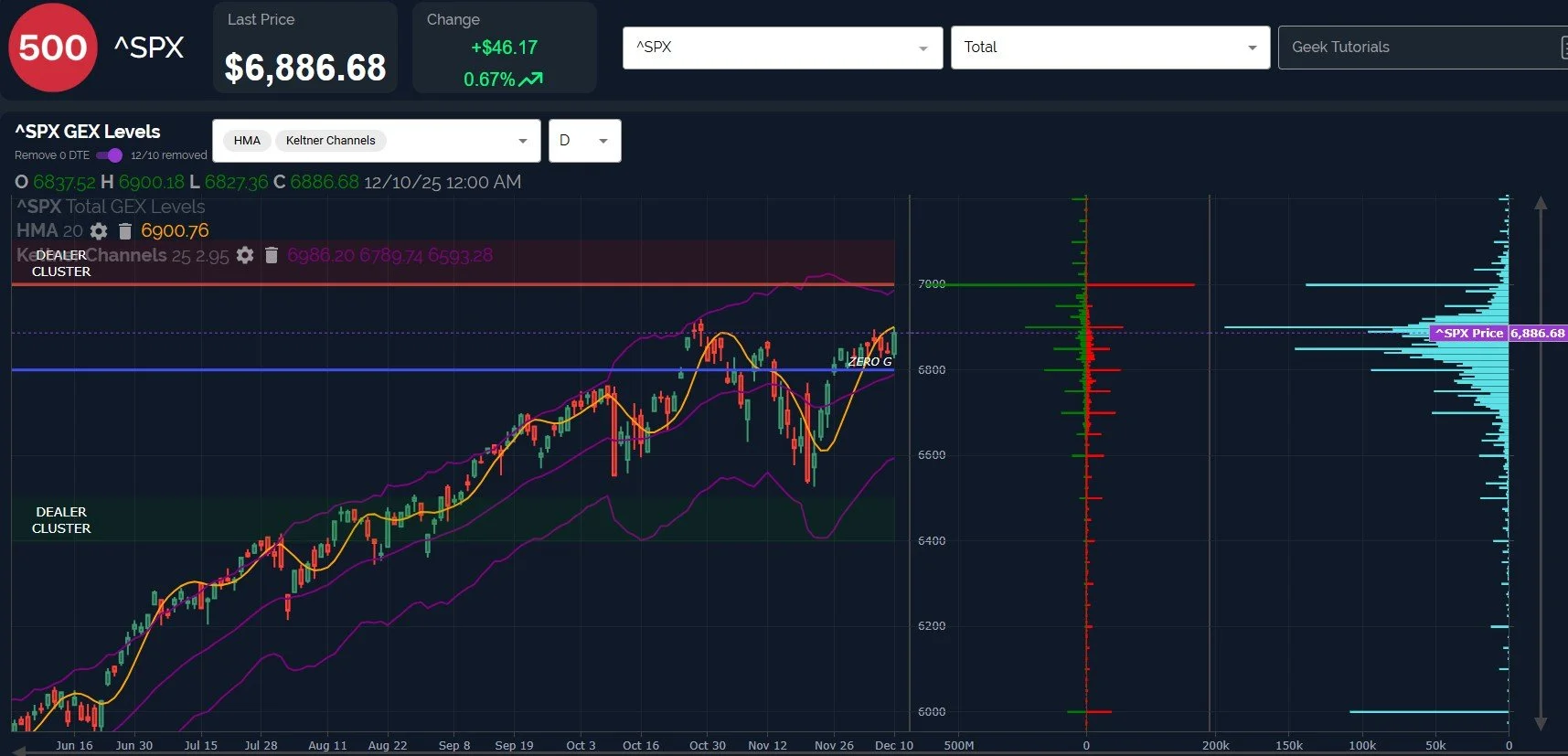

December 18 Stock Market Preview: Indices dropped further today, bringing the VIX to initial weekly resistance while IWM closed just below important weekly support. GEX at SPX 7000 has diminished relative to the 6800 strike. What appears to be likely as we approach the end of OpEx week and the final trading days of 2025?

SPX Into OpEx: Tricks Up The Sleeve? December 17 Stock Market Preview

December 17 Stock Market Preview: Things are getting interesting with the SPX GEX picture heading into OpEx Friday, with a hgue negative GEX cluster at the 7000 strike. With VIX expiration tomorrow, could we see a surprising move heading into Friday?

GEX Divergences And VIX Expiration: December 16 Stock Market Preview

December 16 Stock Market Preview: With VIX expiration Wednesday and OpEx Friday, we may see an interesting week with moves in both directions. Let’s look at some divergences that occurred today as well as looking at the largest clusters expiring Wednesday premarket for the VIX.

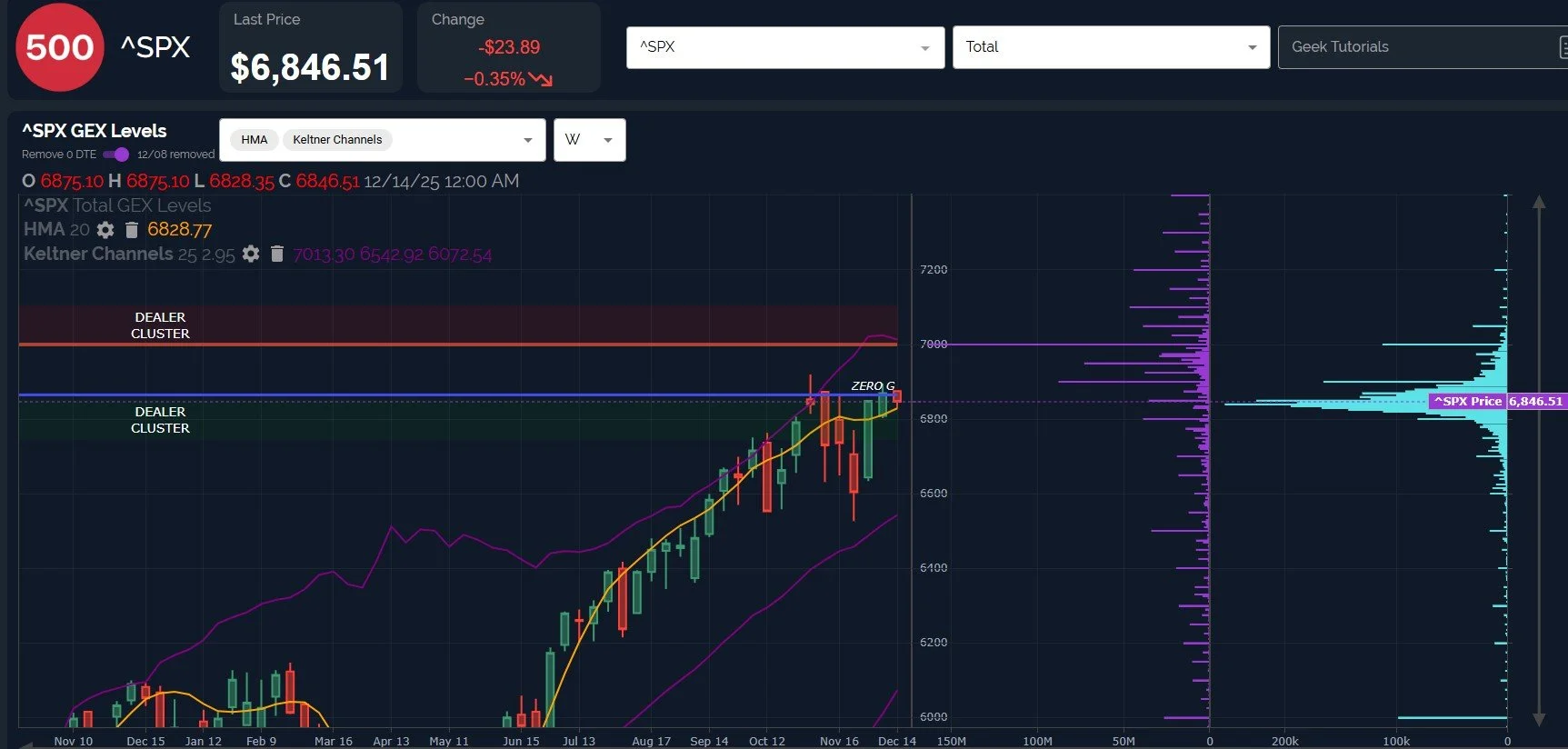

SPX Still Holding Weekly Support: December 14 Stock Market Preview

December 14 Stock Market Preview: Markets displayed weakness Friday, though a closer look reveals a mid-morning low, followed by a recovery attempt, and the VIX was contained. The VIX remains below 16, yet the VIX also maintains above the Hull Moving Average, raising the risk that Friday’s weakness may show a resurgence in the short run (or if the VIX approaches 14.7 again). What does GEX say?

Watching IWM For A Sign: December 12 Stock Market Preview

December 12 Stock Market Preview: SPX is less than 2% away from the huge positive GEX cluster at 7000, and the VIX is at key support, below the largest negative GEX cluster. Is a short-term turn lower imminent?

Inching Toward SPX 7000: December 11 Stock Market Preview

December 11 Stock Market Preview: 2025 gave us yet another fairly uneventful FOMC day, with the VIX getting crushed back toward the Hull Moving Average, exactly what we suggested as a possibility yesterday. With indices pushing higher and the VIX lower, what appears most likely entering the back half of the week?

Navigating FOMC Trading With GEX: December 10 Stock Market Preview

December 10 Stock Market Preview: As we approach the FOMC announcement Wednesday, the VIX appears to give market bulls some hope, though other indices are less certain. What does GEX tell us about the most likely possibilities going forward?

“Bear Tease” Into FOMC: December 9 Stock Market Preview

December 9 Stock Market Preview: Today’s market weakness technically broke the daily Hull Moving Average by the close, but not in a definitive manner. Indices still hold key weekly levels of support as well. With the VIX up 8%, are we setting up for a big drop, or simply providing more fuel for a VIX crush post-FOMC announcement?

SPX 7000 Still In The Crosshairs: December 8 Stock Market Preview

December 8 Stock Market Preview: We’re rapidly approaching the make-or-break timeframe for our year-end 7000 GEX target, a level we’ve been watching for months. GEX positioning continues to indicate a strong likelihood for an approach close to or just above that level. What else can we glean from the VIX and other indices that may help or hurt that potential scenario?

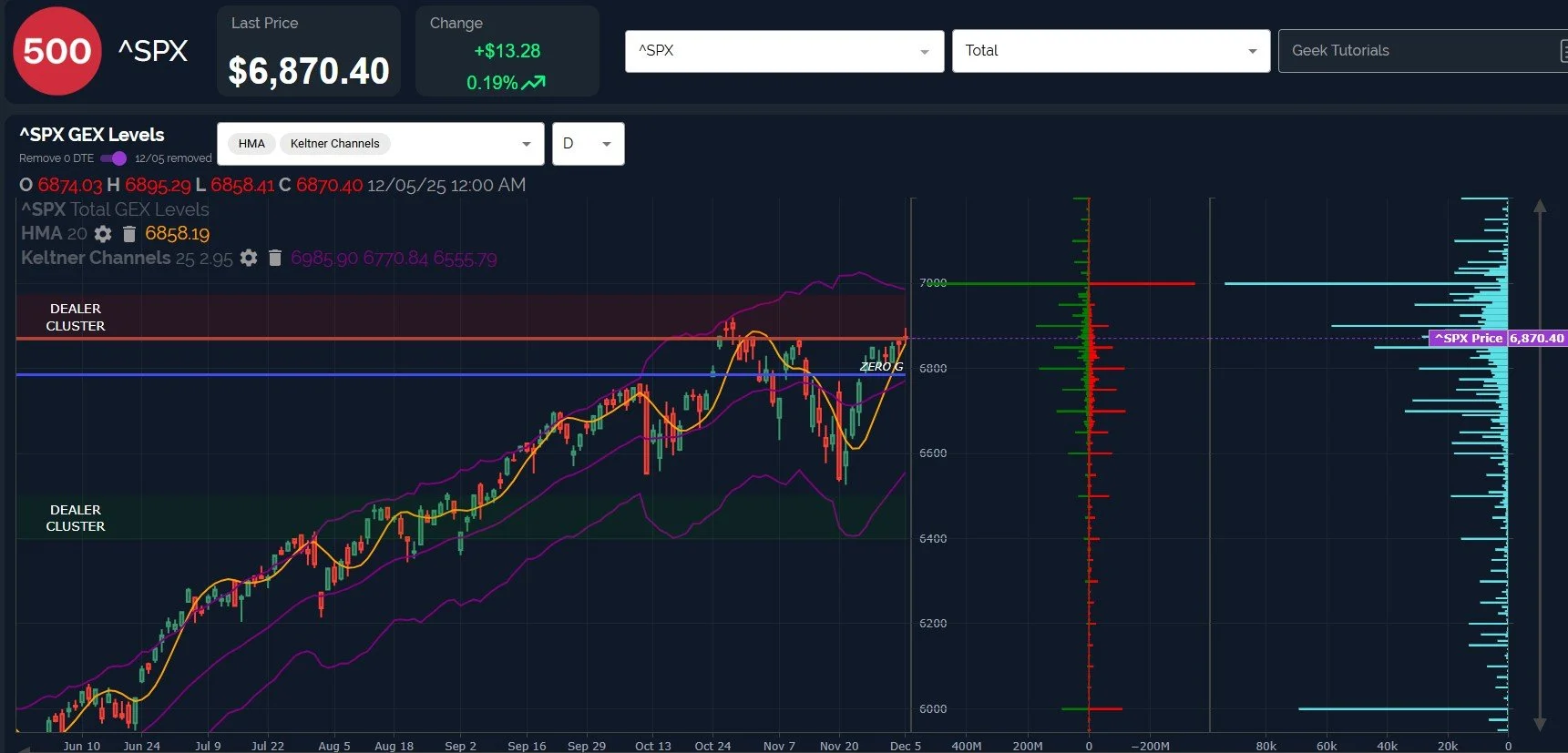

A Bullish Friday Ahead? December 5 Stock Market Preview

December 5 Stock Market Preview: The VIX continues to appear weak as indices consolidate sideways, though IWM has taken the lead to the upside, tagging 250 and closing above it. Odds favor a continued move higher, but declining GEX for QQQ and the VIX approaching 15 may give cause for concern as to the longevity of any upside move from here.

IWM Taking The Lead: Reversal Near?December 4 Stock Market Preview

December 4 Stock Market Preview: Multiple layers of support exist beneath the indices as they maintain upside potential into year-end. IWM is taking the lead, which is encouraging, while QQQ currently lags. A near-term pullback may still leave room for a move toward SPX 7000.

VIX Rejecting 17: The Coast Is Clear?December 3 Stock Market Preview

December 3 Stock Market Preview: IWM’s negative divergence today gives some cause for concern, but overall, indices moved higher, and even IWM appears poised to continue higher, as long as certain key levels are held. Let’s take a closer look at the indices as well as the VIX.

GEX Whipsaw: Noise Or Warning? December 2 Stock Market Preview

December 2 Stock Market Preview: Friday’s extreme positive GEX reading on SPX seems to have served its contrarian role, with SPX dropping modestly today. We have a number of conflicting technical+GEX signals, so let’s take a closer look at what might happen next.

Year-End Is Here: SPX 7000 Or Bust? December 1 Stock Market Preview

December 1 Stock Market Preview: With the odds of reaching SPX 7000 seeming to have increased thanks to the recent strong rebound, we may be due for a pullback to test the resolve of bulls into year-end. Tonight, we take a look at some key levels we’re watching and why the VIX may see a rebound attempt imminently.

Thanksgiving Special: Who Gets Roasted Besides The Turkey? November 28 Stock Market Preview

November 28 Stock Market Preview: Indices have been rallying frantically this week, apparently heading for upside targets with a deadline in mind. The shift has been undeniably bullish in the short run, but we are now at a point where we might be encountering a case of “too far, too fast,” as hinted yesterday. The half-day this coming Friday (the next trading session) may contain some interesting signals and moves, so let’s take a look at what we believe the data suggests as the most likely paths forward.

Are Bulls In The Clear? November 25 Stock Market Preview

November 25 Stock Market Preview: Indices maintained strength today and the VIX melted down, closing just above the 20-level. Is the coast clear for the bulls to sail to 7000 SPX, or is this another trap? Maybe somewhere in between? Let’s take a closer look.

Rallying Into A Decision Point: November 24 Stock Market Preview

November 24 Stock Market Preview: Indices concluded OpEx week with the first close below the weekly 9 SMA since the week that started the March/April drop, at least in the case of SPX and QQQ. Will this shift mark the beginning of a larger decline, or will remaining positive GEX clusters at SPX 7000 defy the warning and lead bulls to redemption (religious analogy as opposed to fund redemption)?

Whelp..The Cat Is Definitely Dead! November 21 Stock Market Preview

November 21 Stock Market Preview: Today’s big gap up ended in a spectacular reversal lower, flushing to new post-October lows by the close. When does the pain end for bulls? Let’s look at a few key levels given today’s rejection.

Dead Cat Bounce Or Lasting Bottom? November 20 Stock Market Preview

November 20 Stock Market Preview: Indices still refuse to show a lot of strength following the beating of the last couple of weeks, but we do see some after hours strength from NVDA following their earnings report. Will the strength last? Let’s take a look at a few metrics to watch tomorrow for clues as to the staying power of any rebound.

Short Term Bounce? November 19 Stock Market Preview

November 19 Stock Market Preview: The VIX attempted to move beyond the big 25 GEX cluster we’ve been watching that is set to expire tomorrow morning, facing rejection and a close right within the range GEX has suggested as we approach monthly VIX expiration. We also see some positive divergence from IWM, though nothing yet from VVIX. Can the market bounce heading into the 2nd half of the week?