A Bullish Friday Ahead? December 5 Stock Market Preview

You can view today’s YouTube video here. Today’s YouTube video takes a look at some recent trades of ours as well as overviews of the indices and some stocks, so check it out!

IWM continues leading the way higher, with SPX and QQQ seemingly asleep at the wheel.

Given my past experiences and observations of IWM, I think IWM’s performance alone increases the odds that QQQ and SPX play “catch-up” to some extent, potentially as soon as Friday.

In addition to IWM’s strength, I always try to say something nice about the VIX (great personality!), but there’s really just nothing nice to say at the moment..The Keltners on the 4-hour chart indicate a strong downtrend, the Hull Moving Average is careening lower, and the VIX has been wicking with each attempt to breach and hold above the Hull.

Despite not seeing large GEX at 15, the technicals strongly seem to point to at least a brief spike low near 15 or just above.

The VIX dropping to 15 likely implies the indices rallying, in theory. Threats to the bullish picture include the VIX holding above 16.25, which would likely mean the VIX pummeling is over for the short term.

tradingview.com

SPX is holding above the Hull, and the 7000 GEX cluster we’ve been repeating for months is looming overhead in magnetic fashion. Can SPX find the strength to climb 2.5-3%? It seems like a lot of points, but percentage wise, completely realistic.

Closing with a daily candle below 6825 starts to make continued upside look a bit dicey, so bulls want to see continuation higher soon.

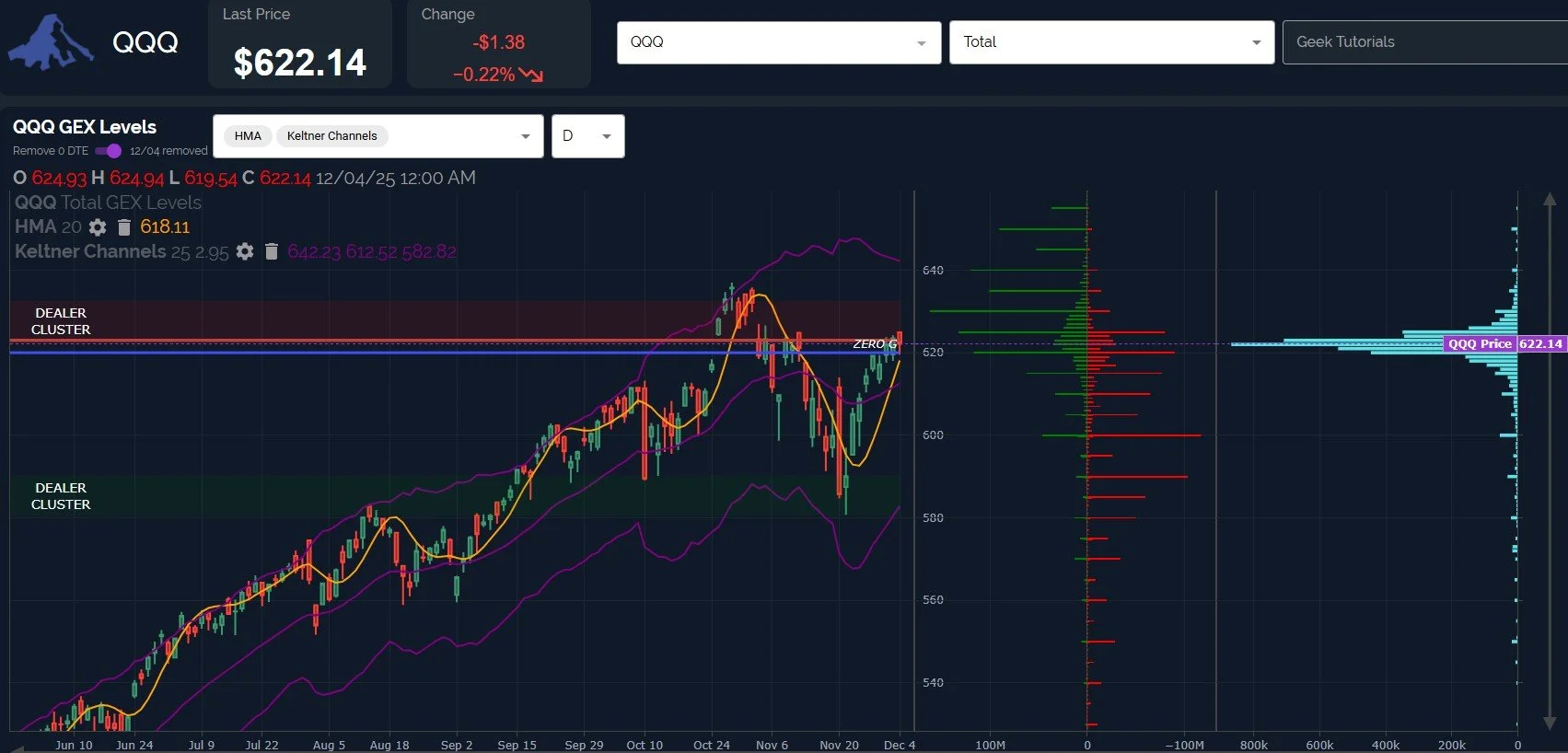

QQQ has been the weakest, and GEX continues heading downward, now almost to the zero line in terms of net GEX.

That said, we still see a large positive GEX cluster at 630, with potential to move to 640, also matching the upper Keltner channel.

Holding 620 is now key. Futures currently show QQQ nicely positive, but it remains to be seen whether or not the rally holds into the cash session tomorrow.

IWM’s high today at 252.66 was .11 below the October high, but the momentum appears stronger this time, and GEX overhead at 255 and 260 that may represent solid targets.

Most of the daily option volume (in light blue) continues to be at lower strikes, interestingly.

Maybe we’re headed for a quick reversal back down after SPX concludes its business toward 7000? I don’t think we’ll have to wait long to find out…

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who share their thoughts, and we share analysis every day as well.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.