SPX 7000 Still In The Crosshairs: December 8 Stock Market Preview

You can view today’s YouTube video here. Today’s YouTube video takes a look at major indices, BTC, PLTR, GLD, and TSLA, so check it out if you have a few minutes!

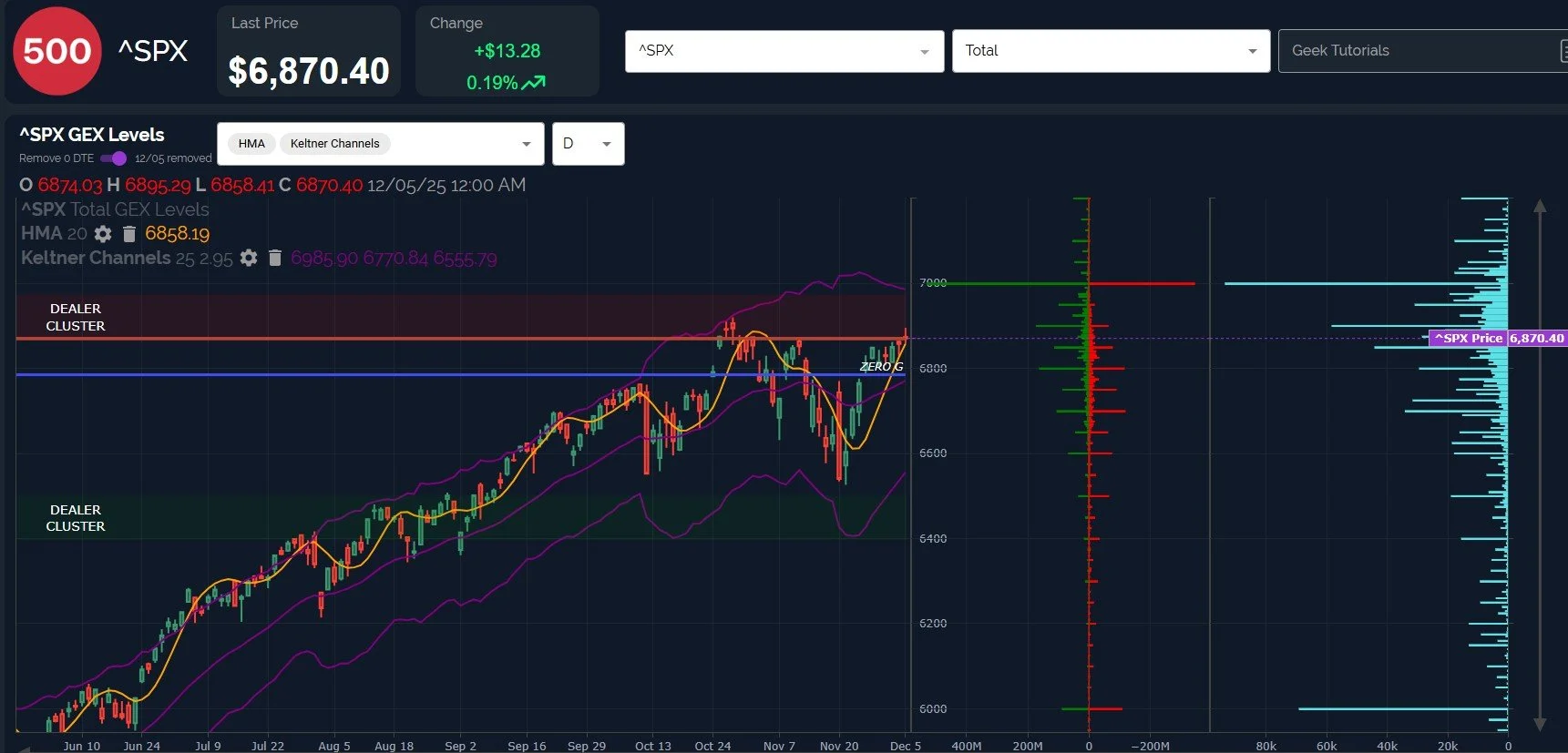

SPX odds of reaching 7000 by approximately 12/31 remain high, if not higher, than the last few months we’ve been highlighting the large net positive GEX at that level.

Technically, SPX is respecting key levels and indicators that bolster the case for an attempt closer to 7000, including the yellow Hull Moving Average and the purple upper Keltner channel on my daily chart below.

Exceeding 6920 will break the previous October high, and the latest consolidation has been sideways to slightly higher, which begins to look like the beginning of a blow-off move, in my personal (un-scientific) view.

Countering any suggestion that SPX is set to begin a new exponential bull market above the 7000 strike, we see very little GEX over 7000 at this point, and certainly less than we see at a variety of strikes as low as 6000.

Additionally, the daily Hull is rising steeply, so any daily close under that line (currently 6858, but rising) risks creating a technical headwind that may imply the rally attempt is losing steam. Such a shift would hopefully be accompanied by actionable observations regarding GEX itself, though it may not be.

Regardless of whether or not SPX continues beyond 7000, current odds favor a tag of 7000 and some sort of consolidation or selloff beyond that achievement.

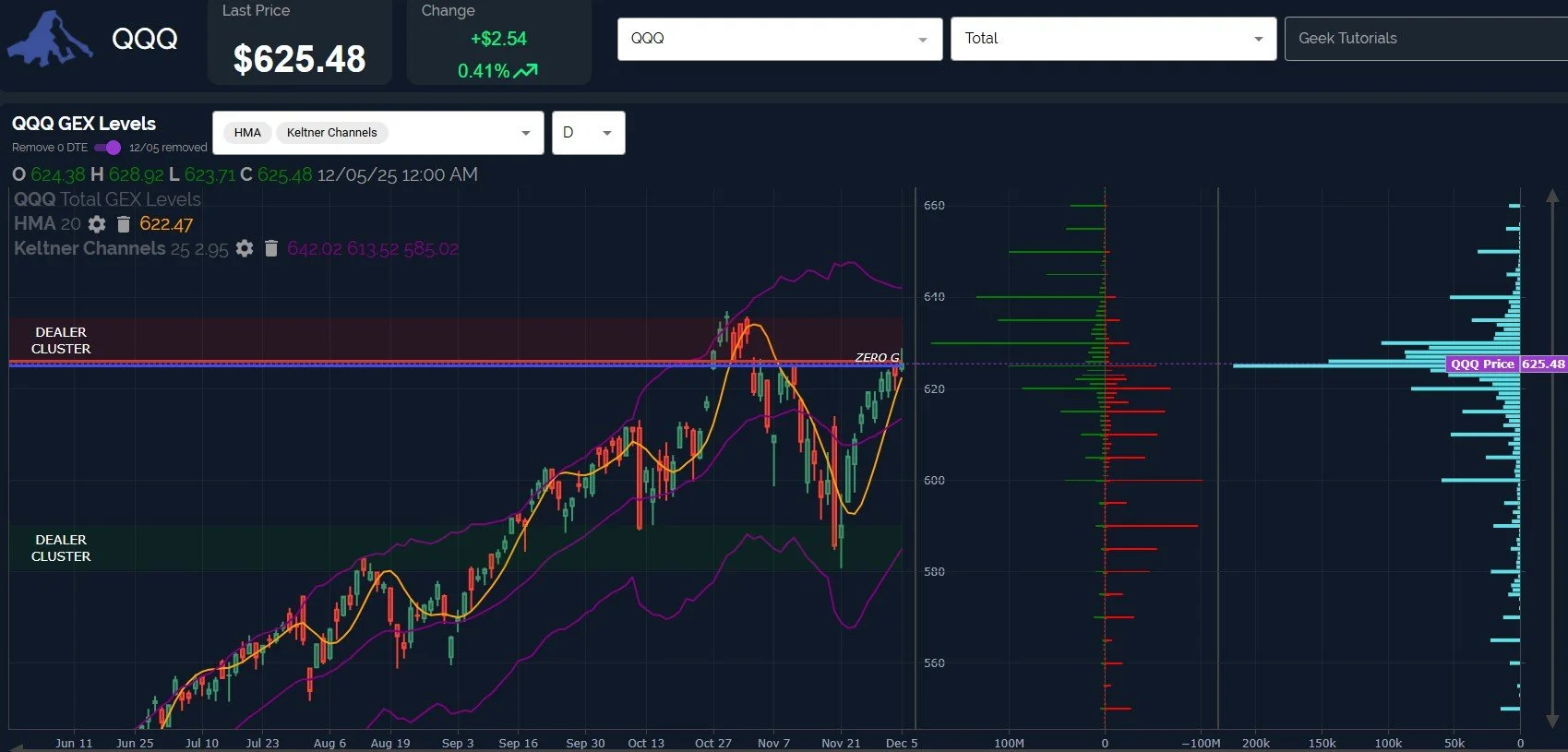

Very similar story for QQQ, though Friday saw QQQ approach the 630 strike in close proximity, with a high of 628.92.

If SPX reaches 7000, the implication is likely that QQQ may shoot for the next largest GEX cluster at 640, also matching the upper Keltner channel fairly closely (currently at 642, but declining).

Daily volume (light blue) continues to be weighted more toward lower strikes, and we’re within the upper Dealer Cluster zone, so further consolidation or a pullback may occur prior to a final push higher.

IWM has led the way higher so far, and IWM has not exhibited any obviously bearish signals lately, except the more negative tilt on GEX recently, which crossed back into negative net GEX territory Friday.

Despite this negative shift, IWM’s largest single net GEX cluster is a positive cluster at 260, then at 255, followed by a negative net cluster at 240.

The VIX shows no immediate sign of reversing higher, though we did see a daily close above the Hull Moving Average, which is technically a VIX long signal according to my methodology.

The declining Hull may decline further, and we see a lot of negative GEX between 15-15.5. A move deeper below 15 is not yet indicated as being likely according to GEX, so we may be close to a market turn.

Note that in the event of a VIX spike, the weekly Hull is around the 20 strike, also the zero gamma level. I think this confluence makes 20 a likely upside target in a bullish scenario for markets: a lower VIX high that may fail, opening the door for indices to continue reaching new highs after a modest pullback.

The 4-hour chart seems to agree with the daily/weekly charts: the VIX is in a downtrend, hugging the declining Hull, and the Keltners are pointing lower with a strong downward channel.

I still believe the channel boundaries are useful for approximate shorter term reversals, so I’ll be watching for any downward spike in the VIX toward 14-14.5 to be an interesting spot to consider new hedges, even if only temporary.

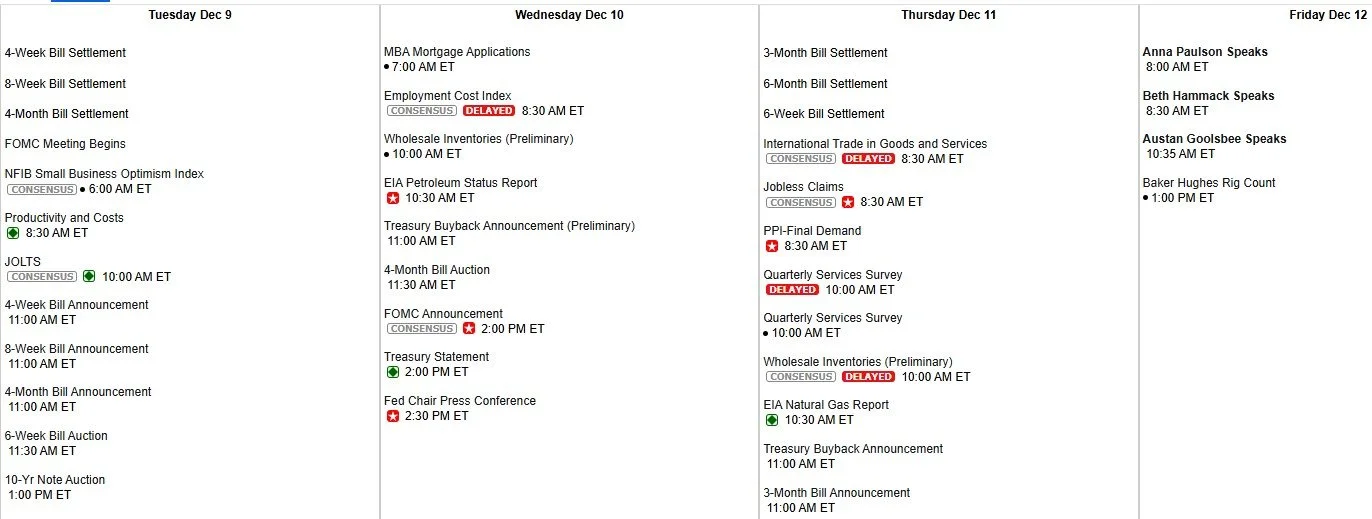

Here’s the link to our Discord server if you haven’t yet joined us in Discord. We’ll share intraday analysis in Discord as well as interact with our other members during the day, so we hope you’ll join us. With FOMC Wednesday, this could be an interesting week!

econoday.com

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.