SPX Holding Below Resistance: March 13 Stock Market Preview

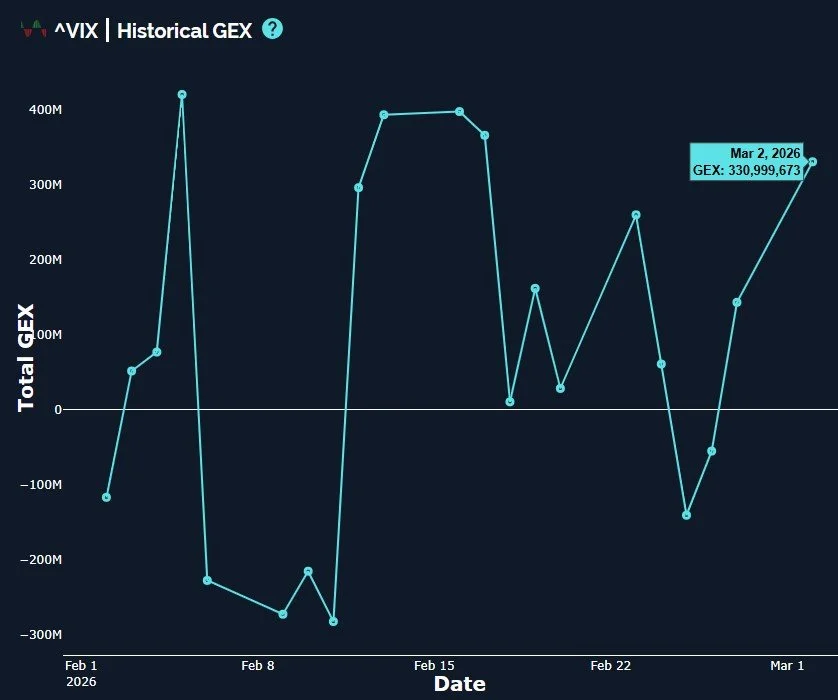

March 13 Stock Market Preview: The VIX continues to hold key support for the current trend higher, and indices are slowly making their way toward lower targets. While a snapback rally could happen at any time, tonight we take a closer look to see if we can improve our probabilities by considering the GEX picture for SPX and more.

SPX Holding Below Resistance: March 12 Stock Market Preview

March 12 Stock Market Preview: Major indices have so far been unable to regain overhead resistance to turn those moving averages into support, yet bears also have failed to drive a deeper breakdown. Meanwhile, the VIX hasn’t changed much, hovering around the 25 area. Let’s look at whether or not volume and GEX can give us further clues pertaining to the next likely move.

Decision Time For The VIX: March 11 Stock Market Preview

March 11 Stock Market Preview: Indices rallied again Tuesday, testing key overhead resistance, failing to close above these levels (so far). While the VIX closed below Monday’s close, the VIX tested and held key support, while VVIX (which measures the future expected volatility of the VIX) was actually positive. This divergence can increase the odds of another VIX spike, if we see several instances over the period of 1-2 weeks. For now, we focus on levels the VIX is holding and shifts in GEX for major indices.

Dead Cat Bounce Or Bottom? March 10 Stock Market Preview

March 10 Stock Market Preview: Monday’s gap down was bought, turning a red day into a rally day with a close above Friday’s gap down open and close. With SPX rallying into resistance, and the VIX approaching support, we’re left once again asking if bulls are almost out of the woods? Let’s review partial evidence for a possible low, or lack thereof.

Accelerating Downside: Opportunity? March 9 Stock Market Preview

March 9 Stock Market Preview: VIX futures are in backwardation as we see the front month contract reaching 30, while ES is down 125. Oil futures have skyrocketed some 25%. Friday’s GEX close reflected negative expectations, as well as closes below key technical levels for major indices. What comes next, and what levels are we watching on the contrarian long side?

The VIX: Not Done Yet? March 6 Stock Market Preview

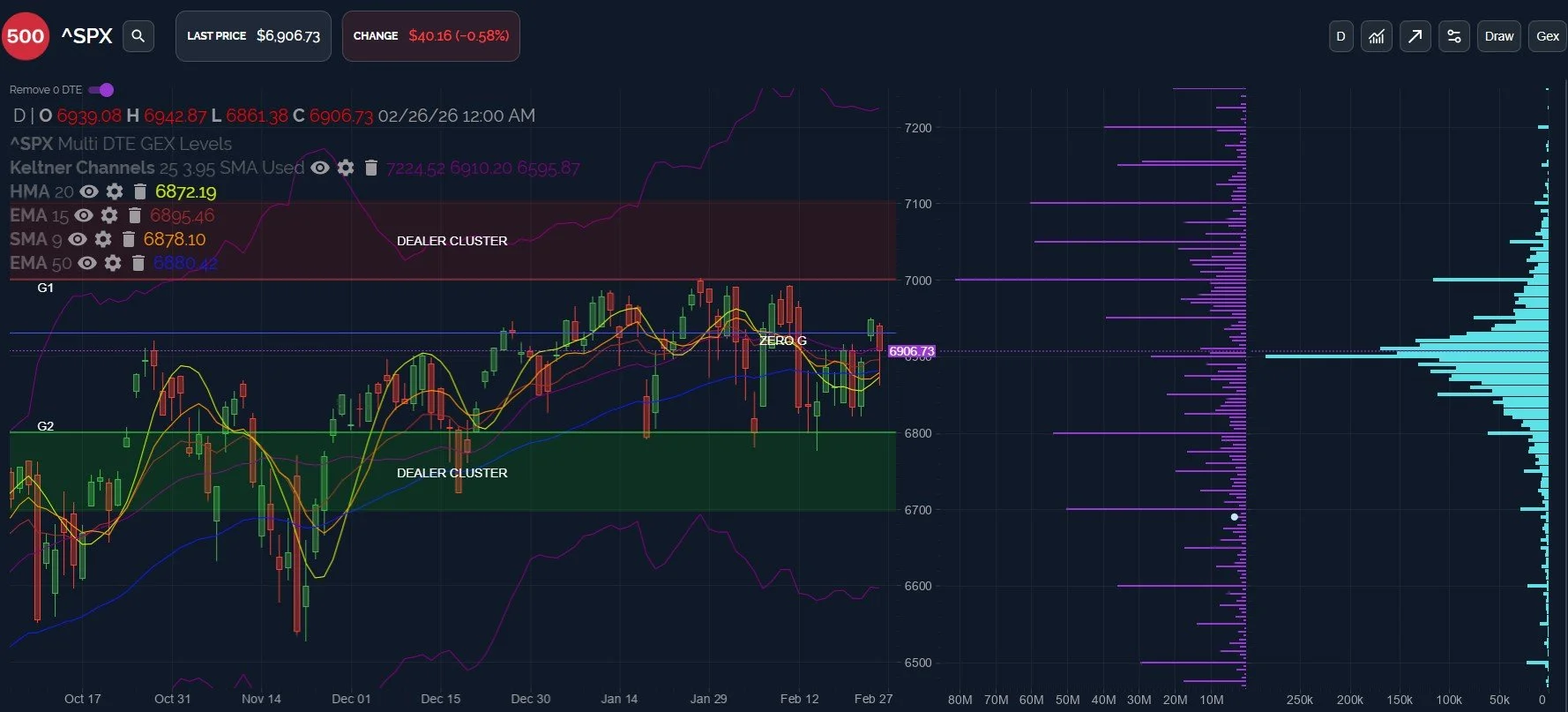

March 6 Stock Market Preview: A fairly quiet morning took a nasty turn as the day progressed, with SPX dropping below 6800 again before recovering in the afternoon. The VIX reached 25, a lower high (so far), but we still see possibilities in both directions. The Keltner channels look negative, as do several moving averages, so bulls really need to overcome overhead resistance to prove a change is afoot (or afeet, for multiple changes, according to Dweebster’s Dictionary).

SPX Rallies To Resistance (Again), VIX Holds Its Uptrend: Make Or Break? March 5 Stock Market Preview

March 5 Stock Market Preview: Wednesday was “gap and go” for the big US indices, with SPX, QQQ, and IWM retesting daily resistance from below. While resistance is holding, indices maintained their gains for the most part, at least until the apparently cranky futures traders took over in the night session. The question remains- have we flipped to a “sell the rip” environment, or was yesterday’s low a classic “buy the dip” bottom?

Dip Buyers Abound: Is SPX Out Of The Woods? March 4 Stock Market Preview

March 4 Stock Market Preview: Yesterday’s VIX and IWM warnings signs saw an immediate confirmation today, with the VIX spiking above 28 and IWM exceeding the large 257 GEX cluster to the downside. Indices did stage a cash session bounce (one that we traded as well), but are we out of the woods yet?

SPX Rallies Into Resistance: March 3 Stock Market Preview

March 3 Stock Market Preview: The gap down in indices Monday was met with a buying spree as dip buyers stepped in. With SPX and other major indices rallying right into potential resistance, and the VIX approaching support near 20, what might be around the corner?

War With Iran: Buy The Dip Or Sell The Dip? March 2 Stock Market Preview

March 3 Stock Market Preview: We’ve noted conflicting signals, with the VIX perhaps being the most consistent warning that more volatility for indices may lay ahead. The news over the weekend of US strikes on Iran and the ensuing drop in futures Sunday evening vindicate the signs flashed by the market to the point, though we acknowledge anything can happen overnight. If the gap down holds, where might markets be headed?

VIX Holding Support, IWM Looks Bullish? February 27 Stock Market Preview

February 27 Stock Market Preview:Thursday saw a drop right to the important support areas we mentioned in yesterday’s newsletter, and so far, those areas are holding. Conflicting signals from the VIX and some encouraging signs for bulls with IWM deserve more attention, so let’s take a closer look.

NVDA Earnings Are Out: What’s Next? February 26 Stock Market Preview

February 26 Stock Market Preview: Indices aren’t moving a lot following NVDA earnings, with futures slightly lower and NVDA also lower after tagging 203 in the after hours session. Overall today, indices continued higher, though the VIX crush that continued right down to the high 17s was not met with a continued rally in the stock market, which topped out relatively early in the day. Does the VIX reaching the weekly/daily support area we’ve been mentioning constitute a negative divergence worth noting?

IGV: Approaching A Low? February 25 Stock Market Preview

February 25 Stock Market Preview: The big picture for indices is mixed, with all of the major indices staging a rebound while the VIX still holds above key areas maintaining its trajectory higher. Is IGV giving us early signs that a bounce may be near? Let’s take a look at the GEX picture across the board with special attention to IGV’s GEX and volume picture.

The VIX Trend Is Higher: February 24 Stock Market Preview

February 24 Stock Market Preview: Today’s action was persistently negative, yet on the surface, no clear decision has been made as to the markets next move. Can we find any clues by evaluating GEX? Let’s take a look, as well as a look at the VIX and VVIX.

The March OpEx Cycle Begins: February 23 Stock Market Preview

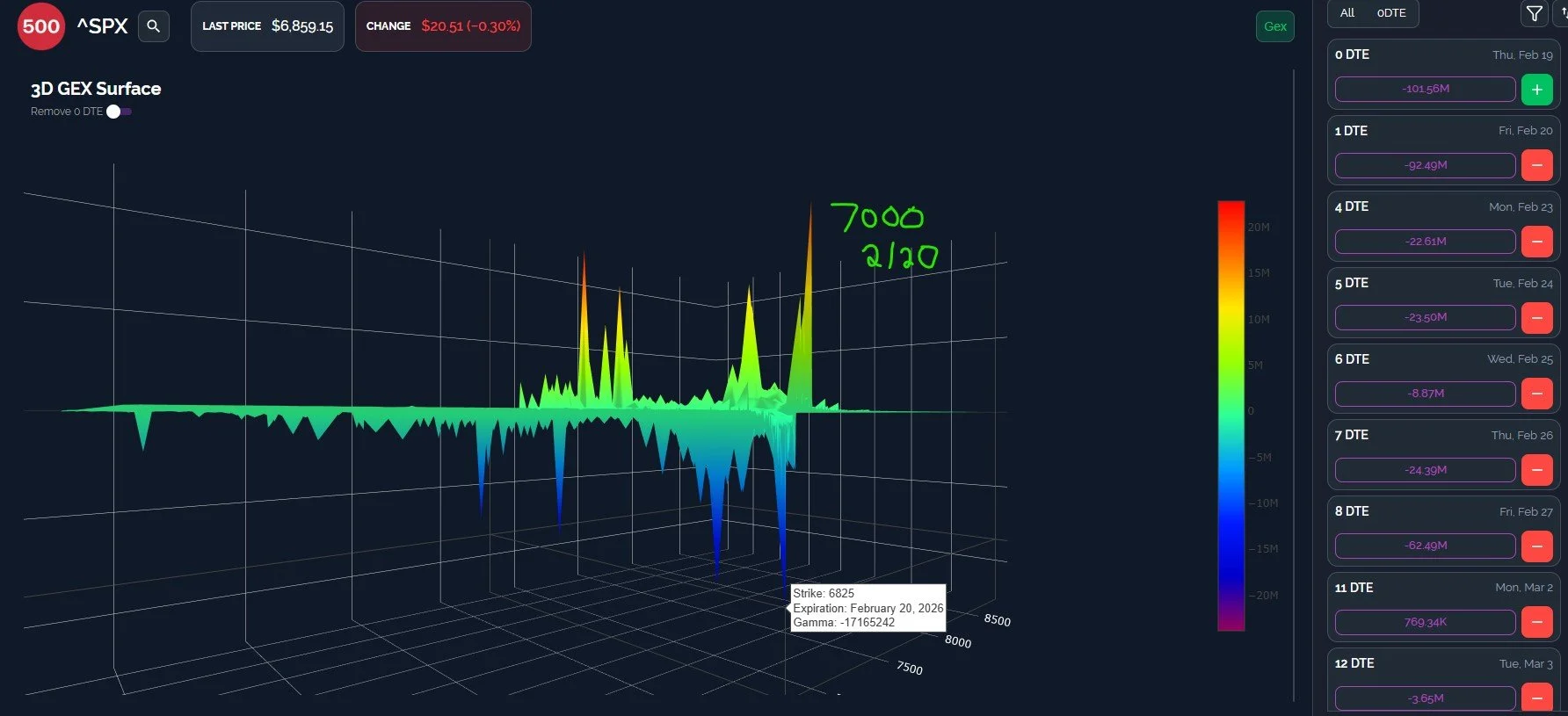

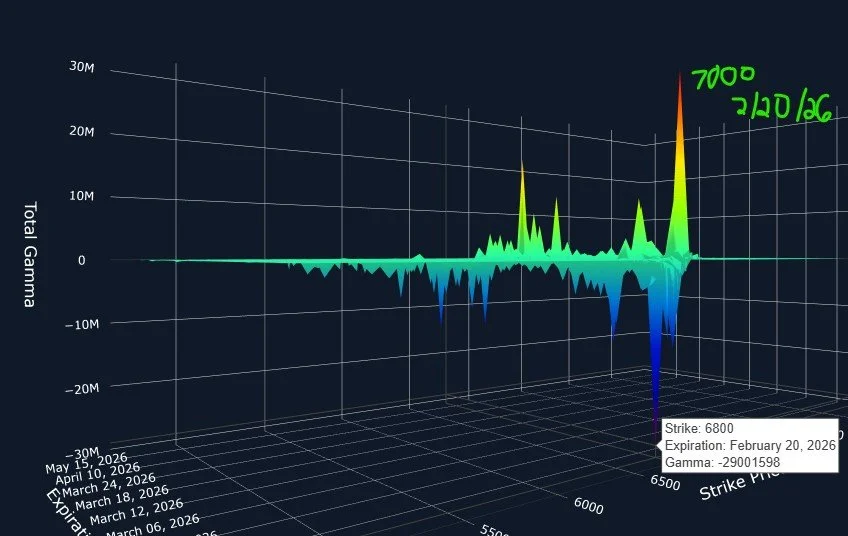

February 23 Stock Market Preview: As we enter the March OpEx cycle, let’s take a look at some potential technical areas of interest as well as the GEX picture to see if we can find some clues as to the most likely scenarios for the markets next move.

Nearing An OpEx Inflection? February 20 Stock Market Preview

February 20 Stock Market Preview: Let’s take a look across the board at SPX, QQQ, IWM, and the VIX as we enter OpEx Friday.

Indecision Approaching OpEx: February 19 Stock Market Preview

February 19 Stock Market Preview: With VIX expiration behind us, we now look toward Friday’s OpEx, with SPX rejecting key resistance today and the VIX bouncing off of lows. Will we get some kind of resolution, or will the “chopfest” continue?

Larger Reversal Or Dead Cat? February 18 Stock Market Preview

February 18 Stock Market Preview: Today’s action seemed indecisive, and net GEX actually moved more negatively for several top indices, including SPX and QQQ. With the VIX hugging 20 as we enter VIX expiration in the morning, what clues do we have as we look toward Friday?

VIX Expiration & OpEx Week: February 17 Stock Market Preview

February 16 Stock Market Preview: Indices may be approaching an area where we might see a bounce, particularly during OpEx week…But maybe not before we see more downside. What does the big picture look like? Let’s take a look at GEX and the charts as we approach VIX expiration Wednesday and OpEx Friday.

VIX Expiration & OpEx Week: February 16 Stock Market Preview

February 13 Stock Market Preview: Thursday’s intraday breakdown led to another test of key levels for indices, with indices not yet testing their lows from last week, except for DIA, which sat out of last weeks decline. DIA had its biggest down day since November, finally joining in the stock market pity party (pity for the unhedged?). Can we bounce?