IWM & VVIX SIgnaling Trouble Ahead? January 26 Stock Market Preview

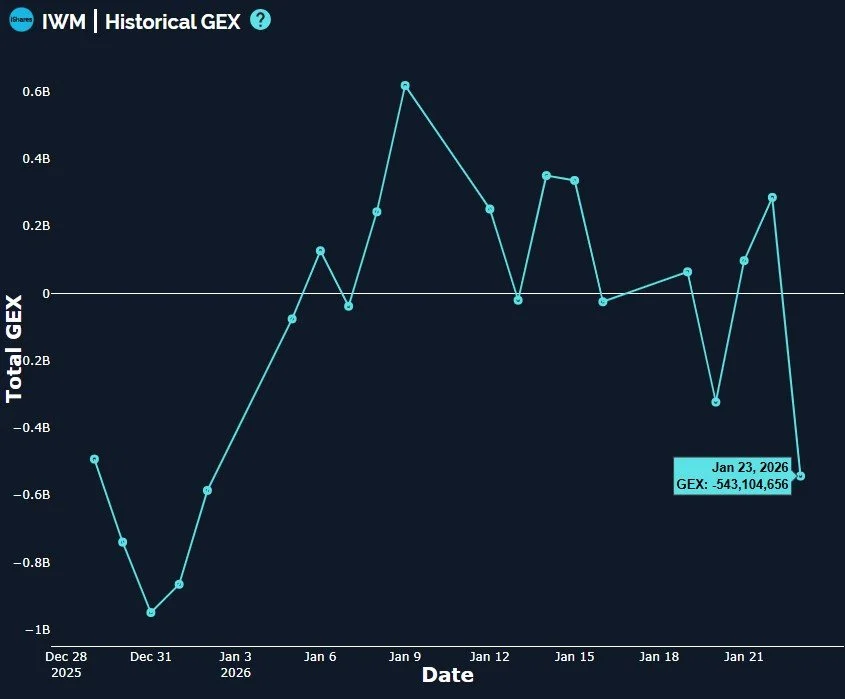

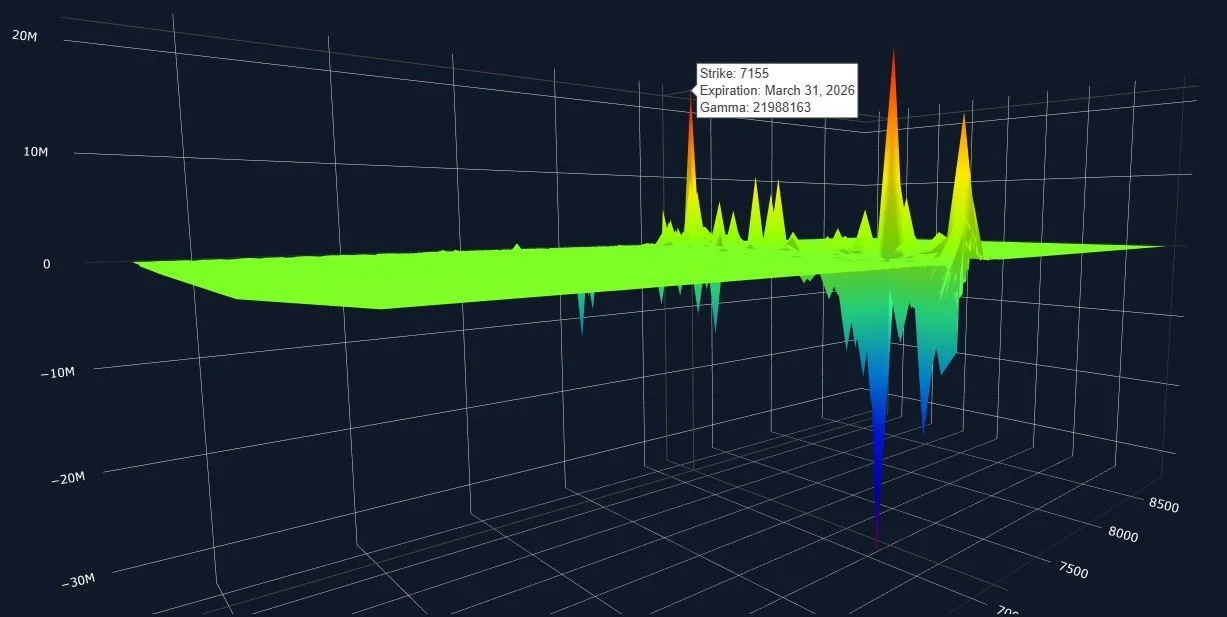

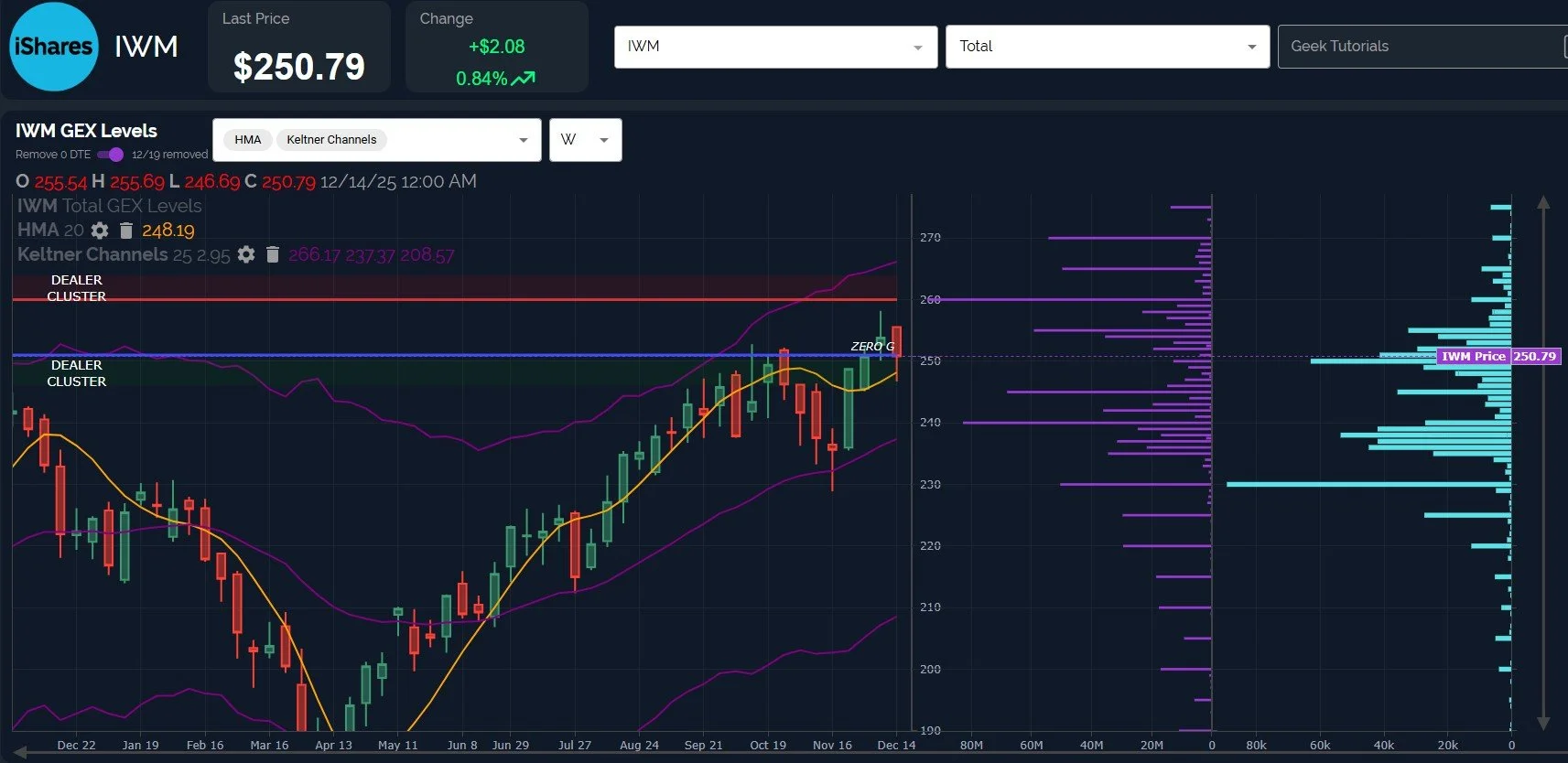

January 26 Stock Market Preview: Friday saw weakness in IWM, which may be a harbinger for the other indices in coming days. A VIX and VVIX divergence also accompanied this move, though SPX and QQQ appear less certain, depending on the timeframe. What does GEX have to say about the current picture?

Decision Point For SPX? January 23 Stock Market Preview

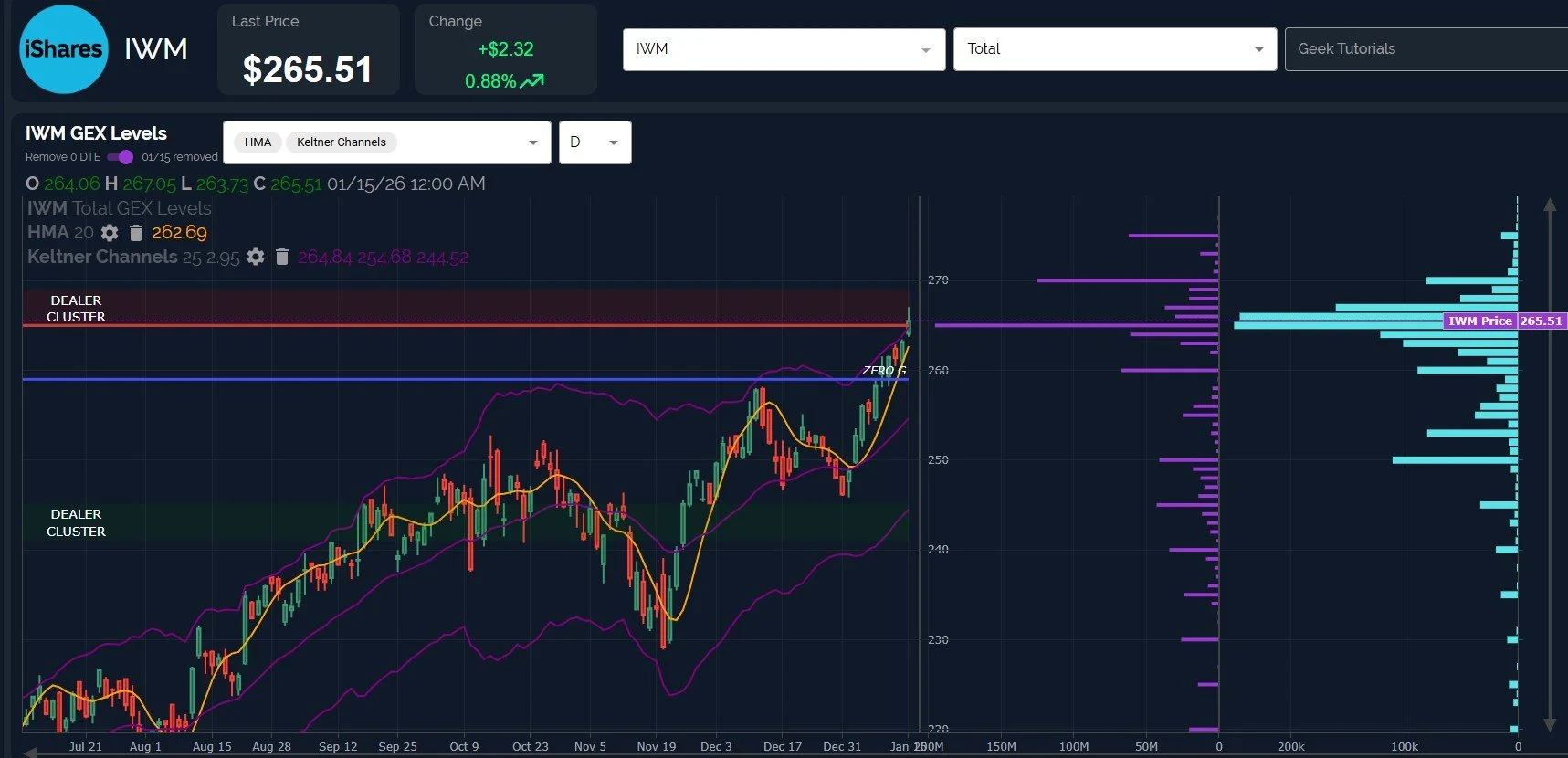

January 23 Stock Market Preview: IWM has entered the nosebleed zone in the short term, but can IWM still climb higher? Let’s look at this and the far less certain SPX and QQQ (in terms of the technical picture) to see if GEX can help us tilt the odds toward the most likely directional move.

Dead Cat Bounce Or SPX 7000? January 22 Stock Market Preview

January 22 Stock Market Preview: Markets staged a rebound today, testing key support-turned-resistance from below. The VIX got crushed, and net GEX improved across the board. But did it improve enough to say we’re “out of the woods?” Let’s look at GEX and the technical picture for indices.

Looking Beyond VIX Expiration: January 21 Stock Market Preview

January 21 Stock Market Preview: Today’s big gap & go to the downside for indices brings us almost to the targets mentioned in yesterday’s newsletter, with the VIX hanging out at 20. What will we look for next?

Stock Market Weakness Entering Earnings Season? January 20 Preview

January 20 Stock Market Preview: Futures are down substantially following OpEx Friday, and the VIX has almost reached 20. With VIX expiration around the corner and earnings season upon us as well, what does GEX have to say?

Entering OpEx Friday: January 16 Stock Market Preview

January 16 Stock Market Preview: OpEx is upon us, and we have a real shot at seeing SPX 7000 tomorrow. With divergent performance from IWM today, will we see the opposite tomorrow? What about the VIX? We’ll take a closer look in tonight’s newsletter.

Deeper SPX Pullback In Play? January 15 Stock Market Preview

January 15 Stock Market Preview: We finally see the VIX fulfilling the spike that we’ve been warning about ever since we noted the ascending VIX pattern since December 26, seeing a test of the 18-strike intraday. Indices closed below the daily Hull Moving Average, except IWM, which is on a different planet. What are we watching as we look ahead?

VIX Spike: Opportunity Or Threat? January 14 Stock Market Preview

January 14 Stock Market Preview: The VIX and VVIX were stronger today than the indices were weak, and indices are still holding key support that may enable a tag of upside targets we’ve been watching for some time. Let’s take a closer look at changes in GEX today and tie it all together.

Q3 Earnings & A Warning From The VIX: January 13 Stock Market Preview

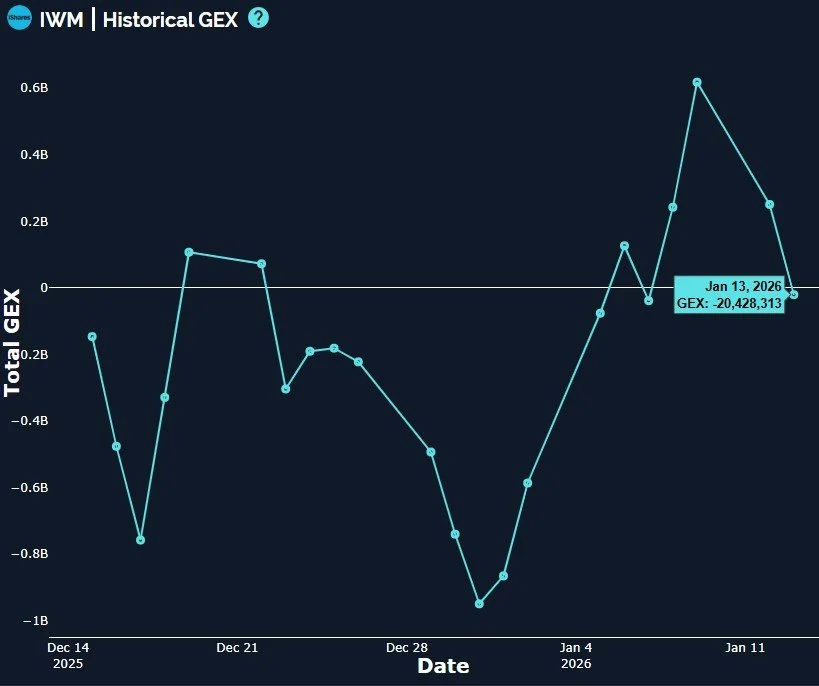

January 13 Stock Market Preview: Indices appear destined for higher levels, yet we have a potential warning from the VIX that a short-term spike may be in store. With OpEx Friday and earnings season kicking off, what do these signals mean for the market?

VIX Breakdown: Bulls Unleashed? January 12 Stock Market Preview

January 12 Stock Market Preview: Indices look solidly bullish across the board, with the current picture favoring the odds of continued strength as the VIX heads toward a retest of 14. With OpEx Friday, financials reporting this week, and a big tariff decision reportedly being announce Wednesday, we may see some interesting twists and turns this week.

Never-Ending Divergences: January 9 Stock Market Preview

January 9 Stock Market Preview: IWM made a new all-time high today, while QQQ and SPX had divergent negative performance, with QQQ being the worst of the bunch. Will the laggards catch up with IWM’s performance, or are we about to see indices roll over?

SPX 7000 Within Sight: January 7 Stock Market Preview

January 7 Stock Market Preview: IWM led the way higher, showing relative strength recently. SPX now appears poised to approach the 7000 GEX strike, and the VIX has room to drop. What are some risks to this scenario?

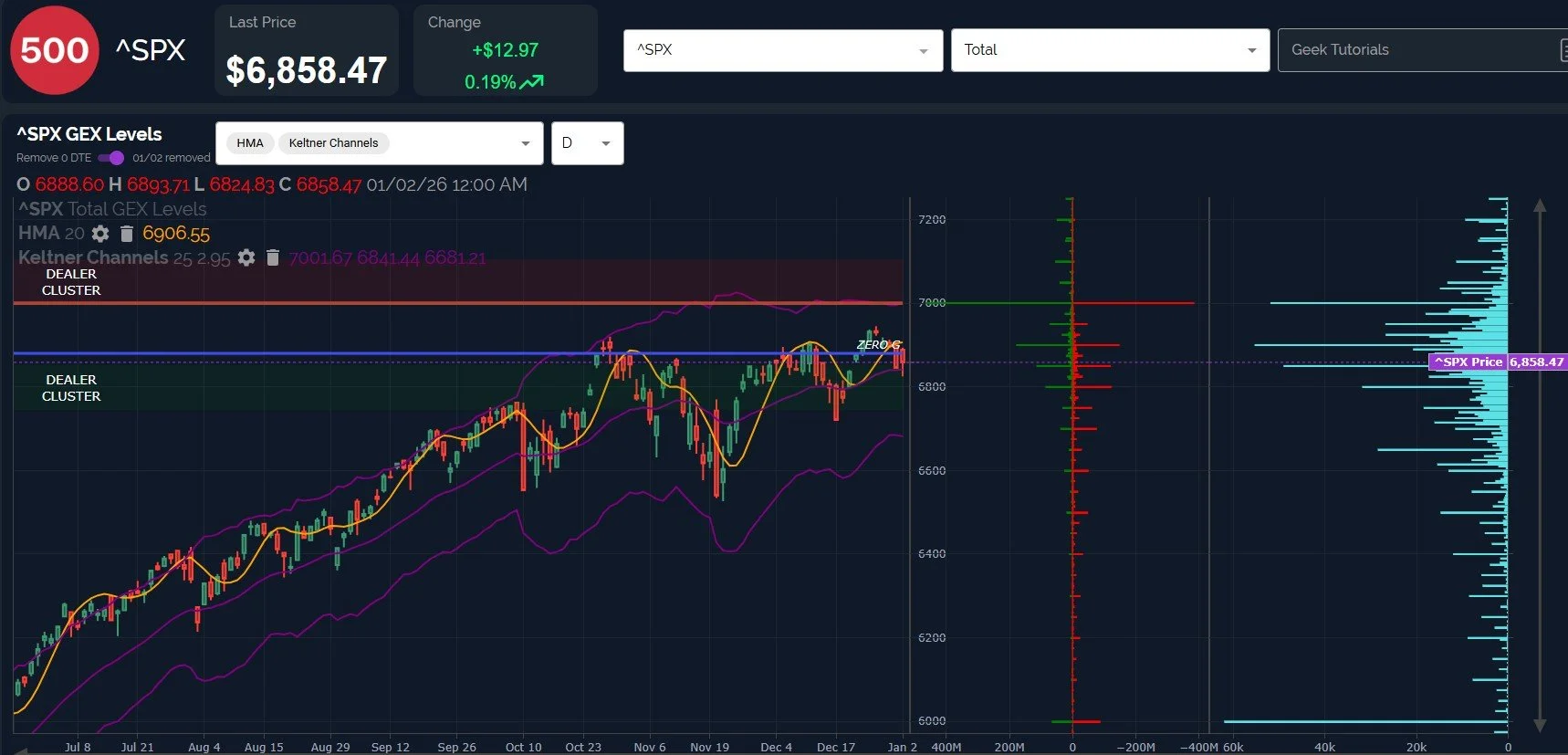

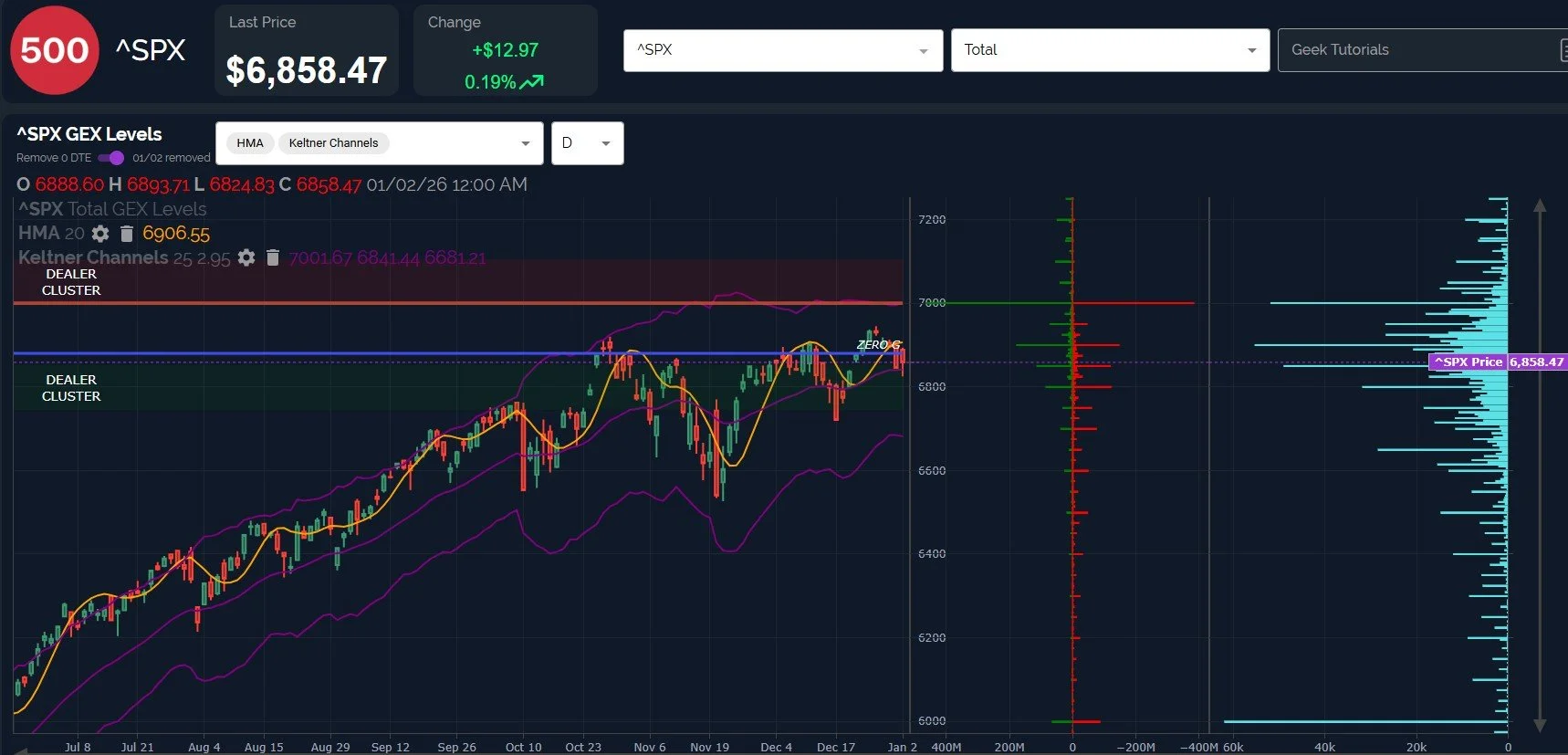

Initial Headwinds For SPX: January 5 Stock Market Preview

January 5 Stock Market Preview: This is our first newsletter of 2026, so thanks for joining us! We enter the new year with interesting historical seasonality as well as an interesting current picture for the indices, both technically as well as in terms of GEX. What sort of fun do we have in store?

Which Divergence Will Win? December 31 Stock Market Preview

December 31 Stock Market Preview: As we close out the last trading day of 2025 on Wedneday, let’s look at some interesting changes in the GEX picture as well as current technical areas gained or lost today across the major indices (SPX, IWM, QQQ, the VIX). What’s next?

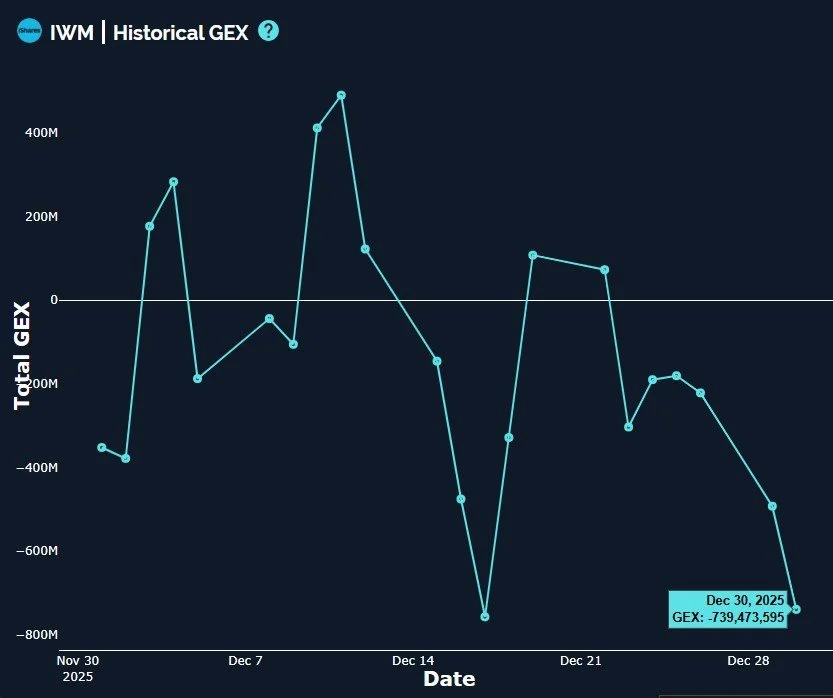

Santa Rally On The Ropes? December 30 Stock Market Preview

December 30 Stock Market Preview: Monday saw the VIX gap above the daily Hull Moving Average, with indices (SPX, QQQ, IWM) showing weakness. As the day progressed, the VIX declined, though indices didn’t make noteworthy recovery, a concerning sign from a contrarian standpoint. Let’s take a closer look under the surface.

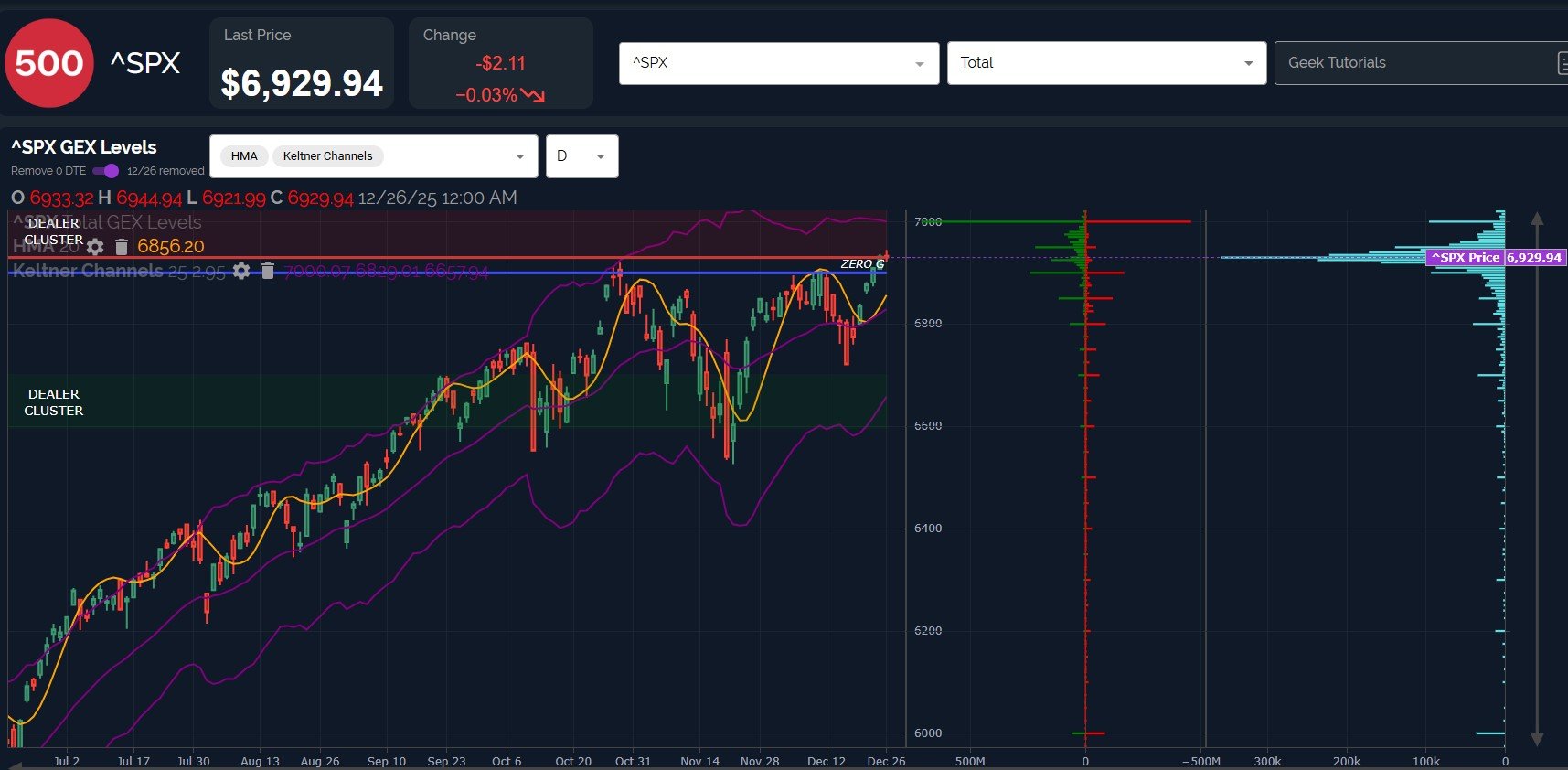

SPX’s Long-Awaited 7000 Target Is Near: December 29 Stock Market Preview

December 29 Stock Market Preview: We approach the final 2.5 days of trading for 2025, with SPX seemingly back on track for a close approach to 7000 and the VIX at lows for the year, in the 13s. Are we looking at a series of potential contrarian circumstances, or is this a sign that a larger uptrend is imminent?

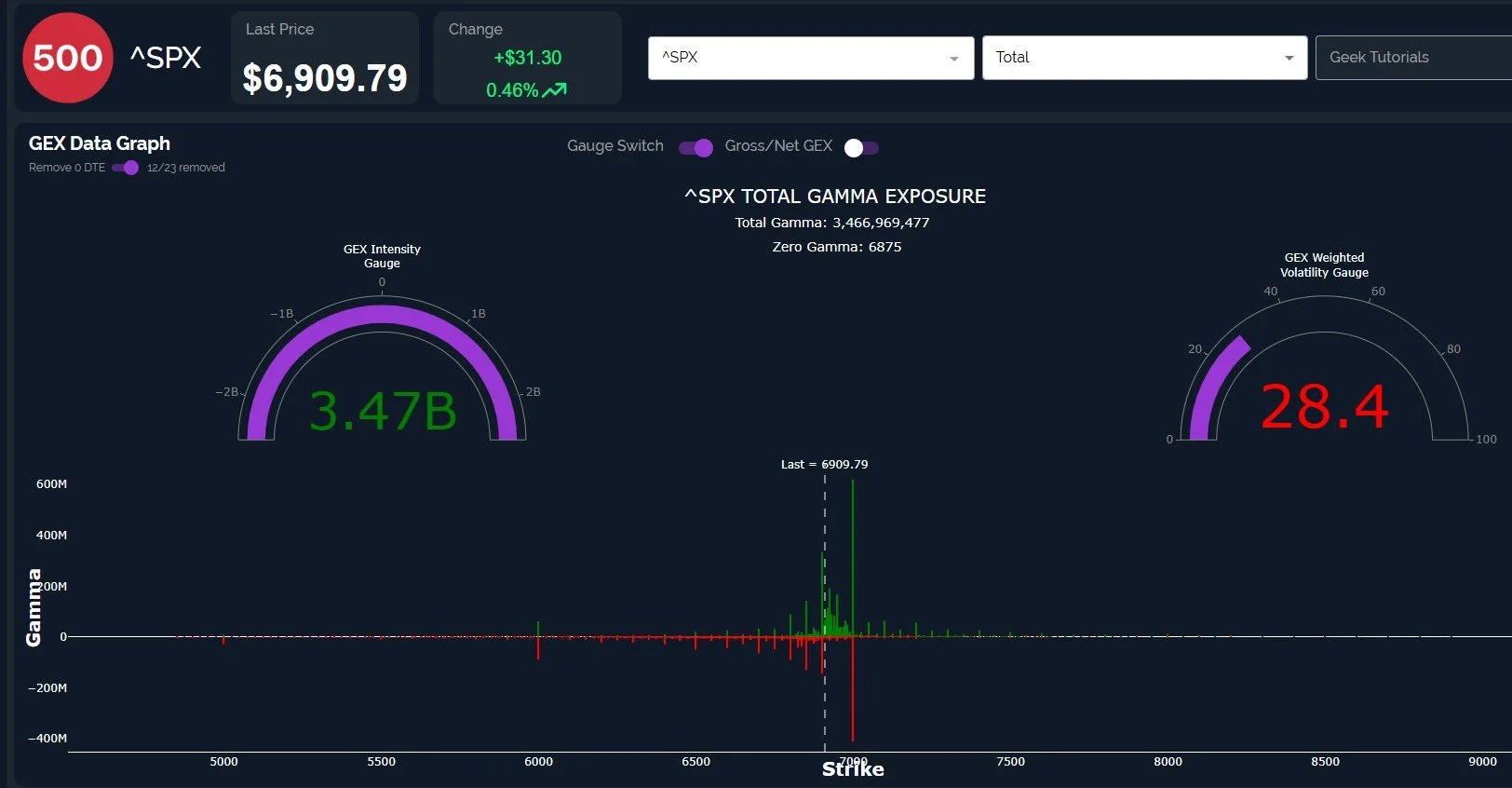

Extreme GEX Heading Into The Santa Rally? December 24 Stock Market Preview

December 24 Stock Market Preview: SPX achieved a massive positive GEX reading heading into the half day of trading tomorrow, though falling short of overcoming the previous high of 6920. Such extreme GEX readings are often associated with reversals, so what are we looking at as we enter the start of the “Santa Rally” tomorrow through the first two trading days of January?

Conflicting Signals For The VIX: December 23 Stock Market Preview

December 23 Stock Market Preview: The crush in volatility seemingly won’t end, with the VIX now at the 14-handle and VVIX in the low 80s. Paradoxically, we see the VIX showing net positive GEX, an unusual condition given the intense move lower. We also see SPX net GEX at the 6900 and 7000 strikes standing strong for 12/31. How do we reconcile these conflicting signals?

OpEx Is Over: “Party Time” With The VIX In The 14s December 22nd?

December 22 Stock Market Preview: With OpEx behind us, the VIX begins a shortened week of holiday trading in the U.S. for the Christmas holiday below 15 again, a level last seen on December 12. SPX was over 60 points higher then, so what do we make of the divergence? I’m going to force you to read the rest of the newsletter, of course.

SPX 7000 GEX Getting Shifty: December 19 Stock Market Preview

December 19 Stock Market Preview: SPX GEX at the 7000 strike, which we can now call “Ol’ Shifty,” was back and is now gone again…Is this a product of OpEx week, or are we done with the 7000 strike by 12/31? We have no vested interest, we simply want to position for the targets with the greatest odds, so we will adjust as GEX adjusts as well.