Making A Move To The Upside

Here’s the link to today’s YouTube video, which can be viewed by clicking here. We always touch on different aspects of some of the same tickers covered in the newsletter, plus some ideas not shared in the newsletter, so check it out.

Despite near-term uncertainty, and a lack of clarity regarding whether the first break out of the recent several days consolidation would be up or down, we’ve been repeating 5800 as an initial upside target. There were days last week where it looked slightly more likely that we might have started a pullback, and other days where it looked like we were on the edge of breaking to the upside, and Friday’s close was right in the middle of a tight sandwich created by the Hull moving average and the 9 period sma on the daily chart. Today’s trade deal news seems to have sealed the deal, at least with the initial gap that unsurprisingly will trap Friday’s shorts Monday morning, likely causing some chasing to the upside as well. Friday’s longs will get the “easy” money, while Monday’s open may present a totally different picture for those just entering. Let’s take a look at a tactical view for what may transpire tomorrow.

The chart above shows ES, which I’m including as an example of where indices stand at the moment in the overnight session. The current gap brings ES just above the daily Hull, an important bull/bear delineation in my methodology, presenting a truly pivotal moment that we’ve been awaiting: If indices close solidly above the line tomorrow, I think odds greatly increase of heading toward the upper Keltner channel (and upper gamma exposure- aka GEX- levels), or if we close below, I believe the deal is likely sealed for a move much lower than we saw over the last week. It’s entirely possible that the combination of late longs and short covering could even see us reaching the 5800 SPX level (or close to it) intraday tomorrow. With futures up 75 points at the moment, the implied SPX level would be somewhere around 5735, all things being equal.

SPX’s chart above shows net GEX in purple, reflecting a large GEX cluster at 5800 as the first hurdle. The upper Keltner channel and next GEX cluster to contend with prior to reaching 6000 is at 5900, which is a bit at odds with ES, which shows 5980 as the upper Keltner channel.

QQQ (below) shows an even more conservative picture as of Friday’s close, with 500 representing the upper Dealer Cluster zone and the largest GEX cluster, much closer to QQQ’s current price than 6000 is to SPX’s price. Theoretically, a conservative approach to managing gains (if one believes the upper Dealer Cluster zones and GEX to be meaningful in making decisions, as we do) would be to look at the major index featuring the upper target closest to the current price and make adjustments (hedging or selling longs) based on that more conservative level being reached. In other words, if QQQ reaches 500, the first thing I would do is look at whether or not QQQ’s largest GEX clusters remain the same or possibly shifted higher. If they shift higher, no problem, maybe the party is meant to continue (curfew is lifted!). If we see 500 staying thick, perhaps caution is warranted whether you have QQQ or SPY or another major index. That’s at least one of several approaches.

The VIX has shown major GEX at 20 for at least the better part of the last several trading sessions, but it’s really 42.5 on the positive side that has been there even longer, and total net GEX remains positive. We saw the VIX close Friday just above the key Hull, but barring another surprise overnight, we should see the VIX approach 20 and perhaps even overshoot toward the lowest likely targets on the VIX between 18-19. Unless the VIX is headed back to 12-15 immediately, my first thought looking at this is “doesn’t volatility look more like a buy in the lower Dealer Cluster zone?”

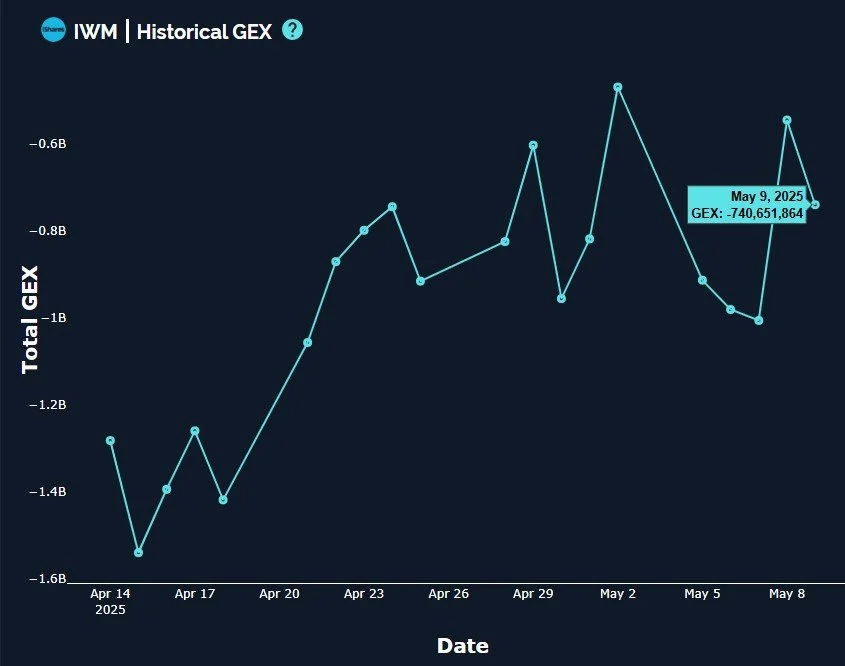

IWM may be quite interesting tomorrow, especially given the one-sided negative nature of its GEX structure. The potential for an IWM squeeze is something we’ve been really focused on for the last couple of weeks as we saw other indices showing a much more positive overall shift in GEX. The summary (for those who missed it) is that IWM does have more GEX at lower strikes, and almost nothing at higher strikes. Since explaining that the first time, we did see GEX at 210 grow, which is a positive shift. But a lot of the negative GEX at lower strikes remained, especially at 190. If 190 held, IWM may see a more positive move more quickly to higher levels. If 190 failed, the picture speaks for itself. With so little GEX existing between 200-210, we could see 210 very quickly, perhaps Monday, which would be a very fast 5% move to the upside and a match with the upper Keltner channel. This looks very likely at this point, so congratulations to the contrarians out there who were long IWM going into tomorrow.

Part of the squeeze scenario with IWM will be seeing a lot of the negative GEX reversing quickly and dramatically, so I would expect the -741M reading from Friday to look very different tomorrow. Could that also mark the reversal point, the “all clear” signal for shorts to actually re-enter? IWM is a tricky animal, so I definitely think there’s a possibility that IWM approaching the positive GEX line could be a good time to hedge again.

In summary, tomorrow should test the limits of bulls and whether or not we will see GEX shift even more positively in the short run. With the VIX very close to the lower Dealer Cluster zone (which could shift as well tomorrow), and QQQ’s upper Keltner channel not far away, we may need to quickly shift focus from fulfillment of the upside targets to downside risks even more, so we will be on deck with intraday analysis of new GEX data as we get it in real time. Thanks for joining us here and in Discord!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out back tested algos and chart indicators and we just increased our ANALYST tier subscription to include 600+ tickers, including individual stocks! Mobile updates are forthcoming over the next few days as well.

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.