Bears Are Dead- What’s Next?

THE ANNUAL SUBSCRIPTION PROMO IS BACK- We restarted our $300 off promo of the annual Portfolio Manager subscription due to popular demand. We have new mobile interface improvements imminently being readied for release, and we’re working on more, as well as our recently started daily livestream. Enter code MAY2025 at checkout to lock in a great annualized cost for access to our highest level subscription!

Here’s the link to today’s YouTube video, which can be viewed by clicking here. we have some complementary thoughts regarding overlapping indices also discussed here, but we also cover a few individual ideas and updates on positions like SHOP that are in our Geek’s Educational Portfolio, so you might find it to be of interest!

What a day, not only did we see a fairly impressive gap up, but indices held gains for the most part, some even closing near highs. What we didn’t see was an immediate shifting of positive GEX toward higher strikes (despite net total GEX increasing a lot thanks to 0 DTE GEX), so where does that leave us in terms of forward expectations?

Our GEX Levels chart above shows that SPX is at the edge of the big 5840 cluster, which indicates a big 0 DTE (zero days to expiration) cluster and a replacement of the largest cluster at 5800 from yesterday and prior. However, a theme that is common across the board following today’s close is a lack of GEX movement into higher strikes. The upper Dealer Clusters have remained at the same level (for now) and the upper Keltner channels match fairly well with those zones.

AS mentioned, SPX GEX saw a big increase in net total GEX, breaching our neutral/bullish 1B level. Recent observations can make an argument that GEX highs may be better selling opportunities than buying opportunities with the major indices, but our GEX Data Graph provides some context to this via the GEX Intensity Gauge, comparing current GEX to observed GEX over the prior 52 weeks. We prefer to wait for a relative extreme before fading such moves, though technical factors play into this assessment as well.

Very similar story for QQQ, though QQQ doesn’t have an equivalent to the big 6000 GEX cluster we see for SPX. The upper Keltner channel (currently at 513) has turned up, a positive signal which raises the question of whether or not we will proceed to new highs (entirely possible), but we don’t yet see a major short-term target beyond 510. A further positive shift tomorrow may bring 520-525 into focus, which would be quite extreme, but we need to consider the possibility. Otherwise, 480 is likely the first place to watch in the event of a pullback.

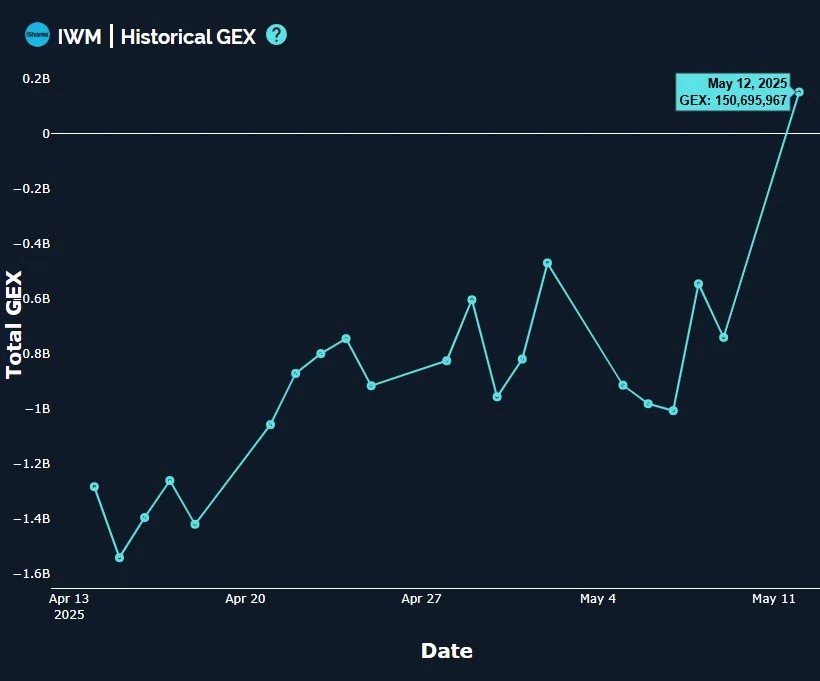

IWM quite perfectly followed the bullish script we outlined in the event of a squeeze: we reached 210 today, we saw a relative reduction in negative GEX at lower strikes (especially the formerly large 190 strike), and IWM jumped into positive GEX territory. All of the hallmarks of a short squeeze. But IWM is currently a desert of bullishness above 210, I see a few tumbleweeds and the mirage of an oasis, but no solid targets to point toward. And we’re at the upper Keltner channel. Considering these factors as well as the volume in light blue, I’d like to see a pullback toward 200 and then reassess, with such a dip likely being a buying opportunity.

IWM’s net GEX rocketed above the zero line into positive GEX territory, another outcome we thought would happen due to the short squeeze that happened. nearly a 1B swing, pretty dramatic! With much of the increase in GEX concentrated on today’s closing price, price near the upper Keltner channels and within the upper Dealer Cluster zones, and CPI tomorrow at 8:30AM ET, we may finally be near the inflection point for a larger pullback, even if it’s within the context of a buy-the-dip opportunity.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out back tested algos and chart indicators and we just increased our ANALYST tier subscription to include 600+ tickers, including individual stocks! Mobile updates are forthcoming over the next few days as well.

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.