The Pullback Is Here

THE ANNUAL SUBSCRIPTION PROMO ENDS SOON- We’re currently offering $300 off of the annual Portfolio Manager subscription. We recently released new mobile interface improvements, and we’re working on more, as well as our recently started daily livestream. Enter code MAY2025 at checkout to lock in a great annualized cost for access to our highest-level subscription! This promotion will last for a few more days.

Today’s YouTube video looks at the indices and the VIX with some slightly different points than those we’ll make it today’s newsletter, so be sure to check it out. You can view the short video by clicking here.

We’ve spent the last few days mostly highlighting the risks present at then current levels in the indices, and yesterday we noted the building negative divergences. Once again, IWM was the canary in the cobalt (or coal) mine with the earliest turn to the negative for GEX exposure from the upper Dealer Cluster zone as well as closing below the Hull moving average. The GEX swing back to the negative side was actually the timelier change of the two. IWM is amazingly close to the 200 target we’ve harped on for days now after one big down day today, which brings the next decision point to the forefront likely this week, given that we’re barely 1.5% away.

GEX took a big dive deeper into negative territory, but ultimately, IWM is going to soon decide whether or not the big negative GEX cluster at 200 will be a launching point for a rebound or a floor that will soon give way to a trip to the IWM basement somewhere between 170-190.

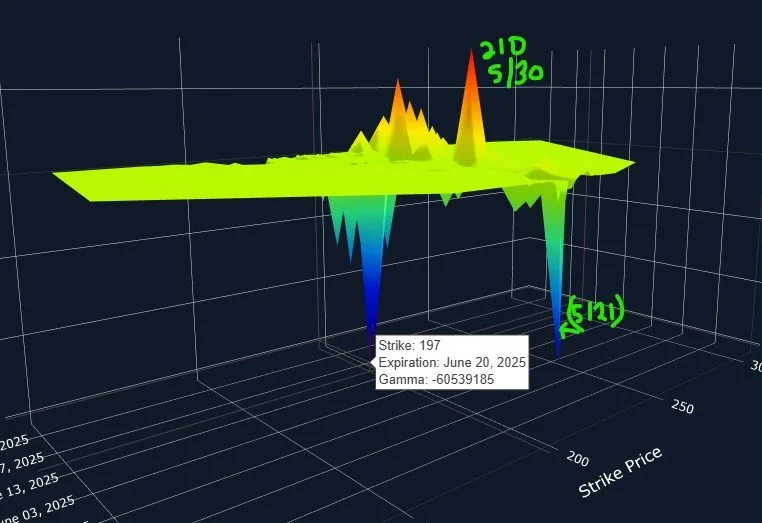

Given the bullish configuration of the Keltner channels, and the lack of equally negative reaction from SPX (which we’ll look at soon), my initial inclination is to treat a test of 195-200 as a buying opportunity. I say 197 because our 3D graph illustrates the significance of the individual GEX clusters at 197 and also at 199. In the meantime, we see a large positive cluster at 210 that expires May 30, potentially indicating a fairly short-term turnaround from the lower Dealer Cluster zone. These clusters can shift, and we show negative net GEX, so we will be considerate of downside risks as we watch and react to price action and GEX over the next few days.

QQQ came remarkably close to 525, so at least QQQ mostly fulfilled what we wanted to see. Today’s high was just below 523. It’s important to remember the context of the Dealer Cluster zones and how participants are positioned, meaning participants might not wait for an exact tag of a target price, or sometimes we even see an overshooting of a zone, reversing very quickly after being breached. There are a few sayings about waiting for every penny as you approach a target..Some are crude, so we’ll leave it at that. Being below the daily Hull, at the upper Dealer Cluster zone, and at the upper Keltner channel should have been enough of a warning from multiple angles, even if we would like the exact tag in the ideal world.

QQQ saw a dramatic shift to negative GEX territory. Note that the GEX high was several days before we saw QQQ’s price high, but it was within relatively close proximity. Could this also signal a relatively short correction that concludes within the next few days? I mentioned 480-500 (admittedly a broad range, but hey, it’s 2025!) in our YouTube video a day or two ago, I’d still like to see that area hit.

SPX is already touching the lower Dealer Cluster zone, so another day or two of negativity makes closing the 5700 gap realistic. And I would call that a positive, wouldn’t you? I know, tell you what happens next and then you’ll be able to say whether or not 5700 is a positive. As long as SPX shows relatively large GEX clusters at 6000, 6100, and 6200, combined with some technical factors, I’m willing to bet bulls aren’t yet ready to be sent off to the back door of the back-alley steakhouse.

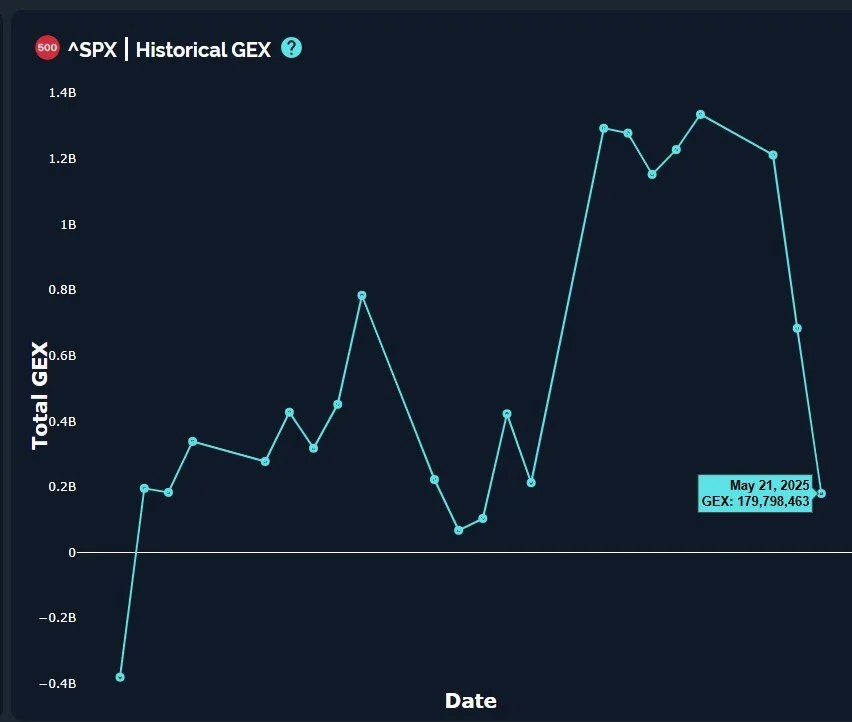

SPX also saw a large drop in positive GEX, yet SPX is still showing overall positive GEX, albeit a neutral reading. I believe SPX appearing slightly more bullish does warrant caution toward giving too much credit to the more negative readings on other index ETFs, and this is based on my own limited recent observation over the last couple of years. Our intraday readings have mostly been keeping us on the right side of the trade despite a relatively more difficult picture compared to weeks ago, so we will adjust accordingly as we see tomorrow unfold. We’ll update subscribers in our Discord server. Thanks for joining us!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.