Negative Divergences Building

THE ANNUAL SUBSCRIPTION PROMO ENDS SOON- We’re currently offering $300 off of the annual Portfolio Manager subscription. We recently released new mobile interface improvements, and we’re working on more, as well as our recently started daily livestream. Enter code MAY2025 at checkout to lock in a great annualized cost for access to our highest-level subscription! This promotion will last for a few more days.

In case you don’t follow our YouTube channel, we posted a video this evening covering the indices, the VIX heading into tomorrow morning’s monthly option expiration, and some individual tickers, so check it out. You can view the short video by clicking here. We’re going to exclusively focus on QQQ and SPX in tonight’s newsletter.

We’ve noted the important negative clusters at 450 and 470 for QQQ, but now that we’re seeing more of a negative shift in GEX combined with certain technical indicators, it might be time to start thinking more about how we’ll handle a pullback. Today was the first day since May 12 for QQQ to close below the Hull moving average, which may tilt the scales toward the negative side in the short term. Especially given that we’re pressing against the top Keltner channel as well, a fairly good guide for potential reversal areas at the extremities. That said, the rising Hull is now virtually at the 525 Dealer Cluster zone we’ve been highlighting for at least a week and a half, providing good confluence for a tag of 525 to also mark a test of the Hull from below. With monthly VIX options expiring tomorrow, we may finally get the volatility that would allow us to both tag 525 and potentially reverse downward in short order (no pun intended).

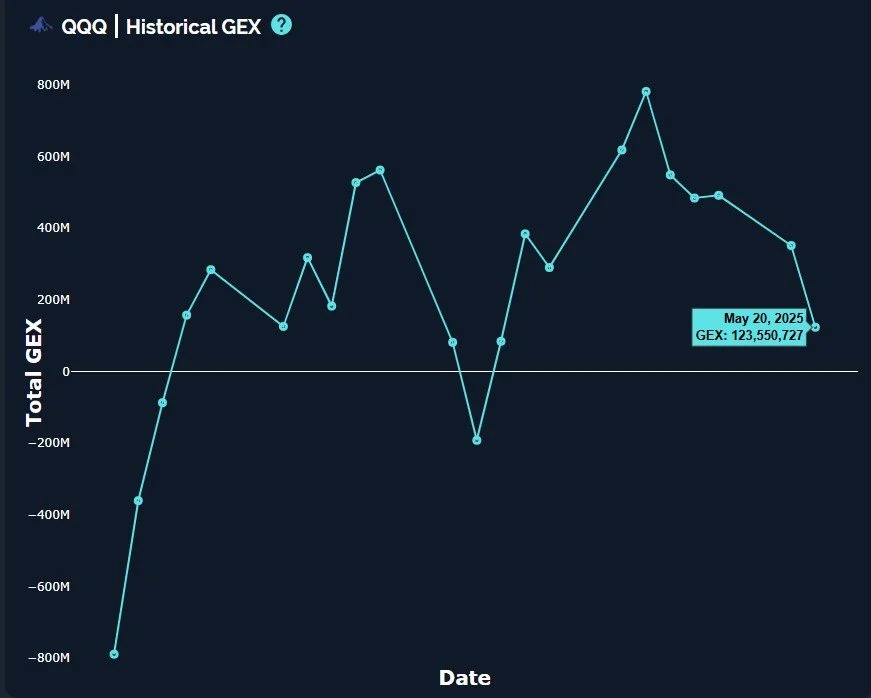

Glancing at the total net GEX reading for QQQ below, you can see a sharp decrease since 6 trading days ago, though GEX is still technically net positive. 4 out of the last 5 days marking a decline in GEX might be warning us that participants are bracing for consolidation of some sort, whether it’s a sharp, short pullback, or a longer sideways move, just to mention two of several ways in which the future might unfold.

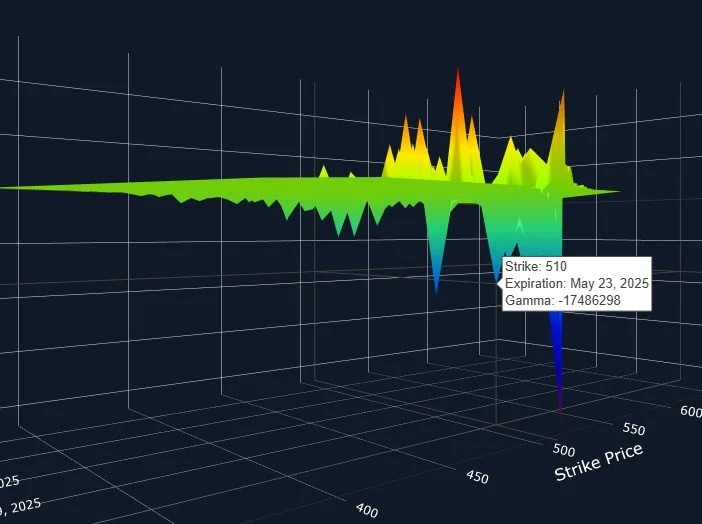

Clicking around on our 3D graph, the largest clusters being those strikes that expired today, of course (they disappear early tomorrow morning), I notice the largest single GEX cluster for May 23 is a negative GEX cluster at 510. If this focal point remains important as the week goes on, we may see a 2-3% decline this week, which fits right in with the negative GEX picture and the technical indicators mentioned previously.

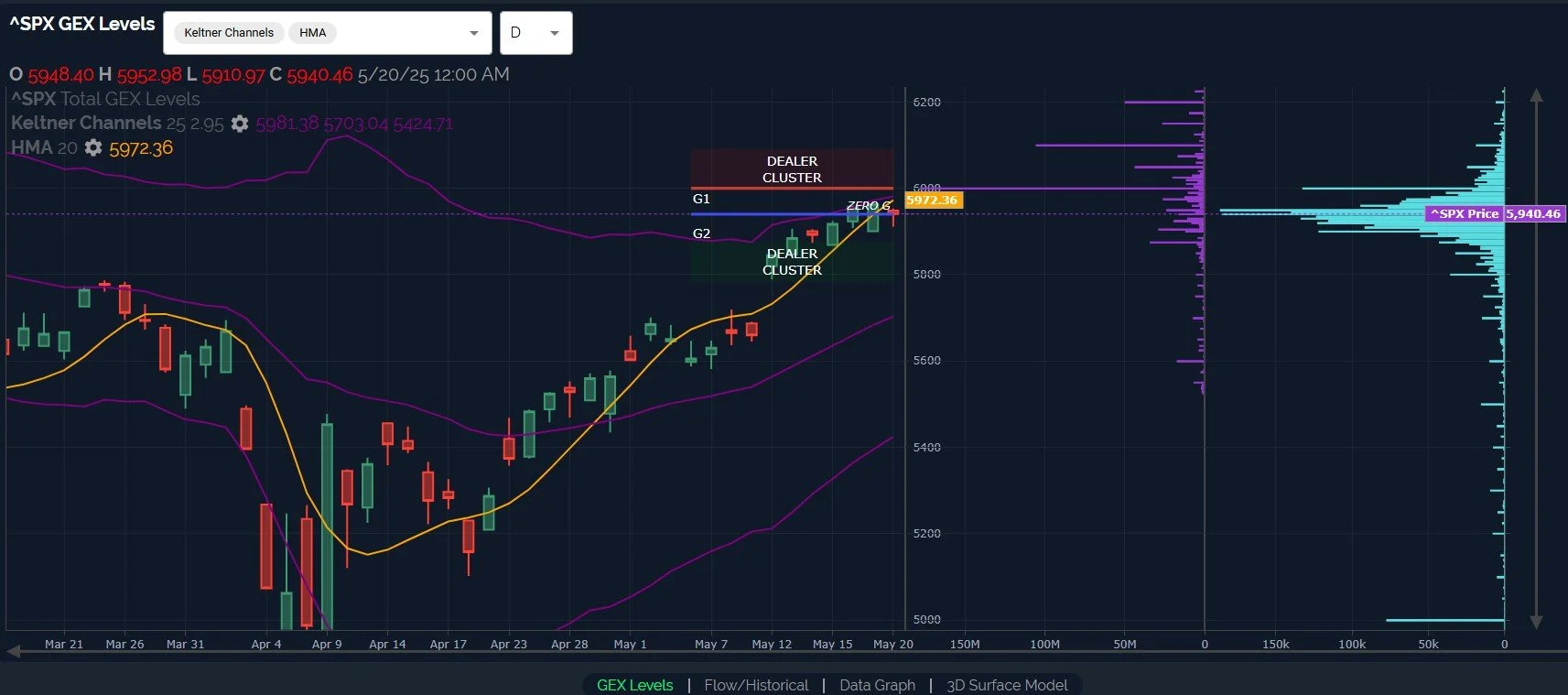

Very similar developments for SPX: A close below the Hull, right against the upper Keltner channel, and a rising Hull that is very close to the 6000 SPX GEX target we’ve been watching even longer than the 525 cluster for QQQ. We see very little negative GEX for SPX, though I will mention the curious volume at 5000 we’ve seen for days on end now. I certainly don’t expect 5000 to come into focus during this upcoming hypothetical pullback, but filling that gap down to the 5700 would be nice, if possible. GEX suggests 5800, so we’ll see how the picture develops as a decline unfolds.

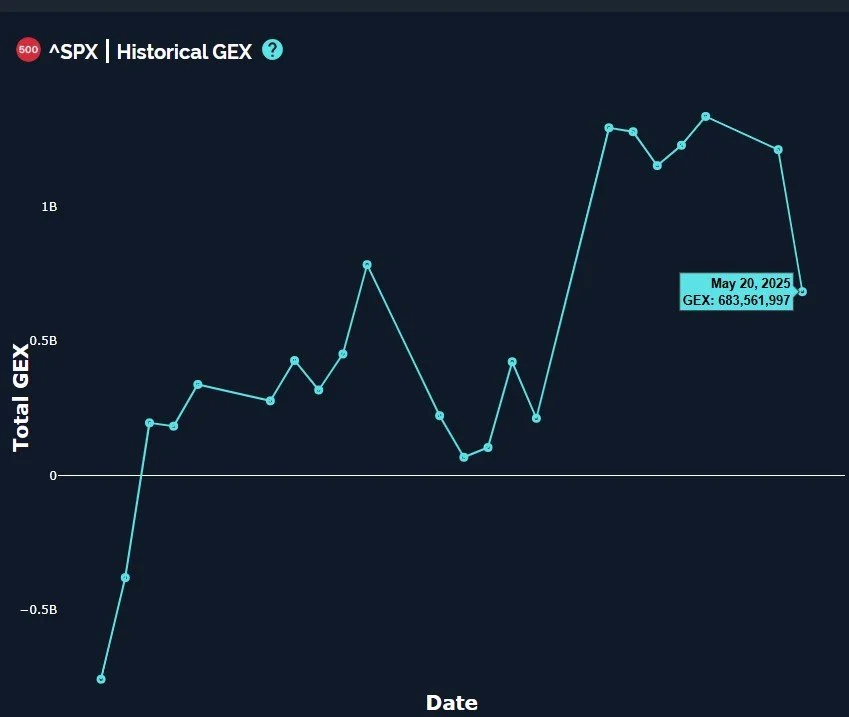

SPX had maintained a more positive GEX picture overall compared to QQQ, but today finally saw a pretty big decline in positive GEX, getting cut in half to 683.5M. This is still a neutral reading, but GEX is heading in a negative direction for the 2nd day in a row.

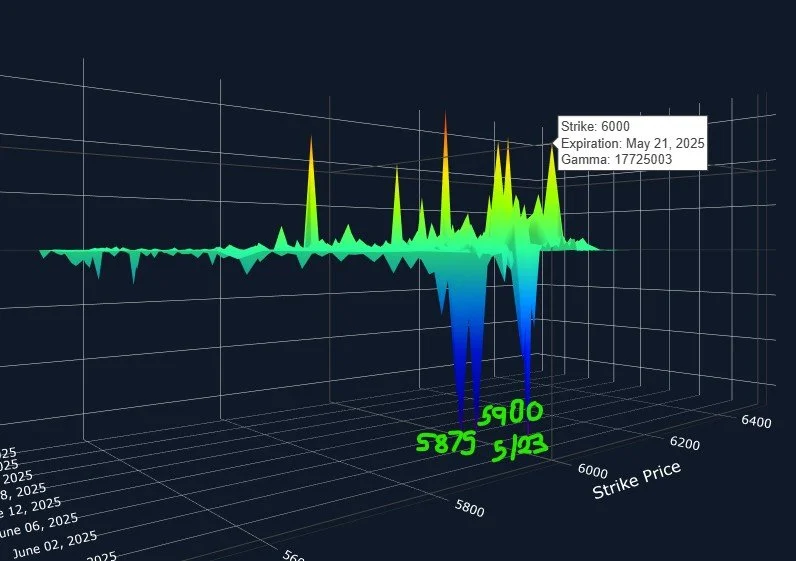

I found SPX’s 3D graph to reveal some interesting similarities to QQQ’s 3D graph, with an additional potential data point that backs my initial assertion that we might hit 6000 tomorrow. Not only do the negative clusters at 5875 and 5900 represent the largest GEX clusters centered around Friday’s expiration, but we see a big 6000 cluster expiring tomorrow. GEX can easily shift tomorrow onward, potentially invalidating this picture, but it’s quite interesting that the current picture adds a lot of credibility to the hypothetical high tomorrow and drop into Friday. We’ll find out soon enough how it plays out.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.