At The Doorstep Of A Spike & Reversal

THE ANNUAL SUBSCRIPTION PROMO ENDS SOON- We’re currently offering $300 off of the annual Portfolio Manager subscription. We recently released new mobile interface improvements, and we’re working on more, as well as our recently started daily livestream. Enter code MAY2025 at checkout to lock in a great annualized cost for access to our highest-level subscription! This promotion will last for a few more days.

In case you don’t follow our YouTube channel, we posted a video this evening covering a quick post-OpEx look at GEX for the indices as well as some individual ideas, so check it out. You can view the short video by clicking here.

In the YouTube video, we mention that we don’t see any immediate reversal signals that would say a market dump is imminent, yet we also mention that (in theory) we may see a pullback soon. To explain further, given the nuance that may seem contradictory if ignored, SPX continues to close above the Hull moving average, maintaining the bullish momentum higher. The debt downgrade and gap down couldn’t stop another close back above the line (hey can I get another one of those gap down headlines? LOL).

Yet we are pressing up against the upper Keltner channel, a line that apparently matters, given that we can’t stay above it. We also have the big ever-looming GEX cluster at 6000 marking the upper Dealer Cluster zone. The historical graph below shows a slight drop in GEX, still maintaining the bullish 1B+ net GEX reading, yet also reflecting 3 out of the last 4 days showing marginal drops in positive GEX.

Glancing at QQQ, we see a far more precarious walking of the line, with 525 still not budging at the largest GEX cluster, yet 450 and 470 have seen some growth on the downside. Participants are still positioned for more upside as the move with the highest odds, but the timing and order of down versus up may leave bulls with a little indigestion short term. QQQ is also right against the upper Keltner channel, barely above the Hull, and right at the doorstep to the 525 Dealer Cluster zone, which is where we think dealers might become sellers (up to a few points above 525 as well).

QQQ shows a somewhat more concerning continued drop in total net GEX, only slightly higher than nearly a month ago on April 25.

Concluding what we see with SPX and QQQ, both are barely maintaining the long signal with the close above the Hull, but we are right at the doorsteps of their respective upper Dealer Cluster zones, and we’re at upper Keltner resistance. So back to the initial statement: Yes, both indicate that the upside may continue, and we don’t have a short signal, even for the start of a modest pullback. Yet we are so close to those zones and technical resistance that we could see such a signal and begin a pullback even in the overnight session. It’s time to have a gameplan for how you’ll manage such a pullback, even if it doesn’t start immediately. Be prepared and have a plan for how you’ll react now so you’re not reacting emotionally in the moment when you wake up to a gap down (again).

IWM is potentially more concerning than SPX and QQQ, and only the future will tell, but it’s possibly telling us something about what comes next for the other indices as well. IWM couldn’t make it back above the Hull moving average, closing below the line. We also haven’t seen GEX shift higher, with 210 still marking the upper Dealer Cluster zone. 200 and 190 are both large GEX clusters and potential magnets from here, and we see high volume at 197 and 199, just below 200.

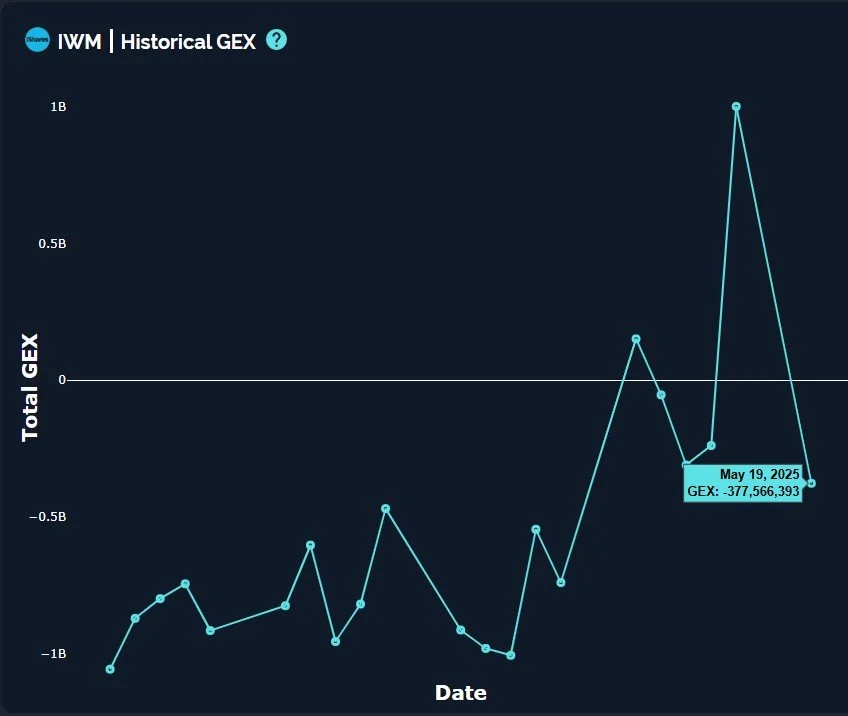

IWM saw a sharp decrease in GEX, right back to negative territory after spending two out of the last six days in positive GEX territory. IWM currently gives me a short signal, given that it’s below the Hull and 200 is the biggest remaining GEX cluster after 210 has diminished, so we have a conflicting picture that will need to resolve itself in coming days, and I still suspect that resolution will be to the downside before we see more meaningful upside.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out back tested algos and chart indicators and we just increased our ANALYST tier subscription to include 600+ tickers, including individual stocks! Mobile updates are now live for a better mobile experience too!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.