GEX Shifting Higher…At Resistance

THE ANNUAL SUBSCRIPTION PROMO IS BACK- We restarted our $300 off promo of the annual Portfolio Manager subscription due to popular demand. We have new mobile interface improvements released tonight, and we’re working on more, as well as our recently started daily livestream. Enter code MAY2025 at checkout to lock in a great annualized cost for access to our highest level subscription! This promotion will end soon.

In case you don’t follow our YouTube channel, we posted a video this afternoon covering some key levels in SPX as well as GLD and individual stocks like TSLA, so check it out. You can view the short video by clicking here.

Indices concluded OpEx week last week by impressively maintaining gains (and some follow through) from Monday’s gap up. The current bottom line is that we need to respect the possible shifts that will occur with tomorrow’s post-OpEx cash session open, with participants repositioning for the next OpEx cycle, and we also have VIX monthly options expiring Wednesday premarket, which will be one of our focuses in today’s newsletter. These are hopefully obvious unknowns. The Hull moving average is rising sharply across the board, but as long as price maintains above that level, my technical bias is higher, and GEX backs that assessment as well. Friday did see a post-close spill off that coincided with a headline about a US debt rating downgrade, and futures are now below the daily Hull, so we need to remember previous warnings, that the proximity to these upper Dealer Cluster zones and technical resistance may mean we start the pullback more immediately.

As of Friday’s cash session close, the Hull rising at such an angle while price hasn’t rallied quite as much gives us a very tight technical area to watch. For instance, looking at DIA above, losing 424 will flip my bias to short on a daily basis. DIA currently seems to paint a picture of not quite being done with its upside for this move: The upper Keltner channel is almost at 433, covered by the upper Dealer Cluster zone, which starts at 430. Dealer clusters are areas where we believe Dealers might become sellers based on our interpretation of positioning, and these zones have worked quite well for us.

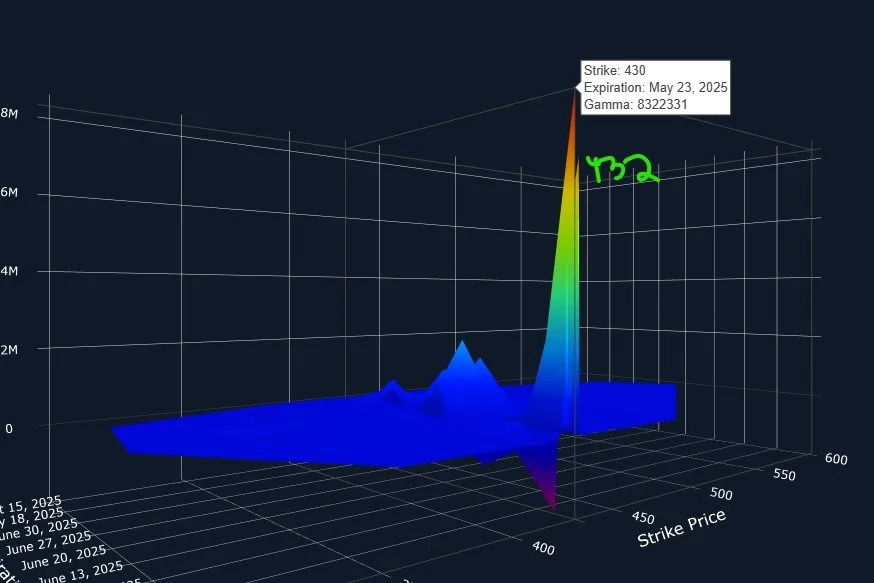

DIA’s 3D graph paints a focus on this coming Friday for the 430 and 432 strikes, which are prominent positive clusters, as you see below. This doesn’t mean that DIA waits until Friday and then hits those targets, but it does mean that we assign higher odds of those targets being met at some point this week. We often see these targets shift once they’re reached, even if reached prior to the expiration of those option strikes. This may shift as soon as Monday morning, so as we said, let’s react to the data tomorrow morning while keeping all likely possibilities in mind until then.

SPX is my stalwart reference point for where I believe similar indices are likely to go, and we do see GEX continuing to grow at higher strikes. The short-term picture is a bit murky though, with SPX at the upper Keltner channel and very close to the big dealer cluster at 6000. GEX suggests the odds are very high of hitting 6000 in short order, which is less than 1% away, but we may be on the verge of a pullback immediately thereafter. An admittedly speculative idea until proven, but lots of surrounding signs point to a reversal coming fairly soon before potentially continuing higher. We do see GEX at 6100 growing, so participants seem more bullish in recent days.

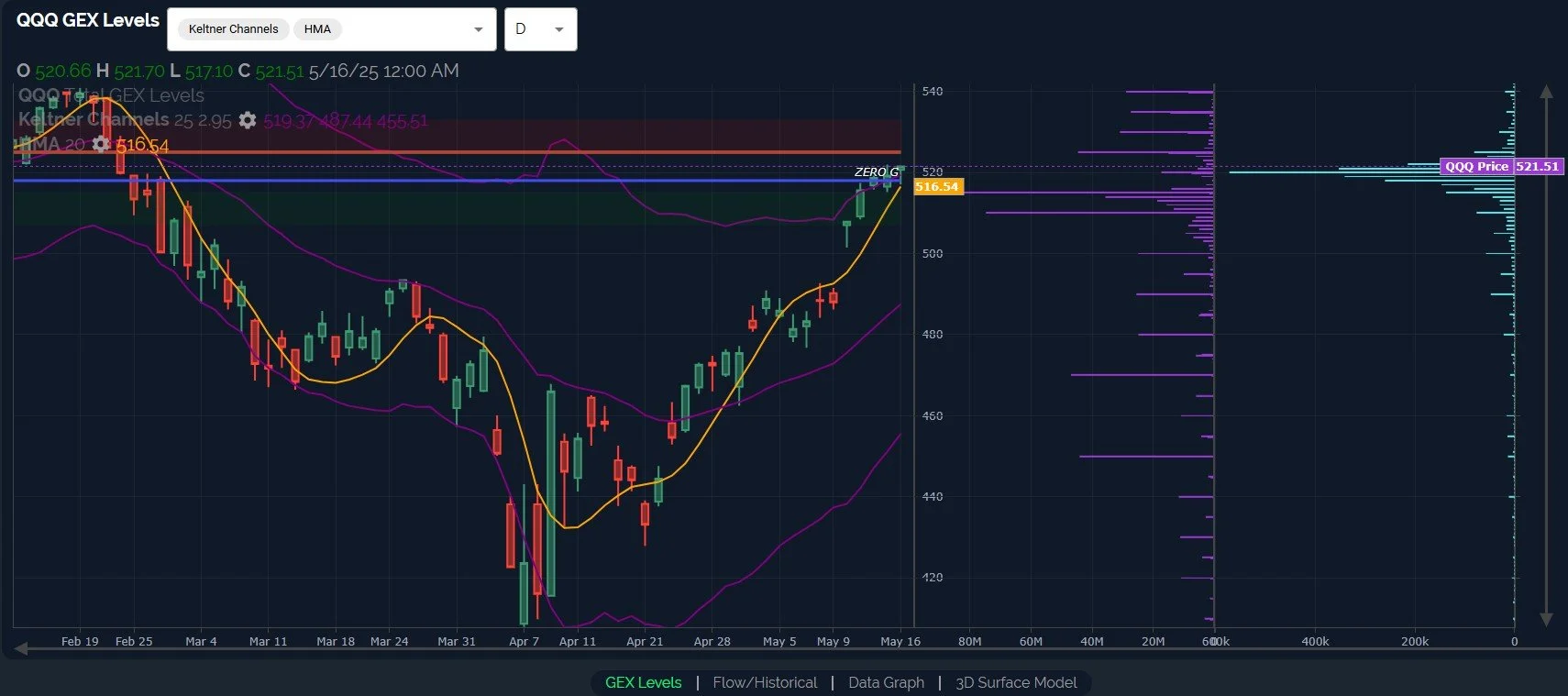

QQQ hasn’t moved much on a net basis for the last 3 days, negatively diverging from SPX. Yet GEX has increased, and we do see a variety of higher targets for QQQ as well, at least down the road. The upper Dealer Cluster zone is just overhead at the 525 level that we were watching all of last week, and QQQ has already (barely) exceeded the upper Keltner channel on the daily chart. The Keltners are rising in bullish fashion, so any ensuing pullback will be viewed by us as a buying opportunity, which we’ve emphasized several times recently.

The VIX has continued its move lower after losing the Hull moving average on Monday, but we see most of the option volume at higher strikes, presumably as participants load hedges at cheap prices while the VIX is approaching an area that has acted as support for volatility for quite some time. VIX expiration this Wednesday shows a lot of negative GEX at 17, and the zero gamma level at 19, so my interpretation is that we have fairly good odds of seeing the VIX hold this area or even rise toward 19-20, incinerating a lot of puts while not giving calls too much life either. This can change between now and Wednesday, so we will keep an eye on the situation.

Lastly, the VIX did just regain the 2 hour Hull (despite the red candle) for the first time since the 15th. I circled 8 instances since late April where the VIX closed above the Hull on the 2hr chart, with 6 of those times leading to higher VIX levels within 1 or more candles afterward, even if a brief spike. So rising above the Hull looks like a pretty good long signal to me, long volatility in this case. It’s simple, but it has been working for me. Some of you have your own indicators you like to use, and that’s great. We hope you’ll join us in Discord as we start a new week and we appreciate the wealth of experience and knowledge that you bring to the table in our discussions!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out back tested algos and chart indicators and we just increased our ANALYST tier subscription to include 600+ tickers, including individual stocks! Mobile updates are now live for a better mobile experience too!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.