Approaching A Likely Market Turn

THE ANNUAL SUBSCRIPTION PROMO IS BACK- We restarted our $300 off promo of the annual Portfolio Manager subscription due to popular demand. We have new mobile interface improvements released tonight, and we’re working on more, as well as our recently started daily livestream. Enter code MAY2025 at checkout to lock in a great annualized cost for access to our highest level subscription!

I’ll start the newsletter with our customary link to our YouTube video, where we discuss some different ideas about the broader indices as well as some individual tickers not covered in the newsletter, which you can view by clicking here.

We actually saw some interesting action today (at least as far as a normal OpEx week is concerned), so I wanted to focus on some of the more interesting developments today. QQQ has entered the upper Dealer Cluster zone, leaving a fairly nasty wick from the intraday highs despite the overall positive day. A few of us in our 0 DTE channel in Discord captured some nice intraday profits from the move off of the highs. Despite the rejection, and the struggle at the upper Keltner channel, we may have just enough “umph” to see another move toward the QQQ 525 level.

Today’s closing total GEX for QQQ decreased, though we are still in positive territory. While this particular divergence with SPX and other major indices is a negative, QQQ still shows 525 as the largest GEX cluster expiring tomorrow, so I think the odds are quite good for yet another push higher above today’s intraday high of just under 522. We are getting very close though, and GEX is not growing at higher strikes, so we are on watch for a pullback in the short run.

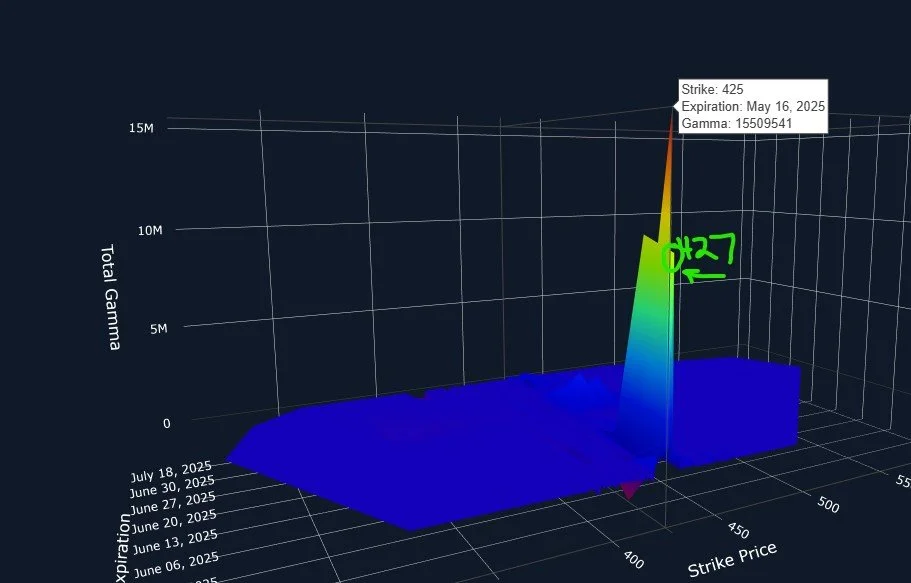

DIA has been underperforming all week, printing lower lows and lower highs even as of today’s close. Despite the price action, the chart appears to look constructive, with the downside this week looking more like consolidation than anything. DIA does have the same problem as QQQ: A lack of substantial GEX growing above the 427 level in this case.

That being said, the highest GEX cluster for tomorrow’s expiration is 425, and 427 also has substantial representation.

DIA also saw a major jump in positive GEX, likely due to the increase at the 426 and 427 strikes. With today’s close over 424, and DIA not having reached the upper Dealer Cluster zone yet, I would say DIA adds another data point in favor of indices making one last short-term push tomorrow alongside QQQ toward 525 and SPX toward 6000 (discussed in YouTube).

Lastly, the VIX broke below the Hull Monday, triggering a short volatility signal, and today an attempt to push back above the Hull at 18.81 was rejected. But we do see volume at higher strikes, particularly 25 and 30, as well as several strikes between 40-50. With the VIX showing a lot of GEX between 16-18, downside may be limited for volatility going forward.

Despite the noted perception of limited downside, we do see the 4-hour VIX Keltner channels pointing toward a possible visit to the 17 area for the VIX. This also supports the idea of the markets rallying yet again tomorrow, even if they ultimately fail to reach the exact targets mentioned. Understanding GEX and what makes GEX, it’s not surprising to see targets missed (even barely) or sometimes briefly exceeded, so tomorrow we will be on high alert and focused on hedging downside risk more than initiating new long positions beyond an intraday timeframe. Thanks for joining us in Discord and thanks for reading!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out back tested algos and chart indicators and we just increased our ANALYST tier subscription to include 600+ tickers, including individual stocks! Mobile updates are now live for a better mobile experience too!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.