Canaries In The Cobalt Mine?

THE ANNUAL SUBSCRIPTION PROMO IS BACK- We restarted our $300 off promo of the annual Portfolio Manager subscription due to popular demand. We have new mobile interface improvements released tonight, and we’re working on more, as well as our recently started daily livestream. Enter code MAY2025 at checkout to lock in a great annualized cost for access to our highest level subscription!

I had to modernize the saying about the canary with a reference to cobalt, which is used in the making of electric batteries by companies like TSLA, just to explain that I’m not crazy (well, not TOO crazy). We discuss a short-term cautious outlook for indices and some long plays with individual stocks in today’s YouTube video, which you can view by clicking here.

SPX is very close to the upper daily Keltner channel (an indicator I personally find to be more useful at upper and lower extremes than bollingers), and even an overshoot would be roughly 2% upside from here. The overall channel appears to be bullish, so any ensuing pullback may be a good buying opportunity. Closing the gap to just below 5700 would be nice, but an overshoot is possible.

Given that it’s OpEx week, we can’t be too surprised by a lack of follow-through, in fact we have at least one long-time subscriber who habitually avoids trading during OpEx week due to understandable frustrations regarding directional trades. But with back-and-forth we can find opportunity…That topic for another day. Back to SPX: GEX is lower for the 2nd day in a row, though but by a large amount, still leaving SPX looking bullish with 1.1B positive GEX.

QQQ shows even less upside, with 525 barely over 1% higher, and QQQ is also at the upper Keltner channel. One potentially bearish observation (other than positive GEX also decreasing for QQQ) is the growth of the 450 strike with accompanying volume today. 450 and 465 both saw some action. Participants are used to short periods of intense volatility, in my opinion, but what if we are embarking on a “new normal” where we will overshoot to the upside and the downside for months to come? I think it’s a possibility we should consider, especially if the VIX keeps making higher highs and higher lows. In the Geek portfolios, we diversify, avoid outsize bets, structure each trade with some degree of asymmetry, and at least partly hedge at times such as this, which allows survival and smooths out the occasional times where we’re inevitably wrong.

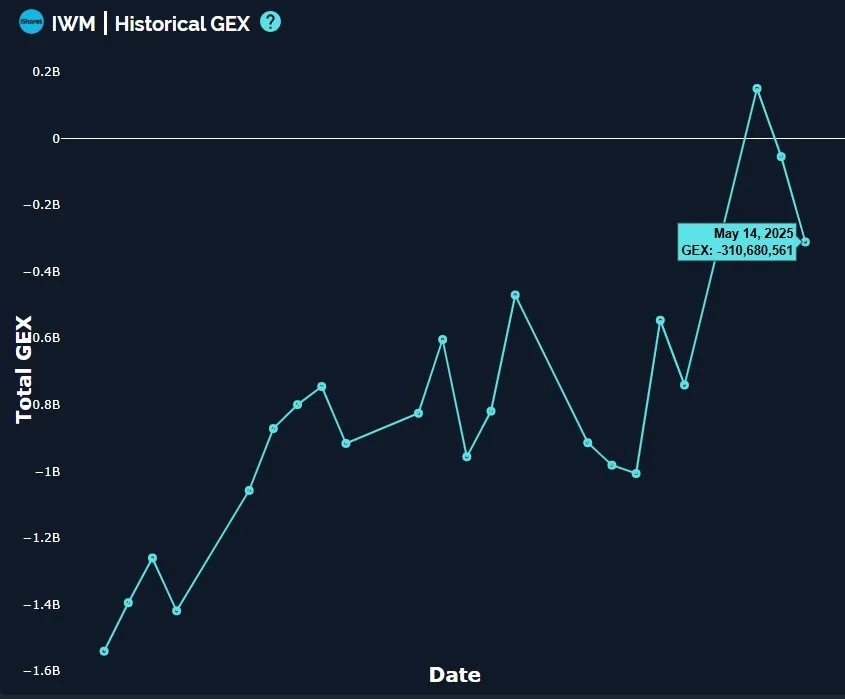

IWM is particularly concerning and “canary-ish,” closing lower than any of the last 3 days, the lowest close since the big gap up Monday. We also see noticeable growth in negative GEX clusters, including that pesky 190 (why won’t it just die?) and down to 180. At this stage, I would welcome a drop to 200, which closes the gap from Friday and gives IWM a chance to arm wrestle with the GEX at 200 that will likely determine whether or not we reverse back up or go lower.

IWM saw quite the negative swing in total GEX, dropping back into negative territory with an almost -500M shift from the peak two days ago. Sometimes IWM’s GEX has been a preview of the next direction for price, but sometimes it’s more of a contrarian signal (particularly at extremes), so we can’t draw any directional conclusions from this single data point right now. But we will be watching for continuation of the GEX trend or reversal for possible clues about the most likely next move.

The VIX is still in firmly negative GEX territory, a shift we just saw this week, but we also saw an improvement toward the positive side for VIX GEX, and we also see the 2nd day of green candles and high volume at 42.5 and 47.5 strikes. I looked at the 2-hour and 4-hour charts, both of which show the VIX having regained the Hull, a long signal. The top of the 2-hour Keltner channel is at 21, and the top of the 4-hour channel is roughly 23.5, matching pretty closely to the zero gamma line at 23. I’m not sure whether or not we see the VIX make a run for 23 this week or next week, but I definitely understand the incentive of causing some pain for both sides of the aisle leading up to next Wednesday’s VIX expiration.

Preserve your capital and we’ll look forward to providing some updates in Discord as we progress through the back half of OpEx week. Thanks for joining us!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out back tested algos and chart indicators and we just increased our ANALYST tier subscription to include 600+ tickers, including individual stocks! Mobile updates are now live for a better mobile experience too!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.