Time To Exercise Caution?

THE ANNUAL SUBSCRIPTION PROMO IS BACK- We restarted our $300 off promo of the annual Portfolio Manager subscription due to popular demand. We have new mobile interface improvements released tonight, and we’re working on more, as well as our recently started daily livestream. Enter code MAY2025 at checkout to lock in a great annualized cost for access to our highest level subscription!

Today’s YouTube video, which can be viewed by clicking here, highlights updates on the major indices as well as a big shift with the VIX. Some individual ideas are shared that you won’t find here, so check it out.

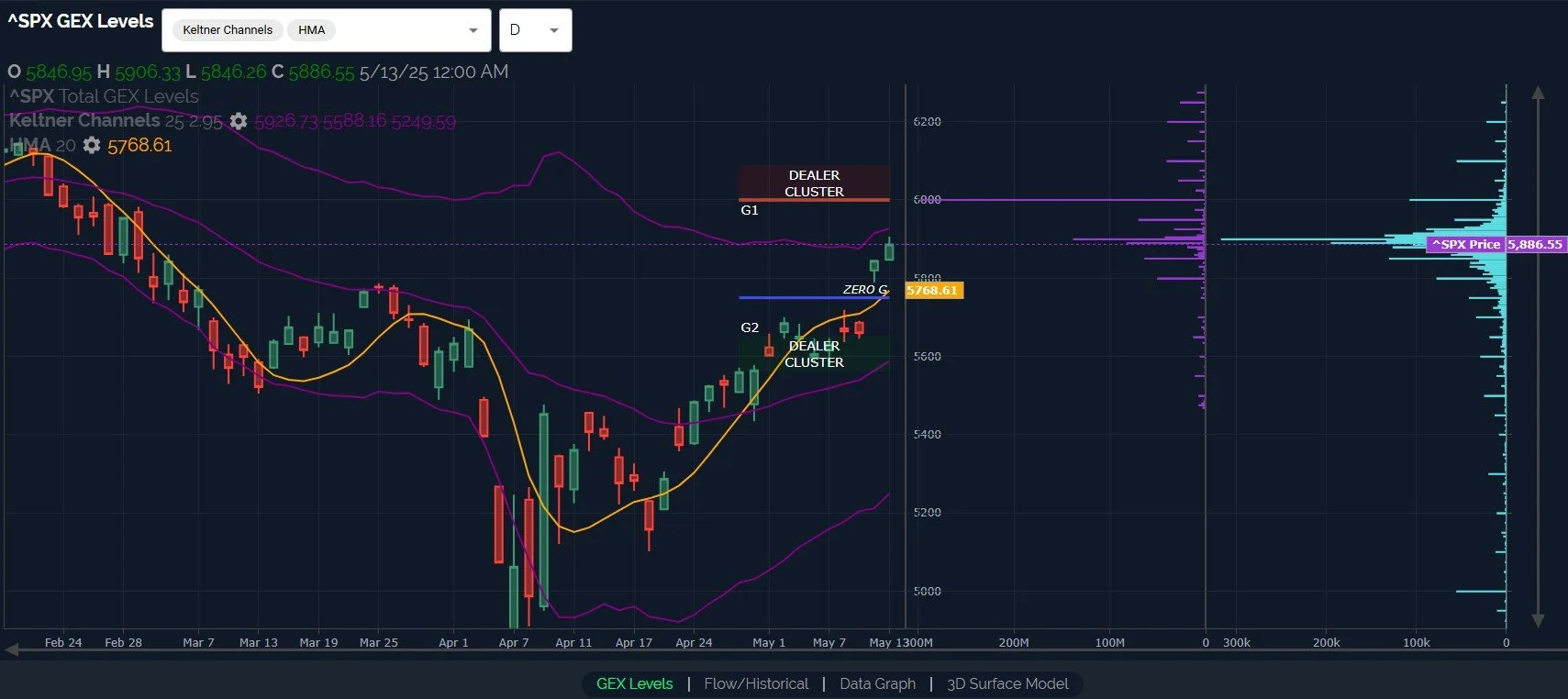

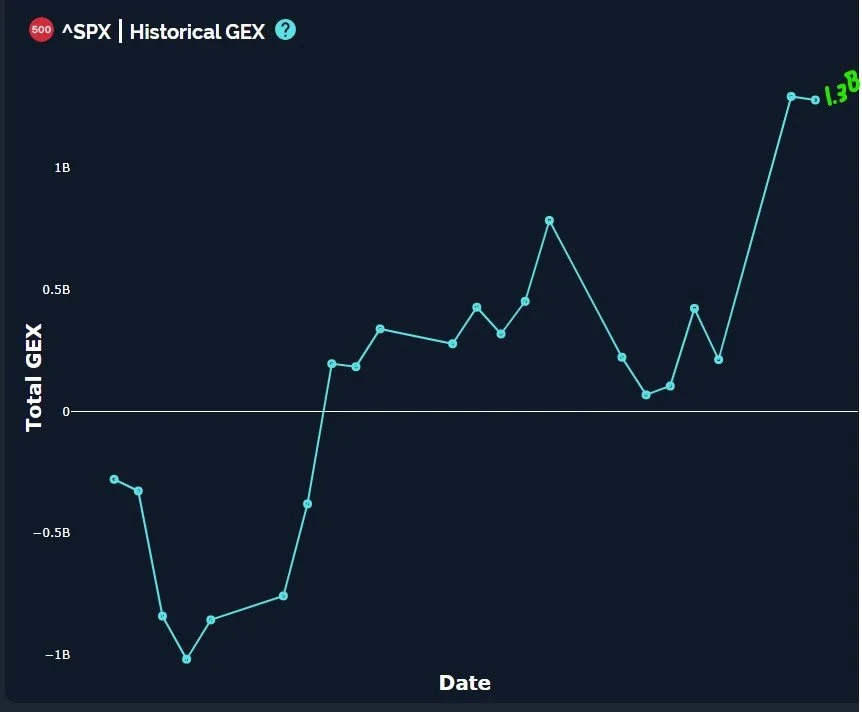

Bullish momentum continues, with nary a seller in sight, I guess they’re all extinct (I think my joke about dead bears triggered a reader or two yesterday). Our recent newsletters might have seemed conflicting as we’ve highlighted the high probability upper targets of 5800 and 6000 for SPX (one down, one to go), while also recognizing that we can reach those targets with a pullback before the final push. Obviously we received clarity in the form of the direct pathway to those targets, with 5900 being breached today and 6000 right around the corner. We’re now at a spot where conviction is rising that an imminent pullback has good odds, and upside potential is likely limited, with 2% more to reach 6000 but a far larger drop could occur to reach the lower Dealer Cluster zone. Let’s take a look at a few other reasons to possibly pull out your old sports cup and maybe a little more padding (and a helmet) as we approach the in (and end) zone.

SPX is now approaching the upper Keltner channel at 5926, and a sizable GEX cluster at 5950 and especially at 6000 are just above. Keep in mind that there’s nothing saying we have to hit 6000, the market can turn south at any moment, or it may exceed 6000. The conservative approach is obviously to be ready for failure just prior to reaching that large GEX cluster, however that looks for your own strategy and approach.

We see a little divergence with SPX and SPY, though I don’t find the divergences particularly clear. I will say that SPY has more influence from retail traders than SPX, and I can think of a few times where SPY reaching an extreme GEX reading was a great contrarian signal. Right now we see SPY with a larger GEX cluster at 590 than at 600, yet total net GEX moved more positive today. SPX still shows 6000 as the largest cluster, yet GEX moved slightly more negative today. I still think SPX ends up being closer to where we land (near 6000), but it’s good to keep in mind that they don’t paint exactly the same picture.

QQQ is also at the upper Keltner channel as well as the upper Dealer Cluster zone. 525 has popped up over the last couple of days as a possible target by Friday, and that’s basically near the upper edge of the zone, so any continued move higher will possibly have 525 to contend with.

Lastly, we saw a big shift in the VIX, now reflecting negative total GEX and showing large GEX clusters down to 16. This looks like total VIX capitulation, with the formerly large clusters at 42.5 and 50 now all but gone. We’re also in the lower Dealer Cluster zone. With OpEx Friday ahead, and participants becoming more bullishly positioned, might we aim for some premium kill on the call side into Friday? It’s a speculative possibility, but we’ll continue taking our clues from how we see GEX shifting intraday. We hope you’ll join us in Discord!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out back tested algos and chart indicators and we just increased our ANALYST tier subscription to include 600+ tickers, including individual stocks! Mobile updates are now live for a better mobile experience too!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.