Is That It?!

THE ANNUAL SUBSCRIPTION PROMO ENDS SOON- We’re currently offering $300 off of the annual Portfolio Manager subscription. We recently released new mobile interface improvements, and we’re working on more, as well as our recently started daily livestream. Enter code MAY2025 at checkout to lock in a great annualized cost for access to our highest-level subscription! This promotion will last for a few more days.

Today’s YouTube video looks at the indices and the VIX with some slightly different points than those we’ll make it today’s newsletter, so be sure to check it out. You can view the short video by clicking here.

The daily close below the Hull has worked pretty well in terms of follow-through on the short side (my apologies to those who frown upon simple indicators), but today itself seems like a “whole lot of nothing.” Indices made a weak effort to push lower, then an effort to push higher, then a late-day embarrassing fall down the last couple of steps on the staircase. Nothing serious, though.

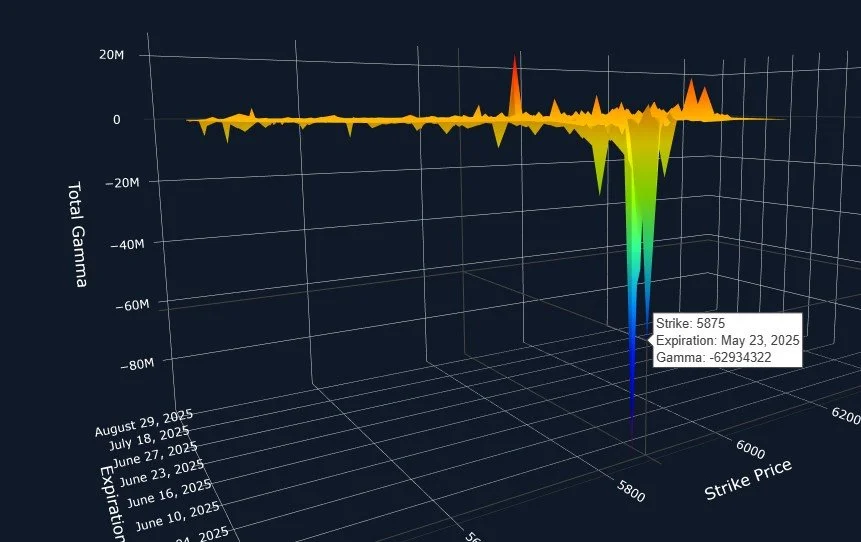

Looking above at the SPX GEX Levels chart, I think it’s worth noting that the GEX at higher strikes starting with 6000 appears to be “sticky,” refusing to budge during this pullback. We also see the Hull (the yellow line) stubbornly elevated above the current price. In addition to those factors, the Keltner channels are fairly bullish, pointing higher, and the upper channel is still very close to 6000. Yes, we do still see an awkward “big guns basement bear” trader trading the 5000 strike, but we’ll ignore that for the time being.

A few GEX clusters expiring tomorrow deserve attention: We see 5800 and 5900 in similar size, and the largest GEX cluster expiring is a big negative cluster at 5875. Does this mean 5875 is a target for tomorrow? I’d say 5875 has good odds of being hit, though that doesn’t mean we close near 5875. We also saw SPX GEX slightly decline further today. In summary: Based on the current picture, a move toward 5800 tomorrow is likely a buy, and any move toward 5875-5900 is likely a sell, of course with the caveat that I will consider new data after the cash session opens before placing any trade with an intraday time horizon.

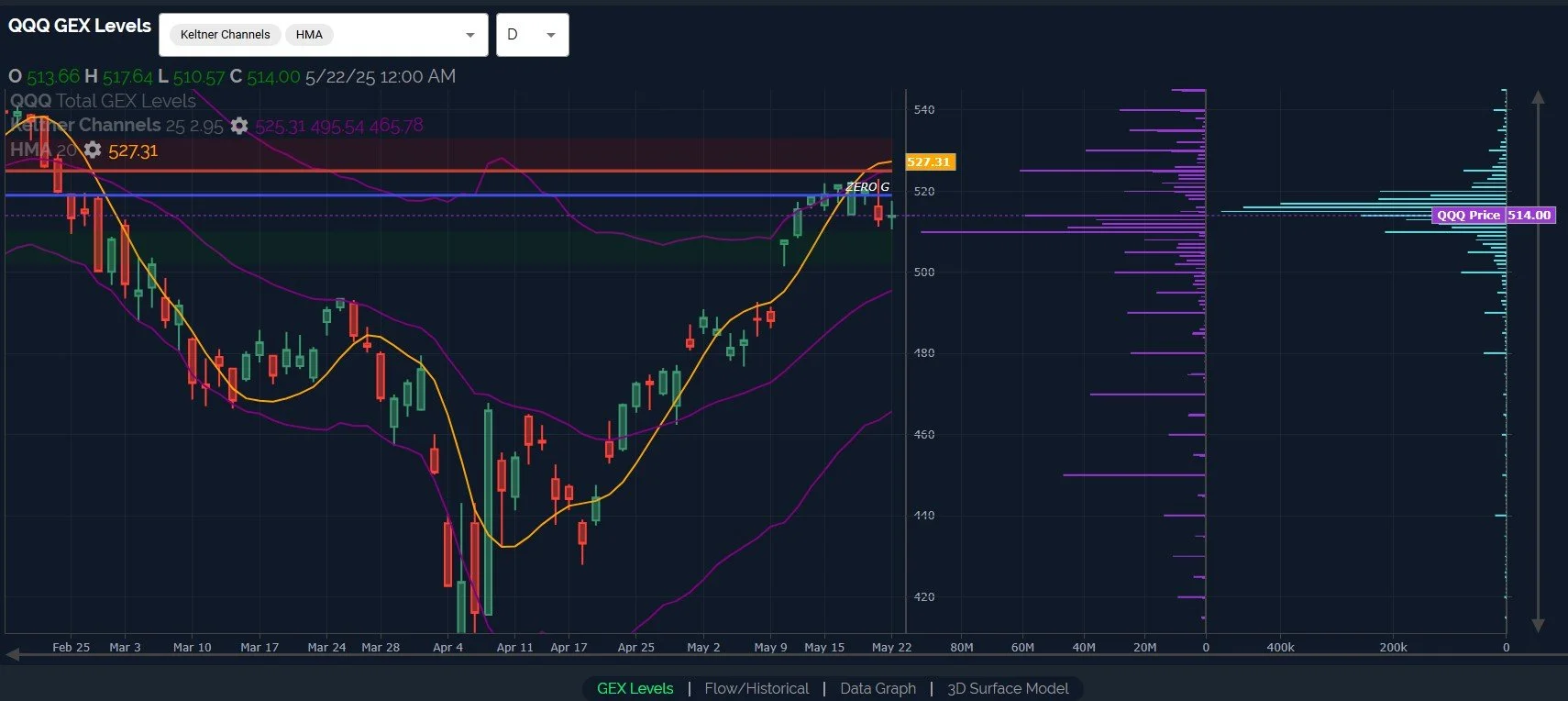

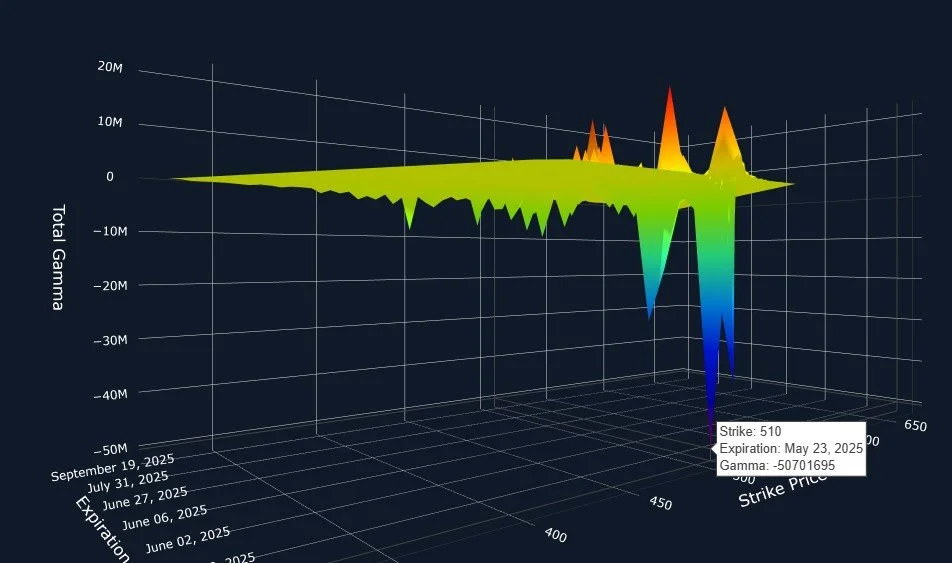

QQQ still shows 525 as a possible target, though I’d love to see the gap going back to May 9 filled. 510 is the largest GEX cluster currently, though we still see 450 and 470 worthy of mention on the downside.

Looking at the 3D graph, 510 appears as the largest negative strike expiring tomorrow, so perhaps we will find our way toward that strike. If we approach 510 early enough, that general area may end up being a buy, similar to 5800 SPX.

Lastly, the VIX is back to showing positive GEX, and participants were more interested in trading higher strikes today, as evident by the daily volume bars in light blue to the right. The VIX is above the Hull, but at 17.10, the Hull is quite far below the current VIX level, sort of the opposite situation we see with SPX and QQQ. Price eventually converges with the Hull, in my experience, so I think it’s reasonable to watch for either the Hull to rise or for price to take the impetus to approach the Hull, whether now or after the current pullback is completed.

Looking at the 4-hour chart below, courtesy of TradingView, the VIX appears to have turned a corner to the upside, and the current pattern off of the recent spike looks like a consolidation before another spike, in my opinion. We did briefly touch 22, a level mentioned yesterday, so it’s possible this pullback is over, though I think QQQ and SPX getting off this easy is unlikely, especially given IWM’s underperformance lately. Let’s see if we can get at least a brief push lower and then look for a bigger bounce, ideally speaking. Given the market’s lack of appreciation for my ideals, join us in Discord tomorrow and we’ll share what we’re seeing in our free channel as we go along. Thanks for joining us!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.