Initial Rebound Imminent?

THE ANNUAL SUBSCRIPTION PROMO ENDS SOON- We’re currently offering $300 off of the annual Portfolio Manager subscription. We recently released new mobile interface improvements, and we’re working on more, as well as our recently started daily livestream. Enter code MAY2025 at checkout to lock in a great annualized cost for access to our highest-level subscription! This promotion will last for a few more days.

Today’s YouTube video looks at the indices at what appears to be a pivotal moment as well as covering a few individual tickers we think you’ll find interesting and relevant. You can view the short video by clicking here.

As for the newsletter, let’s take a quick look at some possibilities from the perspective of a particular set of indicators I personally like to use. We sometimes cover ideas using different indicators, but the same GEX data is a common theme regardless of our chart preferences (and we often arrive at similar conclusions thanks to that).

Starting with IWM, we saw a pretty picture perfect reaction initially, with Friday’s gap down premarket low of 196.58 seeing strong buying pretty much all day once the cash session started, closing above the middle Keltner channel on the daily chart and closing above the key 200 GEX cluster we’ve been discussing for the last week or so. This zone represented the lower Dealer Cluster zone where we expected dealers to potentially become buyers and 200 also represented the largest GEX cluster on the map.

Not all is rainbows and roses with IWM, GEX barely changed (Deeply negative) and IWM is below the Hull moving average without meaningful positive GEX clusters. IWM did a good job of tipping us off early regarding the weakness that unfolded last week, so was Friday’s positive move another heads up on a rebound coming? Futures seem to indicate so, for now.

While IWM reached the lower Dealer Cluster, QQQ and SPX were far less convincing, looking weaker all day Friday and not quite reaching the same middle Keltner channel reached by IWM. Note the continued high volume (50,000 contracts exactly) at the 5000 level? I draw no conclusions from that, but as the year progresses, I’ll keep that number in the back of my mind. We also saw high volume at 6000, a continued large GEX cluster for SPX, which I consider a potential positive development. We are also very far below the Hull (the yellow line), so while being below the Hull is a short bias for me, the distance between the current price and the 5967 level is far enough apart to not be surprised by a strong rebound toward that area- and maybe even an overshoot to finally reach that big 6000 cluster.

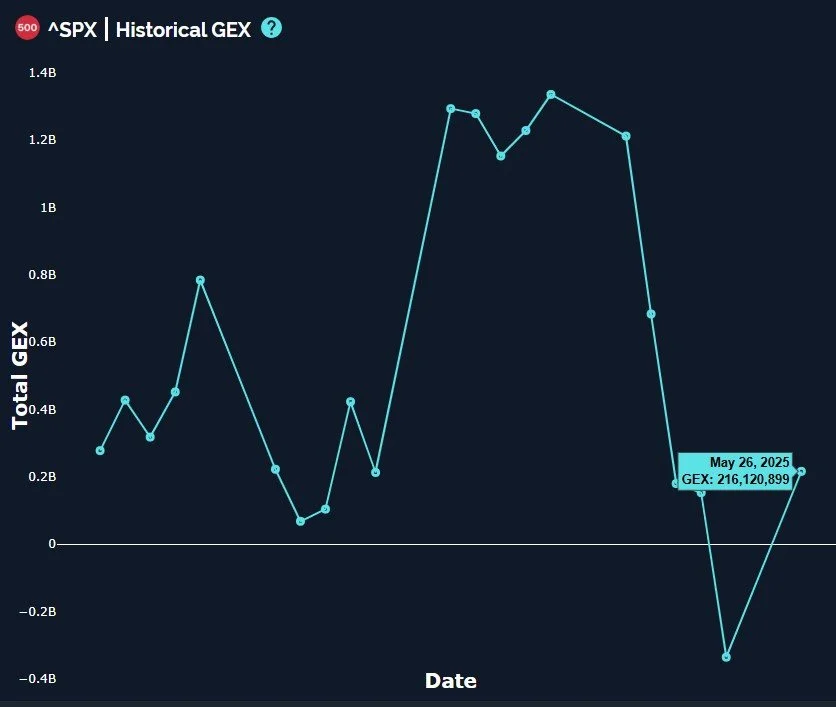

SPX saw a noteworthy jump in GEX back into positive territory, something not seen in SPY or QQQ. While IWM sometimes does a good job of signaling what’s ahead, between the large indices, I tend to give the edge to SPX when SPX GEX differs from SPY.

Prior to the decline starting for QQQ, we noted the growth in negative GEX at 450 and 470, both of which are still large clusters. 450 is particularly large, also representing the lower Dealer Cluster zone, also right at the gap left in late April. 450 sure seems far away…Let’s bring it back to what’s in front of us. QQQ has also maintained the big GEX at 525 that we’ve been watching awhile, also very close to the Hull currently. Could we see a retest of the Hull from below, also tagging the upper Dealer Cluster? Seems very possible.

QQQ did see an improvement in total net GEX Friday, though not quite reaching a positive reading like we saw with SPX. The positive change is still noteworthy.

With futures up, odds look pretty good for an attempt at higher prices in the short term, but we need to keep in mind the overall picture is neutral to negative (depending on the index) and we’re below the Hull. We’ll be looking for clues during this shortened week as we potentially take profits on longs bought last week and reassess our hedges to protect against weakness beyond this rebound.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.