Turning On A Dime

THE ANNUAL SUBSCRIPTION PROMO ENDS SOON- We’re currently offering $300 off of the annual Portfolio Manager subscription. We recently released new mobile interface improvements, and we’re working on more, as well as our recently started daily livestream. Enter code MAY2025 at checkout to lock in a great annualized cost for access to our highest-level subscription! This promotion will last for a few more days.

We’re dealing with a market that turns quickly, particularly in the last few years. The move that catches the most offsides is often the move that happens. We take a look at some of the clues we had in advance as well as a look ahead in today’s YouTube video, which you can view by clicking here.

With GEX increasing into even more positive territory, yet technical indicators pointing at potential resistance ahead, we are faced with the question of what comes next? Will we muscle through resistance in a straight line toward infinity and beyond, leaving a path of gimping and whiny bears along the way, or will the bears chase down the slowest bull and take a few chunks off of the hindquarters before the motivation is found to achieve new highs? Or will the bulls run into a bunch of lemmings and follow them off of a cliff completely? We aren’t very good at analogies, but we can take a look at some of the possibilities for the market.

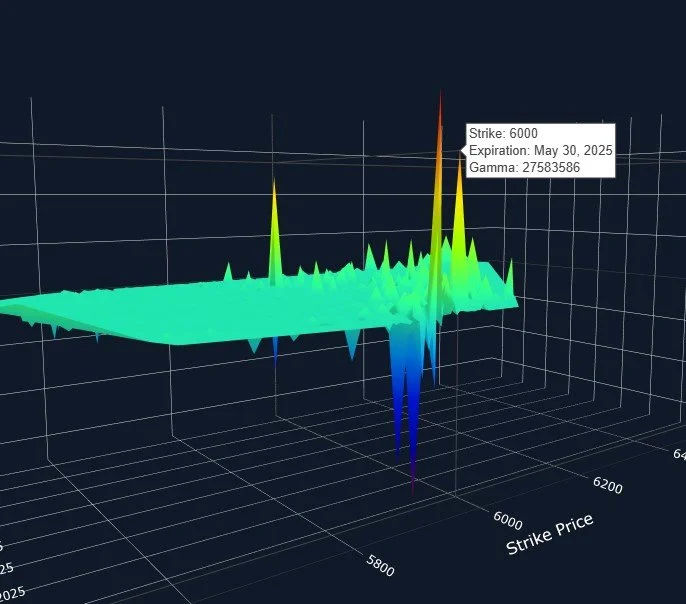

Let’s start with the SPX GEX Levels chart above. SPX rallied almost into the Hull moving average, now at 5951.61, falling just shy of that level. The Hull is declining, but while price is below the Hull, my default bias is to watch for the Hull to act as resistance, only looking to higher prices once we overtake that level and close above it. Looking above the Hull, we have the seemingly ever present and large GEX cluster at SPX 6000, and an increasingly large number of clusters ranging all the way up to 6500. The number and size of those clusters is different than what we saw when we made new highs earlier in the year, and it’s more bullish, surprisingly to some.

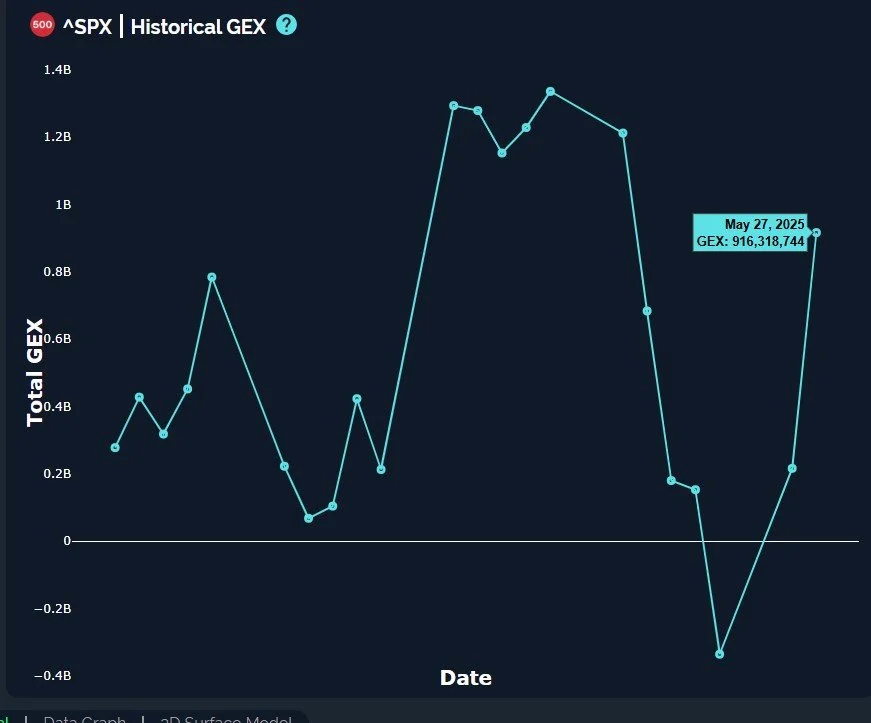

SPX GEX increased dramatically to almost 1B, a sizable increase. We still curiously see the option volume at the 5000 strike, but looking at the big picture, I’m expecting a test and potentially exceeding the 5950 strike at a minimum, then a pullback (maybe even after reaching 6000) more meaningful that what we saw last week, then a move from 5600-5800 to new highs. Insert the usual disclaimer of “my view can change” here as we see how GEX data shifts in coming days (just trying to keep your attention).

An interesting clue for this week- our 3D graph show 6000 as the largest positive cluster for this Friday, so the odds seem good to finally hit the pesky GEX cluster at 6000 by Friday. The large negative clusters are mostly at 5900 and higher, so participants are positioned for limited downside and further upside at the moment.

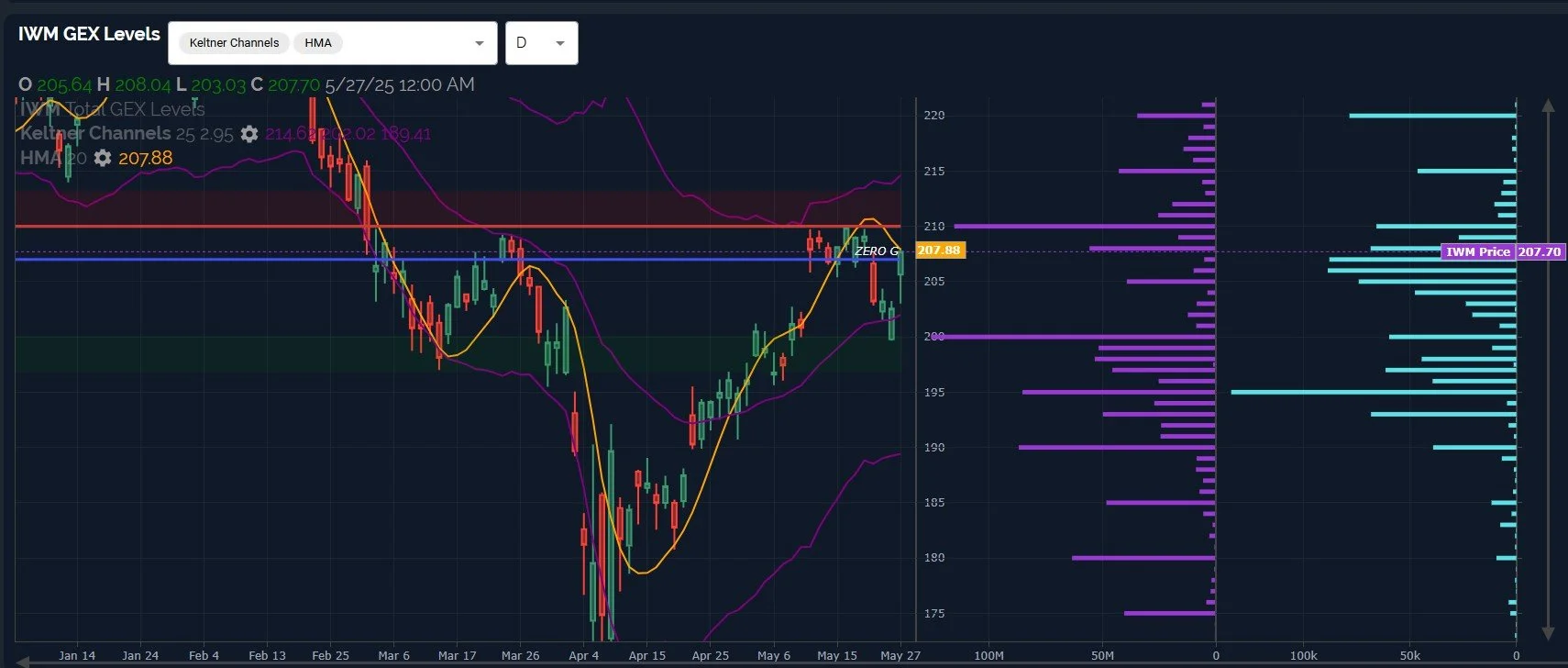

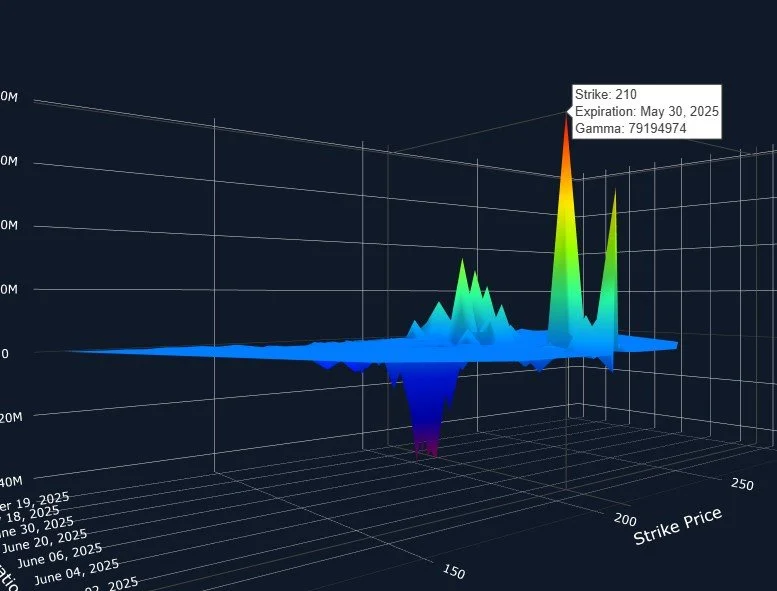

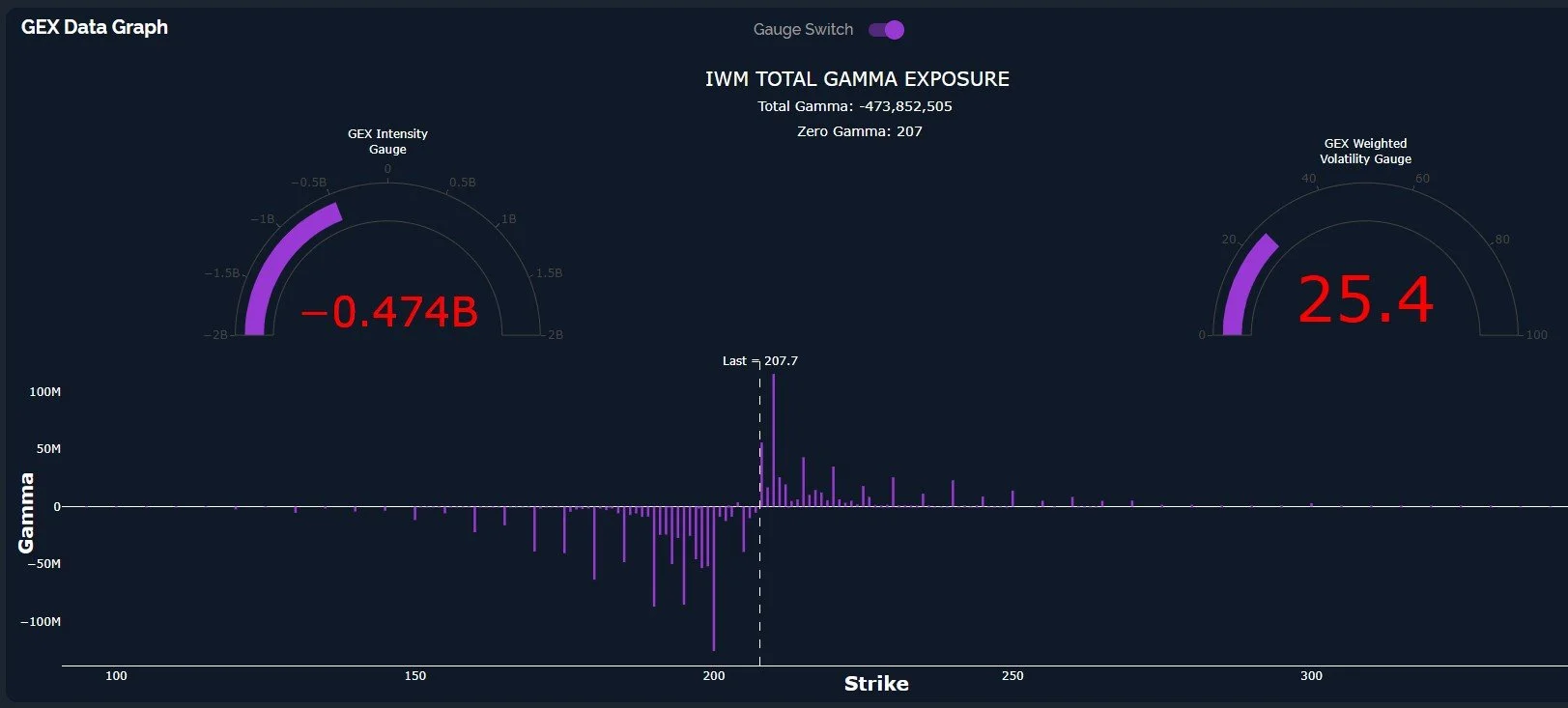

IWM was a great preliminary warning to bears Friday, with its premarket low and straight up pathway from there, and today’s follow through makes IWM the first index to test the Hull from below. We also saw GEX grow at 210, the overhead upper Dealer Cluster zone (which stretches to 215), and we see GEX and volume growing up to 220, a positive set of signals. The Keltner channels are pointing higher as well.

IWM’s 210 strike is mostly concentrated on Friday’s expiry, matching nicely with SPX 6000. This doesn’t mean indices wait to hit those levels until exactly Friday’s close, in fact, they may not hit those levels at all, but the odds support the potential for hitting these levels sometime between now and Friday, in our view.

A big picture warning regarding IWM- GEX remains negative, despite improving, and the weight of GEX is still mostly concentrated on lower strikes, where most GEX is found. 200 remains an important gateway and right now we don’t see sufficient signals higher or lower to say where we are headed after a test of 210, but I lean slightly toward lower prices again, at least temporarily. Stay tuned and we’ll continue updating this picture as we enter the main summer months.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.