Tagging The Upper Dealer Cluster

THE ANNUAL SUBSCRIPTION PROMO ENDS SOON- We’re currently offering $300 off of the annual Portfolio Manager subscription. We recently released new mobile interface improvements, and we’re working on more, as well as our recently started daily livestream. Enter code MAY2025 at checkout to lock in a great annualized cost for access to our highest-level subscription! This promotion will last for a few more days.

We recorded today’s YouTube video just as NVDA was reporting earnings, so we were able to include a brief look at the NVDA GEX picture as well as where the indices stood at the close today. We also discuss MDLZ and some additional setups, so check it out! You can view by clicking here.

While it’s fairly typical to see this market move in a big way after hours, typical doesn’t equal easy, so we are left with a potential scenario entering tomorrow where existing long biased trades will potentially look great (if NVDA and futures hold their gains) while shorts and those desiring to enter long may face a more difficult set of decisions. As for us, we will manage profitable positions while adjusting the portfolio according to new information presented to us by the total and 0 DTE GEX pictures for the market.

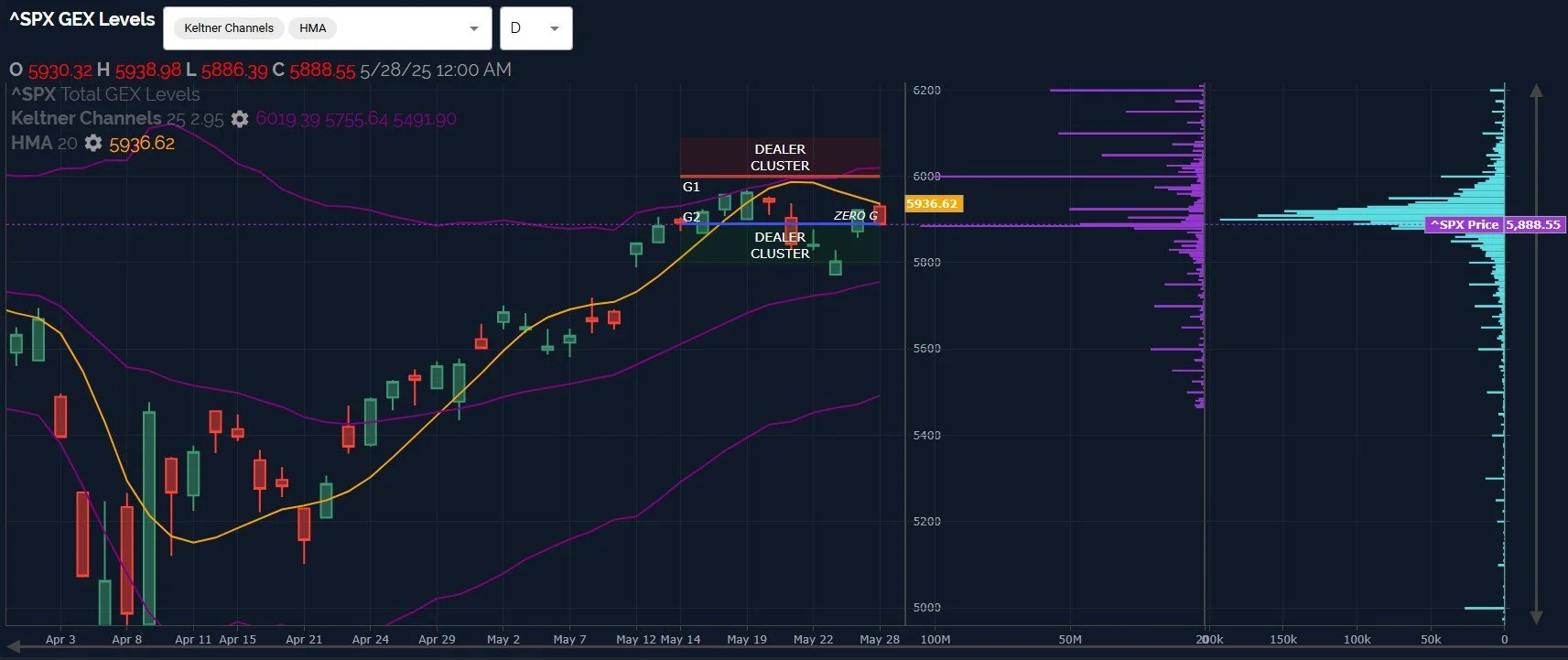

As for SPX, today’s action saw a near-perfect morning rejection of the Hull moving average, which I don’t find to be a surprise. One bullish comment I made in our livestream this morning as well as YouTube is that the declining Hull is creating space overhead where a move higher could be more easily justified, in my view. This is important because the Keltners have typically been a fairly good boundary for up or down moves, so if the Hull is right up against the upper Keltner, we often see price crossing back under, like we did in mid-May. We’ll clearly see SPX above the Hull if overnight gains hold, and we may even open up very close or within the upper Dealer Cluster zone at 6000, a long-awaited target we’ve been watching for weeks. Given that the upper Keltner needs more time to climb toward those higher GEX strikes, my expectation is that any further incursion into the red box will likely meet resistance for now.

Furthermore, SPX actually saw a modest reduction in GEX today, though still in positive territory. We do see GEX growing at higher strikes, which is a positive sign, but the obvious difficulty in trading a bullish picture is navigating the bumps along the way, and tomorrow’s plausible spike higher could easily put us into a reversal zone.

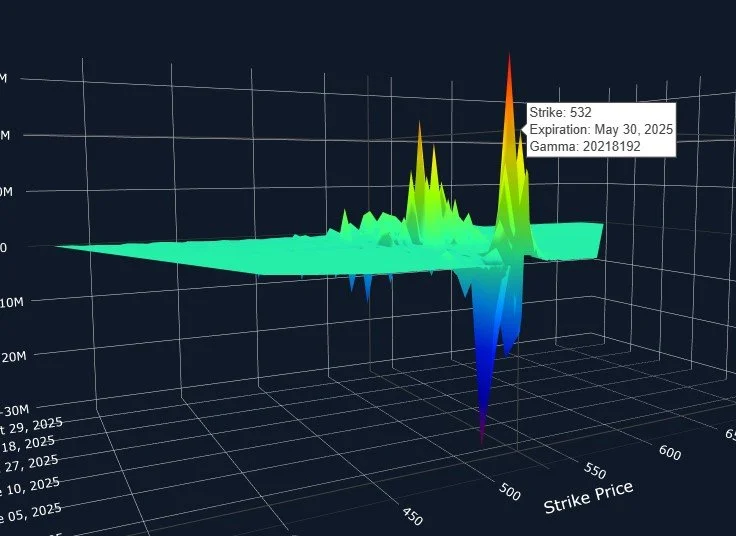

QQQ has finally reached the 525 GEX cluster, which is also the upper Dealer Cluster zone, painting a very similar picture to what we see with SPX. GEX has grown all the way up to 540, and the Keltners are pointing higher in bullish fashion, but the coincidence of the Keltner boundary at roughly 530 and the 525 and 530 GEX clusters raise the odds of a pullback, in my view.

Can QQQ and SPX overshoot these GEX zones? Sure, and we usually see one of two things happen: Either price reverses fairly quickly and returns to the “magnet” of the large GEX clusters below, or we see GEX shift in such a way that participants become willing to support those higher prices, even if we consolidate sideways for awhile. I’d personally prefer 525-532 and then a drop to fill the gap below 500, but the market didn’t ask and certainly doesn’t care what I want (I know, shocking).

Why 532? Well, the 3D graph does show a fairly meaningful GEX cluster at 532 expiring Friday, though really anywhere between 525 and that level is fair game and carries increased risk of reversal compared to where we’ve been.

Exciting times and opportunity lay ahead as we’re finally seeing the catalyzing of the move to the upper Dealer Cluster zones, so we’ll be on our toes to react to changes in the GEX environment with the noted technical resistance in mind. Thanks for reading and we hope you’ll join us in Discord where we will be discussing these changes.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.