Sell In May & Go Away?

THE ANNUAL SUBSCRIPTION PROMO ENDS SOON- We’re currently offering $300 off of the annual Portfolio Manager subscription. We recently released new mobile interface improvements, and we’re working on more, as well as our recently started daily livestream. Enter code MAY2025 at checkout to lock in a great annualized cost for access to our highest-level subscription! This promotion will last for a few more days.

You can view today’s YouTube video by clicking here. We take a close look at the indices and some various individual tickers as we approach the trading month end tomorrow, so check it out.

Today felt more like a trader’s hangover following the overnight futures party, but we still see an uncertain picture that leaves room for a push higher. Unlike the top in mid-May, the rally that started 4 days ago seems to have fairly good odds of a solid move into SPX 6000, and we see a lot of conflicting signals that (to me) lean more bullish. As I type this, futures have turned red, but hey, they were green last night, so I have no conclusion based strictly on the current direction of futures. But will this year fit the traditional “sell in May and go away” mantra? It seems like atypical is the new typical in recent years, and whether its now or later, GEX seems to point to higher prices.

The space between the Hull moving average and the upper Keltner, which coincides with the upper Dealer Cluster zone, gives room for a sizable rally if we can see price hold above the Hull at 5925. The GEX picture is very focused on the positive strikes, and the lower Dealer Cluster zone is just below us, suggesting participants are potentially buyers in the 5900 area and won’t become sellers until 6000-6050. The upper Keltner is now 6025 and climbing, thanks to the consistent uptrend in the channel since mid-April. The largest GEX cluster remains at 6000 SPX, with 6050, 6100, and 6200 right behind in terms of size.

While indices mostly showed a decrease in positive GEX as of Wednesday’s close, today saw consistent increases across the board, which may be indicative of the action we’ll see in the last day or May or perhaps the first few days in June.

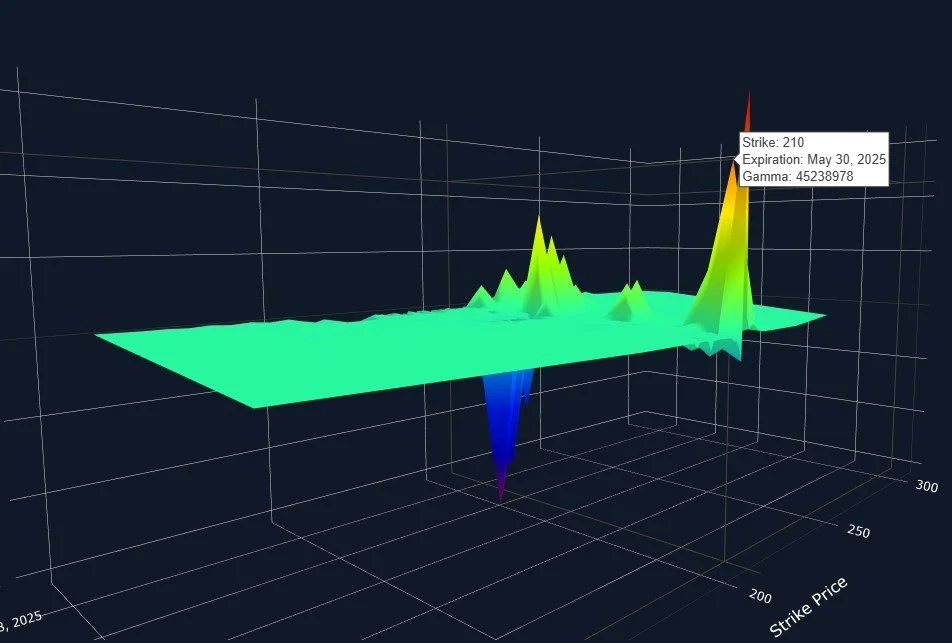

Let’s move over to IWM, which is once again nicely obeying the indicators and GEX levels. Today’s IWM high was a perfect tag of 210 to the penny, touching the upper Dealer Cluster zone. Concerningly for bulls, IWM still doesn’t show meaningful growth at higher strikes, and GEX is stuck in a range in fairly deep negative territory, though GEX did increase today along with the other indices. The bullish counterpoint is that the Keltner’s continue pointing higher, and the GEX at 200 remains very large, so any drop may get stuck there again, or at least between 190-200. Unwinding all of that negative GEX could ignite a larger short squeeze, in theory. We were pretty timely in highlighting this possibility right before the early May gap up, which was almost 5% in one day. I don’t think we will see that at this exact moment, for a number of reasons, but we will revisit this idea if and when conditions seem more conducive timewise.

210 is still the largest GEX cluster expiring tomorrow, so participants may be positioned for another attempt at the upper zone, we’ll see how the morning transpires. If this comes to be, we may see SPX finally rally during the cash session to reach 6000, the only index left with an untagged upper zone during the cash session.

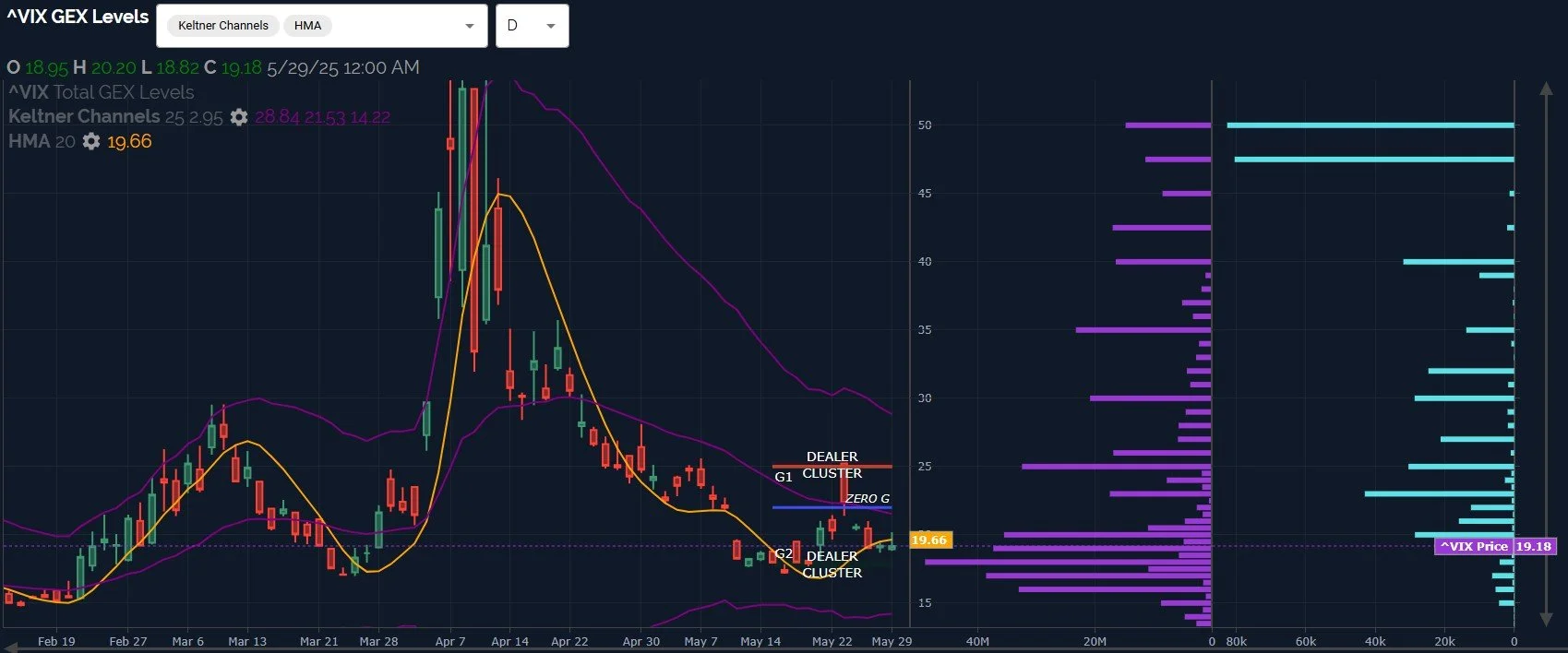

High volume on the VIX at the 47.5 and 50 strikes warrant attention, and the lower Dealer Cluster zone at 18 doesn’t leave a lot of room for the VIX to drop from the 19-area where it closed today. A move toward the 25 strike wouldn’t be surprising, but the question remains as to whether or not SPX will reach 6000 before the bears come out to play. With the VIX still below the daily Hull, the burden of proof is on the volatility bulls to show that it’s time for another pullback in the market. The 4-hour VIX is on a buy signal in my opinion, but the daily chart takes priority in my mind, and we need the VIX to approach 20 to potentially catalyze a move toward 25.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.