A Big Move Is Coming

In today’s YouTube video, which can be viewed by clicking here, we take a look at SPY, SPX, QQQ, the VIX, and some long/short ideas, so check it out.

We did see some nice intraday volatility, with several moves higher and lower beginning in the morning before the FOMC announcement, but we didn’t see a lot of net change by the close. Today was great for traders who like trading ranges and fading moves, but not great for momentum traders, though.

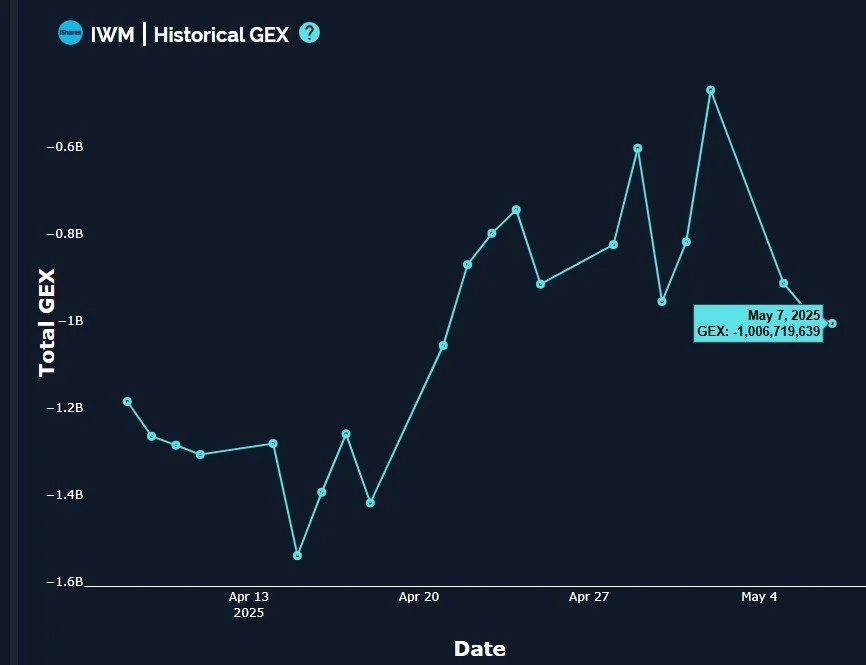

The steeply rising Hull moving average is now at almost 5692 SPX, and SPX closed below the Hull for the second day. While we did see a slight improvement for the major indices in terms of net total GEX (except for IWM, which moved slightly more toward the negative), we are still below the Hull, so my bias is that the bulls have the burden of proof if we are to overcome that resistance and head toward the higher 5800 target. While futures are up some 20+ points on trade deal news, 5691 would be another 50 points from there, so I want to see what happens on that likely retest.

We’ve noted the 6000 cluster, and what I find interesting is that it’s a negative GEX cluster, and most of the GEX at 6000 expires May 16. 5800 is the largest positive cluster set for the May 16 expiration. I find the negative GEX curious, and I also find the positive GEX at 5800 to be in conflict with IWM showing large negative GEX clusters set for expiration on May 16. How do we interpret this disparity? I tend to settle (for the moment) on waiting for more information. Hopefully we can see the test of 5691 SPX and draw some conclusions about whether or not we’ll see 5800 first or a far lower price instead. Given that 5800 is only 2% away from the retest of the Hull, it’s possible we reach 5800 this week, then decline into OpEx Friday, so we’ll want to watch tomorrow closely.

IWM actually fared quite well today despite the red candle, mostly due to the large gap up. As mentioned before, without a lot of GEX between 200 and 210, we could potentially see a fast 5% move to the upper Dealer Cluster zone if markets continue higher in the short term.

With IWM showing a move toward even more negative GEX, it’s hard to say whether or not such upside will materialize. The largest GEX clusters continue to be at lower prices, and (until today) volume has mostly occurred at the 190 area and the strikes close to 190.

The largest strikes for IWM for May 16 are the “infamous” 190 and a large GEX cluster at 193 as well. 185 is present for May 16, but it’s only close to half the size in terms of GEX. Given how long 190 has been on the GEX screen for IWM, OpEx this month may carry interesting implications for IWM in terms of how participants position beyond May.

Lastly, the VIX is still above the Hull, but I notice the 2-hour chart shows a loss of the Hull and no obvious support until we reach the lower Keltner channel, which matches almost perfectly with the 21.73 Hull on the daily chart. Though being above the Hull maintains my bullish bias for volatility, the VIX can easily see an 8-9% crush lower and still maintain that level, so I still see confluence with the idea that markets rally in the short run while the VIX drops. We’ll evaluate the shifting picture as it unfolds tomorrow, so we hope you’ll join us!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out back tested algos and chart indicators and we just increased our ANALYST tier subscription to include 600+ tickers, including individual stocks! Mobile updates are forthcoming over the next few days as well.

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.