Teetering On The Edge?

Today’s YouTube video can be viewed by clicking here. We take a look at SPY, IWM, MSFT, XBI, and more, so check it out!

The market ended the 9-day win streak today, closing lower than Friday’s close. Today’s close placed most major indices right on the line when looking at the daily Hull moving average. Yesterday we mentioned SPY 575 and 580 as big potential shorter-term targets if we didn’t immediately start a pullback, and today’s high was 566.60, a little shy of that initial 575. Given that we have various contradictory signals we’ve been highlighting, such as (though not limited to) the VIX regaining the Hull with positive GEX, we very well could start a larger pullback from right here, though SPY and QQQ are still showing those same targets (SPY 575-580, QQQ at 500).

SPX saw a sharp drop in net total GEX, falling to 222.4M from 784M. This brings SPX GEX closer to the bottom positive end of neutral territory (+1B to -1B) and represents the lowest total GEX since April 24. The decrease in GEX does help toward the case for a pullback here.

QQQ still looks largely the same as last week in terms of the GEX picture: A large positive GEX cluster at 500, but virtually nothing to speak of above that level, which doesn’t inspire confidence in an immediate runaway bull train. The proximity to the Hull at 484.69 and the lack of large GEX clusters until 450-460 is cautionary in my view. Keep in mind the Hull is also rising, which presents a hurdle for QQQ to maintain. I consider a daily close below the Hull as a short-term pivot toward a bearish bias, inclusive of the current GEX picture as well.

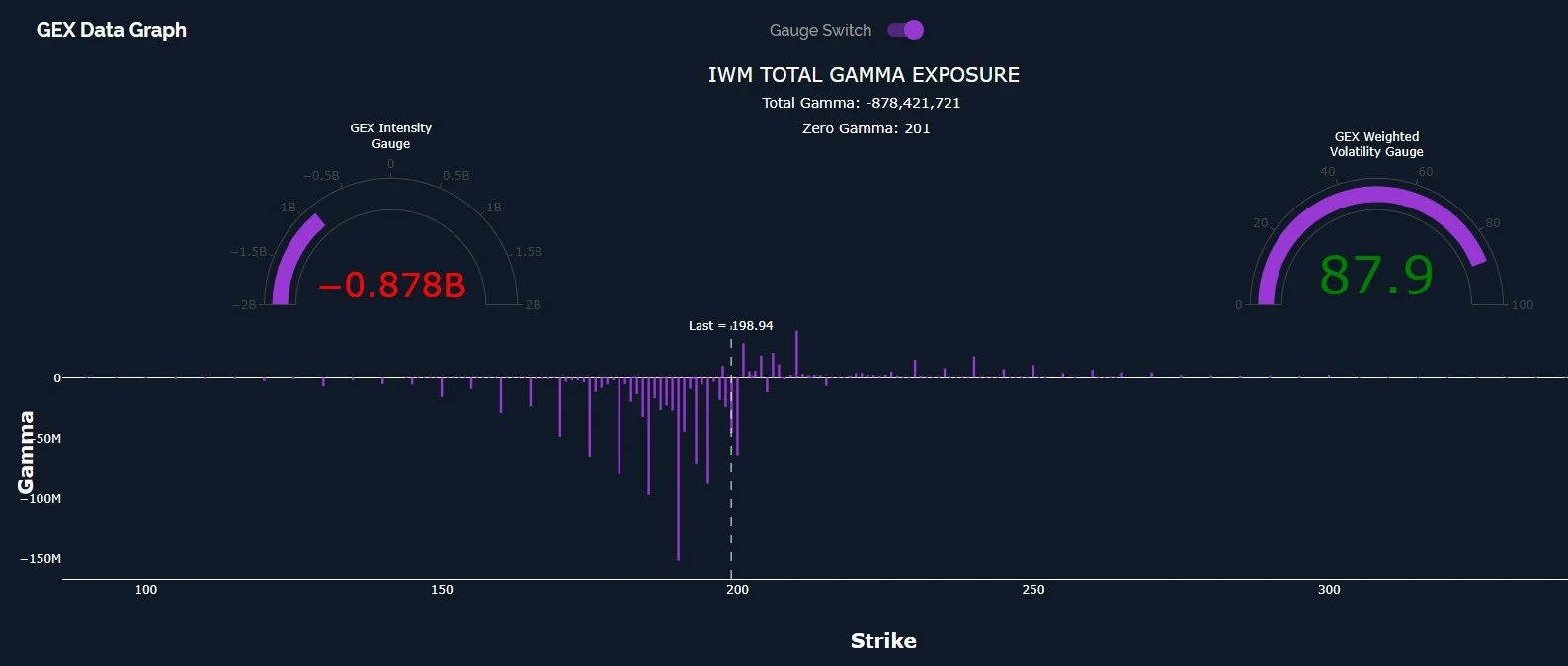

Comparatively speaking, IWM isn’t more bearish than it has been since the decline started, though the other side of that coin is that IWM never really stopped looking bearish…At least overcoming 190 presents a formidable potential area of support if we drop back down to that large GEX cluster, and we have actually seen some growth at higher strikes over the last couple of days, with 210 matching with the upper Keltner channel and 215 seeing noteworthy daily volume today.

In context of what we wrote in yesterday’s newsletter, a drop toward 190 may represent a buying opportunity in theory, and seeing all of the negative GEX disappear upon the next rebound higher may fuel a larger rally for IWM compared to what we saw since the recent lows. We’ll need to see how GEX shifts as the next pullback unfolds, and we’ll also watch the other indices and the VIX for potential clues as well.

Yesterday we wrote “As we enter the new week, let’s look for consolidation in the SPY and QQQ upper Dealer Cluster zones, and we’ll also keep an eye on the VIX for an early warning that a pullback may be due.” So far so good, and the VIX gapped up today, closing higher than Friday’s close while maintaining a long signal above the Hull as well. All things considered, within the next day or so, we’ll likely be looking at the Hull as overhead resistance to overcome, barring a big gap up tomorrow or Wednesday. Caution is warranted, but the next dip may be a great second chance to “buy the dip.”

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out back tested algos and chart indicators and we just increased our ANALYST tier subscription to include 600+ tickers, including individual stocks!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.