“Bear Tease” Into FOMC: December 9 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription, bringing your average cost per month below any of our monthly subscriptions! Enter code HOLIDAYS2025 at checkout! ENDING SOON!

You can view today’s YouTube video here. Today’s YouTube video takes a look at major indices, the VIX, FCX, and more, so check it out if you have a few minutes!

We saw the VIX hold on to 8% gains today while indices faded modestly, perhaps signaling hedging and caution as we approach the FOMC announcement Wednesday.

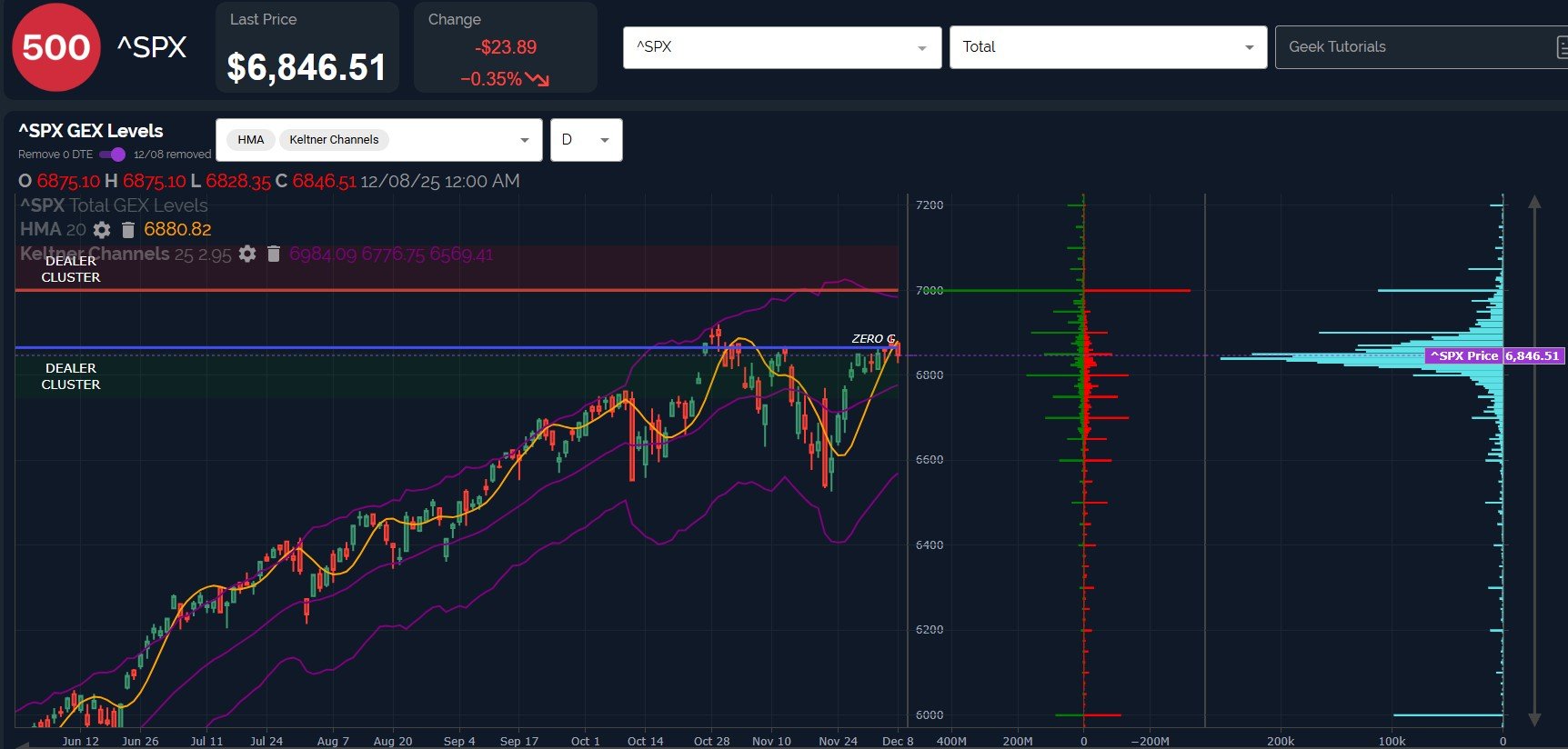

SPX lost the daily Hull Moving Average, though we still see substantial net positive GEX at 7000 as well as a close not far from the big 6850 GEX cluster.

Tactically, in terms of the daily chart, bulls want to see 6880 recaptured as soon as possible to maintain the steep uptrend.

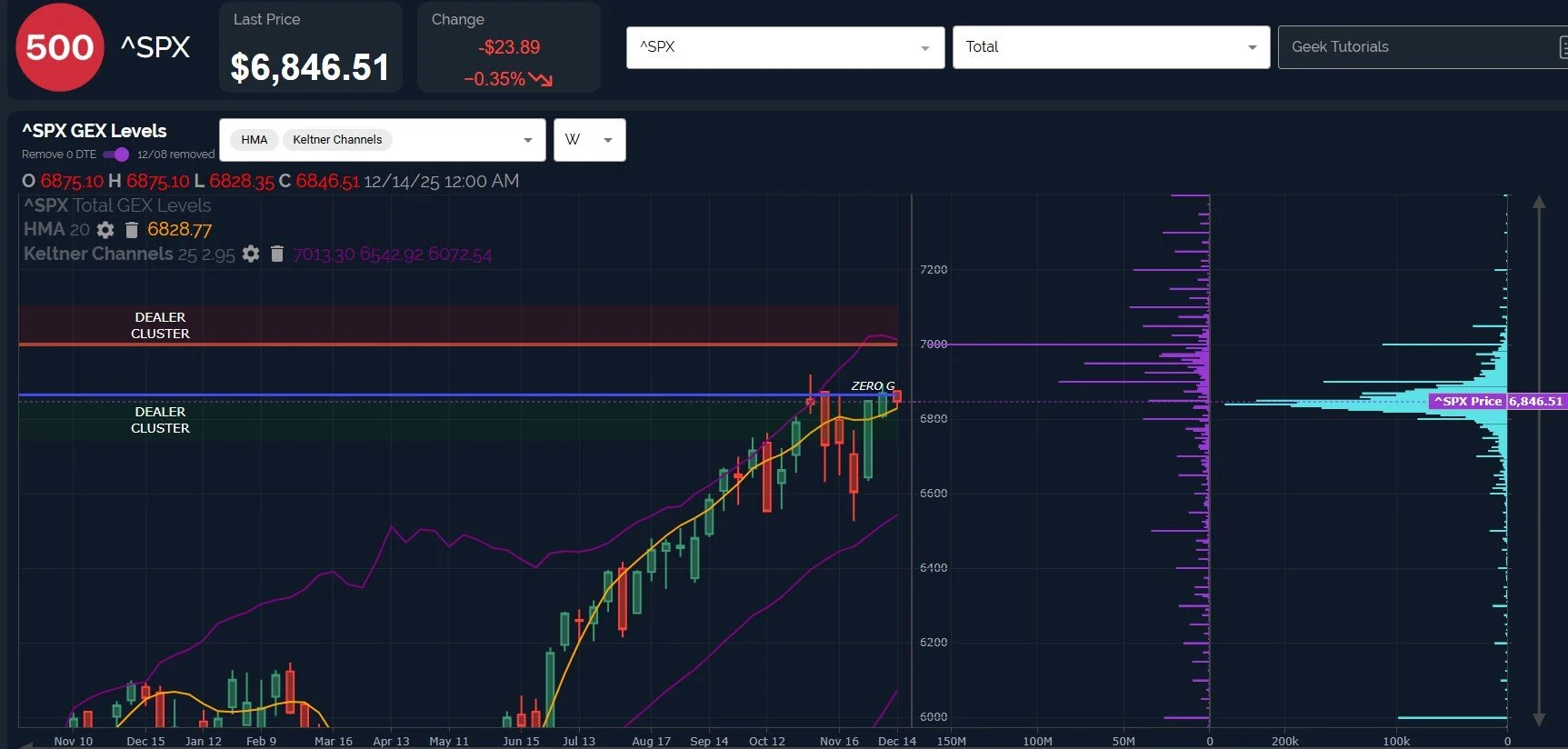

SPX’s weekly chart (with net GEX toggled instead of gross GEX) reveals that even though the daily chart gives some cause for preliminary concern, price is still holding key weekly Hull support at 6828.77.

The Hull at 6828.77 and the big GEX cluster just below at 6800 are key in maintaining the uptrend toward 7000 in coming weeks.

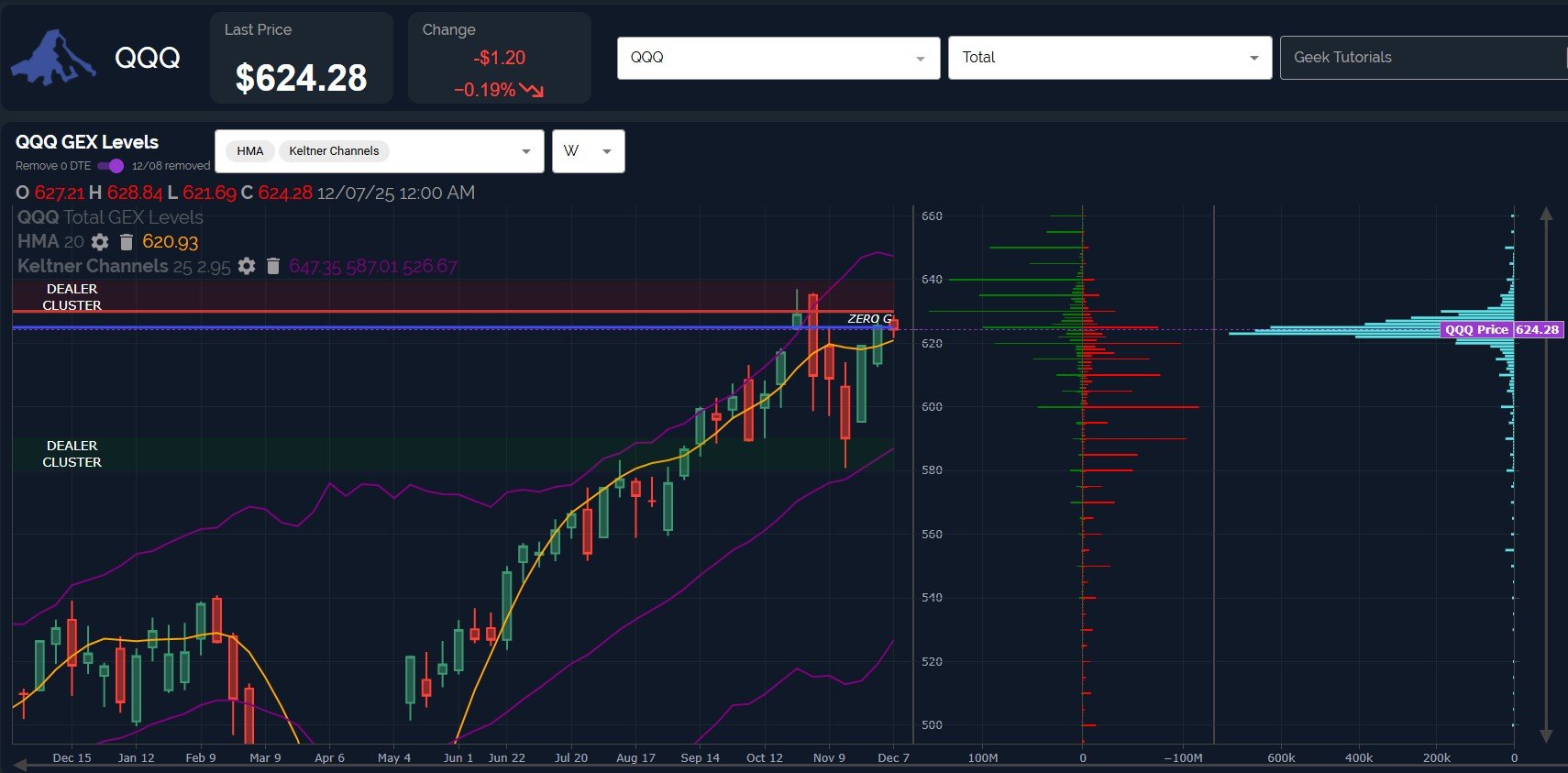

All major indices except IWM showed negative shifts in net GEX today, with QQQ actually going negative for the first time since November, though barely negative.

This change in GEX is worth watching in case it becomes even more negative, but at this moment, the direction is of more concern than the GEX reading itself, which we consider to be within a neutral range.

QQQ’s weekly chart shows similar support at the Hull being respected, maintaining the bullish case toward 640 or higher.

A daily close below 620 increases the odds of a trip back to 600, in our view.

The VIX finally turned higher on the 4-hour chart, turning the Hull and Keltner channels with it. Despite this shift, the strong downtrend since November may be difficult to end so quickly, so we won’t be surprised by a backtest toward 16 in coming days, or perhaps a spike to 19 and then another VIX crush to the 15-area again.

tradingview.com

The VIX weekly chart seems to support our upside target on the 4-hour chart, with 19.45 representing the weekly Hull, and a relatively large positive GEX cluster at the 20 strike.

The bottom line (in our view) is that we have a long lasting and significant net positive GEX cluster at SPX 7000 that will likely serve as a magnet as we approach 12/31.

The VIX dropped to an area expected to show support, but if the VIX rallies 8% every time SPX is down roughly 1/3 of 1%, the VIX crushers can have a good time sending the VIX back to 15 while SPX finally reaches that higher 7000+ target. This hypothetical is clearly not going to prove realistic, but it illustrates a point regarding the VIX: Either we are building for a huge VIX spike, or we will see the VIX slow its progress higher (again), giving indices a shot at climbing higher instead.

We will reconsider our bullish interpretation if we see GEX shift as well as key technical levels lost, but until then, we’re looking to buy the dip as we approach year-end.

Here’s the link to our Discord server if you haven’t yet joined us in Discord. We’ll share intraday analysis in Discord as well as interact with our other members during the day, so we hope you’ll join

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.