Navigating FOMC Trading With GEX: December 10 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription, bringing your average cost per month below any of our monthly subscriptions! Enter code HOLIDAYS2025 at checkout! ENDING SOON!

You can view today’s YouTube video here. Today’s video takes a look at major indices, the VIX, AMD, HOOD, and SLV, so check it out if you have a few minutes!

The VIX and VVIX continue rising into the FOMC announcement tomorrow, which isn’t a big surprise given the event risk and the potential interest by participants to hedge exposure.

The negative GEX cluster at 18 may be a target to the upside, with the positive GEX at the 20-strike just beyond that, at which point market bulls will want to see a reversal and an attempt toward SPX 7000.

The declining Hull Moving Average has just started to flatten, giving the appearance that the VIX might have gotten a little ahead of itself. I highlighted two occasions in recent months where we saw a VIX spike following a steep decline in the Hull, before the Hull had a chance to really flatten out. Each of those cases saw the VIX come back to the Hull in magnetic fashion. If this time is similar, it’s possible we may see the VIX drop back to 15-15.5 in the short term.

There is the risk that the VIX begins an upward climb that lasts for days, which may jeopardize the SPX 7000 target, but notice even the late October uptrend saw the VIX paint several red candles as the Hull required time to catch up to the earlier VIX spike.

All things considered, this year has shown that the VIX is unlikely to stay below 14-15 for an extended period of time, but we may see a pullback in the VIX toward the 15 strike, if we don’t see an aggressive spike in volatility tomorrow.

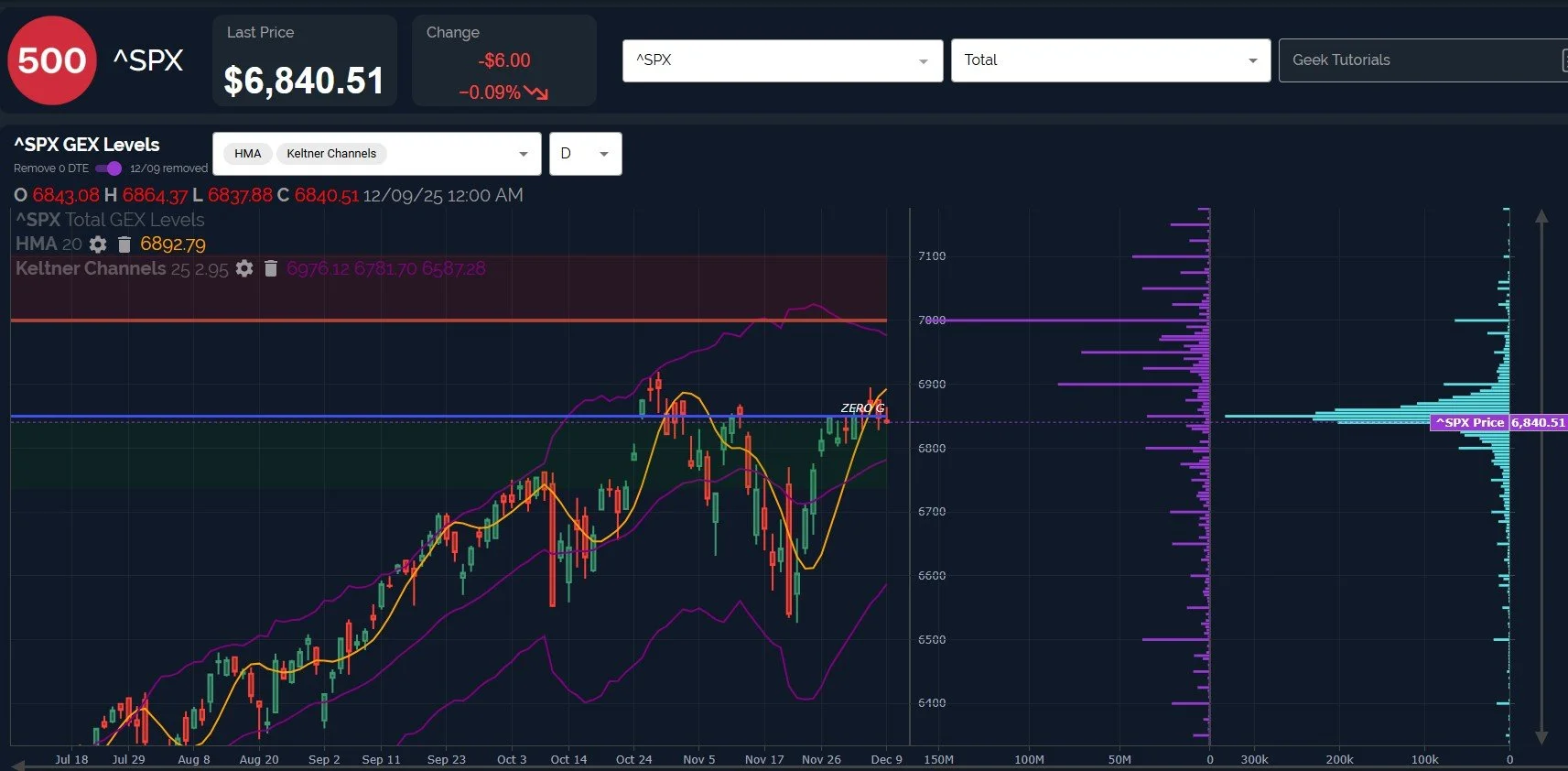

SPX painted a red candle, but SPX also painted a higher low, and the Hull is rising toward 6900 in the meantime.

The current setup, both in terms of price action and GEX, looks more like a bear trap than anything. We have a rising consolidation off of a big spike from the November lows, so all things look relatively strong at the moment.

A break below 6800 on the daily close starts to look more bearish, but until then, the big positive GEX clusters between 6900-7000 continue to stand as targets that we believe have good odds of being reached.

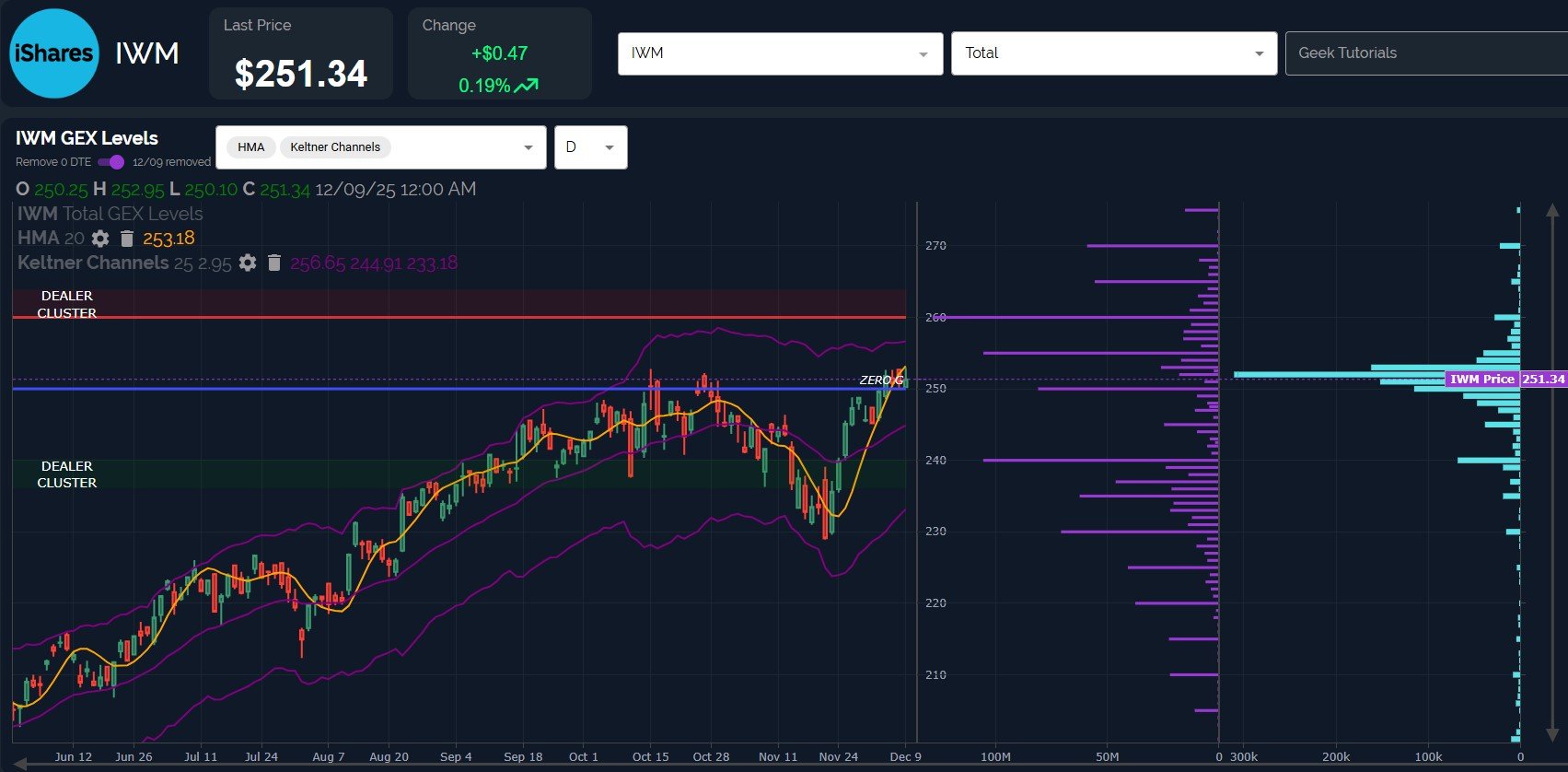

IWM continues holding above the important GEX cluster at 250, and the positive net GEX at 255 and 260 has grown, now reflecting what appear to be solid upside targets (especially 260).

While 245 doesn’t appear to be significant on a net GEX basis, our gross GEX setting (not shown for SPX in tonight’s newsletter) reveals a large GEX area at 245 with both positive and negative GEX. As long as 245 holds, and GEX remains clustered at 260 similar to what we see now, the odds are higher for IWM to continue the uptrend.

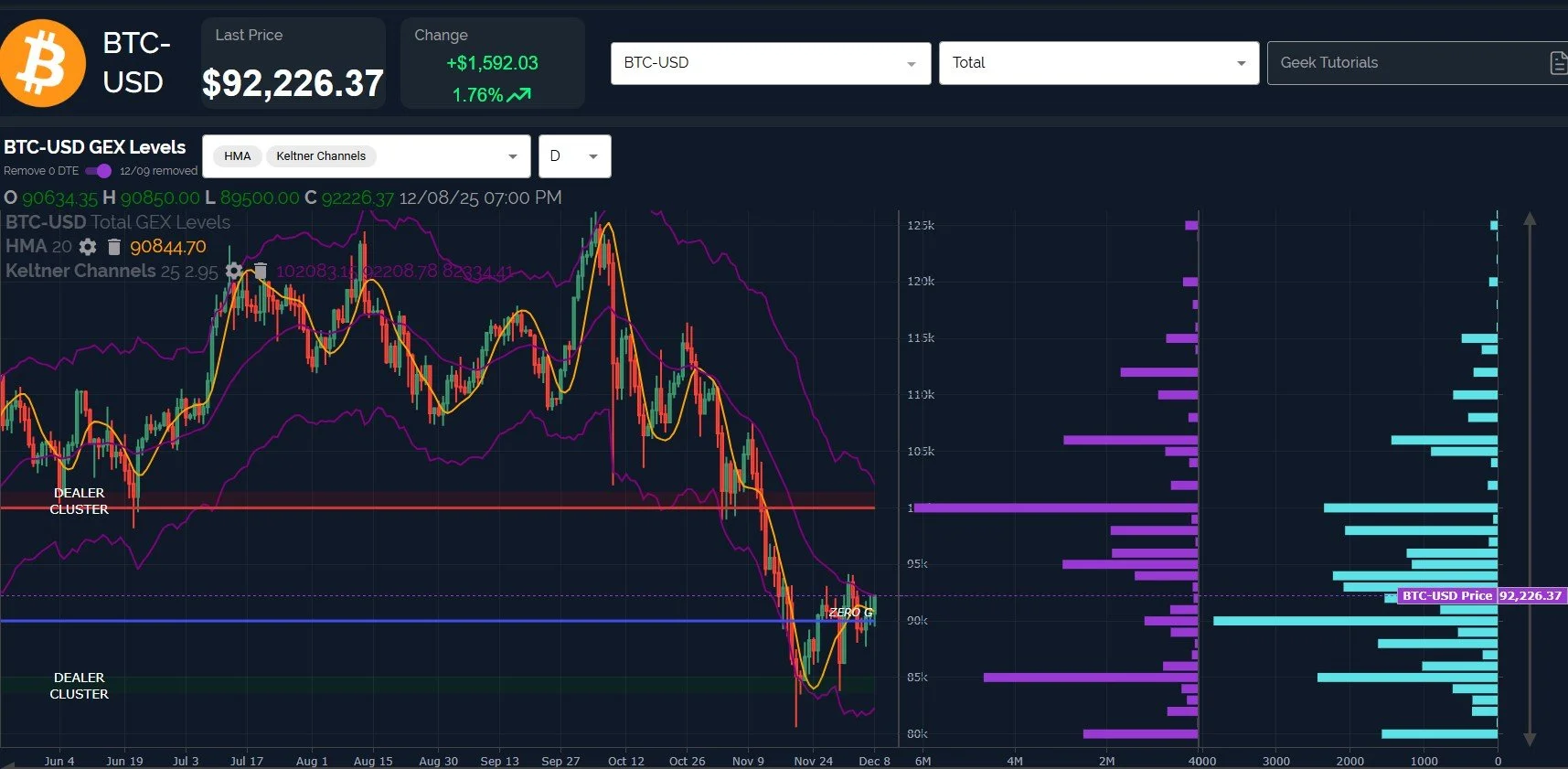

Lastly, let’s take a look at BTC, which appears to be fighting a nasty downtrend that started at the end of September (note the tricky fakeout to the upside prior to the beginning of the downtrend).

The wick just before Thanksgiving does look potentially significant, and BTC has been fighting its way back up, but BTC really needs to break the downtrend and hold those gains for a period of time to appear more convincing.

As of now, the large GEX cluster at 100k appears to be an upside target, but failure again at the 90,800 level may signal a trip to 85k is due.

In the past, we’ve found GEX to shift a lot on some FOMC days, but as long as we pay attention, these shifts can give us helpful insights regarding price action as we tackle the afternoon FOMC activities. We will be sharing a bit more for free tomorrow in our general chat in Discord, so we hope you’ll join us!

Here’s the link to our Discord server if you haven’t yet joined us in Discord. We’ll share intraday analysis in Discord as well as interact with our other members during the day, so we hope you’ll join

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.