Inching Toward SPX 7000: December 11 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription, bringing your average cost per month below any of our monthly subscriptions! Enter code HOLIDAYS2025 at checkout! ENDING SOON!

You can view today’s YouTube video here. Today’s video takes a look at SPX, IWM, the VIX, BTC, and AMZN, so check it out if you have a few minutes!

Today’s VIX action fulfilled a possibility we introduced yesterday after observing prior instances of the VIX climbing away from a declining or sideways Hull Moving Average, with the magnetic effect of the Hull seemingly drawing the VIX back toward the line, closing at 15.77.

The Hull is flattening out after a big momentum move to the downside, so the VIX is now approaching an area where volatility may reverse back up, or at worst (for volatility bulls, at least), move sideways.

The VIX 2-hour chart corroborates this possibility, with the VIX reaching the bottom Keltner channel of what is now a chart with a sideways to slightly upward bias for volatility. The VIX often finds support at the lower Keltner channel on the 2-hour and 4-hour timeframes.

A spike to 17-18 would fit within the parameters of the Hull and the upper Keltner channel, as well as matching the GEX clusters we see at those strikes.

tradingview.com

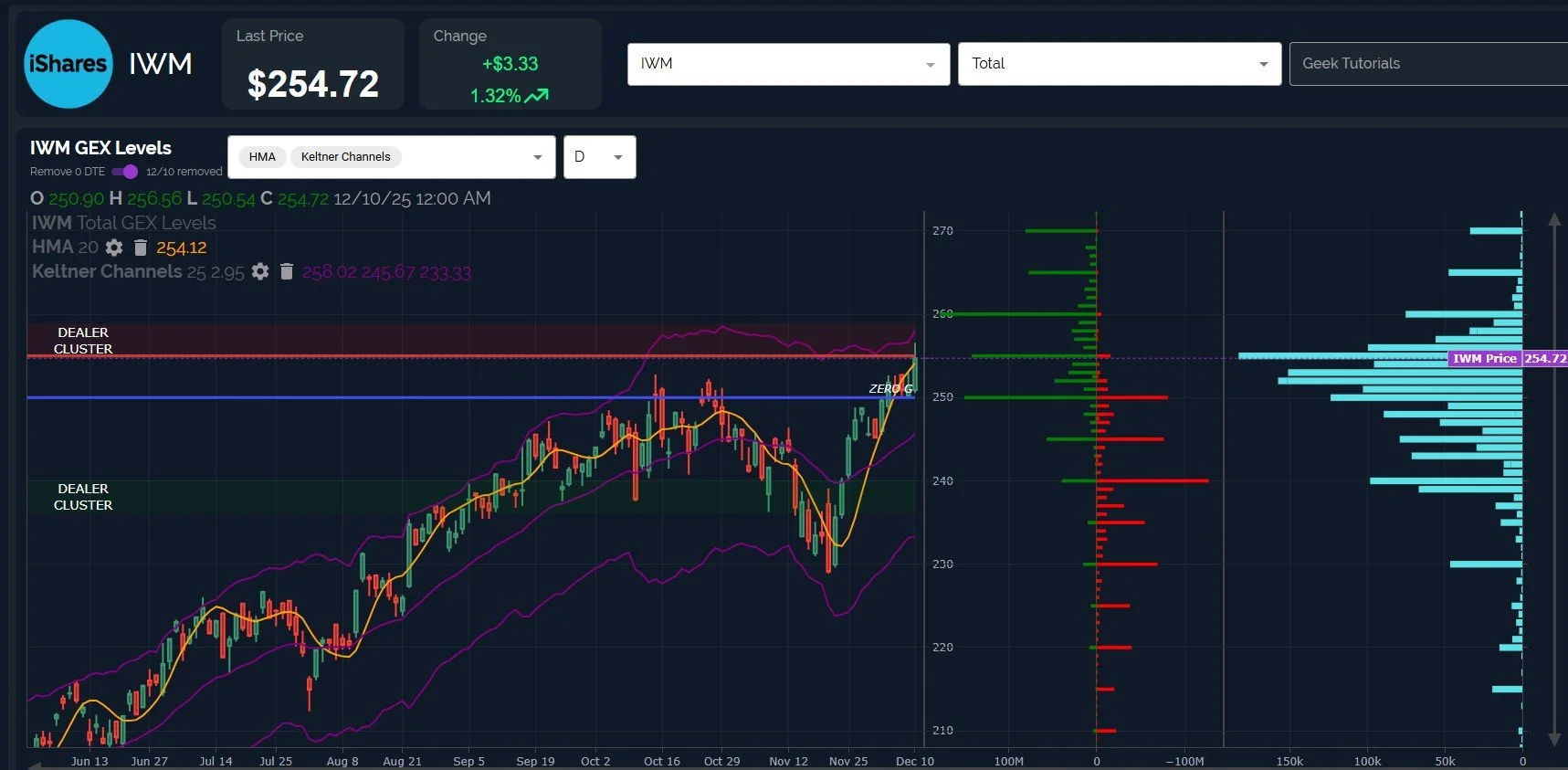

IWM met our first “solid” upside target mentioned recently, surpassing the 255 positive GEX cluster and then closing just below it.

260 is still within the realm of possibilities, also matching the upper Keltner channel, though the Hull nearly reaching the upper Keltner is more typical of a short-term top.

A downward move is possible either by the end of the week or early next week, though the trend is higher, so the current context is that a pullback will be a ‘buy-the-dip’ opportunity as long as IWM holds the 240 area.

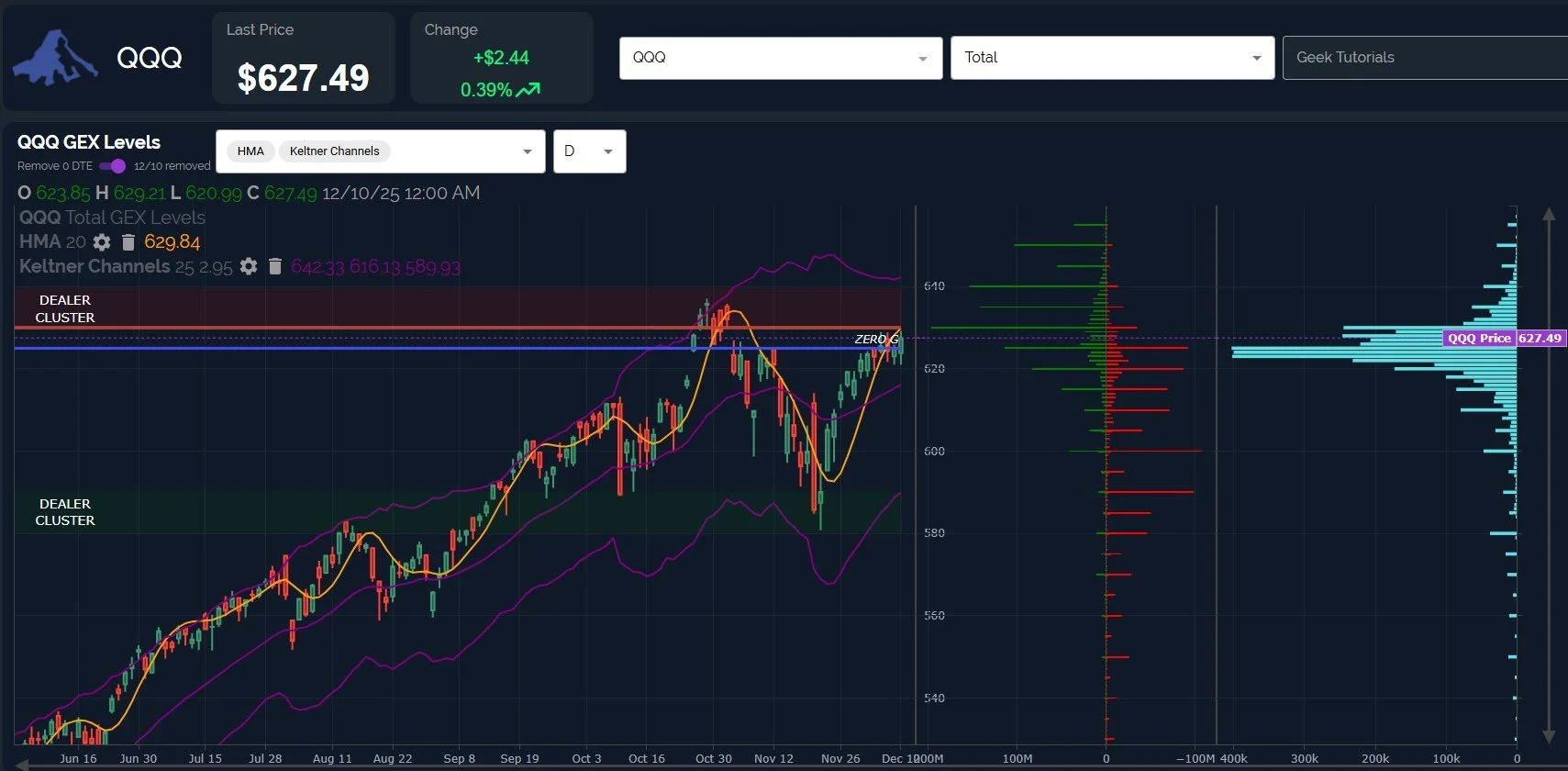

QQQ is at the doorstep of the upper Dealer Cluster zone, almost reaching 630 today, but it remains to be seen if QQQ will push deeper into the box toward the 640 GEX cluster.

Odds seem to favor a brief extension higher, then a pullback, in my view.

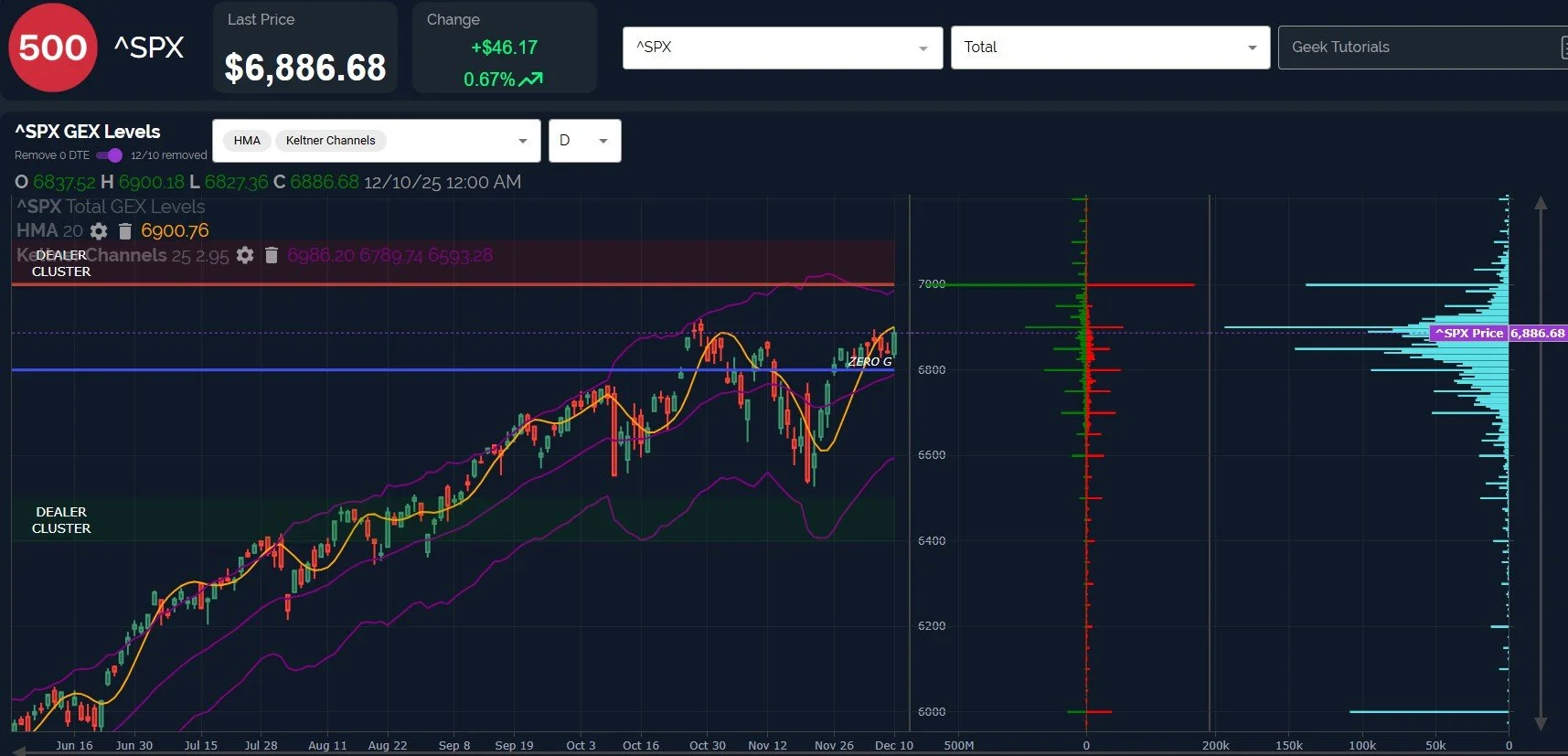

In the past, we’ve found GEX to shift a lot on some FOMC days, but as long as we pay attention, these SPX looks very similar to QQQ, and the big positive GEX cluster at 7000 is still staring at us, along with elevated volume at that strike today.

SPX and QQQ both closed just below the daily Hull, an important line in the sand, so we’re faced with the question of whether or not SPX makes it above the line and approaches the year-end target, now barely 2% away.

With IWM as our guide, it would seem the odds are favorable of further attempts toward the target, even if only for a brief part of one day, enough for the VIX to approach the 15-15.5 area (just below the current 15.77) and for IWM to approach 260. We’ll be watching for signs of a turn in the next few days.

Here’s the link to our Discord server if you haven’t yet joined us in Discord. We’ll share intraday analysis in Discord as well as interact with our other members during the day, so we hope you’ll join

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.