Watching IWM For A Sign: December 12 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription, bringing your average cost per month below any of our monthly subscriptions! Enter code HOLIDAYS2025 at checkout! ENDING SOON!

You can view today’s YouTube video here, where we discuss SPX, IWM, AMZN, the VIX, and more, so check it out if you have a few minutes!

While yesterday saw a narrowing of the gap between the VIX and the recently turning Hull Moving Average, today almost completed the retest, with the VIX surpassing the largest negative GEX cluster at 15 to the downside, closing at 14.85. Another .09 to go to meet the 14.76 Hull.

The VIX is now at an area that has found support all year long, so any further downside for the VIX is not likely to be long-lived.

The VIX 2-hour chart remains in a downtrend, but importantly, we see the VIX touching the lower Keltner channel, a situation that has usually led to a VIX spike in the past, the recent exception being the steep downtrend in late November from a larger spike. Note that the absolute value of the VIX was significantly higher during the downtrend, not at an area of prior longer term support.

tradingview.com

Does the VIX imply that this rally is over? Not so fast..We can see VIX diverging from movement in the indices, rising as markets rise for a short time, or we could see the VIX overshoot to the downside as indices climb, so a number of possibilities exist.

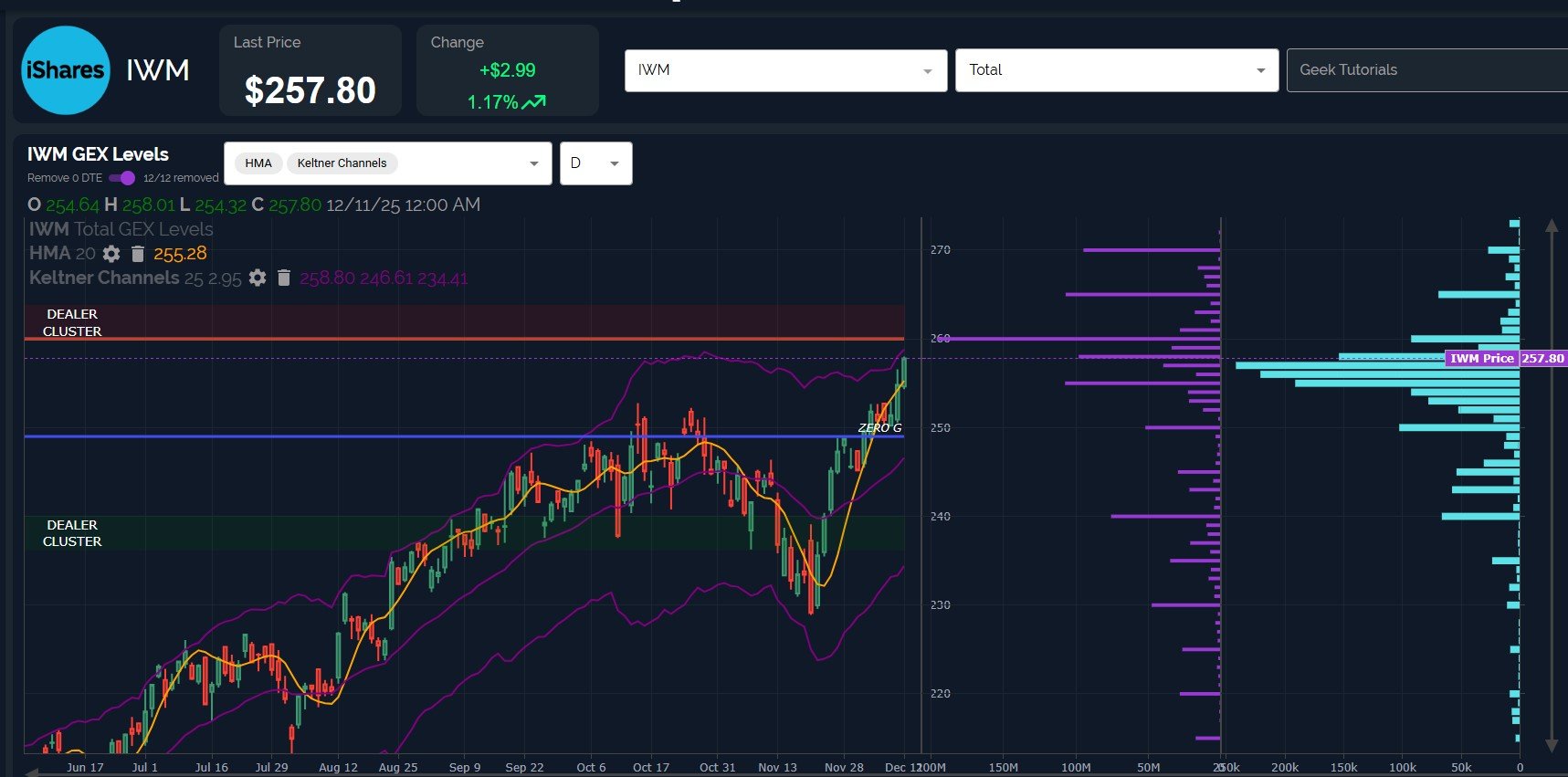

Looking at IWM, which has sometimes been a good indicator of what’s coming for the larger indices, we don’t see any interruption to the ongoing momentum move higher, with 260 still appearing to be a high odds target of this move. Enough positive GEX exists at 265 and 270 to consider continuation higher as a possibility, but those clusters aren’t convincingly larger than the cluster at 255, so we need to see what happens upon a tag of 260.

The upper Keltner channels are rising in bullish fashion, yet we’re approaching the top channel, so continuation higher is possible but not certain. A pullback from the 260 area would fit well within the range of most likely scenarios.

QQQ has been surprisingly weak lately, surprising given the strength we’ve seen in QQQ all year. QQQ is far enough below the daily Hull to raise the possibility of a rally back toward 230-231, and QQQ shows a wick on the daily candle from the middle Keltner channel that may indicate buyers eagerly anticipating a capture of the daily Hull and continuation toward 640.

The other (lower probability) possibility is that QQQ is signaling that the upside move is finished, and the next move is to the downside. We should have our answer between tomorrow and Monday, and we’ll post updates in Discord along the way.

SPX is right up against the Hull, and the net GEX picture reflects the significance of the 6900 area as well as 6950.

It seems that 7000 is still a favorite target based on GEX, but we have a significant cluster at 6950 that warrants consideration as a challenging resistance area, so keep an eye on action at and just above 6950.

The close right at the Hull deserves some attention, because the obvious resistance at the 6900 area may give way to continued upside as opposed to immediate rejection. The Hull is still rising, though it’s starting to curl toward a more flat trajectory.

We will post in Discord during the cash session tomorrow, hopefully in light of some helpful signals being provided by the GEX picture, similar to what we’ve enjoyed all week to this point.

Here’s the link to our Discord server if you haven’t yet joined us in Discord. We’ll share intraday analysis in Discord as well as interact with our other members during the day, so we hope you’ll join

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.