SPX Still Holding Weekly Support: December 14 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription, bringing your average cost per month below any of our monthly subscriptions! Enter code HOLIDAYS2025 at checkout! ENDING SOON!

You can view today’s YouTube video here, where we discuss SPX, TSLA, GLD, and more, so check it out if you have a few minutes!

The VIX gave us a heads up Thursday that downside for volatility was likely limited going forward, and we saw a spike almost to 18 on Friday.

The Hull Moving Average has turned up, and we still see risk of a potential spike to 20 as long as the VIX holds above 14.84.

Bulls targeting SPX 7000 will want to see the VIX get ahead of itself in terms of spiking on a modest market pullback, since these conditions would paradoxically give volatility shorts more room to crush the VIX on its way back down to 14-15, and presumably a short enough index rebound runway to not lose sight of 7000. Other possibilities exist (VIX rising with the market, VIX making new lows, etc), but hopefully GEX will give us the additional clues we need in making positioning changes.

We mentioned that QQQ losing 620 on a daily close could see an accelerated drop down to 600-610, and Friday’s loss of 620 saw a quick move down in the morning toward 611.

Not all is necessarily as it seems- GEX shows QQQ to already be in the lower Dealer Cluster zone, and QQQ is quite extended below the Hull, a condition typically resolved by the Hull and QQQ’s price meeting again. This could be accomplished by either a rebound to the Hull, or the Hull gradually declining to meet QQQ.

The GEX cluster at 610 holds the key to either a deeper move down toward 590-600 or a rebound back toward the 630 area.

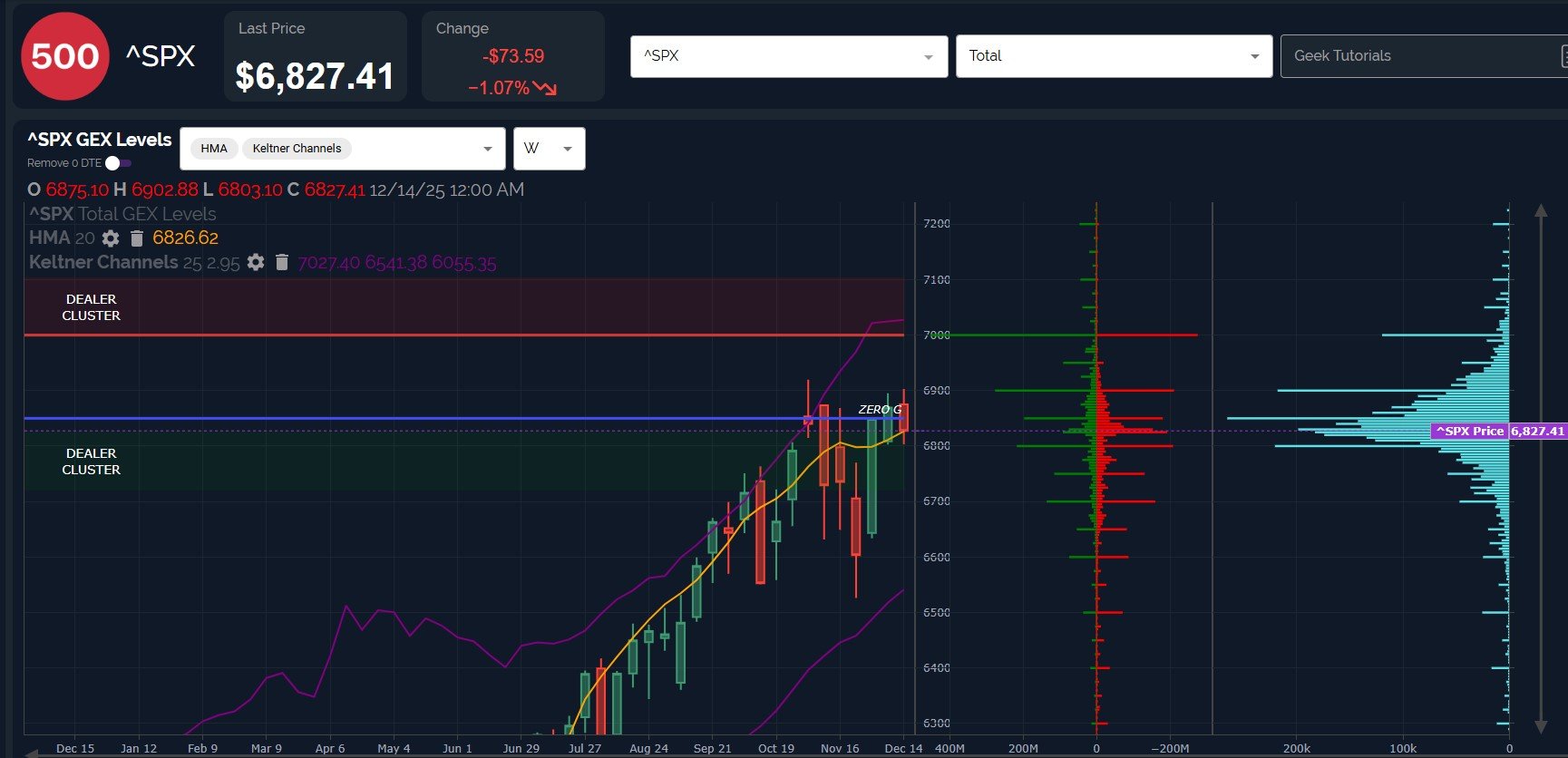

Another positive to highlight as we still stare at the large net positive GEX cluster at SPX 7000 into year-end: SPX is still holding key weekly support, and I think the rebound from Friday’s lows to close less than a point above the weekly Hull demonstrates the importance of the line in signaling continuation toward 7000, or failure toward 6700.

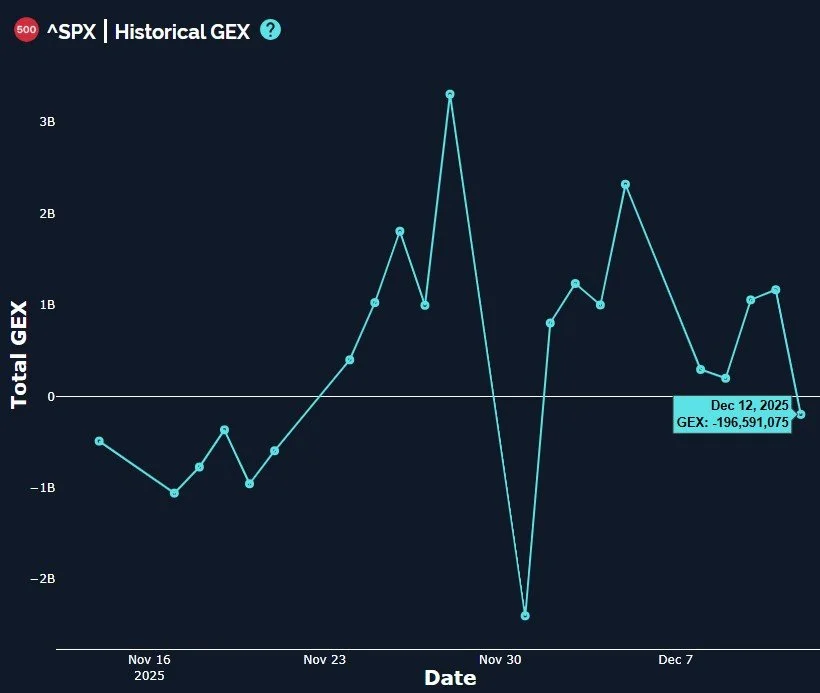

SPX did see net GEX drop into negative territory, though not convincingly so, and if the pop in Sunday night futures holds, we’ll likely see SPX back in positive territory in the A.M.

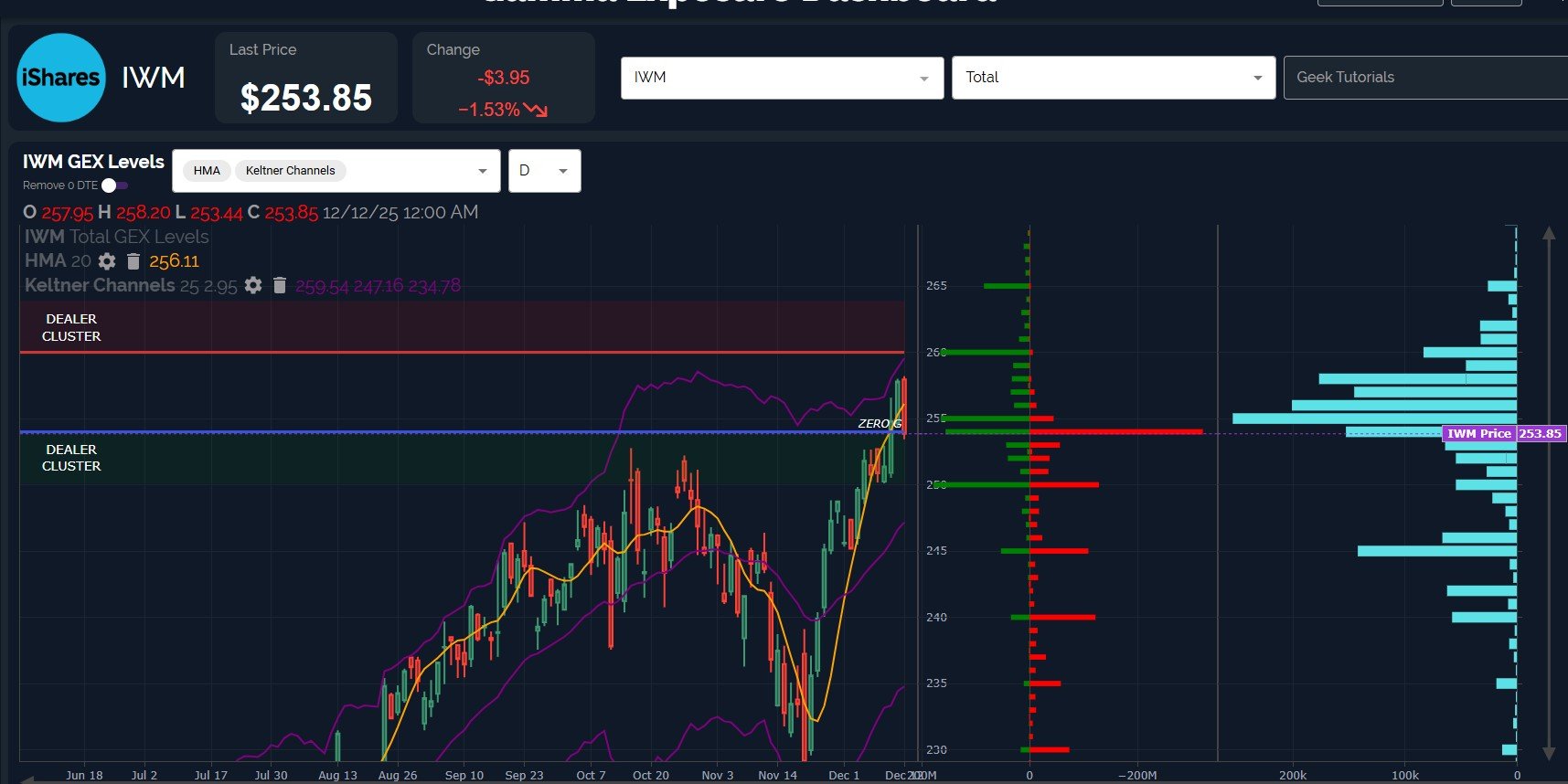

IWM saw a fairly large reversal from 258 Friday, closing at 253.85, below the daily Hull, yet above the key GEX cluster at 250. We still see 260 as a likely target as long as the weekly Hull at 246.66 holds on a daily close.

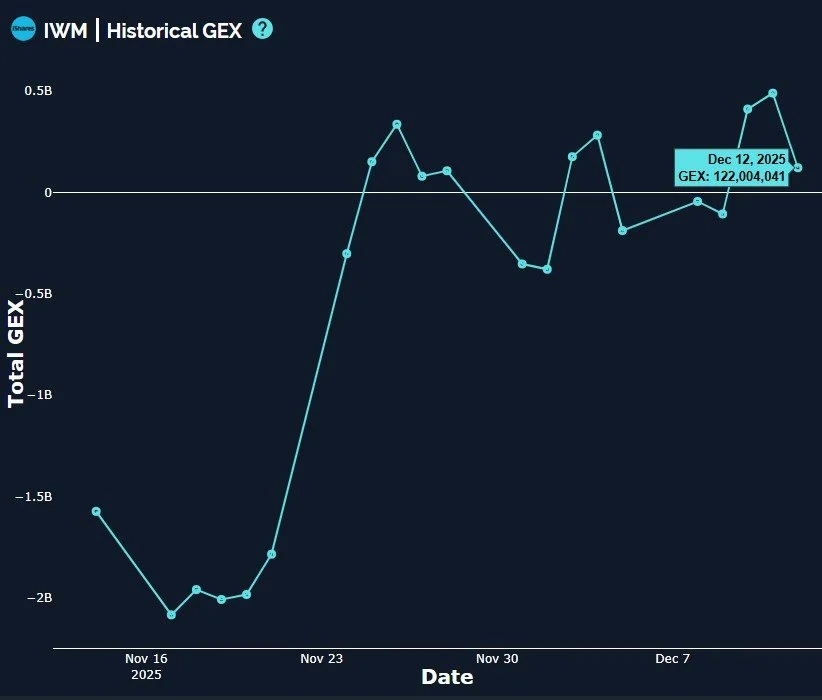

GEX remains net positive, which is significantly stronger for IWM than many times over the past couple of years when IWM saw any sort of drop.

As always, we look forward using what we feel are the best odds using current information, so we can quickly change our minds (and thus our positioning) if we feel the picture is shifting significantly. We’ll continue updating in Discord throughout the day so we hope you’ll join us!

Here’s the link to our Discord server if you haven’t yet joined us in Discord. We’ll share intraday analysis in Discord as well as interact with our other members during the day, so we hope you’ll join us!

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.