IWM Taking The Lead: Reversal Near?December 4 Stock Market Preview

You can view today’s YouTube video here. Today’s YouTube video takes a look at SPX, IWM, META, GDX, and more, so check it out if you have a few minutes!

IWM took the lead today, starting out strong and finishing strong, essentially reaching the 250 upper Dealer Cluster zone.

Price can stretch further into this zone, which reaches the 255 strike, and we see almost equal positive GEX at the 260 strike.

In contrast to the GEX picture above 250, we still see more volume at lower strikes, especially the 237-247 strikes.

IWM has sometimes been an early leader in market pivots, so we will continue watching IWM on a 0 DTE (intraday) basis for potential clues regarding the likelihood of a breach of 250 and continuation higher versus a retest of support areas at 240-245.

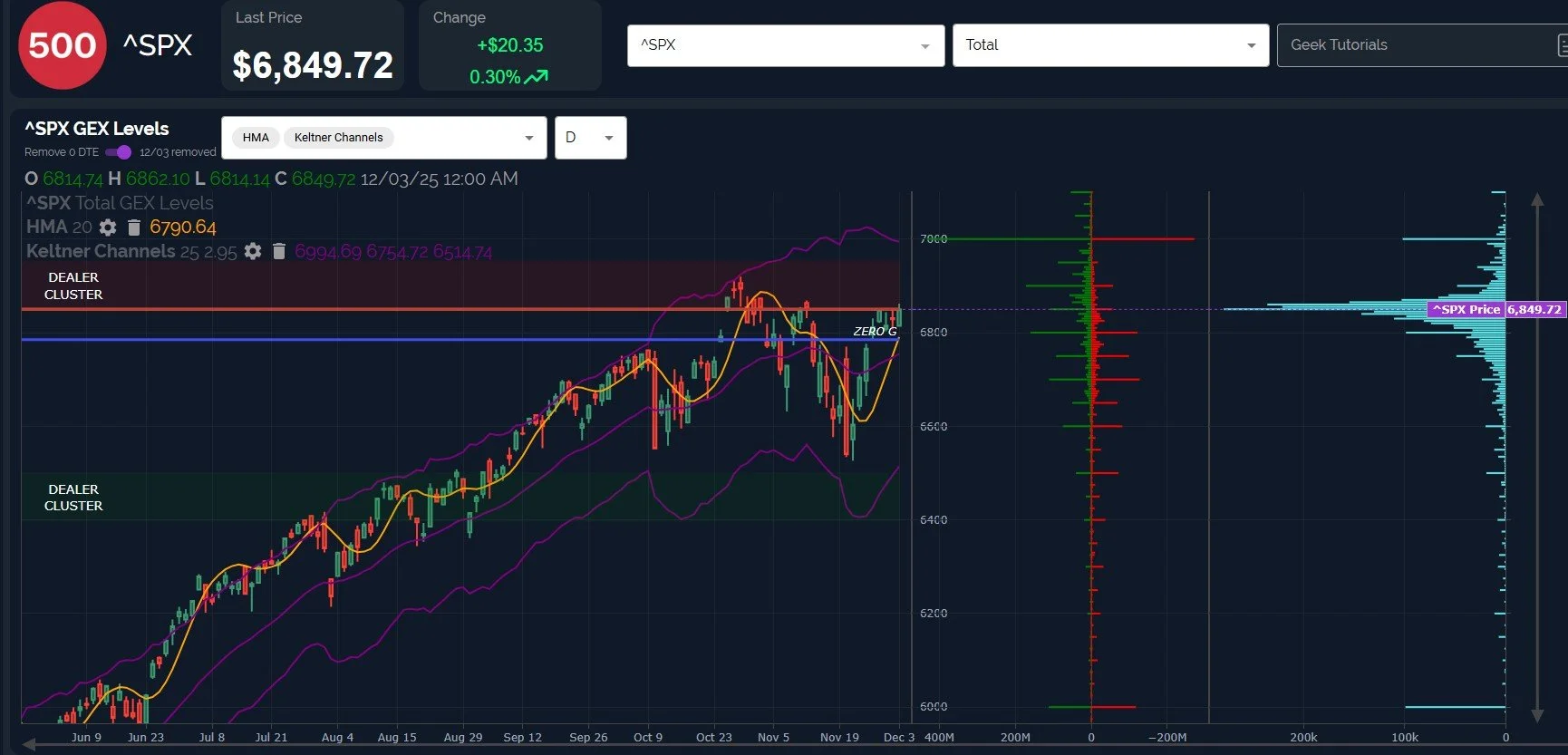

We’ve traditionally looked to SPX as the most accurate barometer pertaining to the markets next move, and the big GEX cluster at the 7000 strike has been persistent for months.

SPX is holding above several overlapping technical support areas (some of which are not shown here) between 6750-6777 that add confidence that any pullback holding this general area likely implies continuation toward the 6900-7000 target.

In terms of reversal, we will consider either a shift in the overall GEX picture and/or a loss of the key technical area highlighted to signal that the tag of 7000 SPX is in danger.

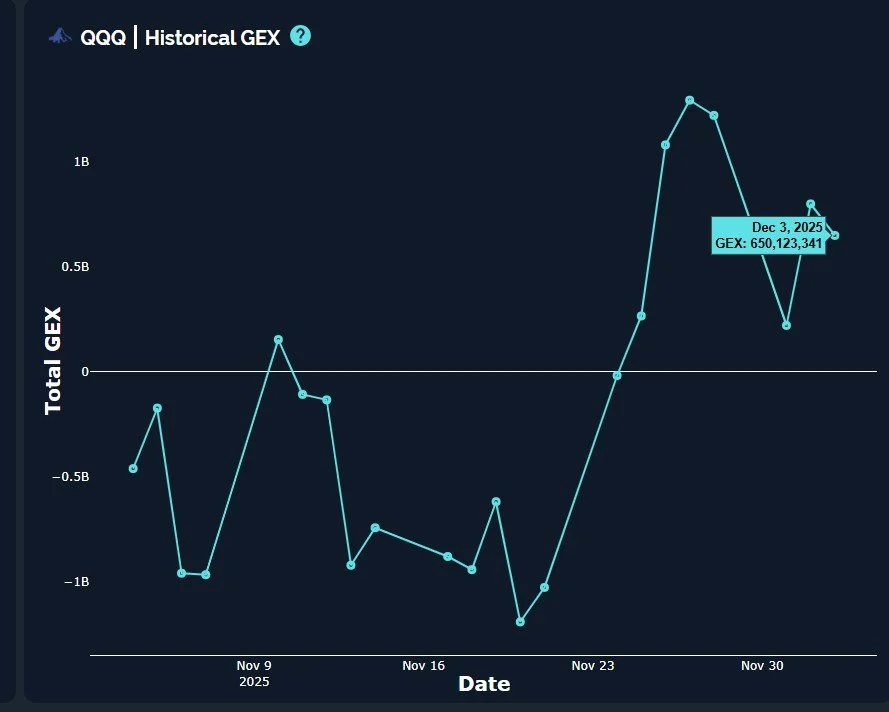

QQQ has really lagged since the all-time high in October, though QQQ still hasn’t tagged the upper Dealer Cluster zone, potentially implying favorable odds of reaching the 630 GEX cluster this week.

Despite the largest positive QQQ GEX cluster at 630, GEX overall has declined 3 of the last 4 sessions, creating negative divergence between price action higher and GEX shifting mostly lower. This occurrence doesn’t mean QQQ can’t reach the upper Dealer Cluster zone, especially given that QQQ GEX is still positive overall, but it’s a trend worth watching, potentially adding some degree of confidence that we might see a reversal lower in the absence of an increase in positive GEX.

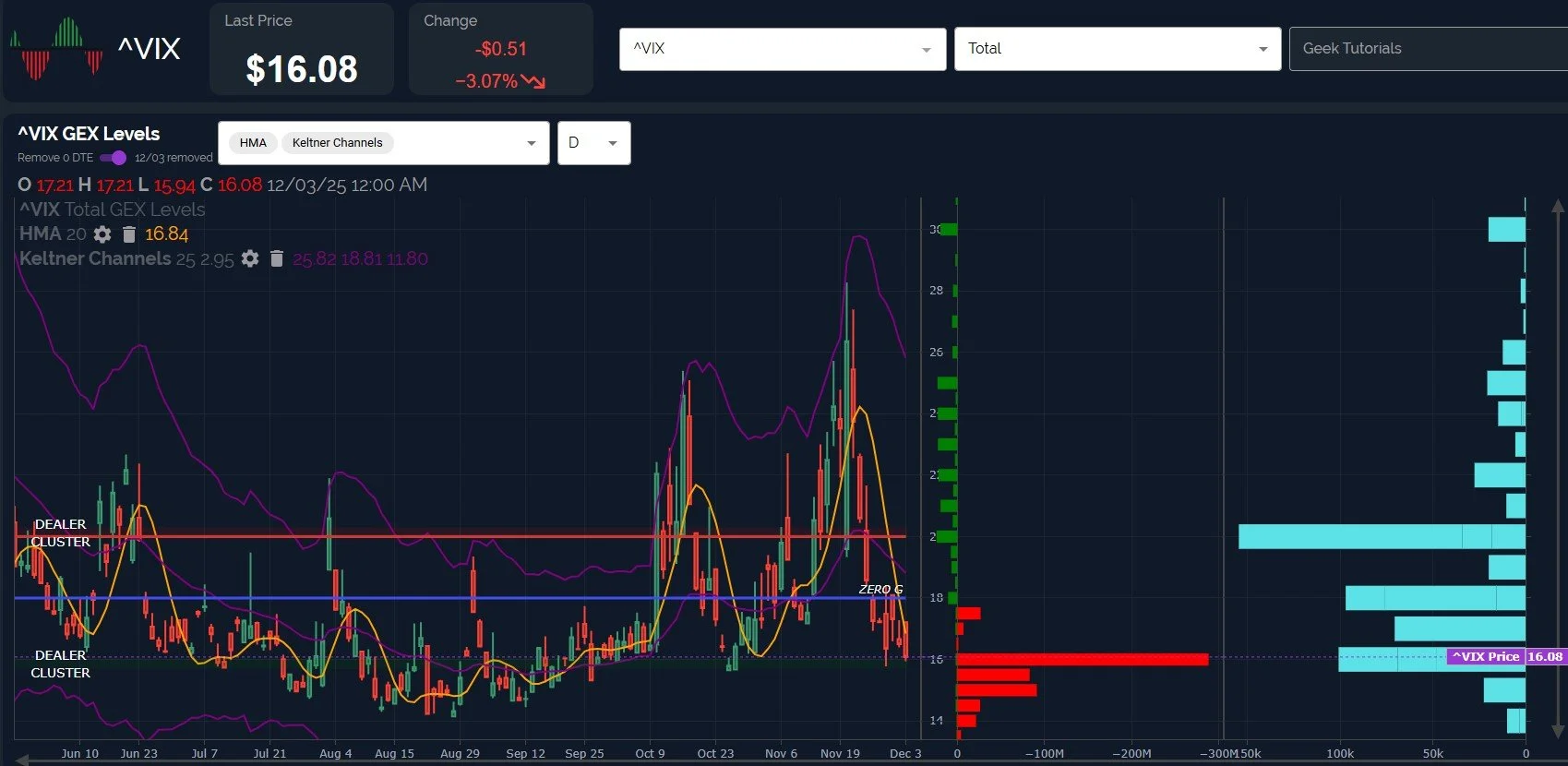

Lastly, the VIX continues holding higher lows relative to the late November low, though we have seen some increase in the negative GEX at the 15 strike.

GEX positioning still suggests a low probability of the VIX dropping below 15, and the steep descent of the Hull potentially implies a crossing of the Hull below the VIX by Friday, an early indication of the VIX turning back up.

Even if the VIX spikes from here, a true shift in the trend isn’t likely until we see the VIX holding above 18, so get the latest 0 DTE data in our Discord chat, where we hope to share any shifts we view as lasting going forward.

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who share their thoughts, and we share analysis every day as well.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.