VIX Rejecting 17: The Coast Is Clear?December 3 Stock Market Preview

You can view today’s YouTube video here. Today’s YouTube video takes a look at SPX, IWM, WMT, and more, so check it out if you have a few minutes!

Today’s cash session was somewhat tame, with SPX and QQQ waking up a bit late in the day to move higher into the close, while IWM diverged negatively, closing in the red.

The VIX continues painting red candles daily since the late November high, though it’s noteworthy that we haven’t yet seen a lower low than Friday’s low.

We also fail to see negative GEX growing significantly below the 16 strike, and the Hull Moving Average is rapidly approaching the VIX, potentially setting up another reversal similar to what we saw in late October.

At this moment, any rebound attempt by the VIX may find resistance between 20-25, leaving room for the indices to reach upside targets into year-end.

In the short run, we see QQQ holding gains since the November lows, allowing the Hull to play “catch-up” while we also see GEX targets up to 640, potentially.

So far, the gap between the Hull and QQQ’s price has closed due to the Hull rising, which is a sign of strength, but we still see QQQ somewhat far above the Hull, so time still allows 1-2 days for either QQQ to pull back and test the line, or for the Hull to continue moving toward price.

QQQ closing above 620 places QQQ directly in the upper Dealer Cluster zone, so it’s unclear at this point whether or not 620 will now act as support for a push deeper into the box toward 630, or if we will see immediate rejection back to the 610 area we mentioned recently.

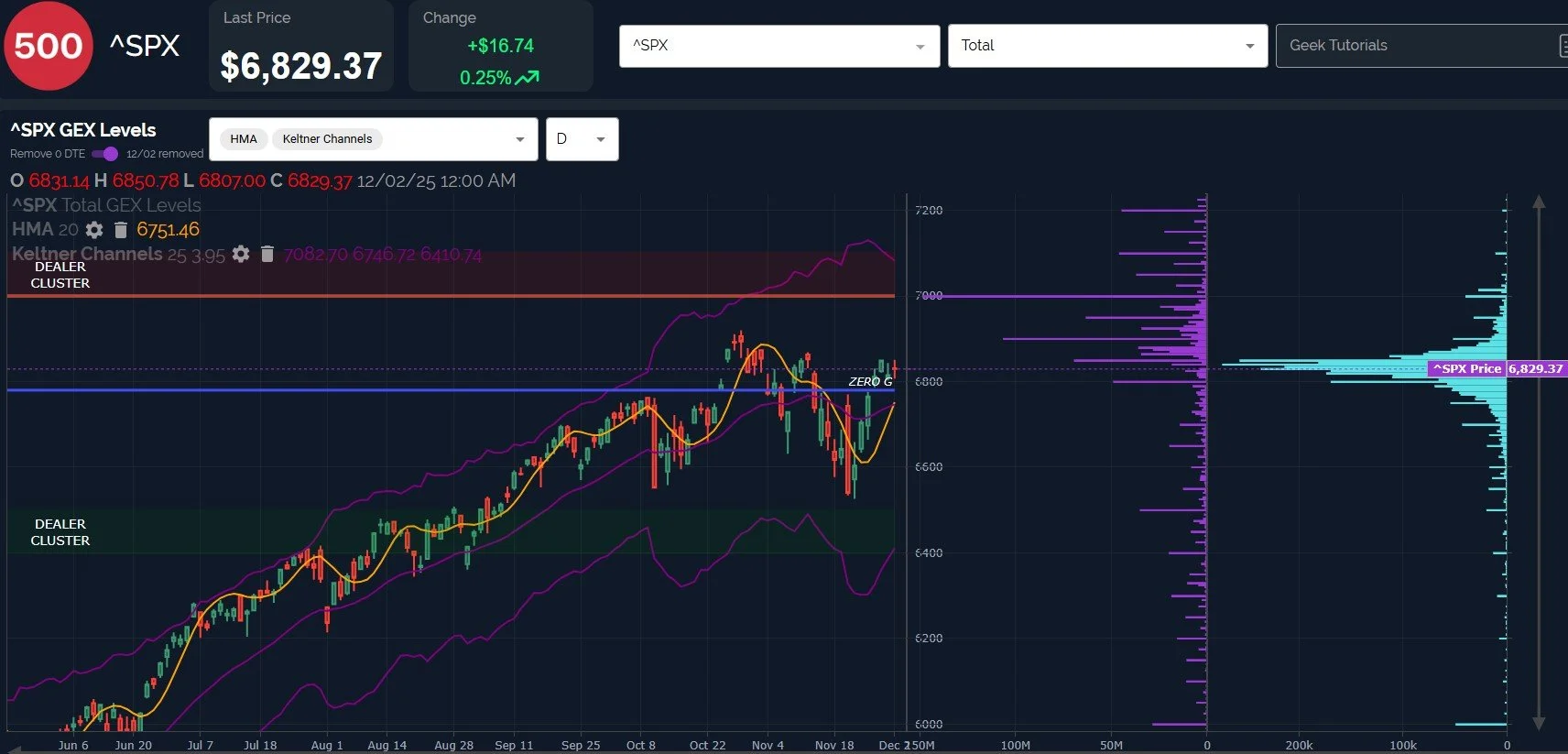

Glancing at SPX’s GEX Levels chart, we see net GEX reflected, emphasizing the significance of the positive GEX at the 7000 strike, a GEX cluster that we’ve been highlighting for several months now.

Most of that GEX is clustered at the 12/31 expiry, and it has remained through several recent pullbacks, potentially validating the likelihood of a closer approach to 7000 by year-end (or just after), as it has remained larger than other net GEX clusters.

The GEX at 6900 is also significant, and a first test at whether or not SPX will make a lower high relative to the October high or a higher high.

Any pullback that holds the 6750 Hull/middle Keltner channel area maintains good odds of reaching new highs by year end, in my opinion.

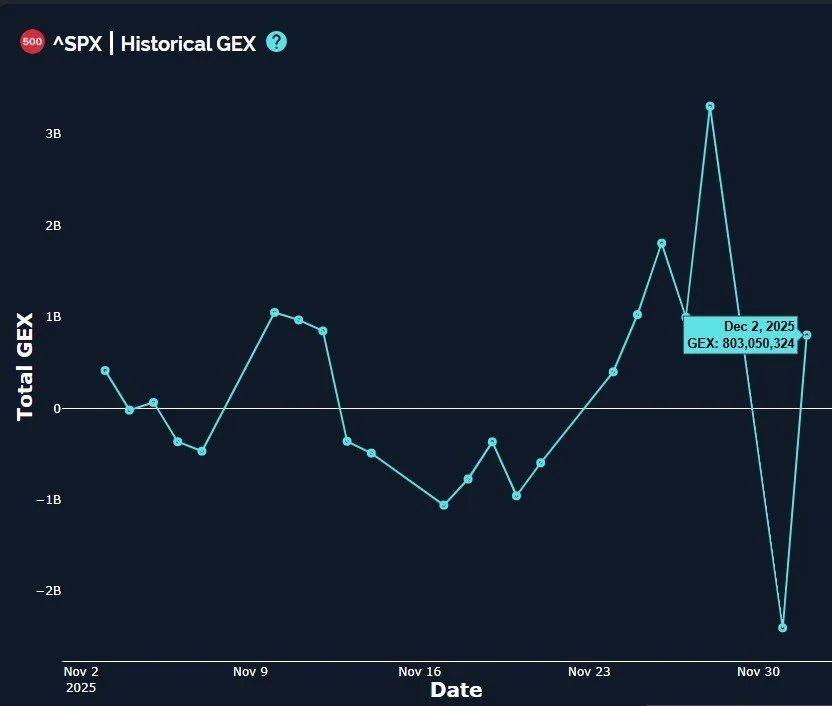

Looks like SPX’s net GEX dump yesterday was indeed a whipsaw, with a return to fairly solid positive territory occurring today. I still find the sharp changes from positive to negative and back to positive again to be unusual and worthy of attention in coming days.

Even while the market is making up its mind, we’re still identifying intraday opportunities using 0 DTE GEX, so join us as a Guest in Discord for 7 days to see our premium channels, or check out our memberships to see which one works for you!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who share their thoughts, and we share analysis every day as well.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We’re running more than one promo now, and they won’t last long! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.