GEX Whipsaw: Noise Or Warning? December 2 Stock Market Preview

NEWSLETTER ONLY Cyber Monday Special: Try our monthly Analyst subscription for ONLY $10 the first Month (First tuime subscribers only)! Enter code NEWSLETTER10 at checkout! ENDING after Cyber Monday, potentially never to return!

You can view today’s YouTube video here. Our YouTube videos sometimes have a little overlap, but we discuss different aspects of major indices as well as a few individual tickers, so check it out if you have a few minutes, or if you’re audibly inclined!

GEX-implied levels worked well today, with SPX initially reacting positively off of an extreme negative opening GEX area (“extreme” defined by our tool that compares GEX readings to readings from the prior 52 weeks), bouncing almost to 6850 before rejecting back toward 6810.

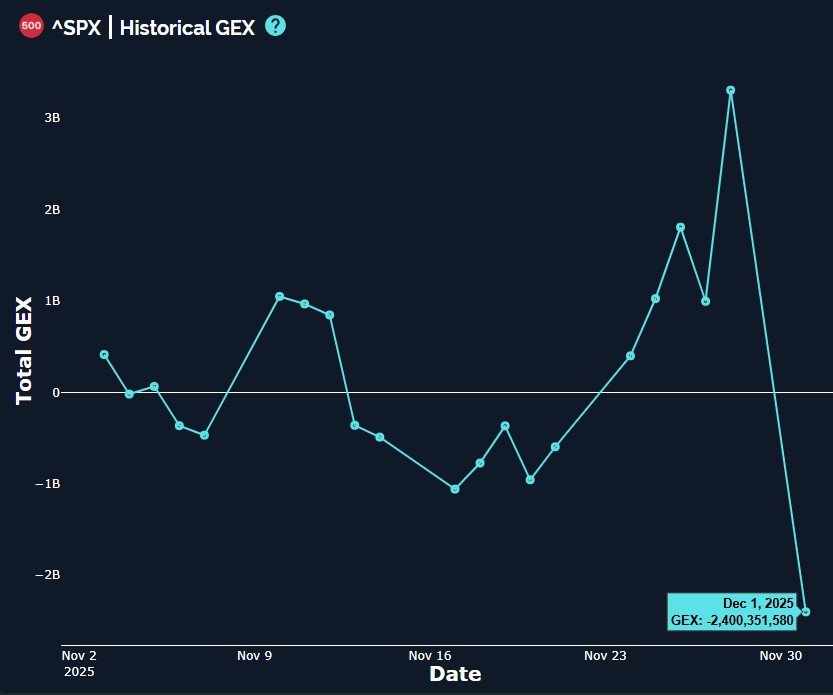

The last two GEX prints represent one of the largest GEX whipsaws I can remember in recent years: An extreme positive comparative GEX reading Friday, following by a near-extreme negative reading today.

We often associate extreme readings on our GEX Intensity Gauge with reversals, but I find the sequence of extremes to be of importance, requiring close watching as we go through this week.

Will the extreme swings be met with a surprisingly volatile move, a short-term reversal, or is it just noise? We use GEX to improve our odds, but we don’t know exactly what will happen from here. Let’s look at some other factors as we aim to improve our picture of what is likely.

SPX still shows outsized GEX at the 7000 strike, and it’s still mostly concentrated at the 12/31 expiry. We also see higher volume at 7000 than at many other strikes.

SPX’s price is extended a bit far above the Hull Moving Average, but as we mentioned, the gap between the Hull and the current price can be met a number of ways: Price dropping, price moving sideways as the Hull rises, or a combination of a shallow drop over time as the Hull rises.

Until SPX loses the key 6800 area, we may continue higher toward 6900-7000, with 6700 appearing to be key on the downside, if we end up declining further.

The Hull is currently just above 6700 at 6711 and rising, so anywhere from 6700-6750 could end up being an area to watch.

A quick look at QQQ’s weekly chart reveals 630 sticking as an important upside target, but so far, QQQ hasn’t been able to hold attempts above the weekly Hull, which is flat at the moment.

A break above the weekly Hull will target 630, and QQQ still shows positive GEX, despite the negative divergence with SPX’s GEX.

A trip down to 600 could happen quickly though, given the short-term technical warnings on the weekly chart and the overstretched daily chart.

IWM continues to hold below the 250 GEX zone, but as long as IWM holds above the Hull at 241.37 (and the GEX at 245), additional attempts to oveertake 250 are entirely possible, with 260-270 possible year-end targets in a bullish scenario.

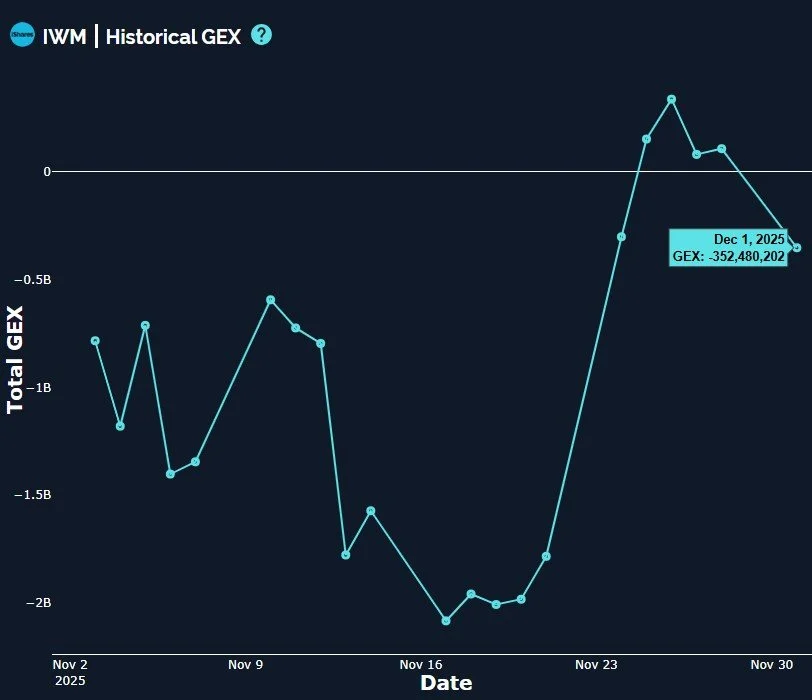

IWM saw a GEX shift somewhat similar to SPX, back into negative territory, though not as extreme of a drop as we see with SPX.

The fact that SPX exhibits the largest drop in net GEX is potentially a red flag in the short run, and it doesn’t help that we see IWM in negative territory. Immediate odds seem to favor a pullback, and the sooner the better, in terms of potentially allowing enough time to rebound toward the year-end targets mentioned.

While the 2-hour chart seems to show the VIX flattening out, today’s close below the Hull at 17.46 may signal another trip toward 16 for the VIX, though we don’t see immediate signs of the VIX heading lower than 15.

GEX also backs the view that downside is limited from here for the VIX, but perhaps there’s enough “juice” toward 16 to allow another market push higher? If not, we may be in for a deeper pullback prior to a push for SPX 7000, so let’s look for additional clues as we enter Tuesday’s cash session.

tradingview.com

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who share their thoughts, and we share analysis every day as well.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We’re running more than one promo now, and they won’t last long! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.