SPX Into OpEx: Tricks Up The Sleeve? December 17 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription, bringing your average cost per month below any of our monthly subscriptions! Enter code HOLIDAYS2025 at checkout! ENDING SOON!

You can view today’s YouTube video here, where we discuss SPX, QQQ, the VIX and more, so check it out if you have a few minutes!

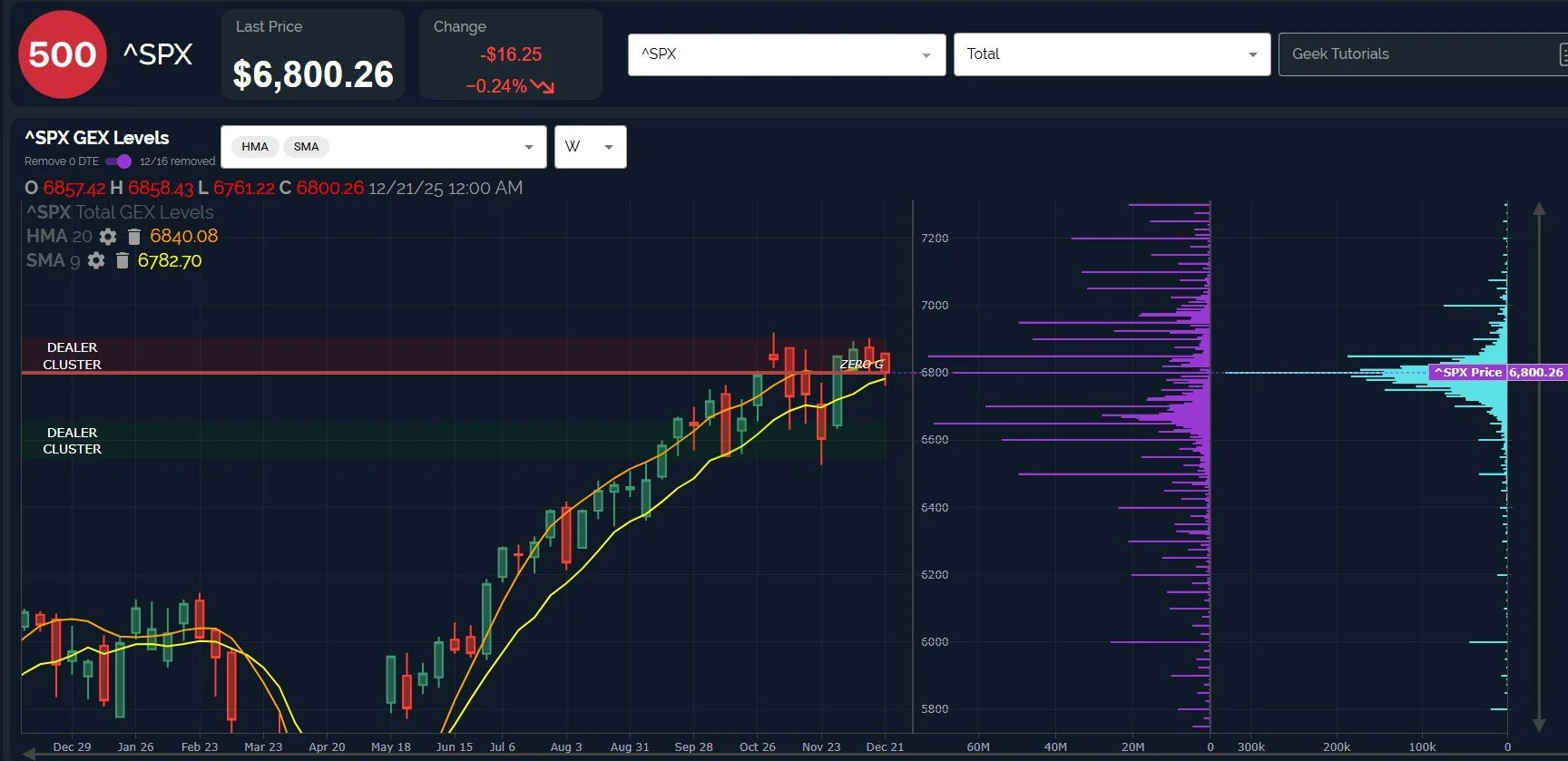

SPX closed right at 6800 today, dipping below the weekly 9 SMA all the way to 6761 before recovering back above the line.

SPX remains below the weekly Hull Moving Average, but much of the last 4 months were spent between the Hull and the 9 SMA, so the weekly 9 SMA appears to be the more important technical border to watch, currently at 6782.7.

An interesting shift occurred today: The net GEX at 7000 appears to be gone. Does this mean 7000 is off the table, or is there more to the picture than meets the eye?

Net GEX is also negative, though barely so. Positive GEX at 6850 currently represents the largest net GEX cluster.

A subscriber asked me a question about SPX’s Dealer Cluster zones in Discord after today’s market close, indirectly bringing a very interesting development to my attention: A huge negative GEX cluster at the 7000 strike on the weekly GEX graph, constituting -155M of the total negative GEX across all expirations of -377M.

What’s the implication of this? Well, for one, if we assume all things remain equal through Friday (for the sake of making a point), the -155M rolling off will leave the majority of the positive GEX at 7000 in place at the 12/31 strike. This means SPX 7000 becomes the largest net positive GEX cluster again..

There may be some other possibilities in play, so we can’t assume that the big negative GEX expiring Friday guarantees a fake-out lower this week, then a rally of 4-5% in the last week of December. Is it possible? Yes. Can we start repositioning now based on these odds? Far from certain. But we may see more convincing signals as we proceed through Friday.

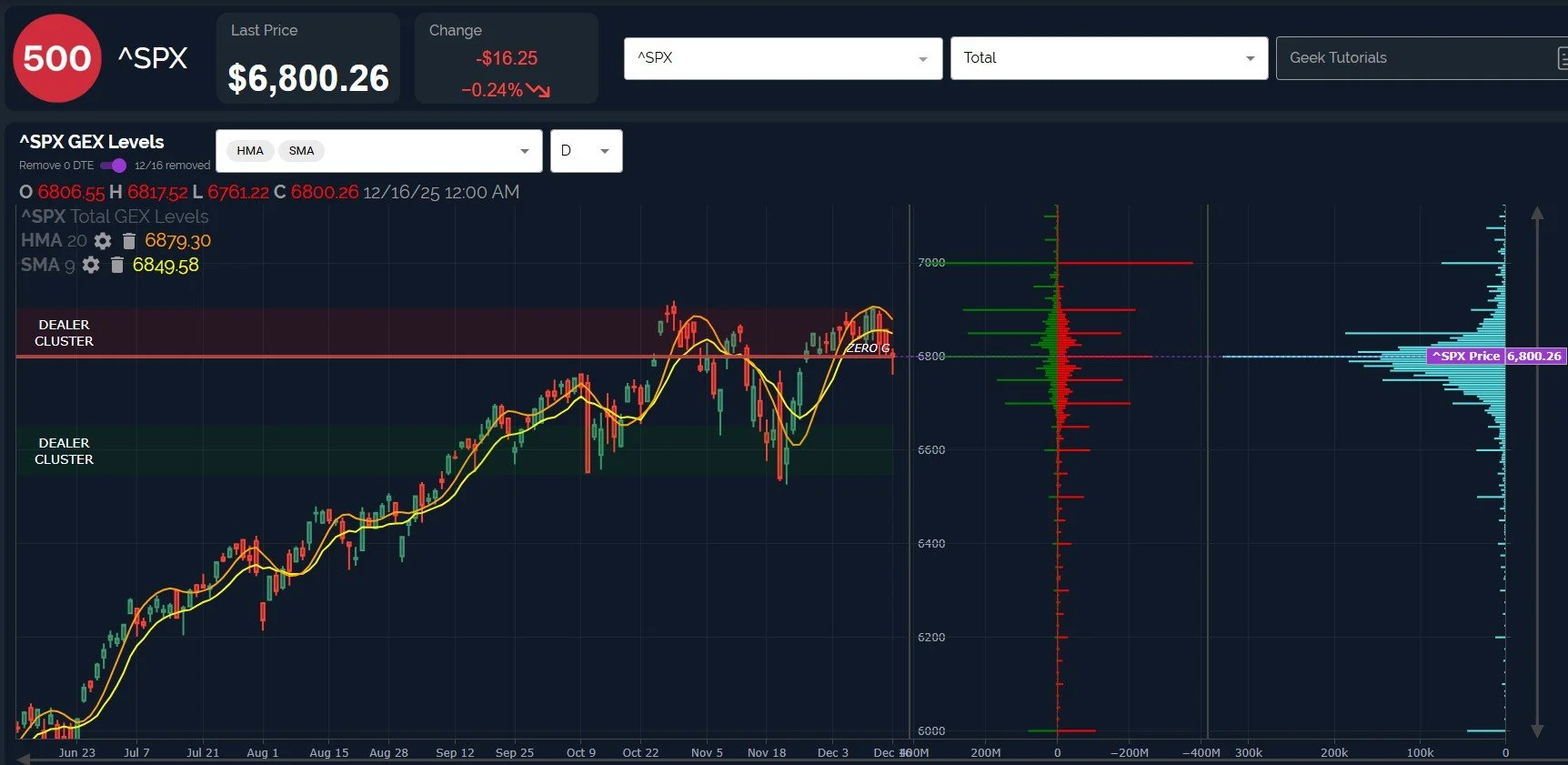

Let’s switch our chart candlestick timeframe to daily and the GEX shown back to the total (gross) GEX picture: You can see the significance of the big negative GEX (much of which is expiring Friday) offsetting the positive GEX at the 7000 strike.

I think our prior point about the negative GEX expiring Friday potentially carries more weight as a warning to bears, and I think the technical picture on a daily timeframe argues for a short-term rebound soon as well.

While the Hull and 9 SMA on the daily chart have started to roll over, price seems a bit ahead of itself, creating a fairly wide margin between price and the Hull especially.

When this last happened to the upside in late November, we moved sideways for roughly a week, and the time before that (early-November) saw a big gap up to bring price back to the line.

The technical picture- and potentially the big GEX at 6800- argue for a rebound soon to at least retest the 6850-6875 area, even if we don’t see SPX resolve in “da bulls” favor.

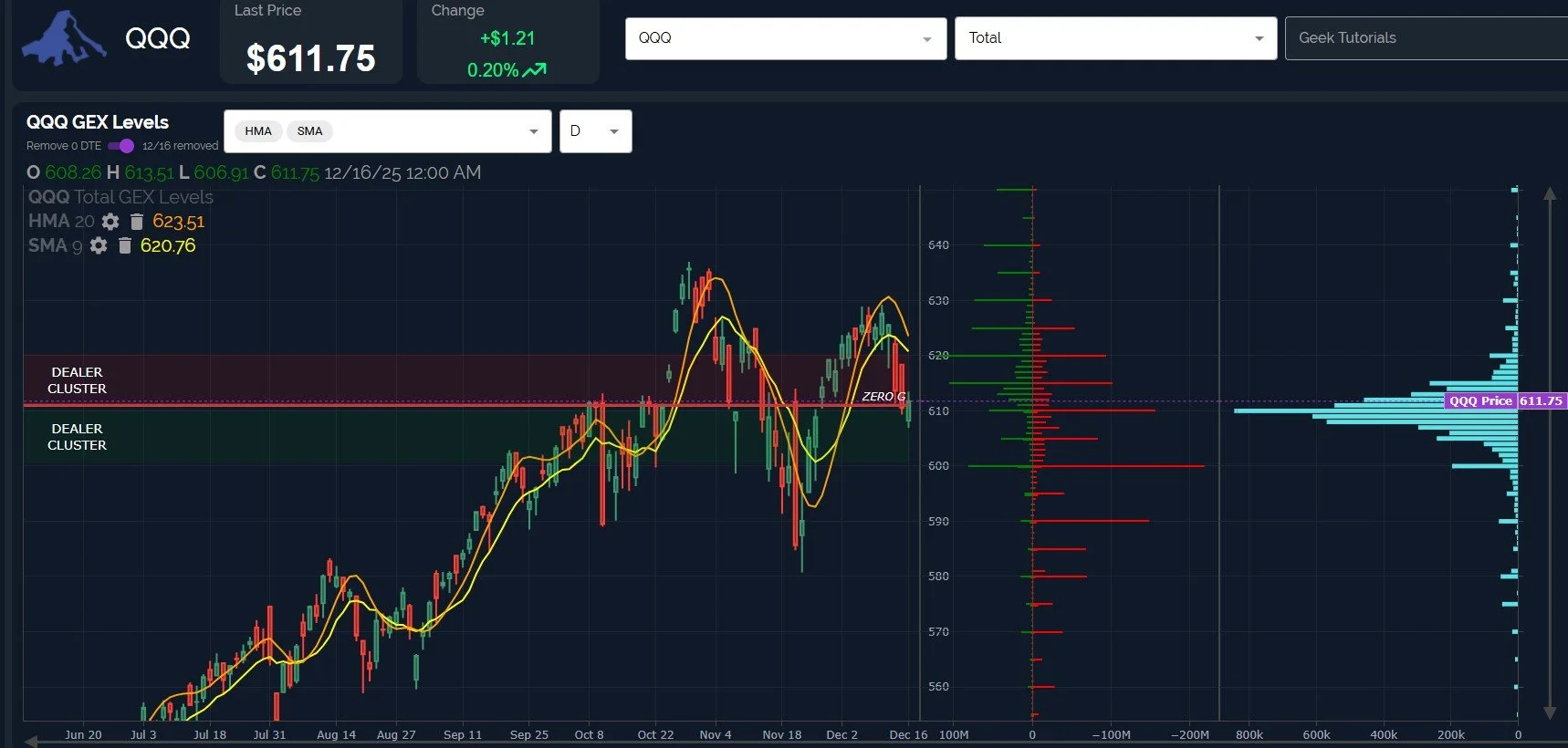

QQQ shows a similar picture in terms of the gap between its price and both the 9 SMA and the Hull, with both moving averages almost converging at the 620 strike.

The setup to me looks ripe for a rebound toward 620, plus we see QQQ in the lower Dealer Cluster zone, where we expect dealer behavior to potentially shift towards buying.

The zone stretches down to 600, and we see a lot of GEX at 600, so a rebound could begin anywhere between 600 and today’s closing price.

The VIX almost reached the declining weekly 9 SMA today, prematurely rejecting (premature rejection is not a laughing matter!) around the 17.5 level, still within the 16-18 range we viewed as likely heading into VIX expiration in the morning.

Given the factors we addressed that may tilt the market bias toward the upside, I lean toward the VIX rejecting any bounce north of 18, at least initially..

We have to zoom in a bit to the daily chart on the VIX, where we now see two days in a row of holding above the 9 SMA at 16.02, and the Hull is starting to turn up as if it’s on a mission…

That said, the Hull is at 15.25, so the market rallying toward the Hull for a retest of SPX 6850-75 may imply the VIX dropping back to test this support, a full point lower.

With the past year as a guide, we may be hard-pressed to see the VIX sustain levels below 14-15, so I am concerned that volatility may be ready to take the stage yet again before SPX reaches 7000.

With conflicting signals and several considerations favoring bull and bear, we will continue watching developments that can help us finish the last 2 weeks of 2025 as strong as possible. We’ll share some observations daily in Discord, so find us there tomorrow!

Here’s the link to our Discord server if you haven’t yet joined us in Discord. We’ll share intraday analysis in Discord as well as interact with our other members during the day, so we hope you’ll join us!

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.