Approaching The Final OpEx Friday Of 2025: December 18 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription, bringing your average cost per month below any of our monthly subscriptions! Enter code HOLIDAYS2025 at checkout! ENDING SOON!

You can view today’s YouTube video here, where we discuss today’s carnage from a slightly varied angle, so check it out if you have a few minutes!

The VIX closed out its monthly option expiration just over the 16 level, then rallied during the cash session, almost reaching the 18 strike.

Net GEX is positive for the VIX as we begin the new January option cycle, and the daily chart shows a rising trend above the Hull Moving Average.

The VIX is holding (so far) below the key weekly resistance levels created by the 9-SMA at 18.03 and the Hull at 18.64, which will be key for the VIX to overcome if it’s going to spike to higher levels.

While SPX’s net GEX at the 7000 strike has decreased relative to the now largest positive net GEX cluster at 6800, bulls may be due for a relief bounce, perhaps matching the VIX approaching resistance.

SPX is almost to the 6700 lower Dealer Cluster zone, and SPX’s price is extended quite far below the daily Hull, so mean reversion and reconvergence with that declining line (currently 6851.43) may happen fairly soon.

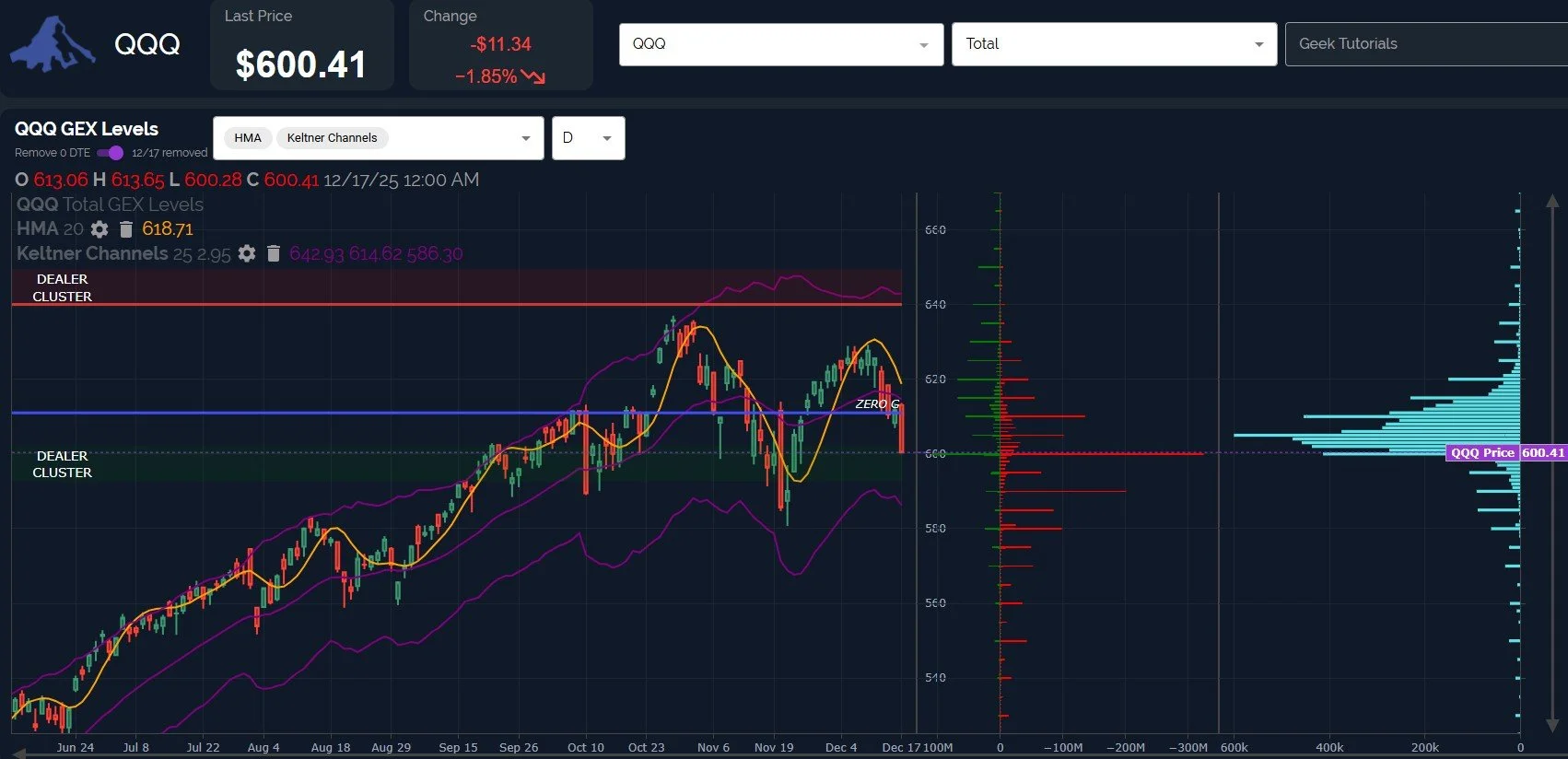

QQQ tells a similar story: The big picture is not looking very positive, and net GEX overall is in solid negative territory, but QQQ is a bit extended to the downside, and the 600 strike is an important GEX area as well.

A retest of the Hull downtrend line at 618.71 wouldn’t be surprising, though we need to reassess what happens from there. The upper Keltner channel is just above the 640 area, which is looking quite far away currently, but it aligns with the upper Dealer Cluster zone.

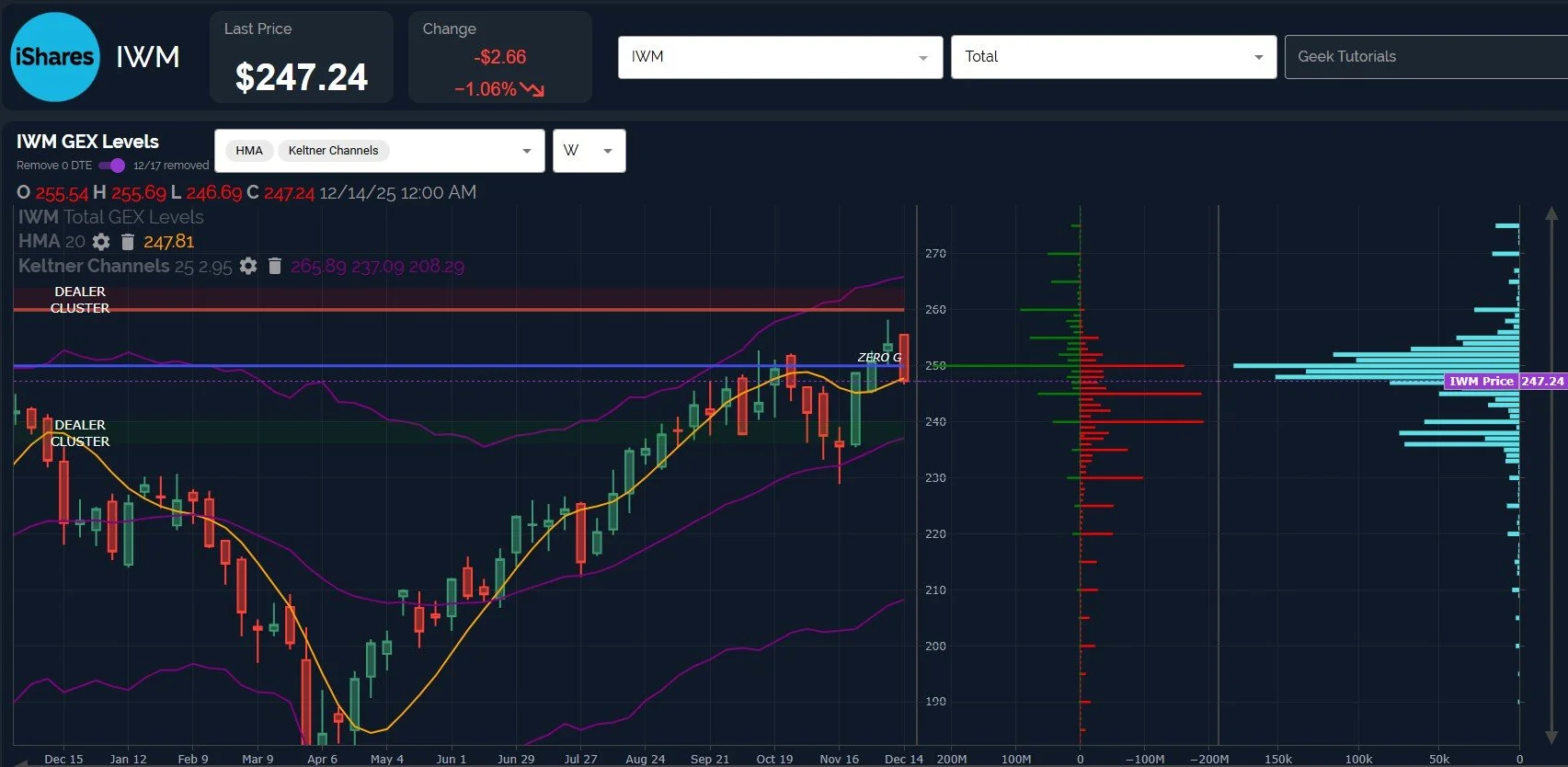

IWM paints the most bullish technical picture, in my view, with IWM’s price just now testing the Hull on the weekly chart. While below the important 250 GEX cluster, any further downside toward 240 currently appears to be a buying opportunity in a solid uptrend.

The daily chart is fairly well aligned in terms of the Keltner channels, and IWM is also extended quite far below the Hull at 254.90, representing a potential bounce opportunity.

We’ll share new observations pertaining to the evolving picture intraday tomorrow, so we hope you’ll join us in Discord for more!

Here’s the link to our Discord server if you haven’t yet joined us in Discord. First-time guests receive a free 7-day trial of the premium Discord channels.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.