Rallying Into A Decision Point: November 24 Stock Market Preview

NEWSLETTER ONLY Black Friday Special: Try our $99 monthly Analyst subscription for ONLY $10 The First Month (First time subscribers only)! Enter code NEWSLETTER10 at checkout! ENDING after Cyber Monday, potentially never to return!

You can view today’s YouTube video here. We Look at SPX as well as AMD, BTC, and GOOGL, so check it out if you have a few minutes!

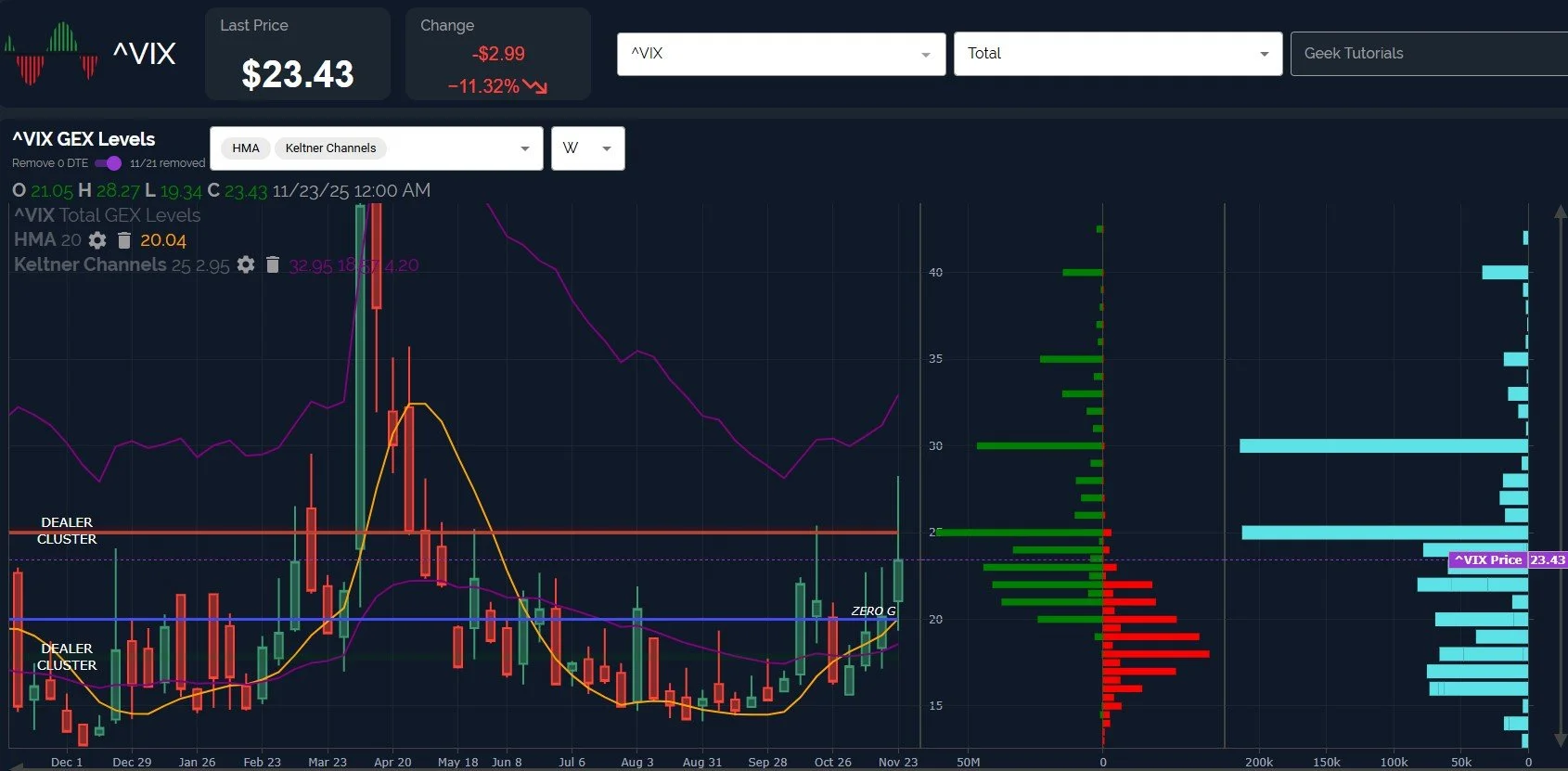

Looking at the VIX, we see a continued respecting of the rising weekly Hull Moving Average, now reflecting the importance of the 20 strike as a bull/bear line. This also matches the GEX at 20, with negative GEX below 20 and positive GEX above.

Friday’s attempt toward the 30 strike, and subsequent rejection to close below 25, is certainly an encouraging potential sign for dip buyers who are hoping for a market rebound.

The bottom line (in my view) for the VIX is that the 20-25 area might be tricky, with a move back above 25 potentially marking a trip to 30-35, and a dip closing below 20 may signal the VIX could drop to 18 or lower.

IWM showed some positive divergence Friday, closing well above the declining Hull and leaving behind a higher low relative to Thursday.

A trip back to retest the zero gamma level and middle Keltner channel at 240 seems likely, with 250 as a possible target if we see a daily close above 240.

GEX has only slightly improved for IWM, and we continue seeing higher volume at lower strikes (220 saw the highest daily volume for IWM Friday) and GEX that has grown down to 220.

Bulls will want to see any attempt to drop again fail to close below the 230 strike, based on GEX and the declining Hull, which is currently at 232 but will soon be at 230, if the current trajectory remains.

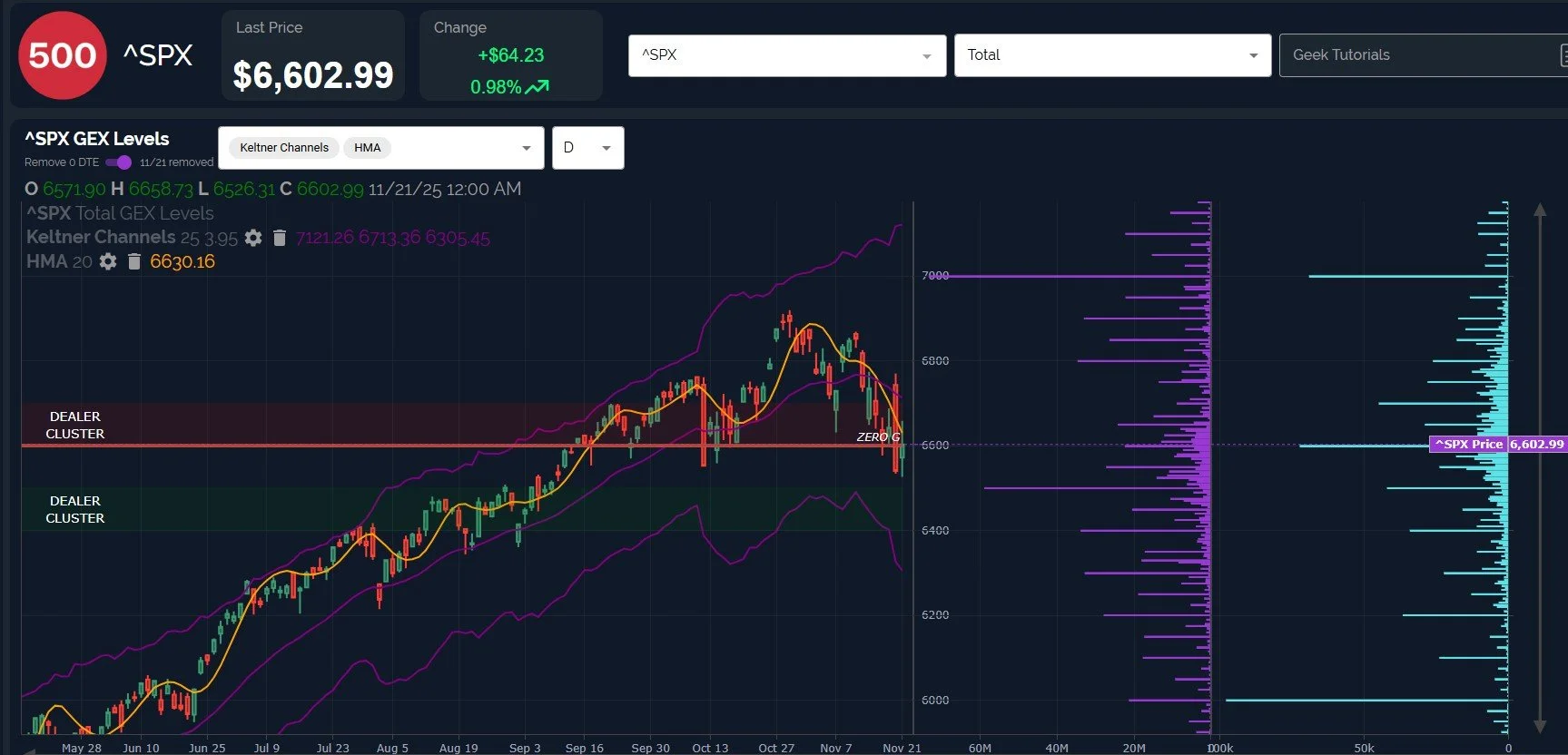

Looking at SPX’s daily chart, I wanted to highlight the net GEX picture, showing that 7000 remains as a sticky GEX level. Most of that GEX is clustered at the 12/31 expiry.

SPX is holding just above 6500 so far, and a pathway higher exists, though each passing day diminishes the odds somewhat as we rapidly approach the end of the year.

GEX has only slightly increased and remains net negative, and each 50 and 100 point increments up to 7000 mark potential reversal areas that will need to be overcome, based on GEX.

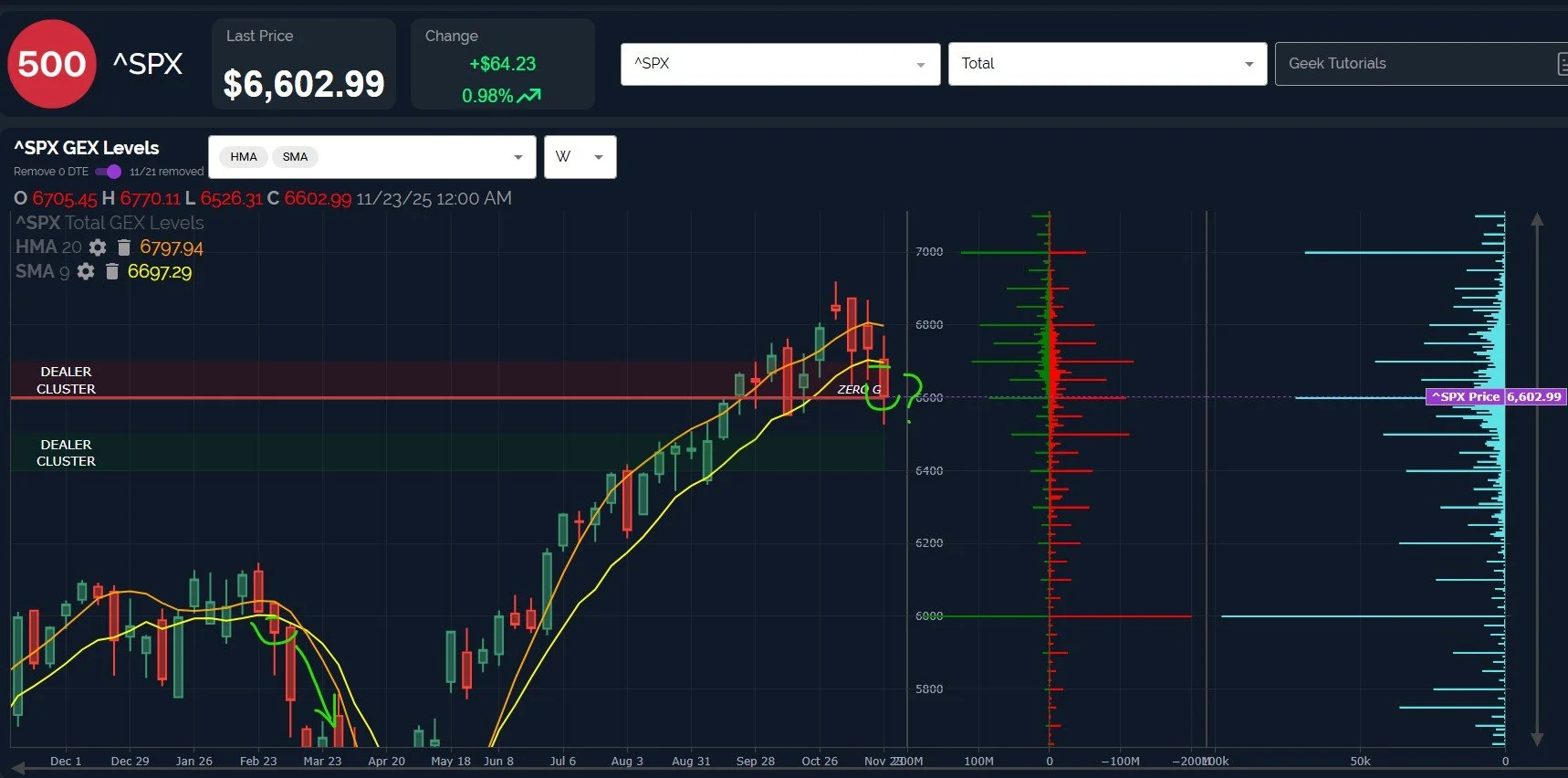

The weekly chart (which I show with gross GEX toggled instead of net) brings forth another concern: Last week was the first time that SPX closed below the 9-SMA since the close in February that marked the beginning of a vicious decline (or as I call it, a shopping spree?) into April.

Will SPX net GEX at 7000 defy the technical gravity potentially signaled by last week’s close, or will it slowly diminish in size as participants shift expectations of when 7000 will be hit? Let’s watch price action around 7000 as well as the VIX in coming days to see if we can get further clues as to which direction is likely to win in coming weeks.

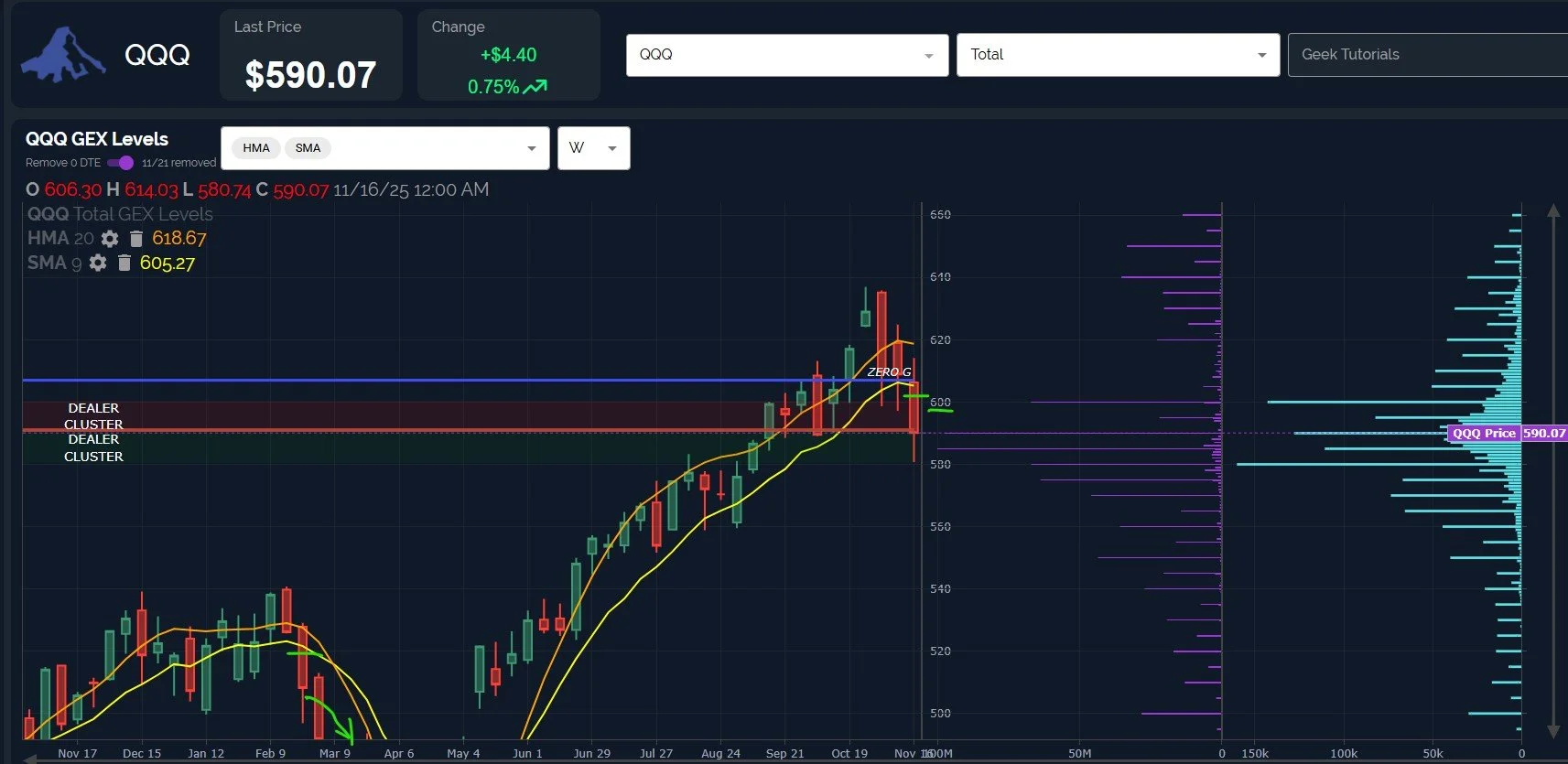

QQQ has the same problem: A weekly close below the 9-SMA with very little improvement in the net GEX picture as of Friday’s close.

QQQ has very little positive GEX to mention above the 600 strike, though we may see a shift fairly quickly on the heels of a strong day ahead, if one materializes. For now, at least a test of 600 appears likely, though the underperformance of QQQ last week and the presence of larger GEX clusters below leaves lingering concerns of a deeper spike lower.

We’ll be watching for 0 DTE clues, and we’re on a 0 DTE win streak with our identified opportunities, so we hope you’ll join us in Discord where we share at least some freebies daily. Take advantage of our promos as well heading into Black Friday!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.