Whelp..The Cat Is Definitely Dead! November 21 Stock Market Preview

You can view today’s YouTube video here. We take a look at some additional tickers like QQQ, GLD, and NVDA, which are not covered in the newsletter, so give it a look if you have a few minutes!

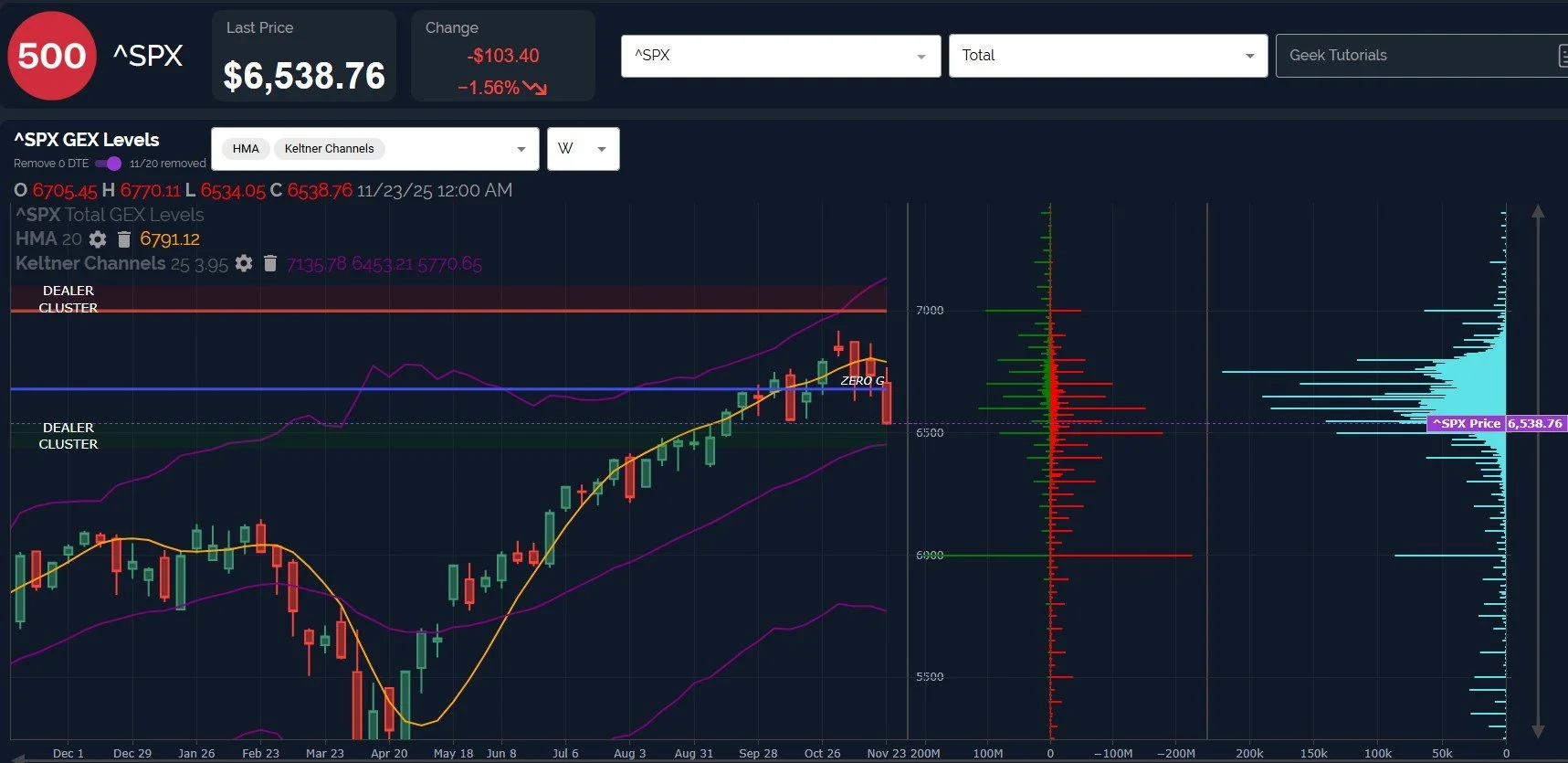

Our newsletter headline references yesterday’s headline, asking a question about the rebound being sustainable or a dead cat bounce. Today’s gap up above the daily Hull Moving Average at SPX 6700 looked promising, but a sharp intraday reversal not only filled the gap, but negated the positive move and more than maintained the downtrend indicated by the daily Hull.

Looking at SPX’s weekly chart, the rejection was fairly close to the Hull, a logical spot for reversal lower. We are now approaching the weekly middle Keltner channel at 6453, I’ll also note the lower keltner on the daily is near 6440, a level I mentioned in Discord earlier today (when it seemed out of reach).

Ideally for bulls, an intraday reversal tomorrow or Monday somewhere around 6450 and a close above 6500 might indicate this selloff is over. Anything short of that and we might be looking at a deeper drop.

The VIX and VVIX appeared to be giving positive signals for market bulls early today, with VVIX down 14 and the VIX down over 4, reversing dramatically to maintain the weekly Hull and closing at new post-April VIX highs, also closing above the key 25 strike on the VIX.

Today’s close above 25, unless negated at the open tomorrow, risks a trip to 30 or beyond, so keep an eye on this. Ultimately, bulls want to see the VIX lose 20 again on a closing basis.

tradingview.com

VVIX has previously marked short-term reversals or breakouts from sideways consolidations with a big spike and intraday reversal, leaving behind big, red candles with long wicks. This isn’t always the case, but it happens enough times to at least hope that we get it this time around as well.

Today’s reversal higher doesn’t look over, so hopefully we get a more solid signal from VVIX in the next day or two.

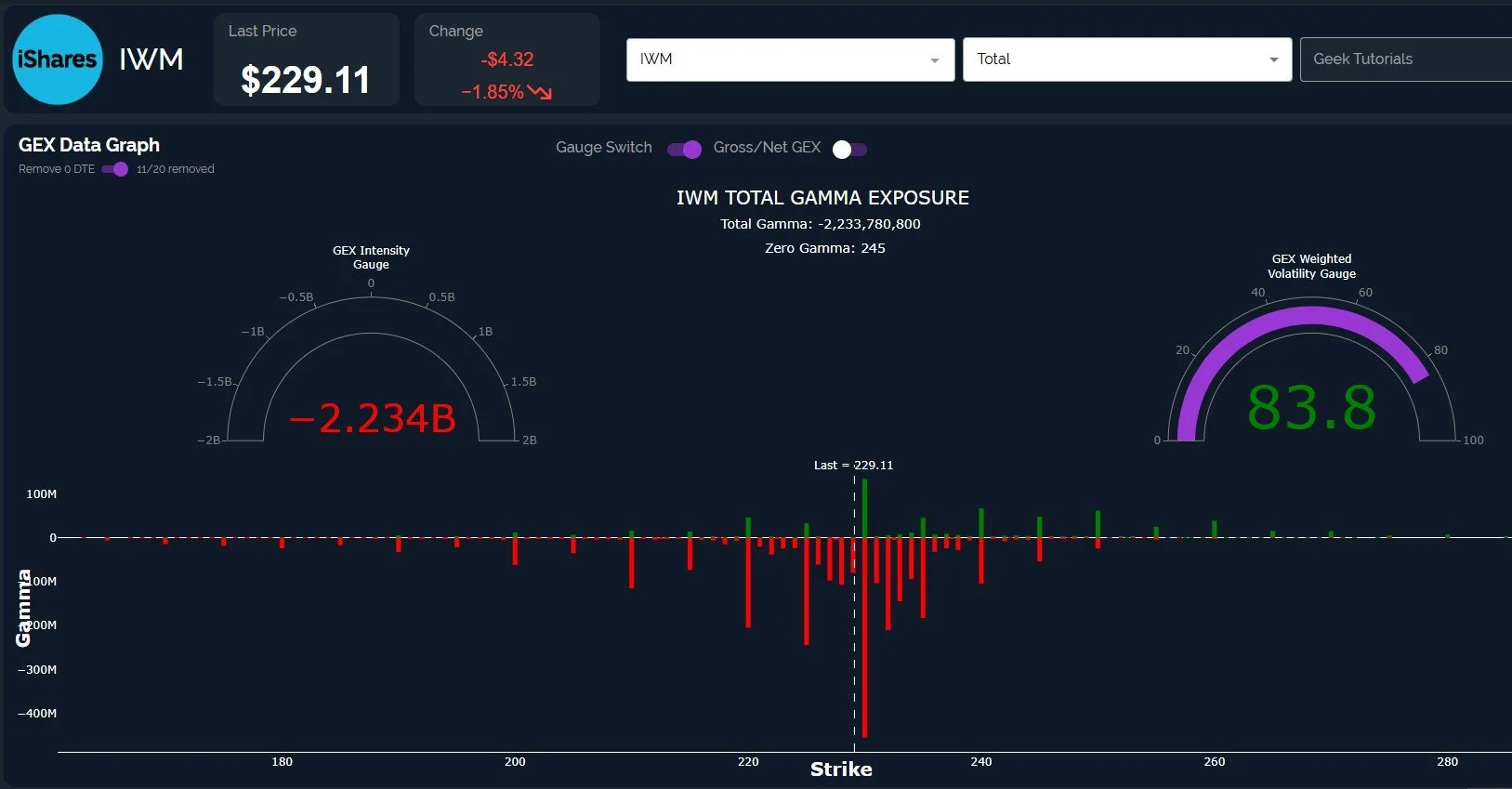

IWM showed slight GEX divergence, with an increase in GEX, but it’s still at a negative extreme.

Today’s close below 230 increases the risk of a trip to 220-225, which have shown higher volume in recent days.

We are still near the lower Keltner channel and IWM is within the lower Dealer Cluster zone, so a bounce could materialize soon.

Furthermore, the extreme negative GEX position likely increases the odds of at least a temporary bounce in the next day or two, so I’ll be watching for a combination of signals (includng 0 DTE GEX) to indicate a potentially attractive long entry.

We will be sure to share intraday shifts tomorrow in Discord, so we hope you’ll join us!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.