Dead Cat Bounce Or Lasting Bottom? November 20 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout! ENDING SOON!

You can view today’s YouTube video here. We add some additional color to the major indices so check it out if you have a few minutes!

This morning’s monthly VIX options expiration went according to expectations, with the VIX closing below the big positive GEX at the 25 strike and above the paltry remaining negative GEX that was mostly clustered around the 21 strike.

We also saw an attempted market bounce, which we speculated might happen following the VIX expiration. The big question is whether or not the bounce is a dead cat bounce or the beginning of a more lasting rally toward new highs, with SPX 7000 in focus.

A quick look at the VIX today reveals a retest of the rising Hull Moving Average that has held so far, though the VIX couldn’t yet make a higher high.

We do see volume and GEX at higher strikes, with 30 standing out, so we may yet see volatility spike further before the market selloff is truly over. Key levels we’ll be watching include a break of 22 to the downside, targeting VIX 18, and a break of 25 to the upside may see 30 quite quickly.

One thing bulls want to see is a swift kick in the butt to VVIX to signal a possible lasting rally. We saw early positive signs today, with VVIX down 4 points, but ideally we will see VVIX down 8-10 points intraday as a sign of volatility deflating. Previous VVIX spikes that faded a lot intraday often marked bottoming candles for the indices. But have we seen the sort of VVIX spike that would count as a climactic volatility top? I don’t think so, though I guess there’s no requirement of one either..

tradingview.com

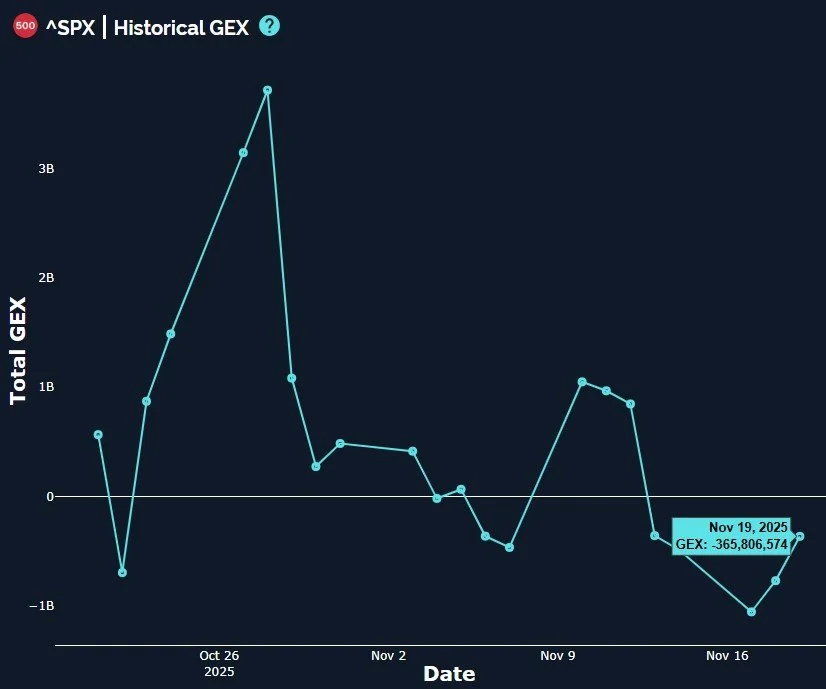

SPX did show a modest positive improvement in net GEX for the 2nd day in a row, though not conclusive by any means. This may be because of NVDA’s earnings after the bell, so tomorrow’s closing net GEX may be more meaningful.

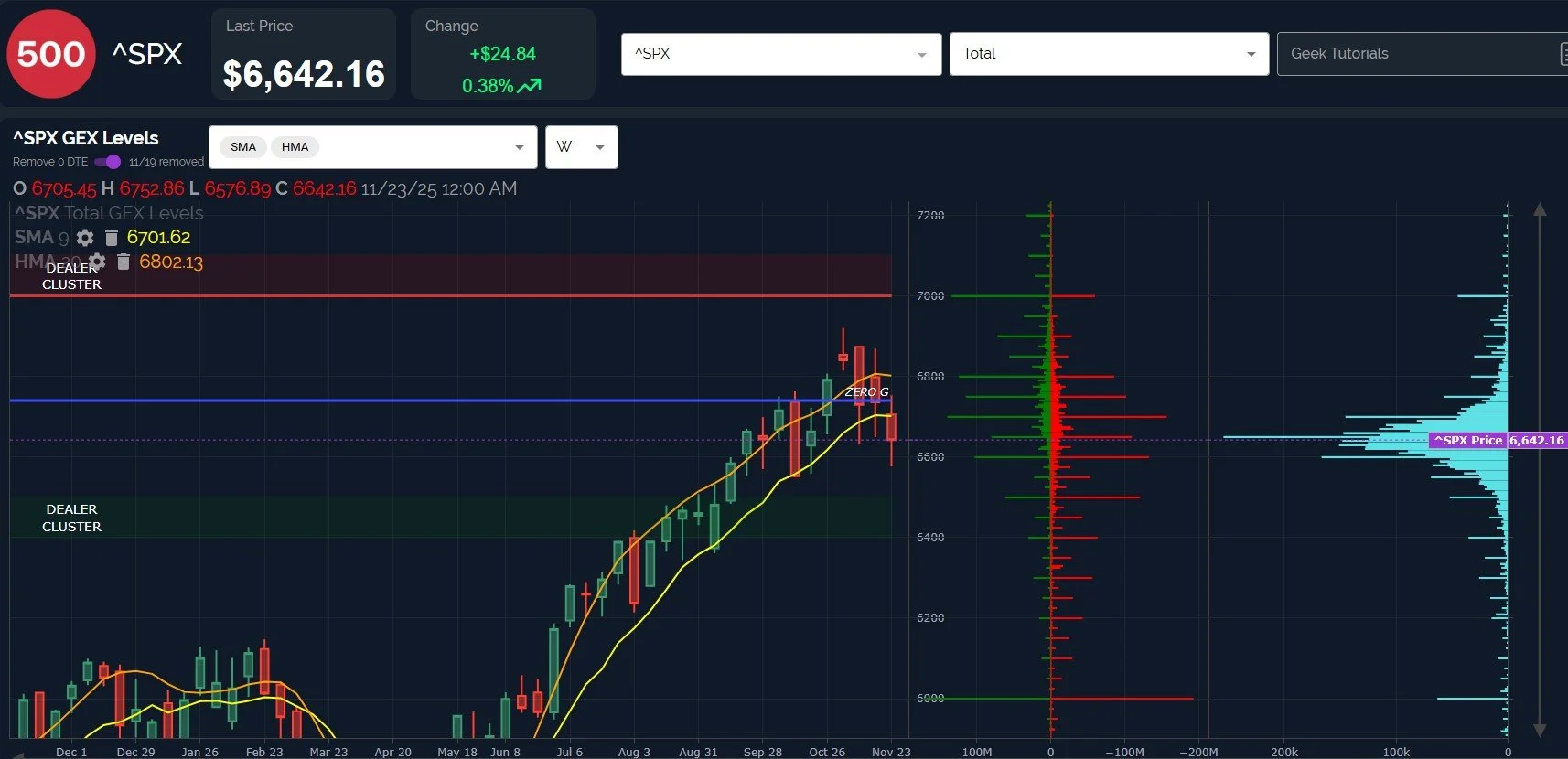

Zooming back out to the weekly chart for SPX, we’re focused on retaking the 9-period SMA for the sake of the bulls, but we also see the weekly Hull at 6800.

These two important support/resistance levels coincide with the big GEX clusters at 6700 and 6800, so we need resolution above 6800 or below 6700 to potentially find the next trend move: Above 6800 targets the sticky 7000 GEX we’ve seen (and still see) at the December 31 expiry, while below 6700 ultimately may target 6500 and then 6000.

I hate to break it to you, but a visit to 6000 may be a great opportunity. This level represents the topping consolidation zone we saw from December through February, so this would be resistance-turned-support, if revisited. Seems far away, doesn’t it? Sorry, but that’s what a wild-eyed 45% move higher (without interruption) in 6 months does to the human mind.

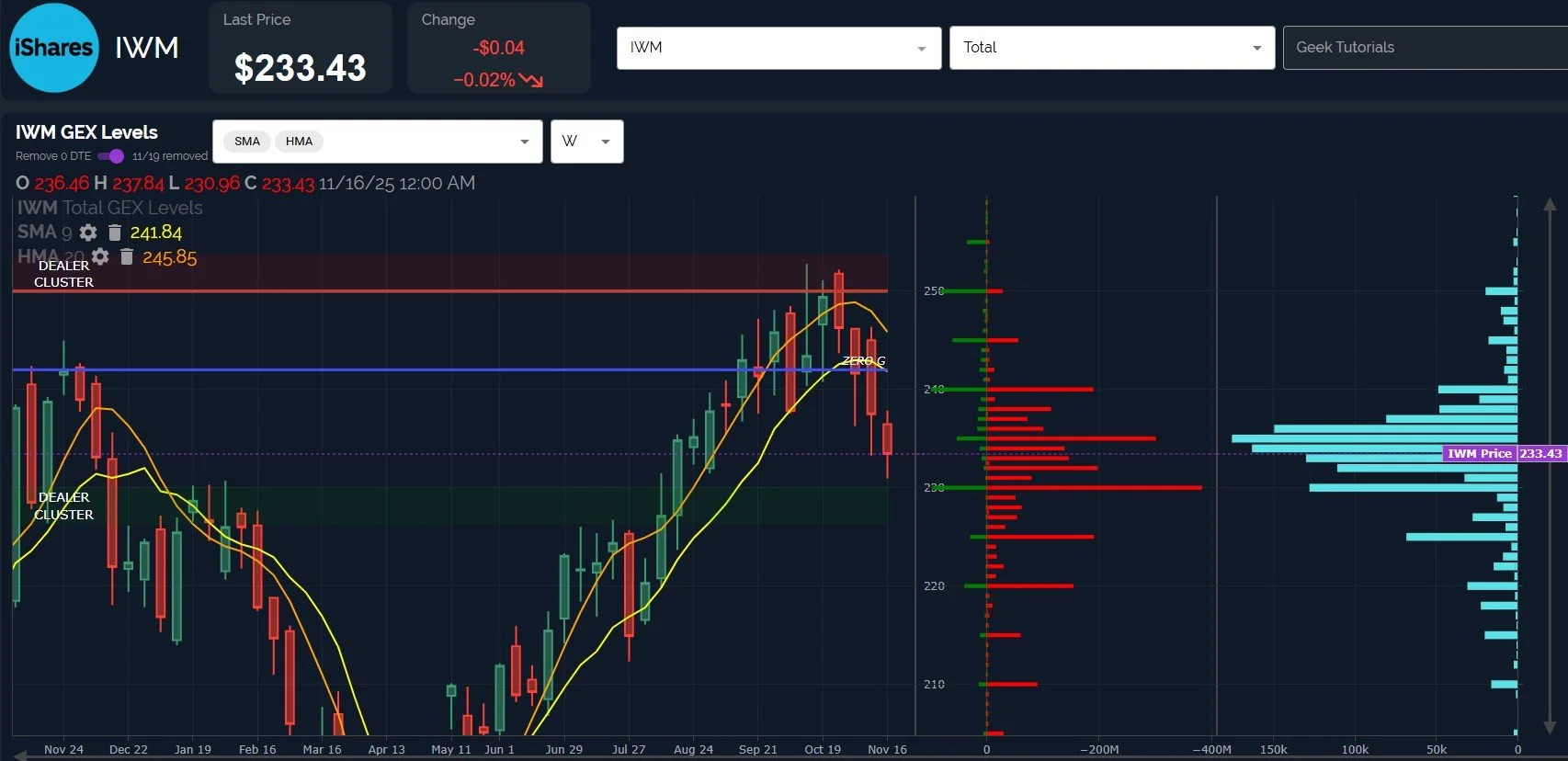

We still hold out hope that IWM may find lasting support at the 225-230 area, and we are stretched quite far below the weekly 9-SMA and Hull.

At this point, 240 appears to be formidable resistance, so we can’t become too bullish until that level is overtaken on a daily close.

In closing, let’s take a quick look at SMH, which will move with the influence of NVDA tomorrow. NVDA’s upside target based on GEX is around the 200-mark, and we see NVDA higher after hours.

As for SMH, 250 and 260 are important upside resistance areas, so keep an eye on price action around those zones, especially 250, given the large positive and negative GEX clustered at that strike.

We will be sure to share intraday shifts tomorrow in Discord, so we hope you’ll join us!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.