Short Term Bounce? November 19 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout! ENDING SOON!

You can view today’s YouTube video here. We discuss the major indices (SPX, QQQ, IWM), the VIX, CRWD, and MU, so check it out if you have a few minutes!

Heading into monthly VIX options expiration tomorrow morning premarket, we see the VIX holding the big GEX cluster at the 25 strike, cooperating well with what GEX told us was likely this week.

The VIX is extended quite far above the rising Hull Moving Average at 20, which may serve as a retracement target if the VIX pulls back tomorrow. The VIX is notoriously difficult to predict in the middle of a spike higher, but failing to overtake 25 does favor consolidation or a pullback toward lower strikes. We should learn a lot more about participant positioning as we proceed through tomorrow.

IWM is just above the big GEX cluster at 230 that we’ve been watching, also fairly close to the lower Keltner channel at 228. The confluence of these factors and IWM’s positive divergence today compared to other indices may be a good sign for bulls looking for a market bounce.

The weekly chart also shows the current spot to be just above the weekly middle Keltner channel, yet another indicator matching up to signify potential importance of the 230 zone.

Losing 230 opens the door to 225 aND 220, but GEX really drops off after that, so we’ll want to watch the intraday picture for more clues.

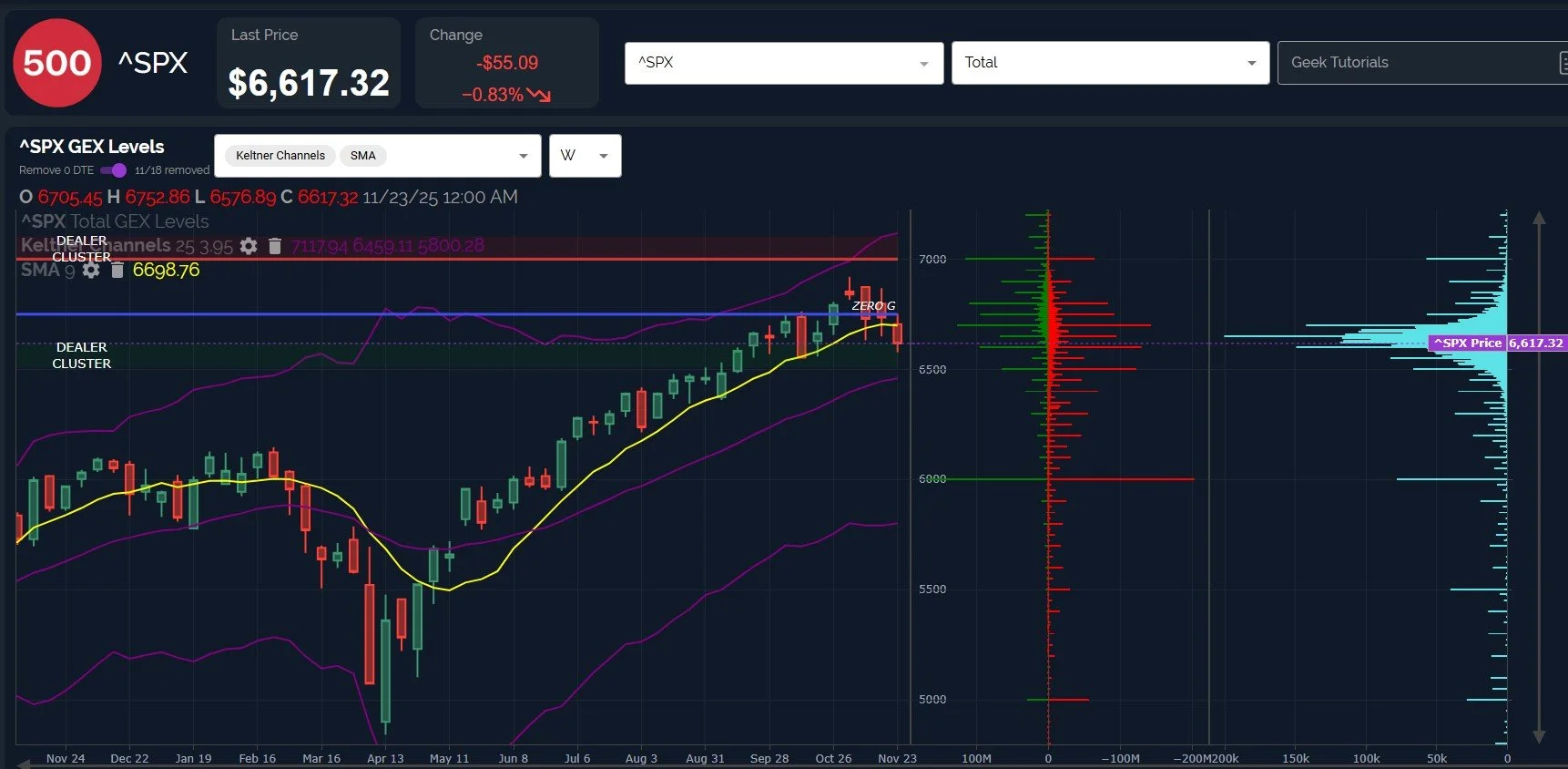

SPX has entered the lower dealer cluster zone around 6600, also appearing quite far extended below the declining Hull. Usually, large gaps between price and the Hull end up being narrowed one way or another.

The weekly chart shows the middle Keltner at 6450, the big GEX cluster at 6500, and large GEX at 6000 that has been at that strike for awhile. 6000 only comes into play if we decisively lose 6500, in my opinion.

The loss of the weekly 9-SMA is concerning in that we haven’t seen price below that line on a weekly closing basis for quite awhile.

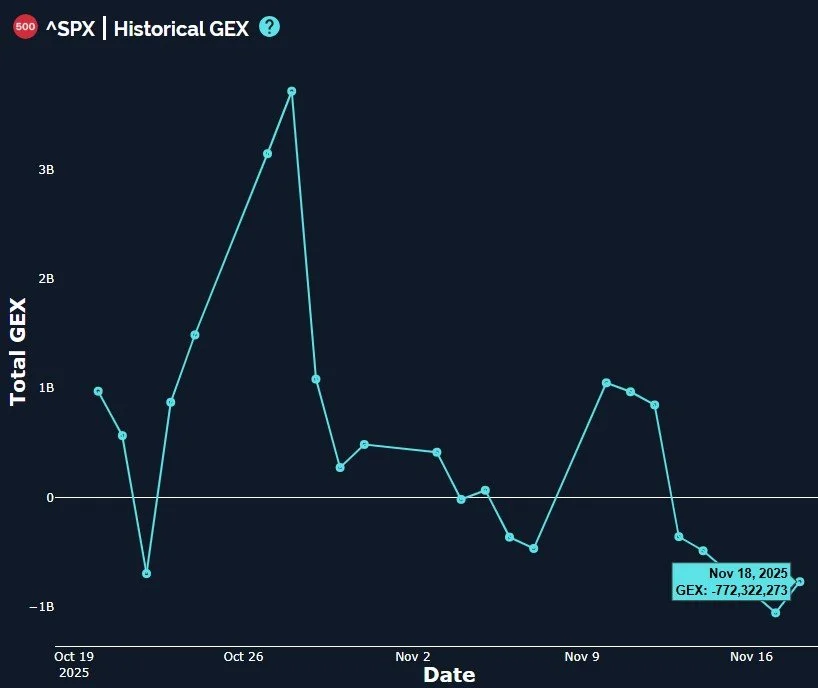

We did see SPX net GEX increase slightly, which is positive.

One speculative possibility is for the market to attempt a rebound for the 2nd half of the week following the VIX expiration in the morning. This would serve to kill put premium after seeing the calls killed for the first half of this OpEx week.

If we do see a nice bounce soon, which seems to be likely based on a number of factors, the larger question mark will be whether or not we continue the decline after a dead cat bounce or if we overtake the 6700 area and resume the climb higher into year end. The time for decision is near and we will do our best to reflect our observations in Discord in coming days, so we hope you’ll join us!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.