In The Danger Zone: November 18 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout! ENDING SOON!

You can view today’s YouTube video here. We take a look at the major indices, the VIX, and NFLX, so give it a quick view if you have a few minutes!

Indices opened the week in a precarious position, initially attempting to push higher after Friday’s recovery, but ultimately failing.

Starting with QQQ, we see the weekly 9-period SMA acting as resistance, with today’s close exactly 3.4 points below at 603.38. We also see the 3rd weekly test of the 600 GEX area, reaching 599.87 intraday before recovering back above the 600 mark by the close.

While the week is still early, we want to at least acknowledge the importance of the 9-SMA looking back this year: The last time we close below the 9-SMA on a weekly basis following a week with a close above the line was in February, marking the beginning of the entire decline into April.

Are bulls due for a proper shellacking and reality check? Probably so, especially given a 45% rally in mere months. Will a drop actually stick this week or any other week in 2025? The burden of proof is on the bears…With FOMC minutes, VIX expiration, NVDA earnings, and OpEx this week (with a sprinkling of consumer sentiment and other data), it’ s too early to say.

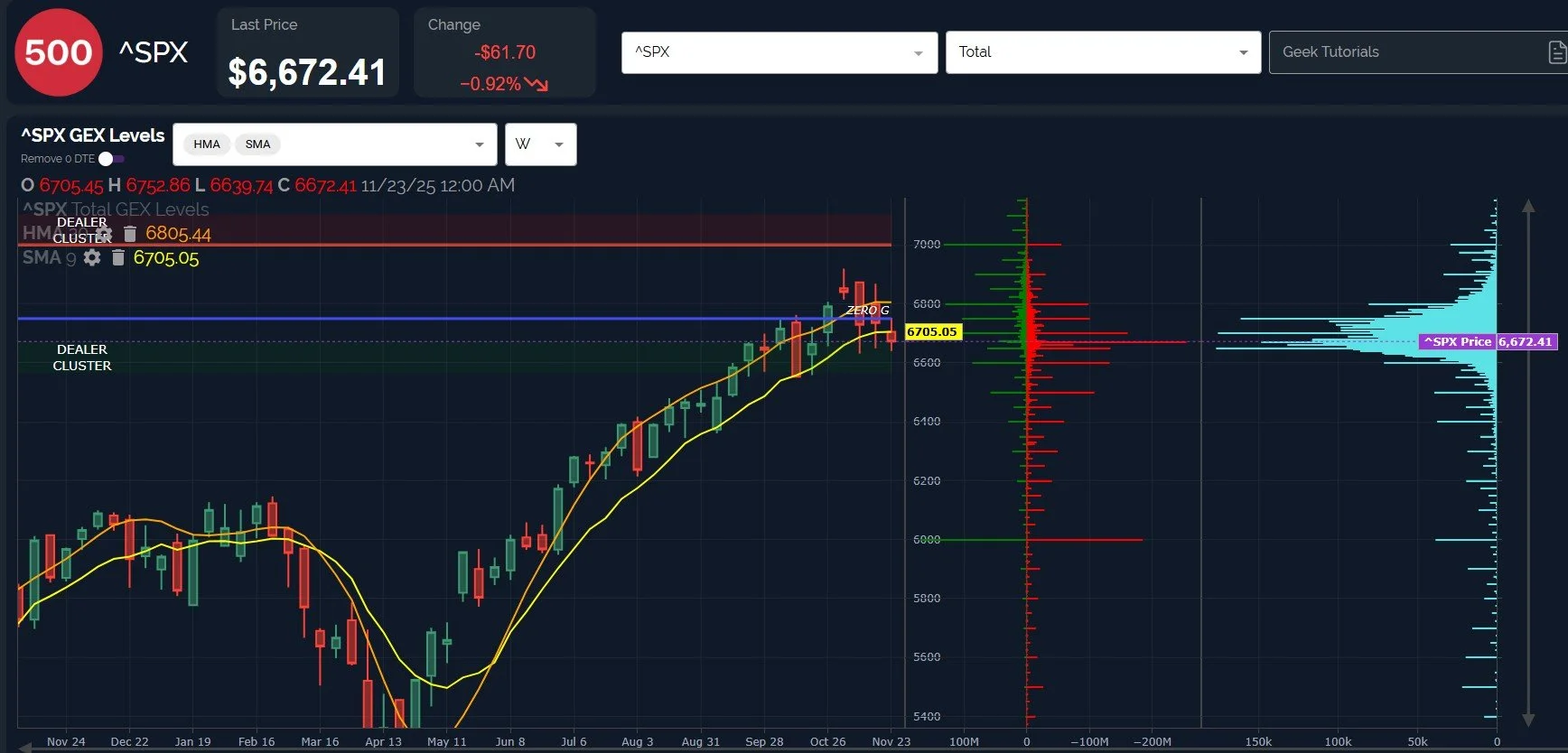

SPX is facing the same hurdle to overcome the weekly 9-SMA and maintain the more bullish slant. 6600 is a huge level that potentially marks a pivot between bullish and bearish biases, with 7000 still prominent above, and 6000 as the obvious eye sore below.

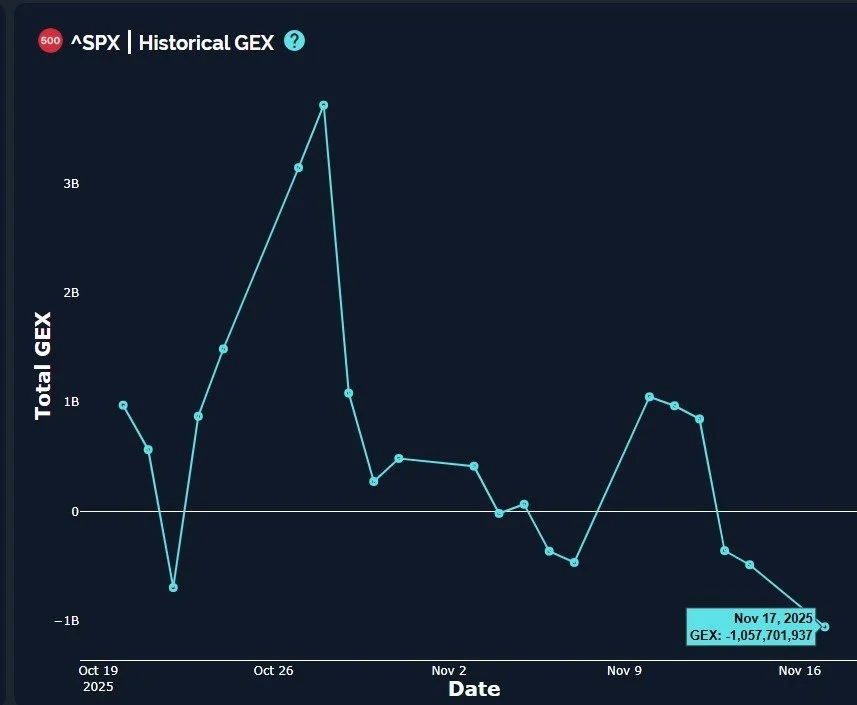

It’s not encouraging that SPX saw its largest GEX decline in 3 trading sessions, heading deeper into negative territory. This point by itself doesn’t guarantee more downside, in fact, there’s an argument to be made that deeply negative SPX readings are buying opportunities, especially when one considers the general bias over time toward the upside for markets. But we can try to get a more solid vision of the highest odds moves by considering a variety of factors.

The VIX made a higher high and a higher low yet again today, maintaining the short-term trend higher.

VIX GEX is positive overall, which is not “the norm,” and we see the positive GEX at 25 as a huge potential magnet as we approach Wednesday’s premarket VIX expiration, when monthly VIX options expire.

Market bulls want to see the VIX lose the 20 strike on a daily closing basis, and ideally, a big drop in VVIX, signaling potentially lower VIX volatility ahead. We haven’t yet seen VVIX deflate, by the way.

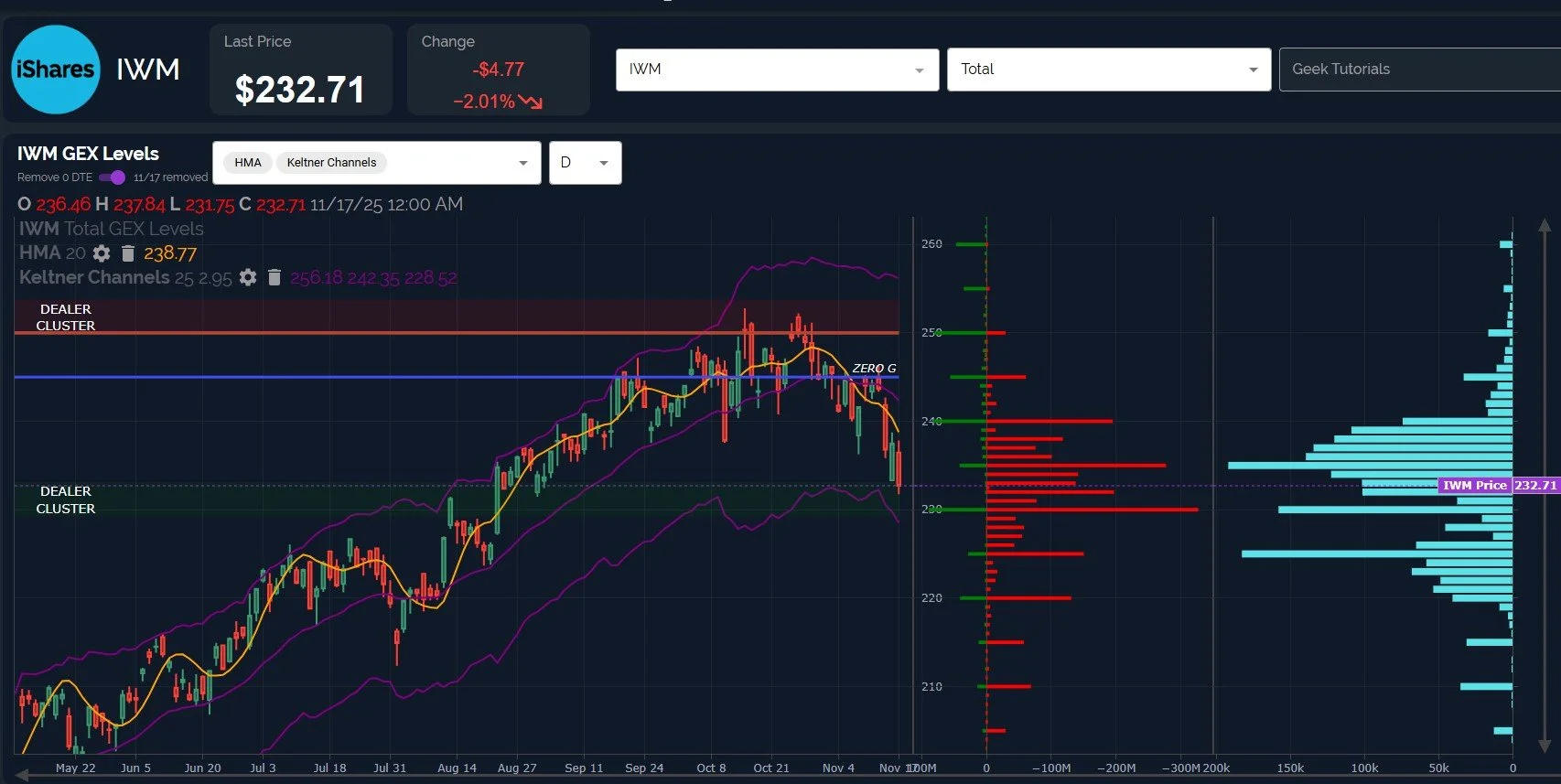

IWM is inching ever closer to 230, a huge GEX area that is very close to the 228.52 lower daily Keltner channel. Volume continues to be elevated at lower strikes from 225-227, so we are open to the possibility of an overshoot of 230 toward those lower strikes.

IWM is stretched below the declining Hull, so a rebound (even if it’s only temporary) appears to be more likely in the event of a further push lower.

Encouragingly from a contrarian standpoint, we finally see IWM’s GEX Intensity Gauge reflecting a negative extreme, a condition often associated with reversal zones. This doesn’t mean we can’t see the gauge move toward an even deeper extreme, but it does increase the odds (in our opinion) of a rebound from these general prices on a swing basis.

We’ll be active in Discord tomorrow as we see the first early readings from the market during this OpEx/FOMC minutes/NVDA earnings week, so check it out if you aren’t already with us in Discord!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.