Event-Filled Week Ahead: November 17 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout! ENDING SOON!

You can view today’s YouTube video here. We take a look at SPX, QQQ, the VIX, AAPL, and NVDA, so give it a quick view if you have a few minutes!

The VIX made a higher high relative to the last spike 5 trading sessions ago, reaching exactly 23 before getting crushed to below 20.

The rebound in indices from Friday’s gap down was not unexpected, particularly given the big news events this coming week: NVDA earnings, monthly VIX options expiring Wednesday, FOMC minutes, and OpEx Friday.

Specifically in terms of the VIX at this moment, the move back down may continue until we see a test of the rising Hull Moving Average, currently at 19.01. This coincides with the large negative GEX we see at the 19 strike, potentially marking a defining area where the VIX will either resume its trend higher or get crushed lower toward an overshoot area near 18.

While we see daily volume elevated as low as the 16 strike, GEX dramatically drops off after the 18 strike, so the current GEX picture warrants caution in expecting any sort of sharp move lower in the VIX below 18.

Taking a brief look at BTC, price is approaching a previous consolidation zone from which a breakout occurred, so BTC may find support near the big GEX cluster at 90k, if the decline continues.

Bulls can take some solace in that this move lower appears due for a bounce according to a number of metrics, and we don’t see meaningful GEX below the 85k-90k area at this time. The odds appear good for a possible reversal or consolidation around 90k despite the net negative GEX on an overall basis. 100k becomes key resistance now.

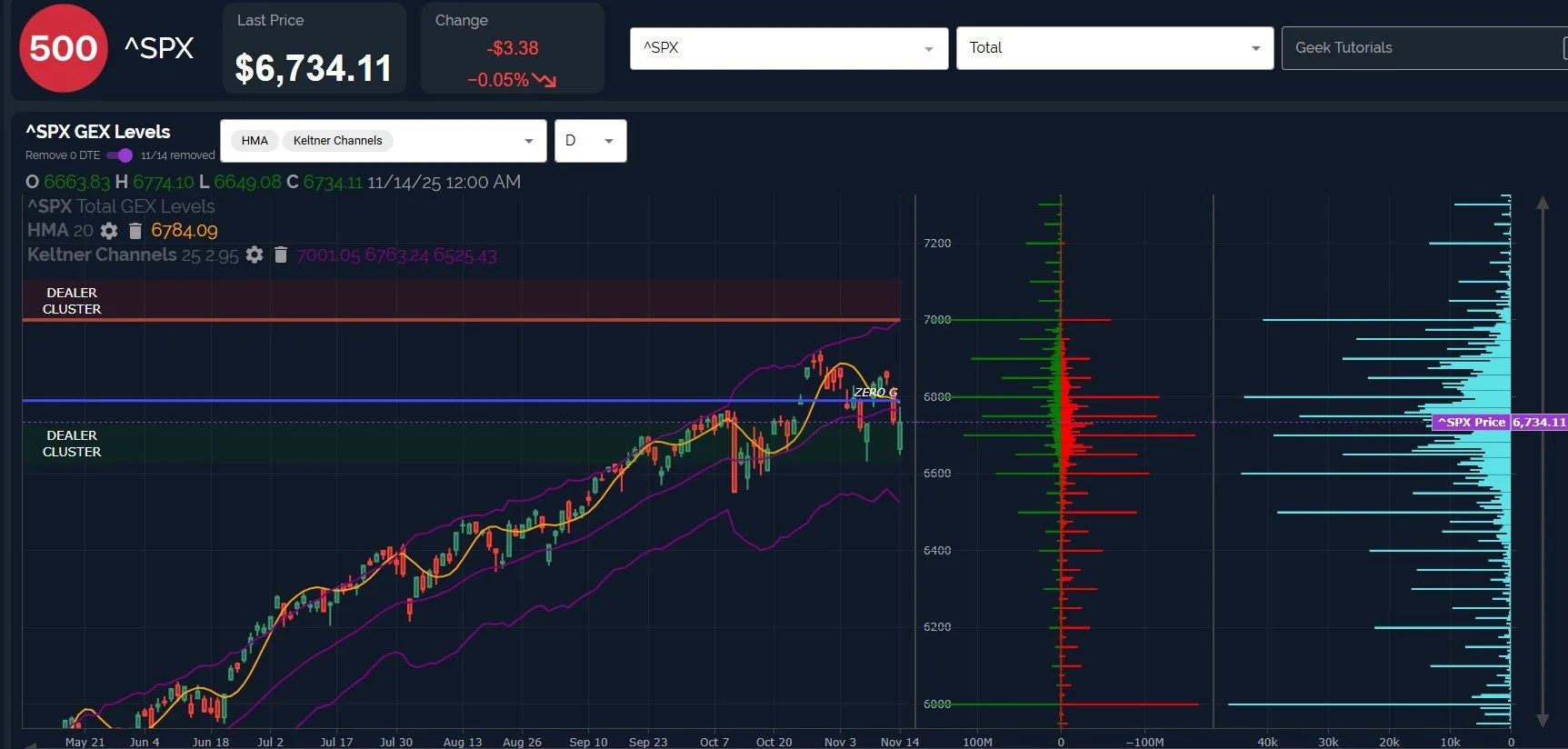

SPX made a higher low compared to the previous low, though recall the VIX made a higher high, so we have some divergence between the two.

SPX came very close to retesting the declining Hull at 6784, reaching to within 10 points of the indicator before failing and closing just below Thursday’s close.

6800 is now an important GEX area, with a close above 6800 increasing the odds of a 6900-7000 tag.

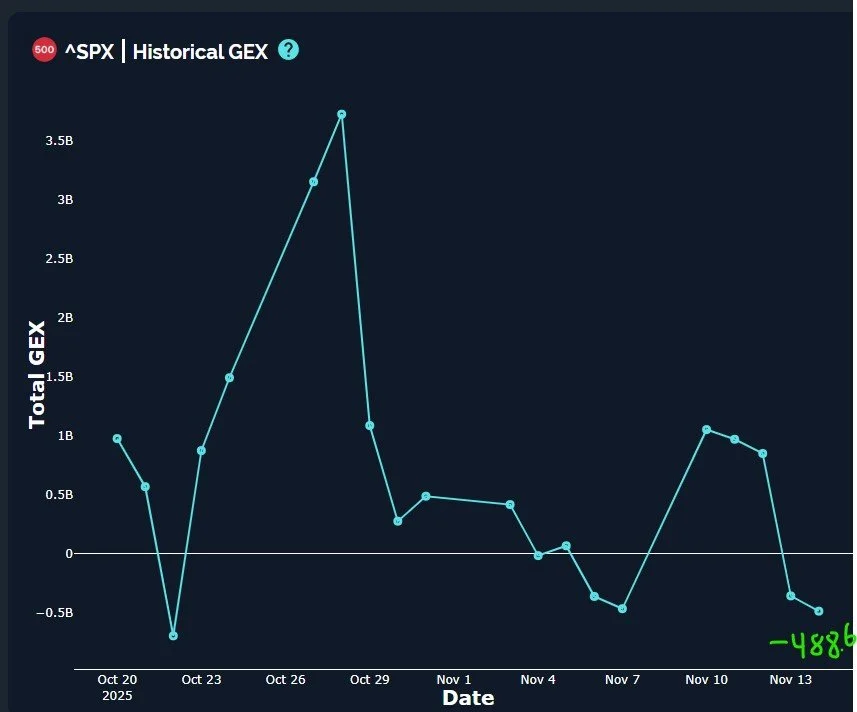

Disappointingly, SPX saw net GEX dip slightly deeper into negative territory.

Ideally, we would have seen positive GEX increase along with the increase in price, but that didn’t happen. In fairness as far as how things might play out, last Friday saw GEX move lower while price increased, but GEX sort of played catch-up Monday instead. So we’re open-minded as we simply point out that the decline in GEX doesn’t help in terms of clarity as we see prices rising.

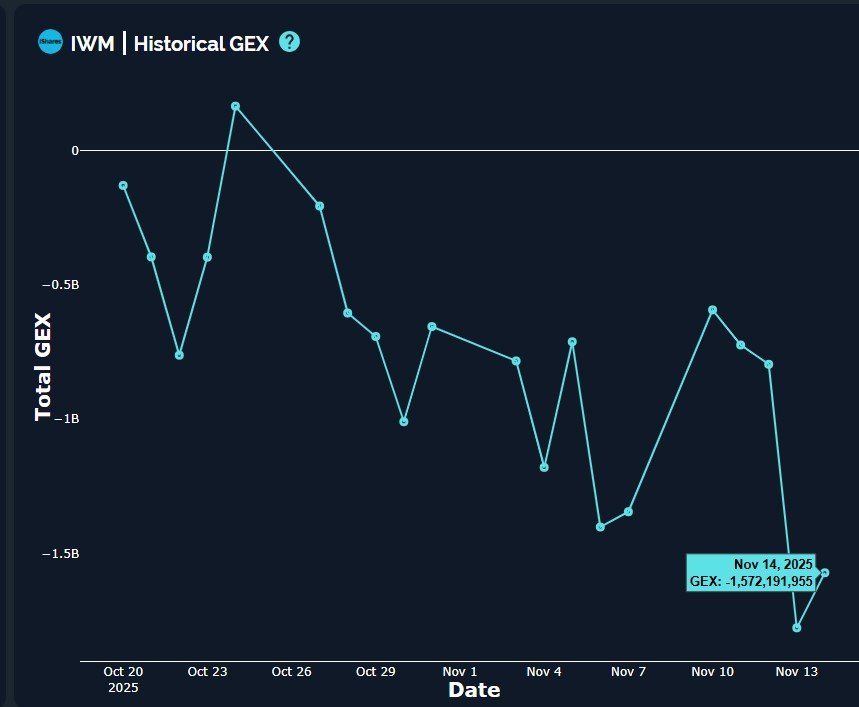

IWM came very close to the 230 target we’ve mentioned previously, touching 233 before rebounding.

Volume is still heavy at lower strikes, though a test of 240 may be in the cards before another decision is made in terms of what comes next.

We had early indications of small cap strength Friday, so we’ll continue watching IWM and its components for possible early clues that might tell us what to expect directionally from other indices.

IWM did see net GEX increase slightly, but not in a major way, even though GEX is on the floor in terms of a deeply negative GEX reading currently.

Lastly, IWM’s almost extreme reading on the GEX Intensity Gauge shows that the current negative GEX is noteworthy compared to previous readings from the prior 12 months.

Reaching the negative extreme can be an actionable contrarian signal, so we can combine this potential with the GEX picture showing 23o as an important GEX area to narrow down how we might want to act when that price is hit.

We’ll be active in Discord tomorrow as we see the first early readings from the market during this OpEx/FOMC minutes/NVDA earnings week, so check it out if you aren’t already with us in Discord!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.