2nd Leg Down: 2nd Chances For FOMO Buyers? November 14 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout! ENDING SOON!

You can view today’s YouTube video here. We take a postmortem look at the indices as well as a closer look at GS, so give it a quick view if you have a few minutes!

We’ve acknowledged a range of possibilities in our newsletters and videos this week, with one overarching theme being the concern regarding the big gap from Friday’s close to Monday’s open, and another being the VIX seemingly running out of room to the downside. Let me spoil what happened today, for those awakening from comas or simply those on a vampire sleep schedule: The gap got filled, the VIX spiked.

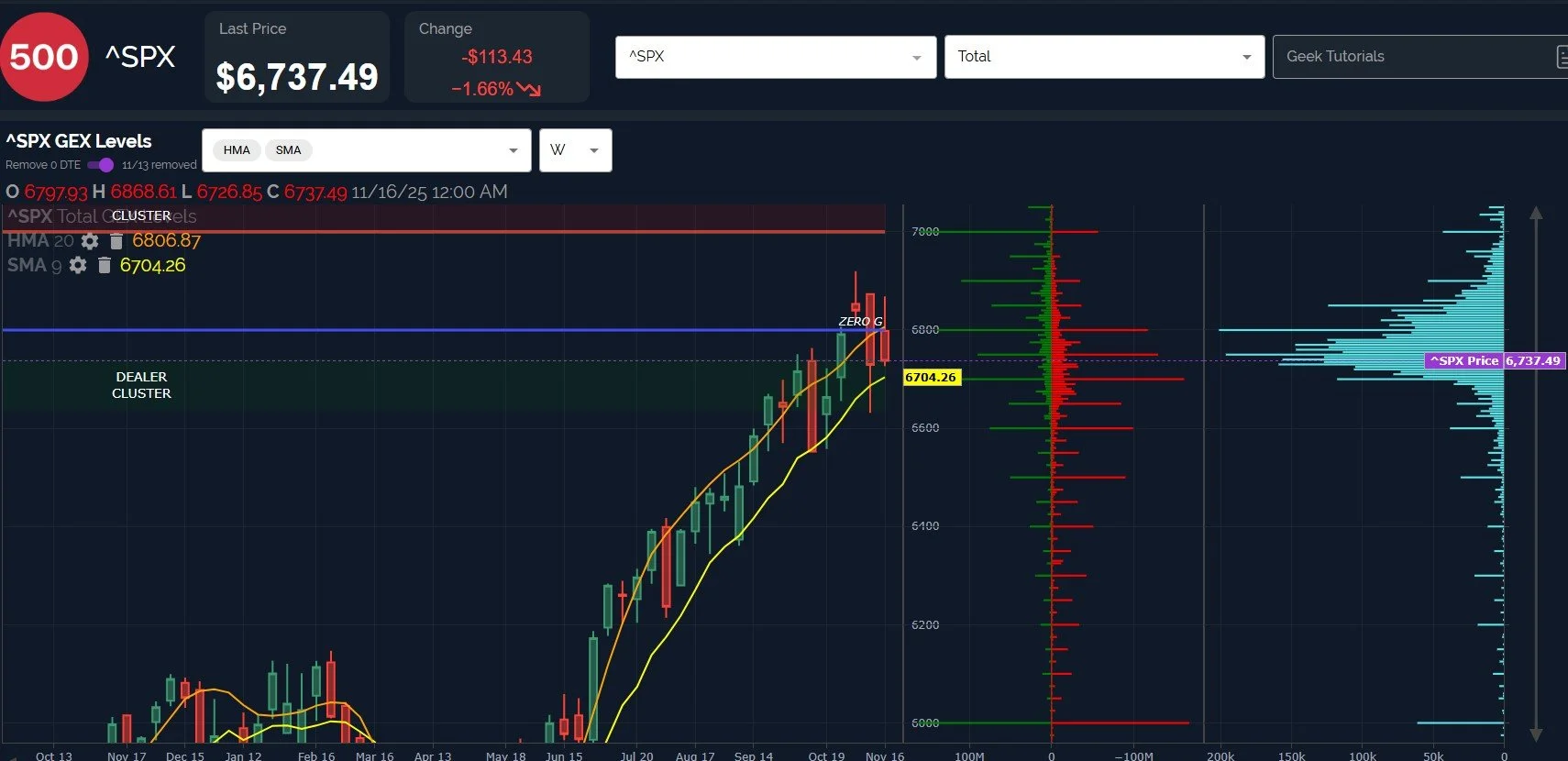

Where do we go from here? With Friday’s gap filled, we technically have a more solid foundation for a rebound, but we need to factor in other data points as well. As far as gamma exposure (GEX), we have a huge area of positive and negative GEX at 6700 that hasn’t been tested again this week. The weekly 9-SMA at 6704 is awfully close to 6700, so if the move lower continues, bulls will want to see 6700 hold on the daily close, otherwise the loss of the 9-SMA may signal further weakness ahead, if the breach holds into the weekly close.

Looking to next week, I think bears need to be cautious expecting a major crash given the FOMC and NVDA earnings. Ultimately, the biggest crash may be in put option premiums looking to next Wednesday/Thursday. Caution is warranted.

SPX net GEX dropped into negative territory, slightly higher than Friday’s GEX low.

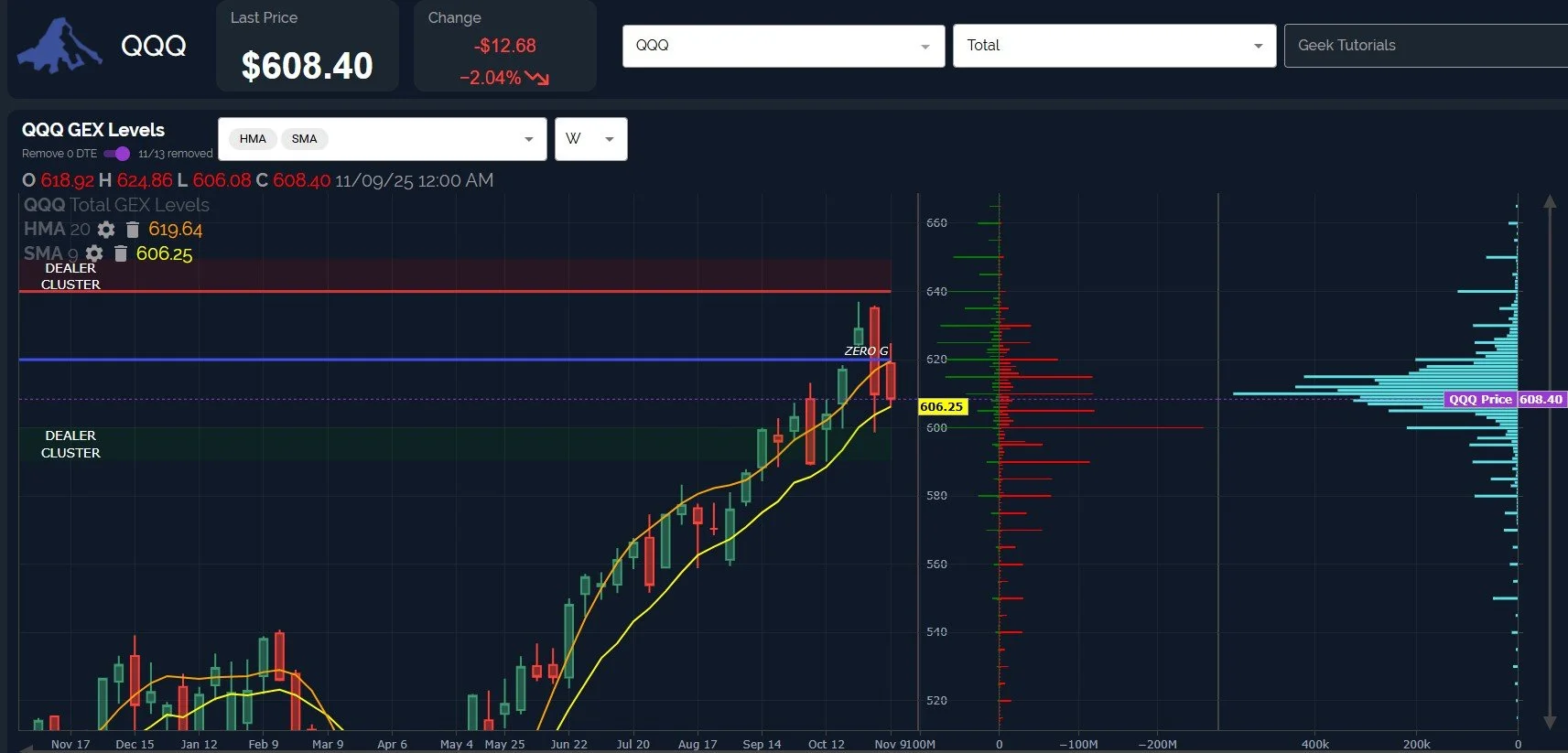

QQQ actually reached the 9-SMA, bouncing slightly and closing just above it. 600 continues to be an important GEX area that may be a retest target as well as the last spot bulls can make a stand in order to lower the odds of further downside.

The rejection of the weekly Hull at roughly 620 is certainly a concern, so we want to see what happens especially next week as we approach two potential events mentioned earlier that could result in big trend changes or confirmation- FOMC and NVDA earnings.

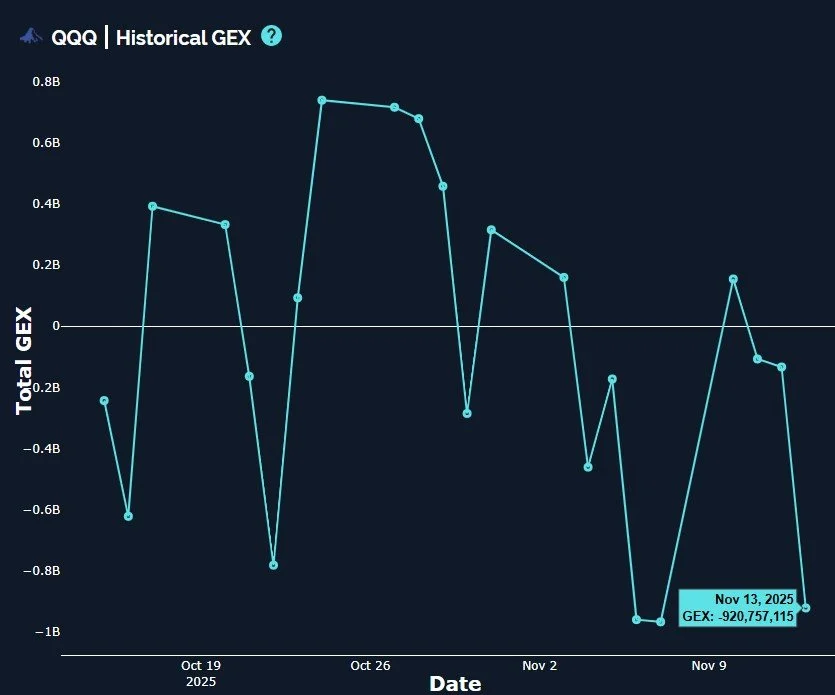

QQQ saw a sharp drop into negative GEX territory, with GEX closing slightly higher than Friday’s close. Given the contrarian recent history of deeply negative QQQ GEX, we need to be on the lookout for a rebound beginning here or down to 600.

Yesterday we said “a move to [VIX] 18-20 wouldn’t be shocking, but the risk exists of a push beyond 20 as well, so we need to monitor any attempts to surpass the Hull Moving Average at VIX 18.42 for clues as to what comes next.”

The VIX gave us a cute little close right at 20. Technically, we’ve overtaken the weekly Hull and 9-SMA, so this move may continue toward 25 (again), so we are right on the line of an important decision being made by participants.

IWM extended quite far below the declining Hull Moving Average today, coinciding fairly closely to the 240 GEX area we’ve mentioned as the gateway to lower prices. Once we lost 240, it was all downhill for IWM.

Note our previous week or two of noticing the very high volume at the 230-235 strikes. Also we have big GEX at 230, which coincides with the lower daily Keltner channel, providing good confluence for a possible support area if IWM continues declining.

Given today’s lower low and lower close relative to Friday, IWM seems to signal risk of further downside more clearly than QQQ or SPX, and maybe that’s by design.

IWM’s weekly chart brings further attention to the 230 GEX strike- the weekly middle Keltner channel also rests near 230, in the lower Dealer Cluster zone.

Contrarian buyers may want to wait for confirmation signals in terms of price action, but 230 appears to be a solid area to consider going long, given the current picture.

IWM’s GEX Intensity Gauge (an indicator comparing GEX now to GEX over the last 52 weeks) is very close to an extreme, adding credibility to the idea that we might be close to a reversal, even if temporary.

We don’t see a lot of meaningful negative GEX below 230, hence the focus on 230 and the importance in seeing what happens if we can test 230.

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.