Diamonds Are Forever? November 13 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout! ENDING SOON!

You can view today’s YouTube video here. We cover SPX, QQQ, the VIX, AAPL, and META, so give it a quick look if you have a few minutes!

Indices had a relatively tame day today, with QQQ perhaps showing the most volatility early on and the VIX staying positive most of the day.

DIA was the big standout- building off of yesterday’s monster upside move with another push higher, bringing DIA to a new high compared to the end of October while other indices have only made lower highs so far.

Given the larger presence of defensive stocks in DIA, the negative divergence of SPX and QQQ relative to DIA may be more of a warning sign than a positive, though time will tell.

DIA closed in the middle of a thick cluster of positive GEX between 480-484, but we see meaningful GEX at 490 that was also accompanied by elevated volume today.

We also see the upper Keltner channel matching closely with the 490 GEX. My conclusion is that we technically might have completed the upside move for DIA for the time being, but there’s a good likelihood we might push toward 490 first.

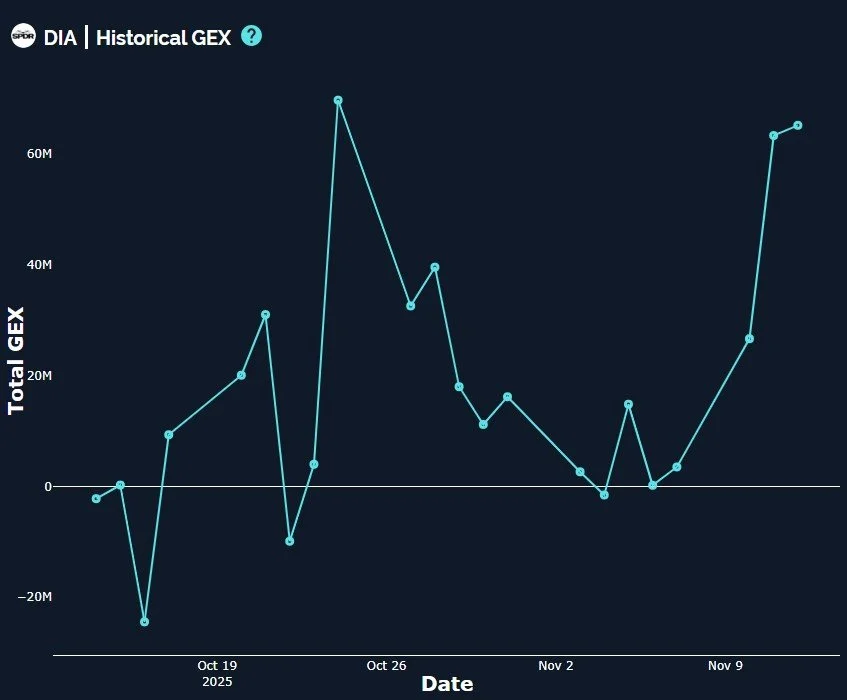

Taking a look at DIA’s net GEX as of today’s close, we have a huge spike this week that arrived close to the October 24 GEX top. Note that the October 24 GEX high was 4 trading days prior to the price top, so we can only generally say that we might want to watch for a top in the next few days.

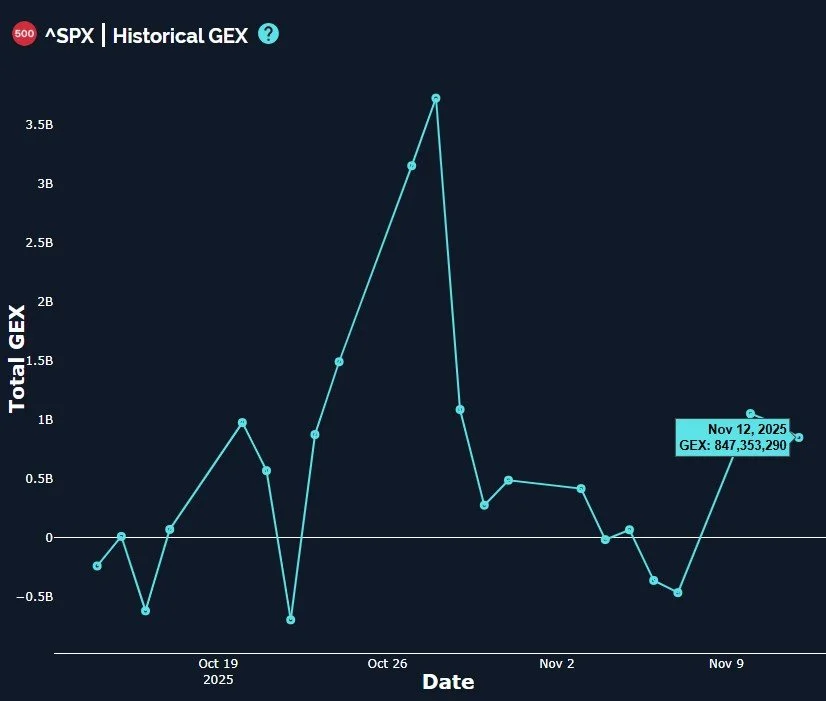

You can see how contrasting this is with SPX’s lower high and more constrained movement overall, with SPX printing relatively normal to narrow candles below the big GEX cluster at 6900.

If DIA pushes toward 490, we very well might also see SPX reach 6900-6950, or QQQ reaching 630, so we are open to the targets presented as we start each day and review the 0 DTE GEX picture, which we share in Discord.

Another divergence is the negative push in SPX net GEX the last two days, which has been modest, but enough to push SPX below the 1B mark, a line in the sand between bullish and neutral environments, in our view.

This same negative move in net GEX was present in IWM and QQQ today. The GEX shift isn’t strong enough to draw any conclusions of an immediate drop, but it’s not bullish, either.

We saw the VIX and VVIX positive today, and both have room to move higher from this point. For the VIX, a move to 18-20 wouldn’t be shocking, but the risk exists of a push beyond 20 as well, so we need to monitor any attempts to surpass the Hull Moving Average at VIX 18.42 for clues as to what comes next.

A downside move accelerating for the VIX appears to still have a relatively shallow stopping point at 16 or higher, at least according to GEX at the moment.

The 2-hour chart shows the Hull turning, with a 19-19.5 target to the upside. Losing 17.31 may open the door to the lower Keltner at 16.49 or the big GEX at 16, so we are at an important inflection at this very moment with the VIX. We hope you’ll join us tomorrow and we’ll discuss more in Discord!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.