More VIX Crushing Ahead? November 12 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout! ENDING SOON!

You can view today’s YouTube video here. We cover the major indices as well as PLTR, so check it out!

SPX is holding above the declining Hull Moving Average for now, which I view as a positive development, though bulls will want to see the Hull flatten and then start curling upward again to indicate a continued uptrend.

One challenge may be that we’re already in the upper Dealer Cluster zone, where we expect dealers to potentially become sellers based on current positioning between 6850-6950.

Monday, we noted the large GEX cluster at 6900 as the last really important stop before 7000 based on the large GEX concentration at that strike, and the potential for reversal at 6900 still looms as GEX remains elevated at that strike.

Bulls also want to see 6800 hold on any further downside attempt, this would represent holding a test of the Hull as well as a huge GEX area.

The gap below down to roughly 6740 would also potentially be constructive if filled, as long as we holding above Friday’s low.

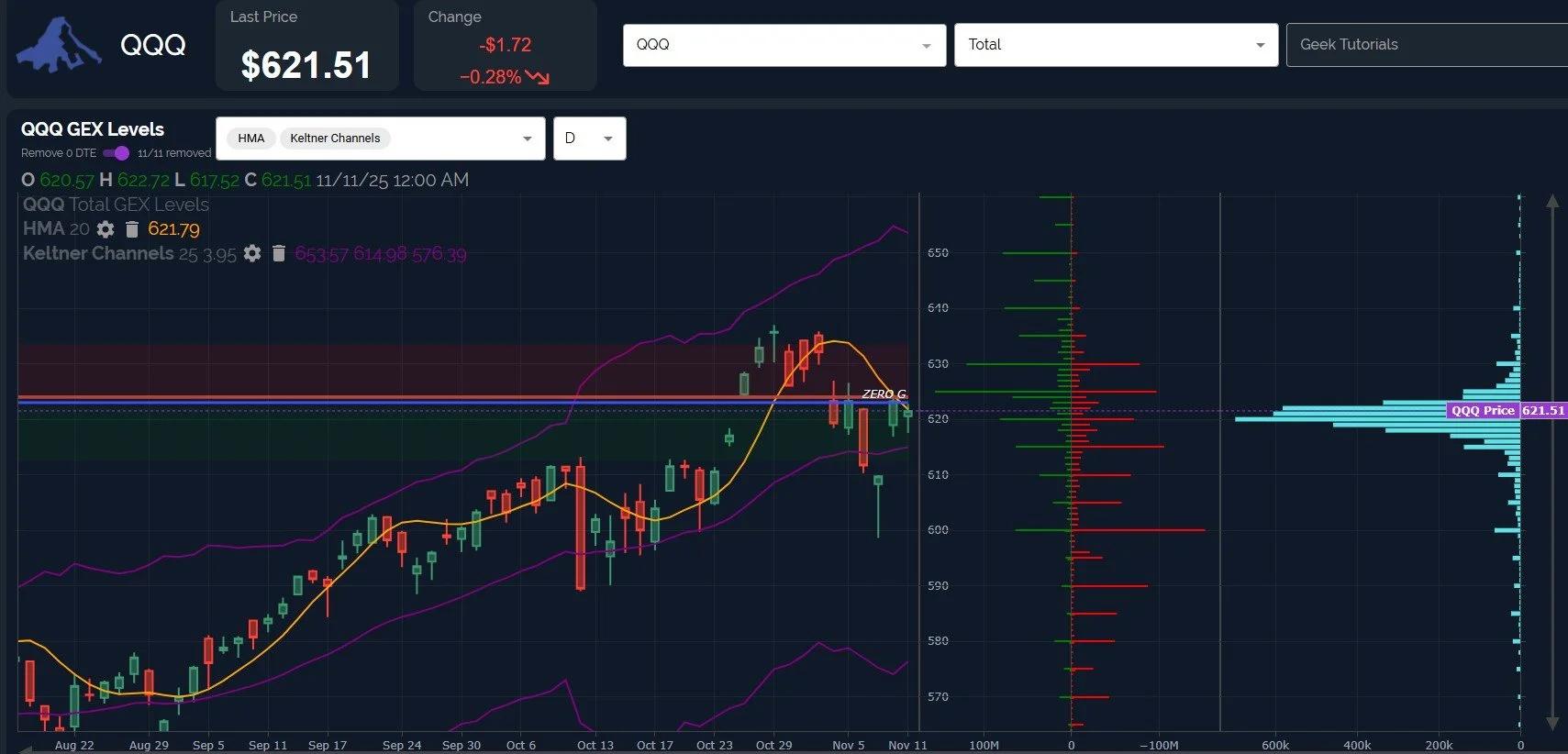

QQQ is looking less bullish, failing to close above the Hull for 9 trading sessions now, and net GEX flipping negative again (though modestly so).

With NVDA earnings a week from tomorrow, we may see either a sideways consolidation or at least an important high/low leading up to their report, given the importance of NVDA to both the semi sector as well as the broader market.

IWM is holding above the Hull and almost tested the 245 GEX area today, and as long as 240 holds, we may see a push toward 250 sooner than later.

The VIX presents the most worrying case for bulls, in my view, mostly due to the VIX already being near 17, with 15 as a likely maximum downside scenario, as long as the support holds as we’ve seen all year.

Current GEX positioning suggests the VIX will hold above 16, and we still have a rising Hull and 9 SMA that the VIX is tracking relatively closely.

Unusual volume of almost 385,000 contracts traded at the 35 strike today as well.

Zooming in to the 2-hour chart, the VIX appears to have potential to drop down toward the 16.75 area, though the VIX may reverse at the lower Keltner channel to head higher. A retest of 19-20 would match the upper Keltner channel.

We will take it one day at a time, sharing what we see on the 0 DTE picture both in our live stream in the morning and in Discord, so we hope you’ll join us!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.