Beginning Of The Final Push? November 11 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout! ENDING SOON!

You can view today’s YouTube video here. We cover a number of major indices as well as individual tickers, so check it out!

Indices bounced nicely today, turning an attempted pullback after the open into a trend up day.

QQQ left a huge gap behind, and closed right below the declining Hull Moving Average.

The strong bounce off of 600 Friday and continuation higher today led to initial resistance just over the 620 area, eventually recouping early losses from the gap up and closing over 623.

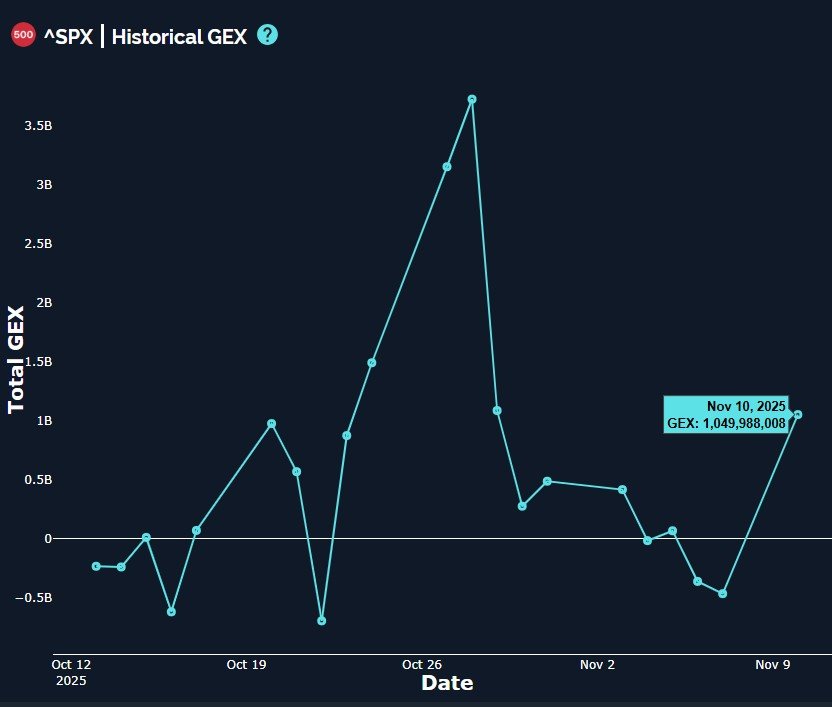

Importantly, one factor we noted as missing Friday (and possibly giving more hope to bears in the short term) appears to have joined the party today- an increase in net positive GEX, and a big one, at that.

Bulls will want to see any retest attempts this week stop at the 610-615 area and either consolidate or continue bouncing from there to keep the door open into a year-end move potentially to 650 for QQQ.

Continuation higher now (entirely possible) likely means we reach that target even sooner, potentially fading into year end from that point.

We’ll want to watch how GEX changes as each higher or lower target is hit for additional clues.

We noted the importance of the SPX 6800 level, and we certainly did see the attempt to drop from just above 6800, dropping nearly 30 points before rebounding and closing near highs.

While QQQ closed at Hull resistance, and below the 625 GEX cluster, SPX closed ever so slightly above the Hull and above the 6800 GEX area (mostly positive GEX).

The declining Hull will eventually start turning back up in coming days if indices can hold these gains, otherwise, price continuing to rise will form a large gap between the Hull and price that is likely to be narrowed by either price dropping or perhaps the two meeting in the middle. Overlaying 6800 with the Hull at 6809 (soon 6800 as the line is declining) continues to show the importance of the level.

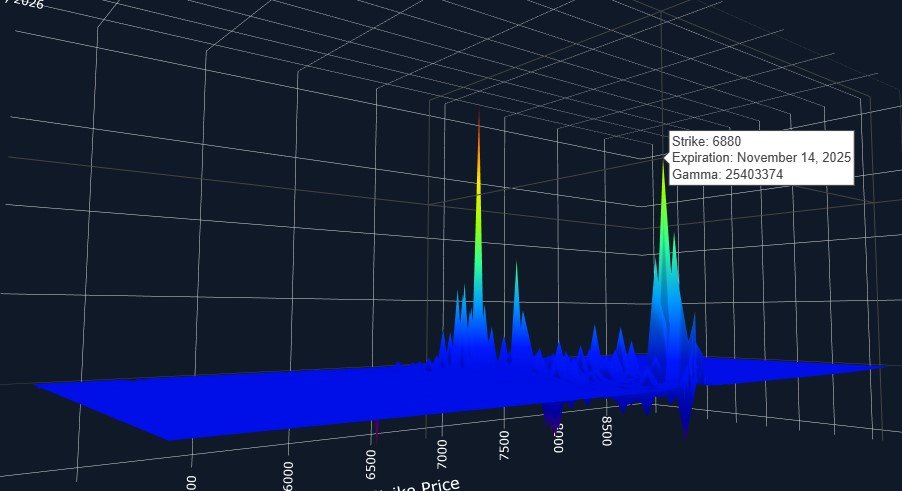

SPX net GEX saw the big increase bulls wanted to see Friday, and going along with that is a strengthening of the GEX at 7000 and even growth up to 7200 that is noticeable on our 3D graph.

Ideally, any attempt to fill the gap from Friday will see GEX remain positive or neutral, reinforcing the buy-the-dip nature of the downtrend that started a week and a half ago.

Looking at SPX’s 3D graph for this week, we have 6880 as the largest GEX cluster expiring Friday, with a close 2nd represented by 6950, if you can believe that. The whipsaw appears to be in play.

IWM also overtook the Hull, and we see large negative GEX at 240, so any drop toward 240 may be telling in terms of the next intentions.

This morning, we saw IWM indicating early weakness, so we continue to watch IWM for clues that may tell us where SPX and QQQ could eventually go as well.

IWM closed just below the positive net GEX at 245, and 250 looks like a solid upside target. This will be multiple attempts to hold above 250, if attempted further, and some theories hold that multiple attempts that reach the same ceiling eventually break through the ceiling.

Similar to SPX, the declining Hull still defines a downtrend, which is a bit of a problem, so IWM may need to chop a bit sideways to drag that Hull at least to a flat position as it starts to curl upward.

IWM net GEX is still quite negative, but it was very negative, so the increase toward the positive side was substantial. In fact, today’s GEX reading is basically back to where it was shortly after the decline began.

Let’s wrap up with the index bulls love to hate, the VIX. Today’s close brought the VIX to just under the confluence of the 9-SMA and the Hull, but GEX isn’t looking like the VIX has a lot of room to drop, or at least room to new lows for the year.

We still see the general trend of higher lows and highs intact since the last week of October, and actually a more subtle observation involves the trend shift that goes back to August.

GEX doesn’t indicate a current high likelihood of breaking 15 to the downside, let alone the 16-17 area.

The rapid deflation (overexcitement by vol shorts?) of the VIX may lead to another quick rebound, similar to the last spike to 25 that led to Friday’s spike to almost 23 in a short timeframe.

Ideally for bulls, a seemingly inevitable VIX rebound will stop after a gap fill near 19.5-20, possibly corresponding with indices filling Friday’s gap, then a final push higher. That is only one of several scenarios, so stay with us as we take in fresh information in coming days!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.