Bottom Is In? Not So Fast… November 10 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout! ENDING SOON!

You can view today’s YouTube video here. There will be no live stream tomorrow morning, but we’ll continue with our normal daily routine beginning Tuesday.

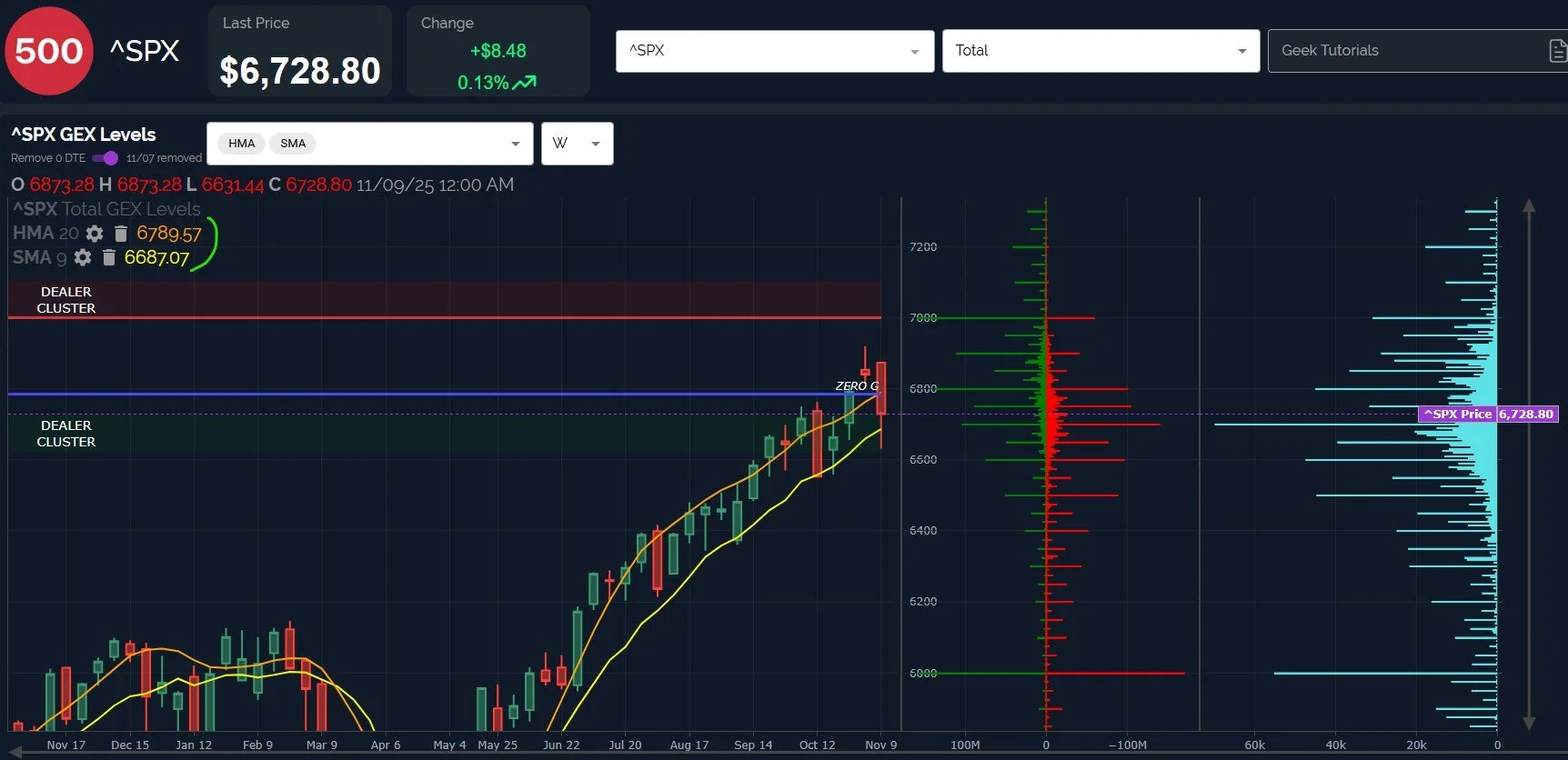

As recently as Thursday, we noted a likely tag of 6686 on SPX, with GEX suggesting 6600 or 6650 being possible as well. Bears didn’t wait long, pushing SPX down to 6631 before a nice bounce into the end of the day, closing above the key 6700 level.

The bounce appears likely to continue in the very short run, with noteworthy GEX at 6750 and 6800 just above, and potentially additional granularity provided by the weekly Hull Moving Average at 6790.

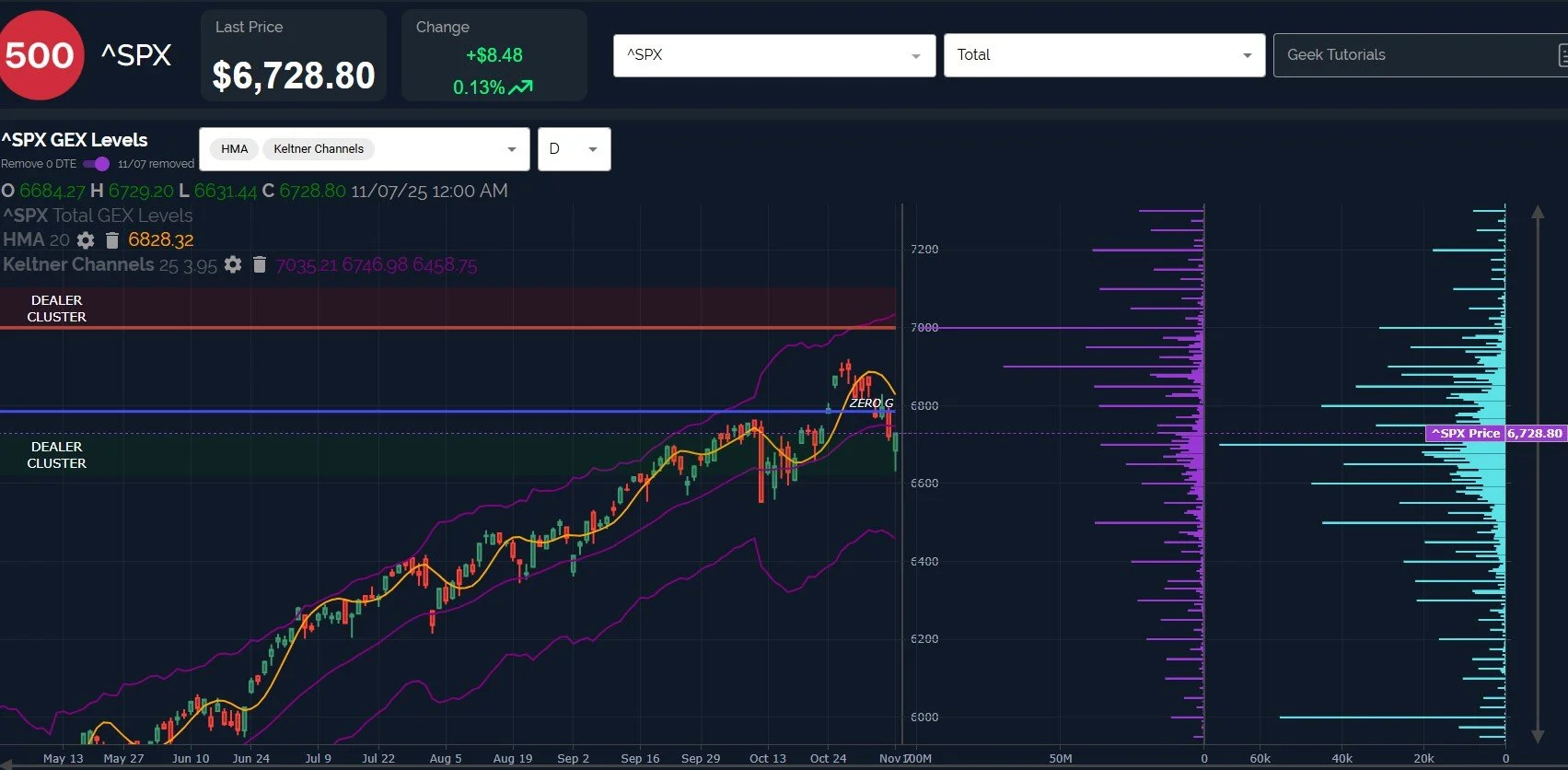

Let’s flip our GEX toggle to net GEX on the daily chart (the above chart reflects gross GEX), showing 7000 is still a potentially important upside target.

As of Friday, I notice the 7000 GEX appearing as meaningful clusters for November 21, December 19, and December 31, similar to what we saw before the pullback. The November 7000 clusters have been flaky and shifty, so we’ll want to keep an eye on that as we approach the 21st.

6900 is large enough to recognize its importance in opening the door to 7000, given how close they are in size and the proximity of their prices as well. With the daily Hull in a downtrend and potential resistance at 6900 first, the burden is currently on bulls to overcome support-turned-resistance and to resume the steep uptrend since April.

Note the elevated total daily volume at 6000, 6500, and 6600, all lower than Friday’s low.

SPX net GEX as of Friday’s close gives reason for pause, actually closing more negative than on Thursday. And SPX isn’t alone- we see the same phenomenon across other major indices, except what I’ll dub as “retail heavy” SPY, which did see a notable increase.

I appreciate the idea that maybe participants didn’t anticipate fundamental developments over the weekend- but then why such a significant rebound Friday in terms of price?

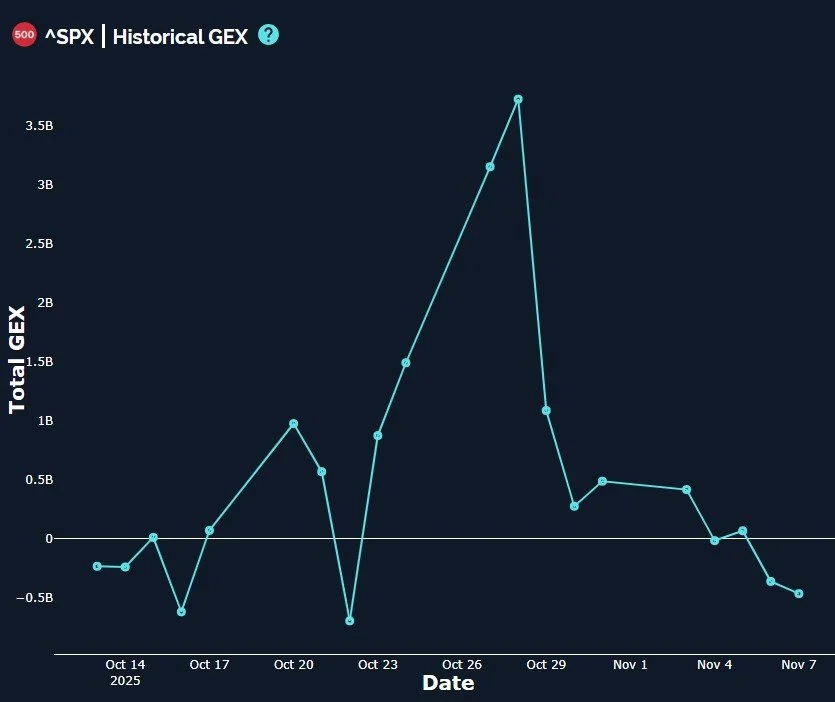

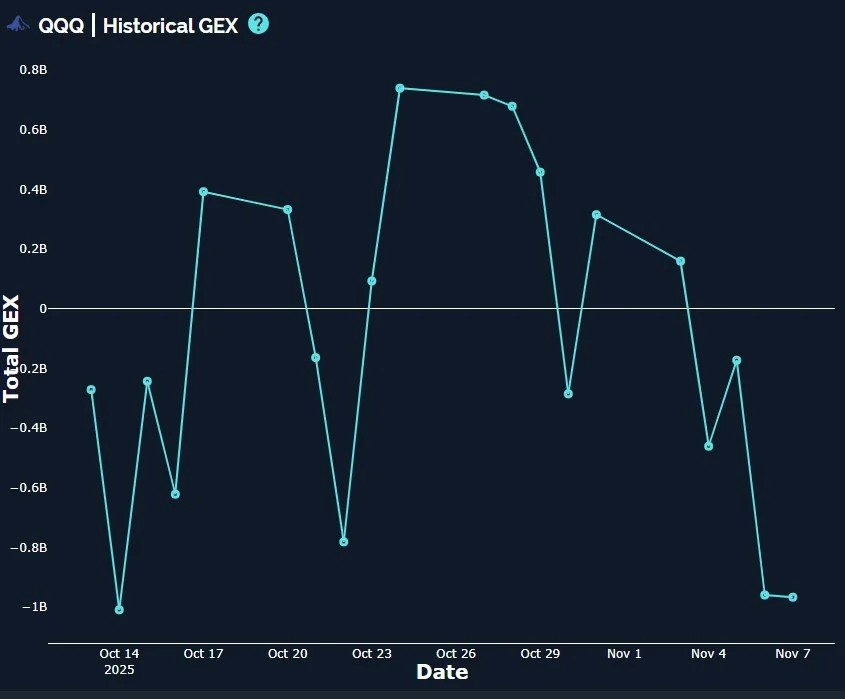

If you look at previous lows, we typically see a fairly sharp rebound in GEX at least by the time we see price rebounding. The October 22nd GEX low was following by a move from negative GEX to positive GEX, just as price saw a bounce.

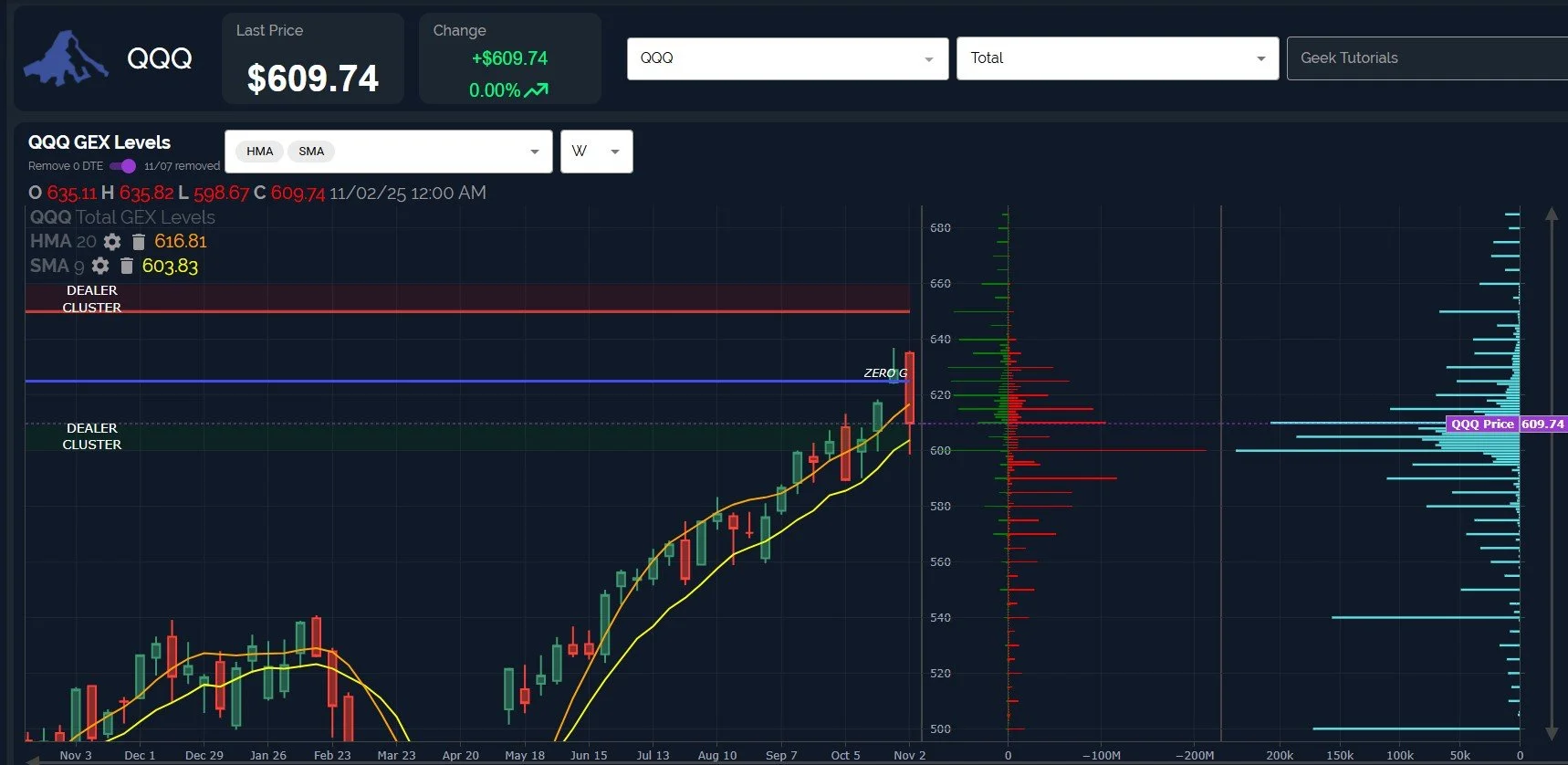

QQQ also bounced where we wanted to see it bounce, briefly dipping below the big 600 GEX area before mounting a strong rebound almost back to 610.

The next area of interest overhead is 615, then 620.

QQQ has the same negative GEX divergence noted with SPX, which actually surprised me. Before I looked at QQQ’s net GEX as of Friday’s close, I expected to see a positive change, similar to SPY. Not this time.

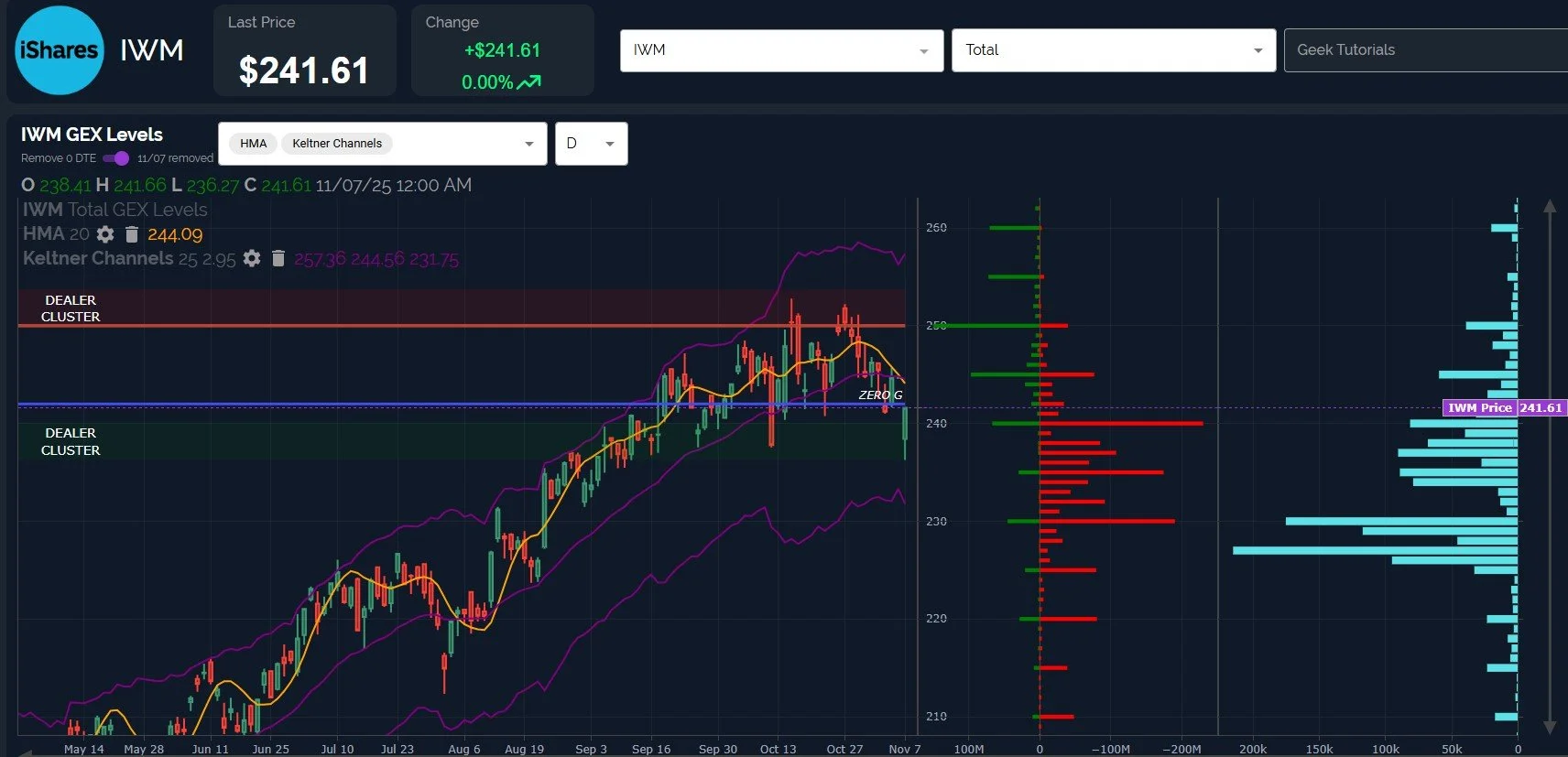

IWM reached 236.27 Friday, getting quite close to the 230-235 area we’ve noted for days, and we still see elevated volume at 230, as well as 227.

IWM recapturing 240 may be significant, given the amount of total GEX at that level, but we need to see follow through to the upside. The declining Hull at 244 and the next large GEX area at 245 will be key, and I anticipate we will see some sort of 0 DTE GEX picture that may add further clues tomorrow.

IWM did show a very minor increase in net GEX Friday, I’d call the move toward the positive side more of a technicality than a noteworthy shift in net GEX.

I highlighted the 10/22 GEX low because it occurred the same day as IWM’s price low, and note the sizable bounce the following day as price began rebounding.

Another point that I have noticed on many prior occasions, though not pertinent to this exact moment: Notice the GEX high that occurred on October 24, which was actually a trading day before IWM made a price high on the 27th? we often see GEX signal shifts in advance (“often” doesn’t mean “every” time, of course).

Is GEX simply depressed, took Friday off to play golf, or is it telling us something about the pullback not being over? Bulls will want to see GEX play catchup Monday with a big increase to scare bears back into their dank dens.

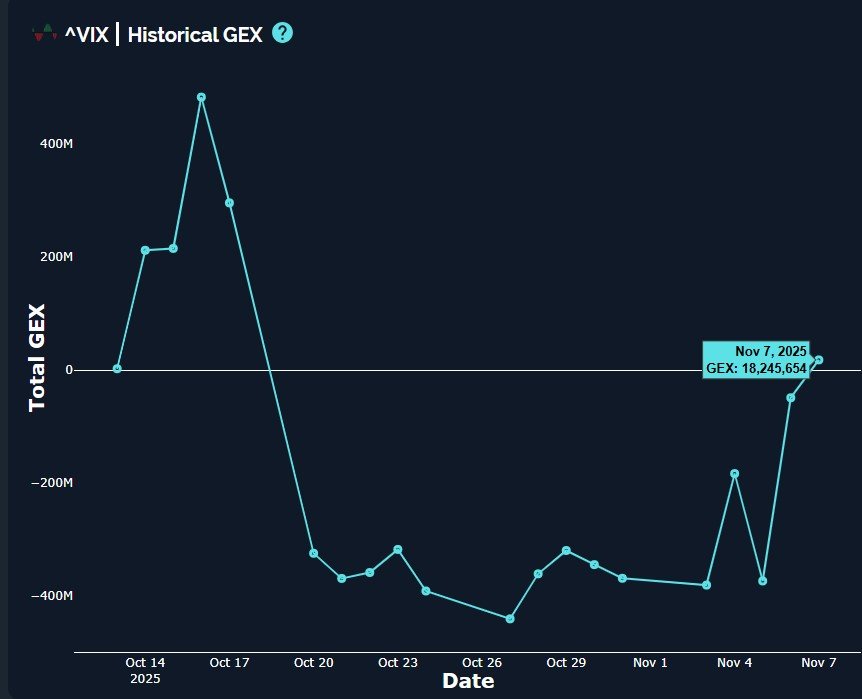

The VIX topped over 22 before getting crushed, closing just above 19. The rising daily Hull at 17.82 is important, and we also see some confluence around the 18 area on the 2-hour and 4-hour charts, as well as the large negative GEX cluster (with corresponding daily volume) at 18.

Volatility bulls will want to see that area hold to continue a spike toward 25, which I’ll note has grown recently in terms of GEX.

I do find it unusual that VIX GEX also increased slightly Friday, actually touching positive territory.

Our educational courses and videos highlight expectation that positive GEX environments mean “buy the dip,” but of course market bulls will hope that the slight touch into positive territory on Friday won’t last for the VIX, and that it will soon be banished back into the dungeon run by volatility shorts, right into cell number 15 (the food is terrible, I hear).

Join us in Discord tomorrow where we’ll share some analysis in our free general-chat channel (in the absence of our live stream, temporarily) and hopefully this will include some fresh insights inspired by the 0 DTE GEX picture visible tomorrow!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.