Correction In Play: November 7 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout! ENDING SOON!

Travel circumstances prevented a YouTube video today, but we will try to post one tomorrow and we will resume regular scheduling next week! We will still conduct our free live stream presentation, so feel free to join us via our homepage link or our posted link in Discord around 10:30 AM ET.

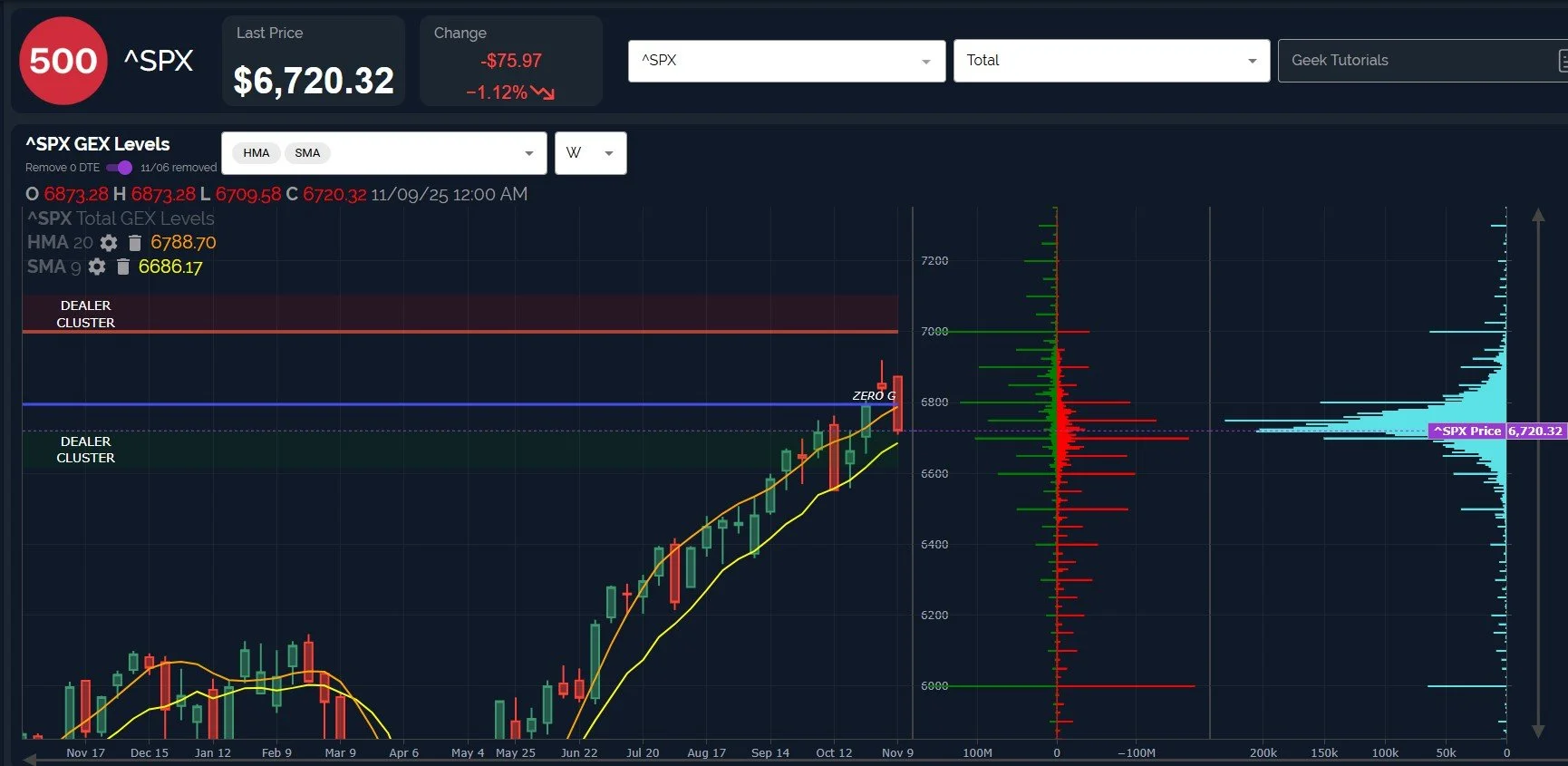

We’ve been looking at the SPX weekly chart, noting the tendency for price to eventually test the 9-period SMA. We’re almost there, with 6686 marking the current point, also close to the big GEX area at 6700.

Today’s low was 6707, so theoretically close enough to count as a tag, though other factors (such as the VIX) certainly make it seem as though we have a good chance at pushing at least a little lower.

6600 and 6650 also look like areas of meaningful GEX, if we lose 6700. A spike below the 9-SMA may end up being a good buy for a move toward 7000 into the end of December, if GEX holds up with the current positioning.

SPX finally moved into negative GEX territory on a net total basis, and it can certainly move more deeply negative, if we are to continue lower.

QQQ is almost to its own 9-SMA at 604, with a very large GEX area at 600 just below as well. 580-590 are additional areas of interest for QQQ.

Technically, indices are a bit stretched below the daily Hull, so the odds of a bounce are increasing as we move lower, paradoxically.

The VIX is certainly a more bearish looking omen in my view, with the VIX rising on top of the bullish (for volatility) Hull Moving Average. Is another spike to VIX 25 in the cards? Perhaps even higher, if this decline evolves into something more than a typical post-April pullback.

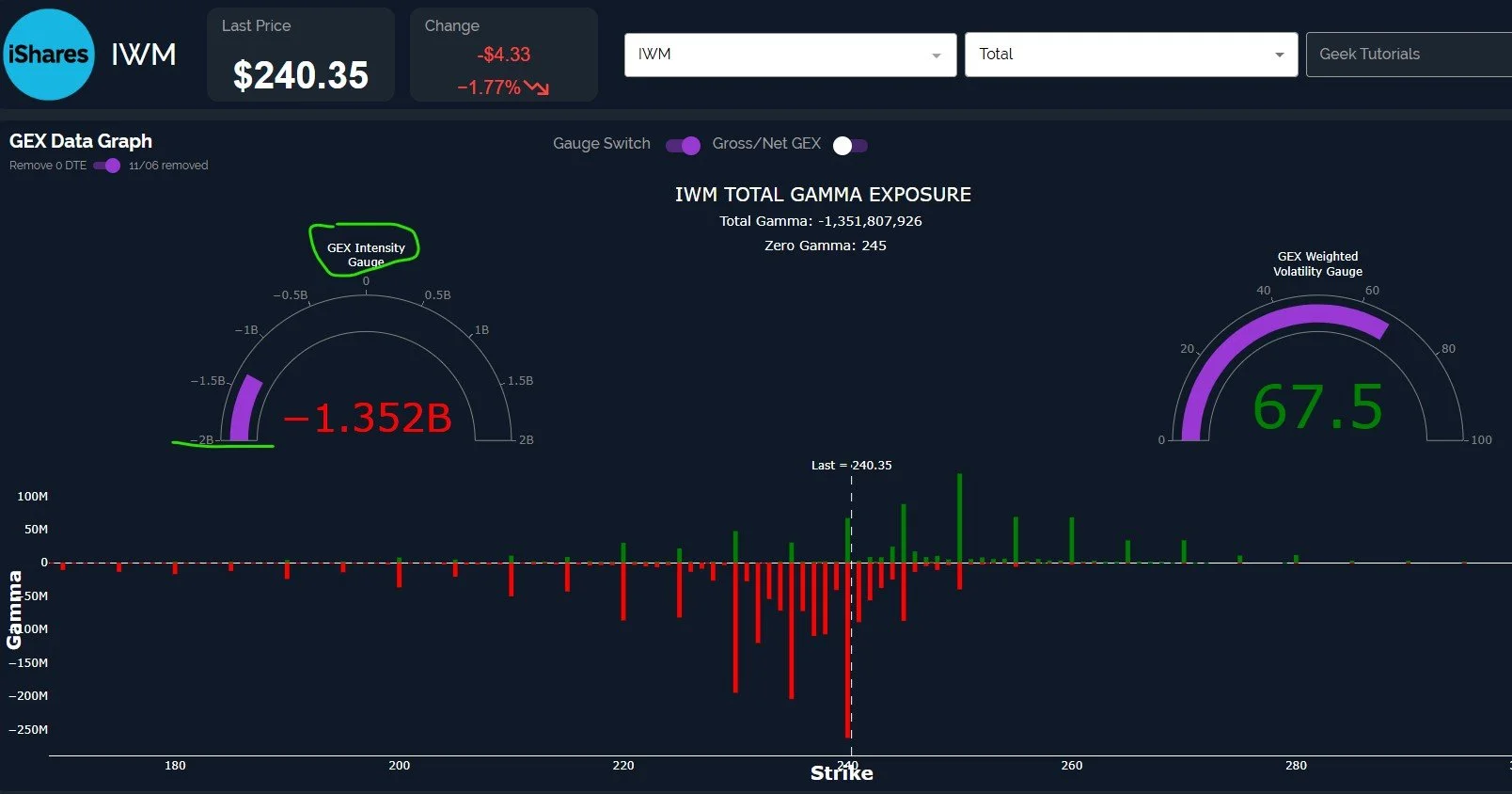

IWM has the longest running downtrend of the major indices, going on two weeks, finally reaching the 240 GEX cluster.

Volume was highest at the 230 strike today, which also matches the lower Keltner channel, so an overshoot toward 230 is certainly possible.

One thing we want to watch with IWM in particular is the GEX Intensity Gauge, which compares current GEX to GEX readings from the past year on a relative basis. The intensity gauge shows us if GEX is relatively bullish or bearish, and it also reflects extremes, which can act as contrarian buy signals.

IWM reaching -2B or more in negative GEX might end up being a good place to buy, for example.

We’re already adding new long positions as we look ahead, but we also remain hedged, so let’s let the market tell us what is most likely as we approach the next few days. We’ll be sure to update our Discord channels with new GEX data as we enter tomorrow’s cash session.

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

While there’s no YouTube video today, we will resume posting tomorrow, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.