Rebound Attempt Rejected? November 6 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout! ENDING SOON!

Travel circumstances prevented a YouTube video today, but we will resume our daily videos soon! We will still conduct our free live stream presentation Thursday, so feel free to join us via our homepage link or our posted link in Discord around 10:30 AM ET.

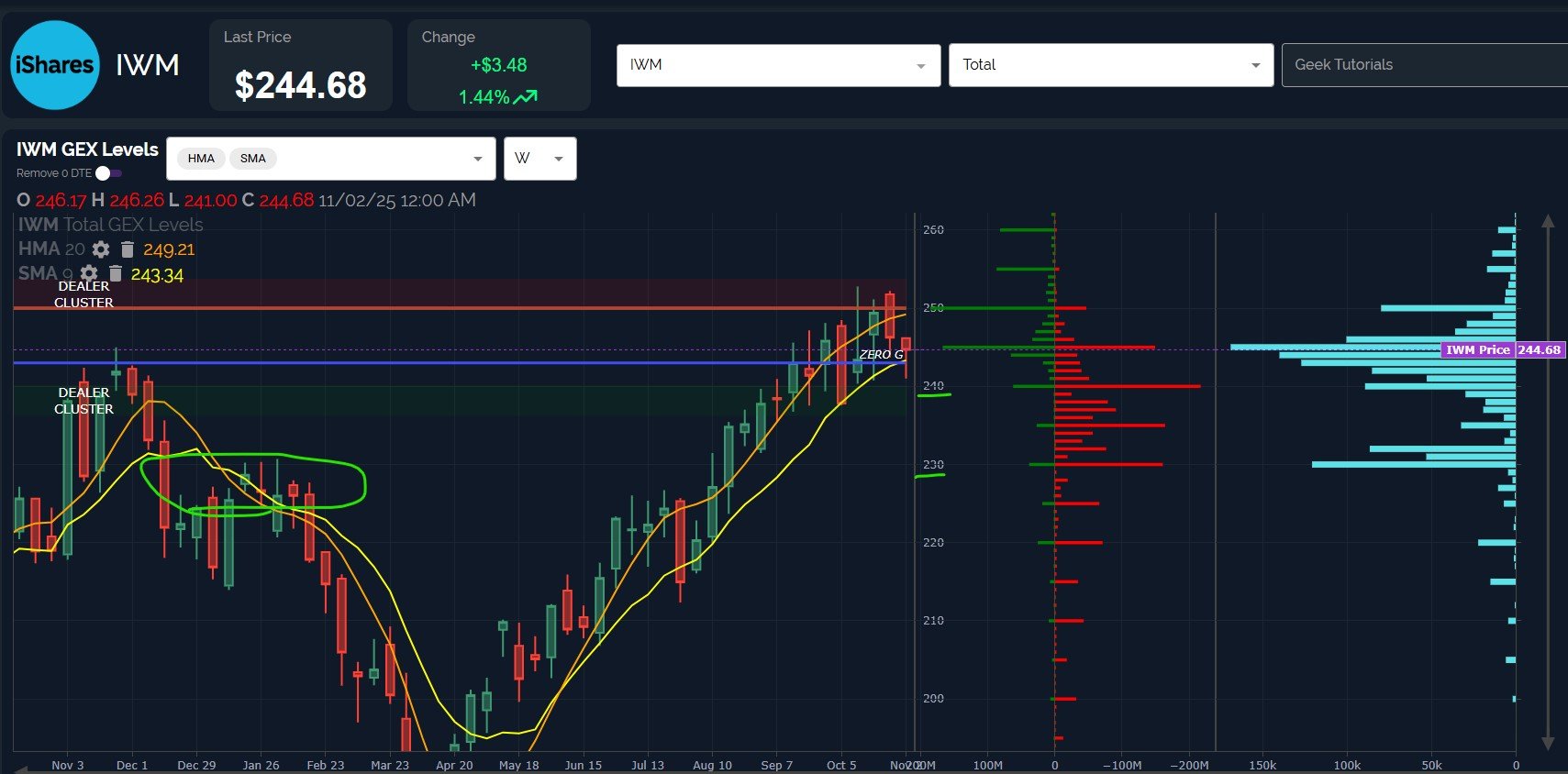

A brief look at IWM’s weekly chart shows a bounce attempt before 240 was reached, holding the important 243 9-period SMA intact. The next directional move is unclear, though holding 243 increases the likelihood of 243 acting as support.

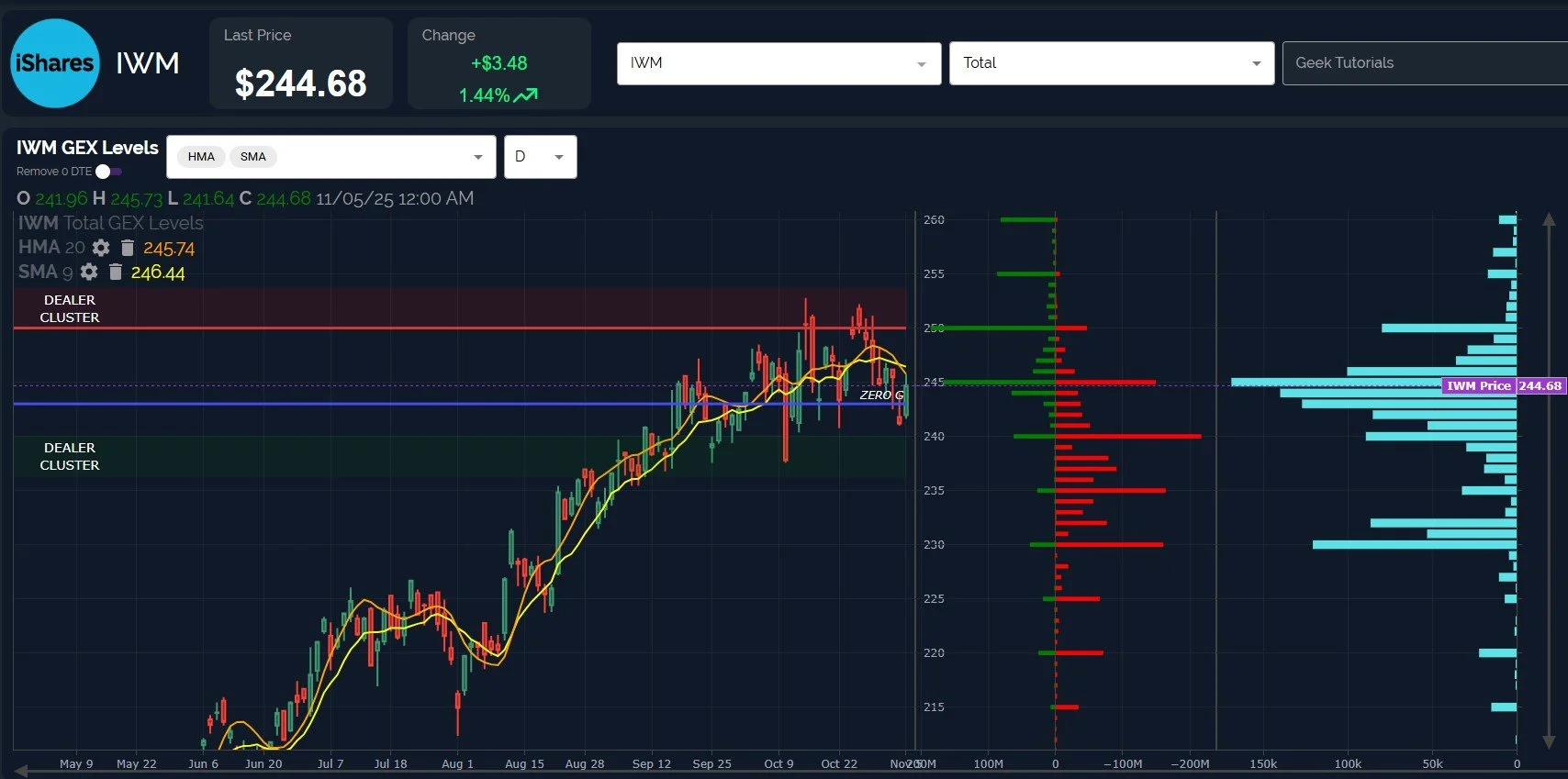

The IWM daily chart show price rejecting off of the 9-SMA and Hull Moving Average inflection point, potentially opening the door to 240 and 235 below.

Volume was particularly elevted at 230 and 232 strikes, a speculative metric admittedly, yet one that points to interest amonst participants in potentially lower prices.

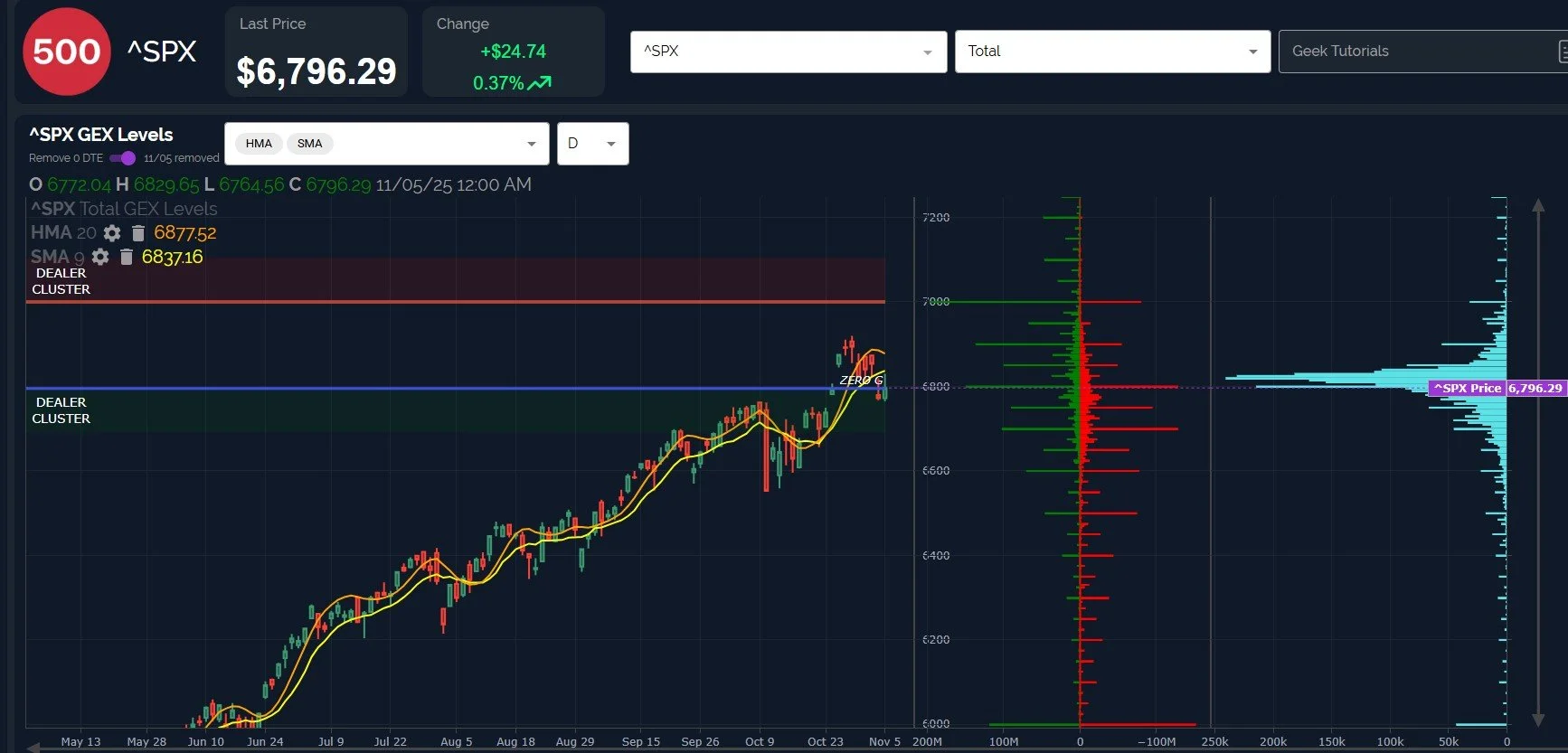

SPX spent a lot of time over the last five months between the 9-SMA and the Hull, so the last 3 weeks above the weekly Hull raise suspicion as to the sustainability of such a move above the weekly Hull.

A retest of the 9-SMA at 6694 would not be surprising based on history.

The daily chart also shows rejection near the 6837.16 9-SMA, with the declining Hull at 6877.52 potentially acting as an important resistance area if SPX surpasses 6837.

As long as we remain below 6837, SPX 6700 is an initial possibility.

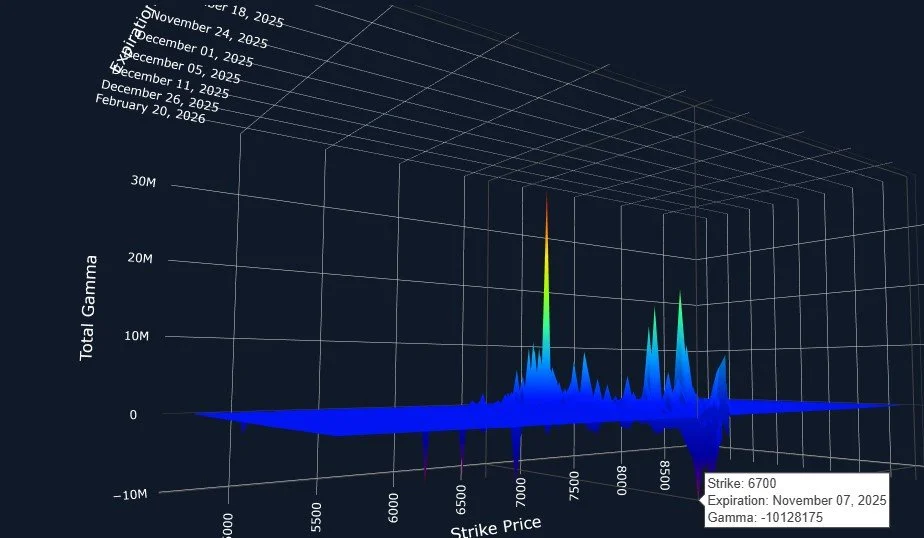

To add to the most recent statement, 6700 is the largest GEX cluster set to expire November 7, bringing the possibility of a further decline into the forefront as we approach Friday.

The VIX also tested important support in the 17.50 range, potentially opening the door to another attempt at 20-25, yet we also see Hull support at 16.66, slightly below the GEX-indicated 17 area.

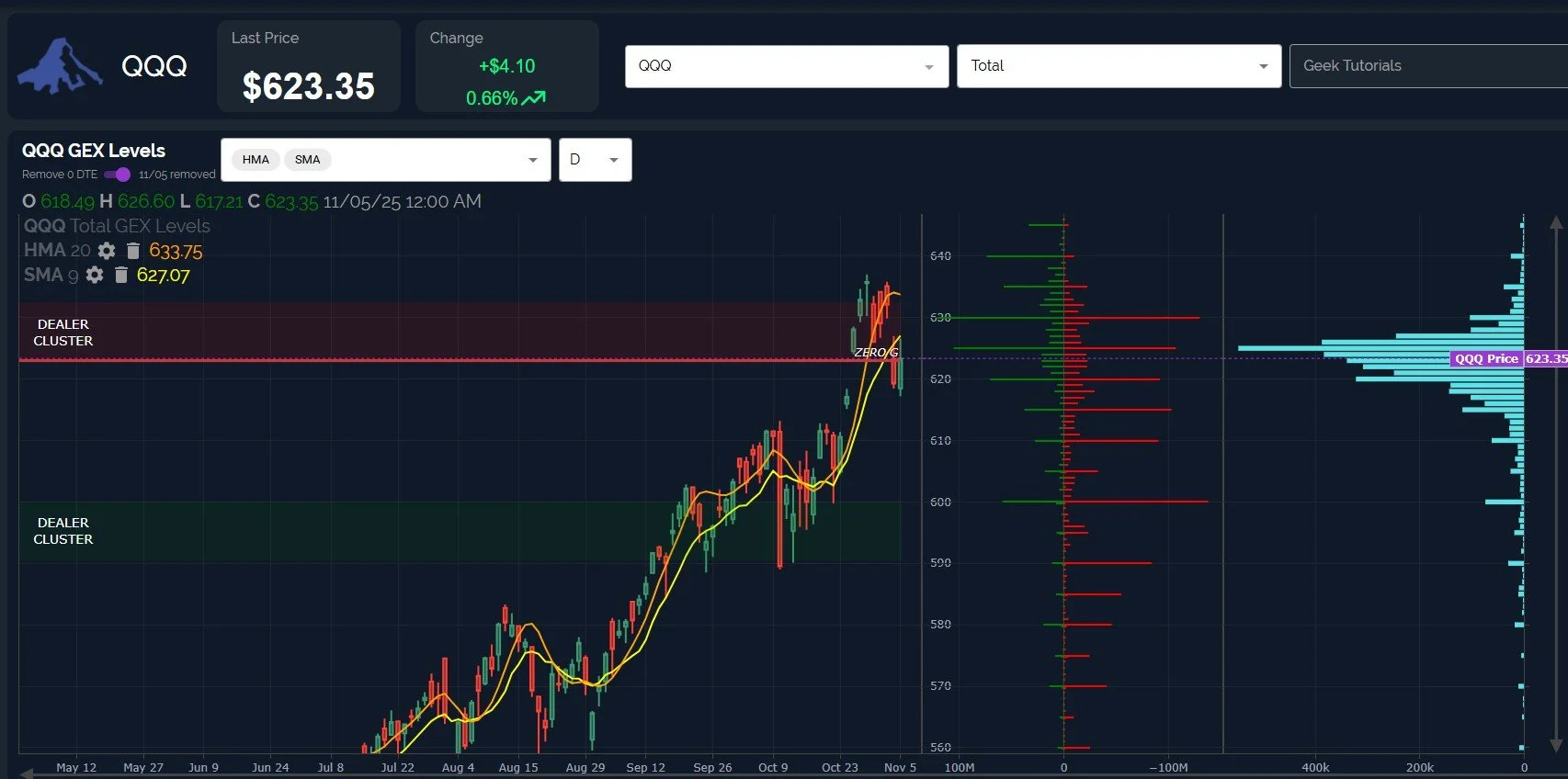

QQQ also retested the 9-SMA at 627, rejecting and facing possible effort toward the 610-615 area. 630 also remains as a possible upside target and pivot if QQQ can maintain above 620.

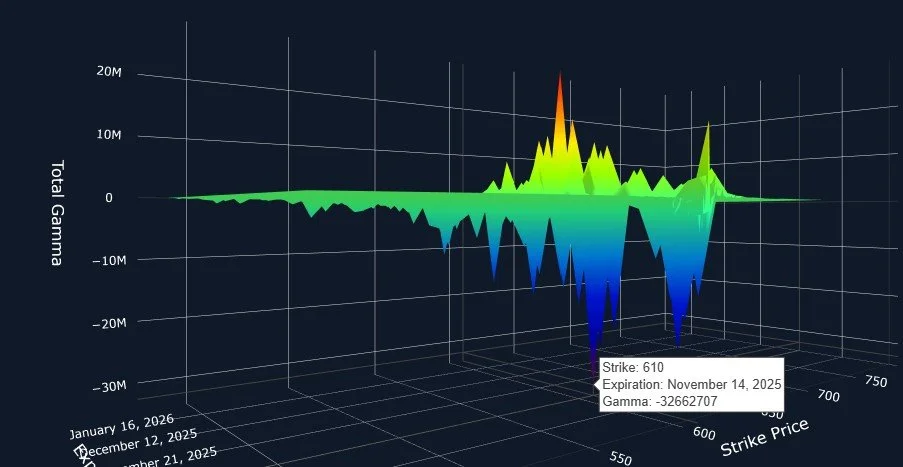

Interestingly, and possibly a feather in the cap of the bears, GEX for QQQ has shifted to reflect the largest GEX cluster at 610 expiring November 14, implying potential downside into next week, even if an intermittent bounce carries us slightly higher.

We’ll monitor any potential shifts in GEX in coming days so we can evaluate such changes in light of what we see with price action as well.

Thanks for joining us and we hope to see you in Discord tomorrow!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.