Are Bulls In The Clear? November 25 Stock Market Preview

NEWSLETTER ONLY Black Friday Special: Try our $99 monthly Analyst subscription for ONLY $10 The First Month (First time subscribers only)! Enter code NEWSLETTER10 at checkout! ENDING after Cyber Monday, potentially never to return!

You can view today’s YouTube video here. We add additional commentary on SPX and QQQ as well as covering GLD, the VIX, COIN, BTC, and SMCI, so check it out!

Today’s rally continuation saw the VIX get crushed again, including VVIX, both moves initially appearing to be favorable toward a bullish resolution into year-end.

That said, the VIX has declined right into the zone of the rising weekly Hull Moving Average, also just above the key GEX pivot at the 20-strike. The presence of large positive and negative GEX clusters shown on the gross GEX picture below illustrates 20 as a line-in-the-sand for a drop toward 17-18 or a rebound toward the 23-23 area, at least.

The 2-hour chart shows a fast retest is near of the lower Keltner channel near the 19.5-20 area as well, matching the weekly Hull and the GEX cluster at 20. I underlined a few times where the VIX respected the bottom of the 2-hour Keltner channel. If the future shows substantial violation of this boundary going forward, I will stop relying upon it..Until then, the usefulness of the indicator stands.

I will note that the mid-October VIX crush saw continuation lower as the VIX hugged the bottom channel as it trended lower, which is entirely possible. Even that occasion saw a 2-day bounce prior to continuation lower.

IWM saw a huge reversal in GEX following the conclusion of Friday’s option expiration, an encouraging sign that has previously seen instances where the initial move for IWM was lower, but resolution was higher over a matter of days/weeks.

IWM validated our recent warnings to bears that the extreme negative GEX readings- extreme based upon our GEX intensity gauge, which compares current GEX readings to those over the prior year-often lead to contrarian reversals. GEX is no longer at an extreme for IWM, and remains negative despite the sharp increase toward positive territory.

IWM closed just below the key 240 GEX level we’ve highlighted after testing above the line, which isn’t unexpected.

Notice the distance between the current price and the Hull, which is almost 8 points. Such distances are usually closed by the two converging.

In bulls favor, the Hull is in the early stages of flattening/turning higher, though any conclusions from such shifts are speculative at this point. My summary is that I believe a pullback to be likely at this point, but holding 230-235 keeps the prospect of a year-end rally alive. A close below 230 likely implies further downside before a sustainable bottom.

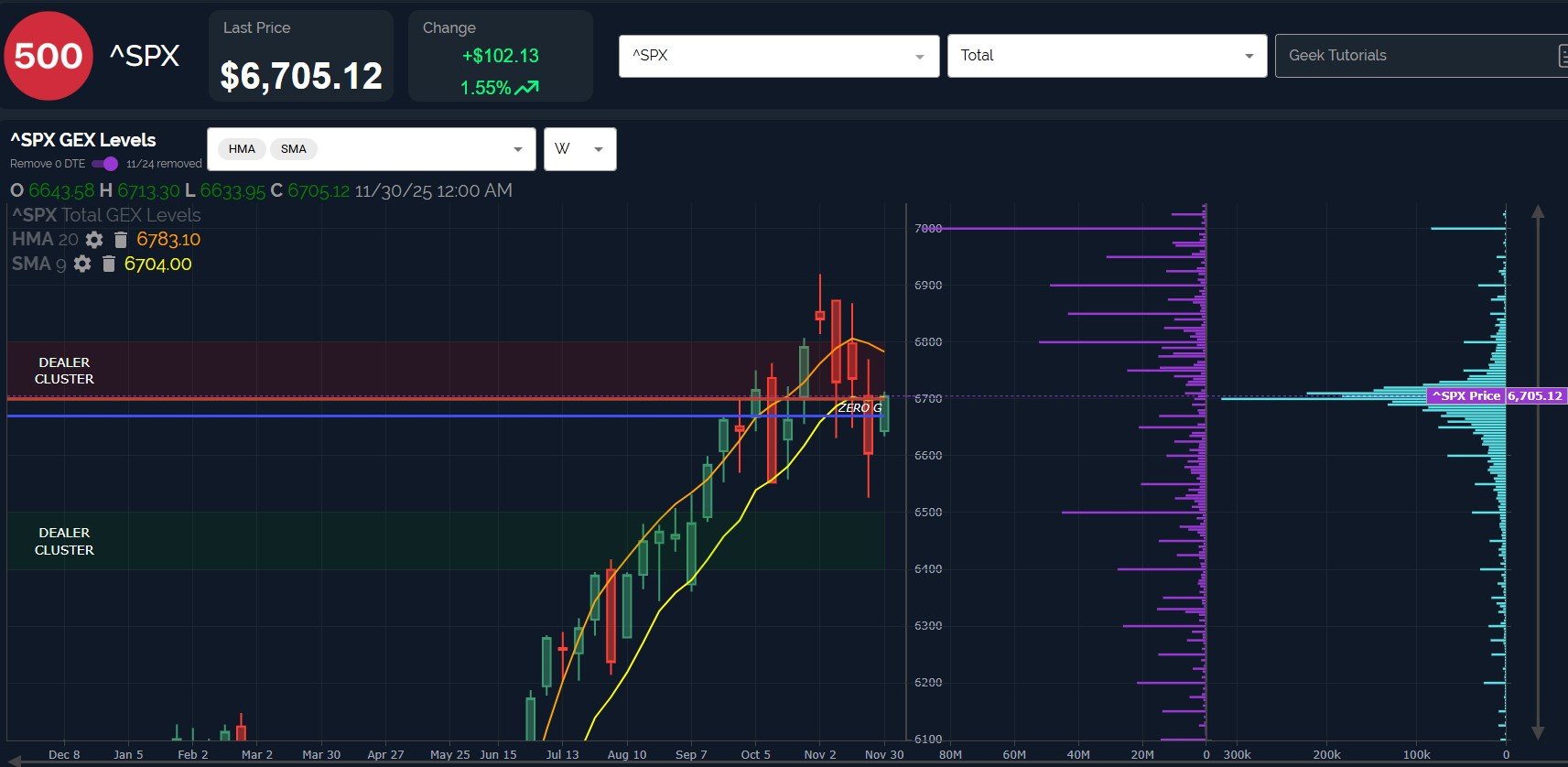

switching gears to SPX, we see the weekly 9-period SMA tested from below, with a close merely one point above the 6704 level.

Yesterday, we highlighted the continued significance of the positive GEX cluster at 7000, mostly clustered at the 12/31 expiration, and today’s positive action keeps that target alive.

We don’t see a lot of net GEX between 6700 and 6800, and 6800 is close to the next significant resistance level I show on my chart at the weekly Hull of 6783, so SPX holding above 6700 should see a rapid test of the 6780-6800 area.

Failure here may happen in the short term for reasons identified below.

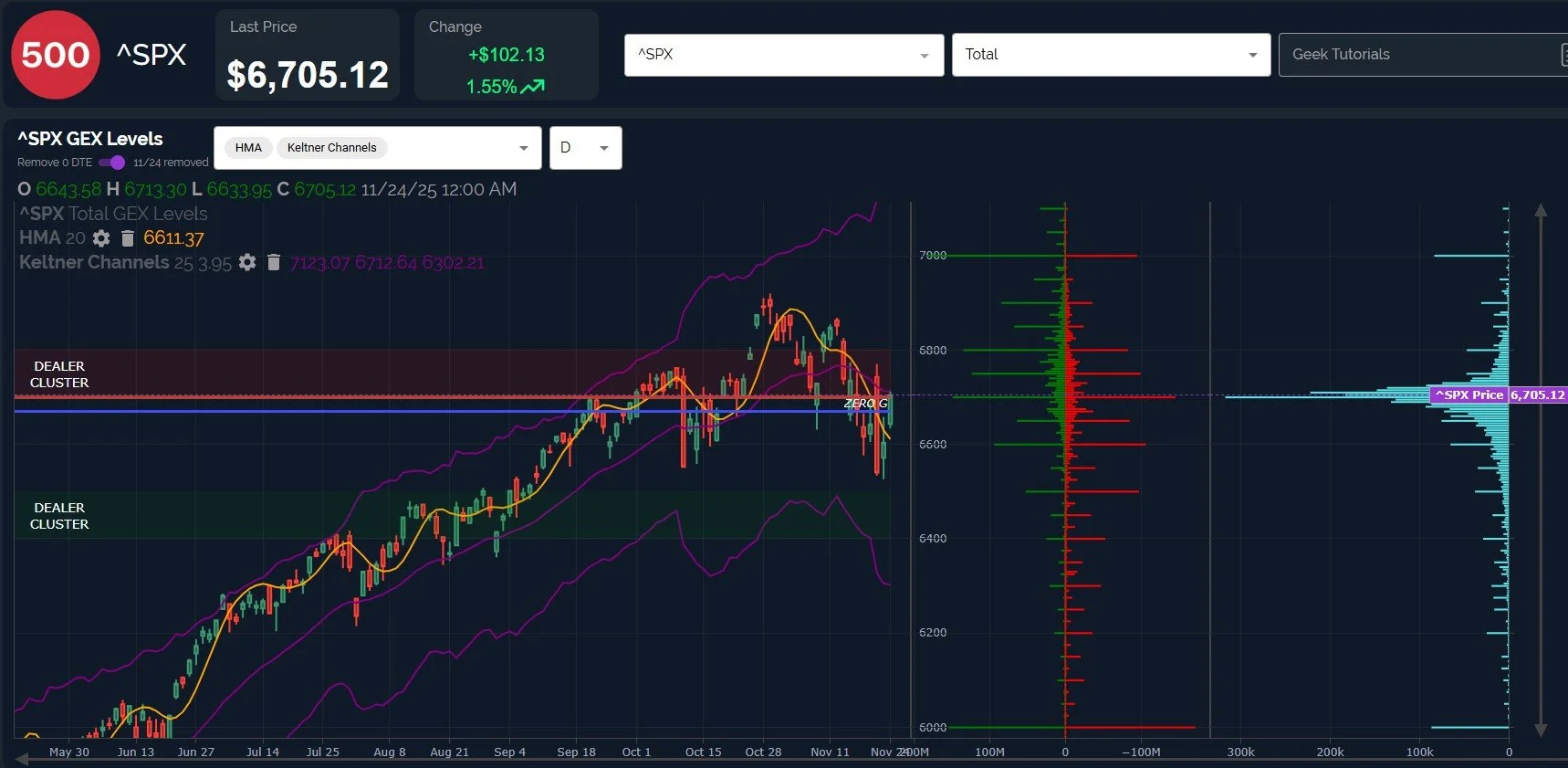

To expand on the previous point regarding near-term risk to the downside, we can zoom into the daily chart, reflecting the same steep downtrend of the Hull, currently aligned with 6600-6610.

The largest net negative cluster is currently at 6500, but bulls likely want to see the large gross GEX clusters at 6600 held to maintain or increase the odds of a reversal toward 7000. With a mere 4 weeks remaining in 2025, and a shortened holiday week ahead (Thursday is closed, Friday is a half day), important decisions and perhaps heightened volatility in both directions are possible in coming days.

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who share their thoughts, and we share analysis every day as well.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.