Thanksgiving Special: Who Gets Roasted Besides The Turkey? November 28 Stock Market Preview

NEWSLETTER ONLY Black Friday Special: Try our monthly Analyst subscription for ONLY $10 the first Month (First time subscribers only)! Enter code NEWSLETTER10 at checkout! ENDING after Cyber Monday, potentially never to return!

You can view today’s YouTube video here. We discuss QQQ, AMZN, META, and GOOGL, as well as the major indices, so check it out!

Starting with the VIX, we see the strong downtrend continuing, bringing the VIX to the important 17 GEX cluster and close to the bottom of the 4-hour Keltner channel. The VIX is right at the lower Keltner channel on the 2-hour chart, so we are within a short-term reversal zone.

Even if the VIX spikes from here, the odds favor the VIX making lower highs and lower lows, so we need to see what happens at the 20-21 strikes ultimately.

The VIX weekly chat shows a precipitous decline almost to the largest negative GEX cluster at 17, with GEX diminishing rapidly below 17, potentially implying an imminent short-term low for the VIX.

The burden at this point is on VIX bulls to show strength and a recapture of the 20-strike upon a retest, which is yet to be seen.

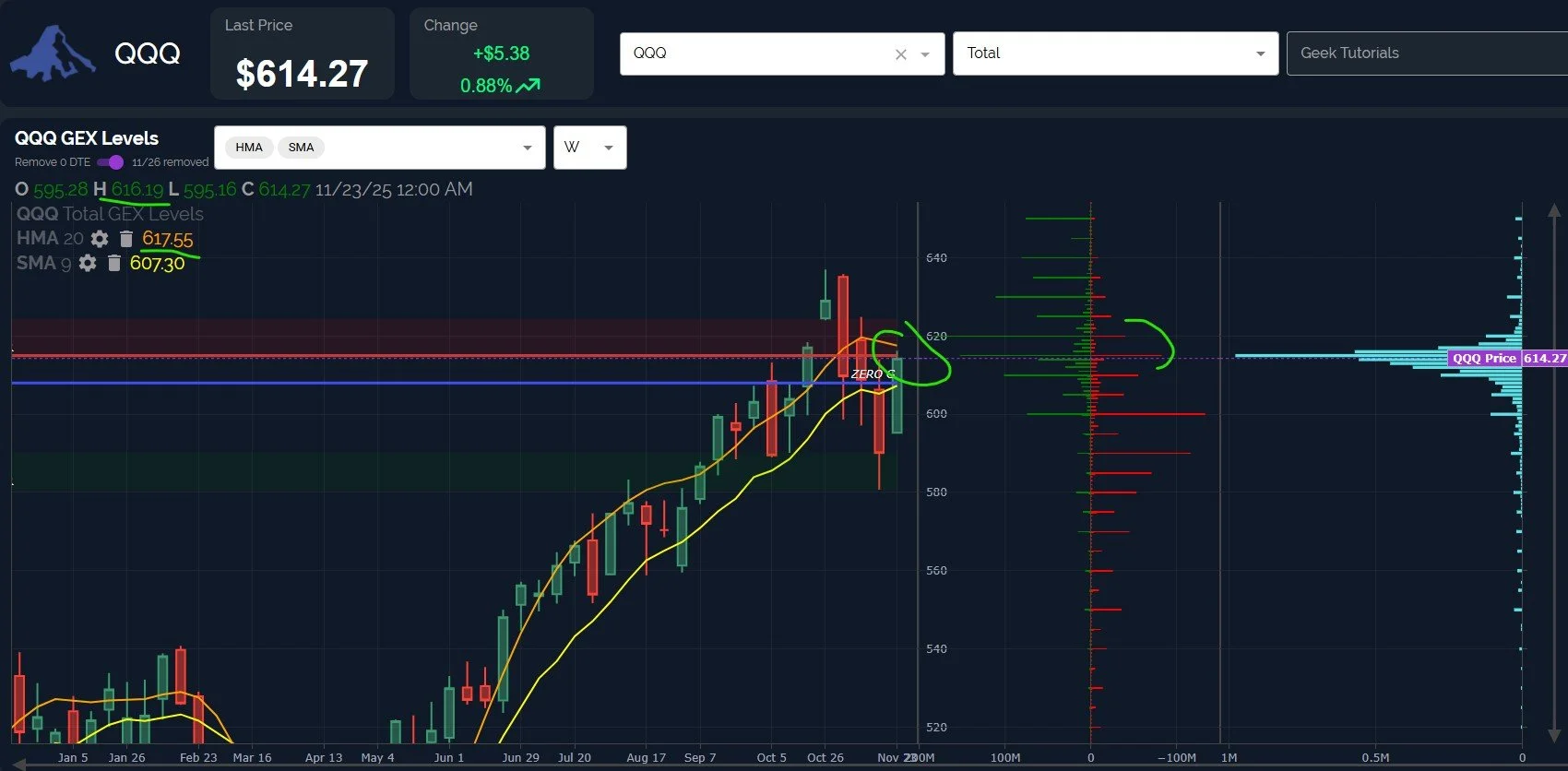

QQQ topped today within about a point of the weekly declining Hull Moving Average, a possible sign of hope for bears, as long as QQQ closes below 617.55.

Large GEX clusters at 615 and 620, with very little to show above 620, implies we may see reversal in the short run.

Bears need QQQ to close below 600 in order to revive hopes of a “real” correction, though as of now, a higher low (perhaps even a perfect retest of 600) appears to be more likely.

To add to what we see on the weekly chart, the daily chart shows price well extended above the daily Hull Moving Average, implying a convergence of the two is fairly likely in the near future. This could happen by way of QQQ price dropping to meet the rising Hull, currently just below the big 600 GEX area.

We also see a “jaws” pattern on the Keltner channels, implying greater uncertainty and higher odds of a whipsaw or greater volatility going foward.

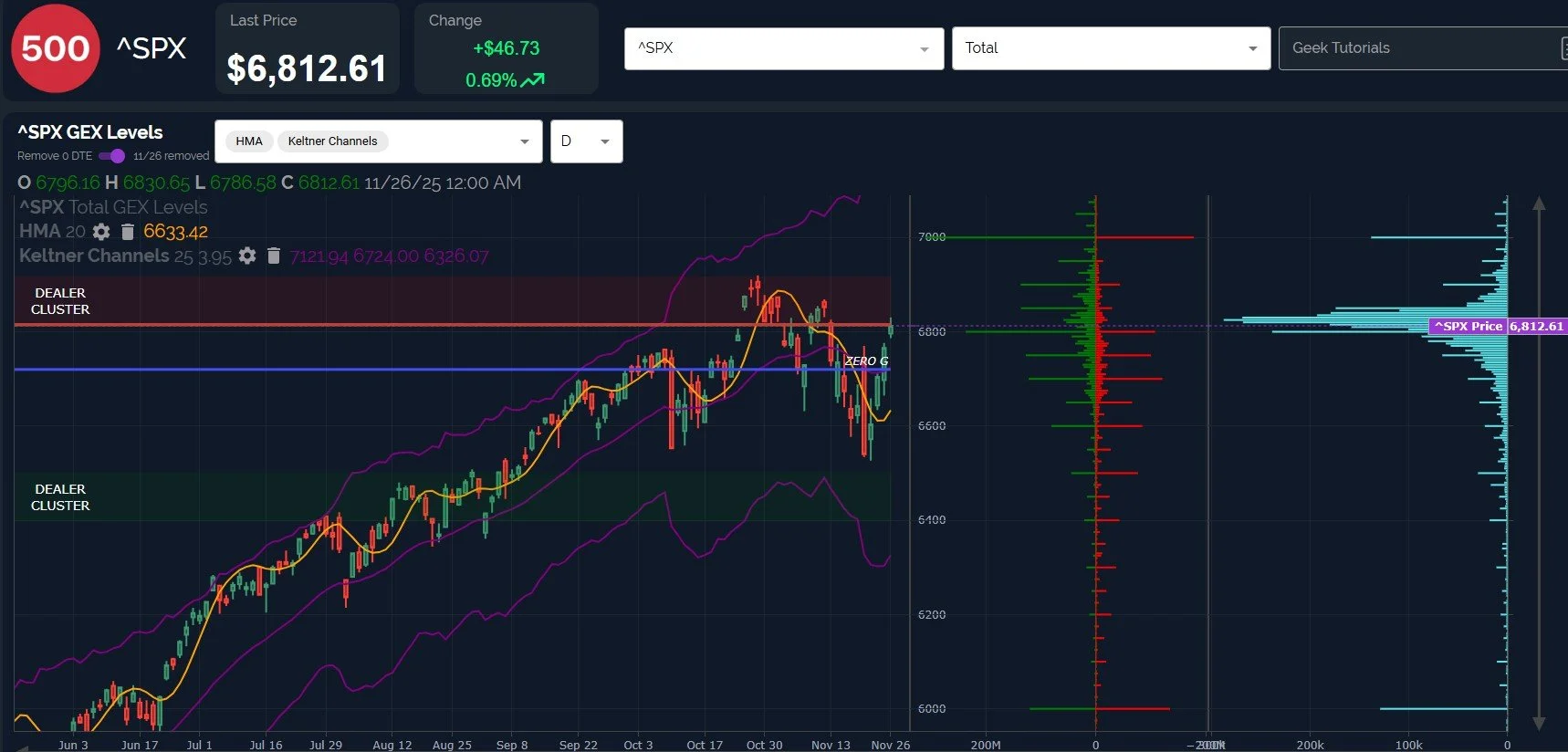

SPX shows the same large gap between the Hull and the current price, which also sits in the upper Dealer Cluster zone, with 6800 now almost equal to 7000 on a net GEX basis (gross GEX shown below).

In my opinion, the increase in negative GEX at 7000 and the growth in positive GEX at 6800 implies the potential of a top around 6800, which could raise odds of a pullback as low as 6600 before continuing higher.

A word of caution toward any conclusions regarding the move into year-end: We just saw roughly 300 points gained in 4 trading sessions on SPX, so we have plenty of time for a pullback and then a final push higher into SPX 7000. We might not see that, but don’t write it off if we have another drop on the basis of being too short of a timefame. A lot can happen in this world of greater uncertainty!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who share their thoughts, and we share analysis every day as well.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.