In The Danger Zone: November 18 Stock Market Preview

November 18 Stock Market Preview: The VIX continues making higher highs, holding above the Hull Moving Average. We see positive GEX for the VIX heading into monthly options expiration Wednesday, so we might be heading for a less common market low by Wednesday. SPX and QQQ are holding below the weekly 9-SMA, yet the week is still young? What happens next?

Event-Filled Week Ahead: November 17 Stock Market Preview

November 17 Stock Market Preview: Friday’s gap down and solid rebound certainly looks constructive at first look, and we’re entering an event-packed week with VIX expiration, FOMC, NVDA earnings, and OpEx Friday. It’s too early to say if we’ve made a final low for the year, but we won’t be surprised if we see whipsaw volatility in both directions this week.

2nd Leg Down: 2nd Chances For FOMO Buyers? November 14 Stock Market Preview

November 14 Stock Market Preview: Cautionary signals proved accurate, with the VIX spiking and indices receding. We are near an important area on the indices that may prompt a bounce heading into FOMC and NVDA earnings next week.

Diamonds Are Forever? November 13 Stock Market Preview

November 13 Stock Market Preview: SPX and QQQ showed negative divergence from the wildly bullish DIA today, which made a new high relative to October 29 while other indices made lower highs. The VIX is also at an important crossroads that may determine whether or not we spike to 19-20 (or higher). Let’s look more closely at the big picture.

More VIX Crushing Ahead? November 12 Stock Market Preview

November 12 Stock Market Preview: Indices saw some back and forth action today, still holding above key resistance-turned-support for now. The VIX may have some room to the downside, but various factors suggest a push higher for the market may not have staying power as key reversal areas are once again close by.

Beginning Of The Final Push? November 11 Stock Market Preview

November 11 Stock Market Preview: Early downside action following the large gap up today ultimately gave way to a sustained rally, trending higher and closing near highs. While GEX gave us the big increase that was lacking Friday (a positive), we still have a VIX that might be deflating too quickly again, potentially limiting the duration of further upside.

Bottom Is In? Not So Fast… November 10 Stock Market Preview

November 10 Stock Market Preview: We saw an overshoot of our recently mentioned 6687 SPX target, but a nice rebound into the end of the day saw indices closing above key levels. Tonight’s newsletter will cover some interesting data points suggesting that the pullback may not be over, as well as some key levels to the upside and downside.

Correction In Play: November 7 Stock Market Preview

November 7 Stock Market Preview: Indices continued lower after yesterday’s consolidation, with SPX reaching a low of 6707 for the day. We’re getting close to an area bulls will really want to see held if we are to reach 7000 by the end of December. What’s next?

Rebound Attempt Rejected? November 6 Stock Market Preview

November 6 Stock Market Preview: Today’s range resulted in an attempted rebound that tested the 9-period SMA and rejected for all major U.S. indices. The VIX reached the 17s, yet closed right at 18. What else does GEX tell us today that might help us prepare for tomorrow? You’ll have to read further to find out, of course.

Forwarned Decline Activated: Opportunity Knocks! November 5 Stock Market Preview

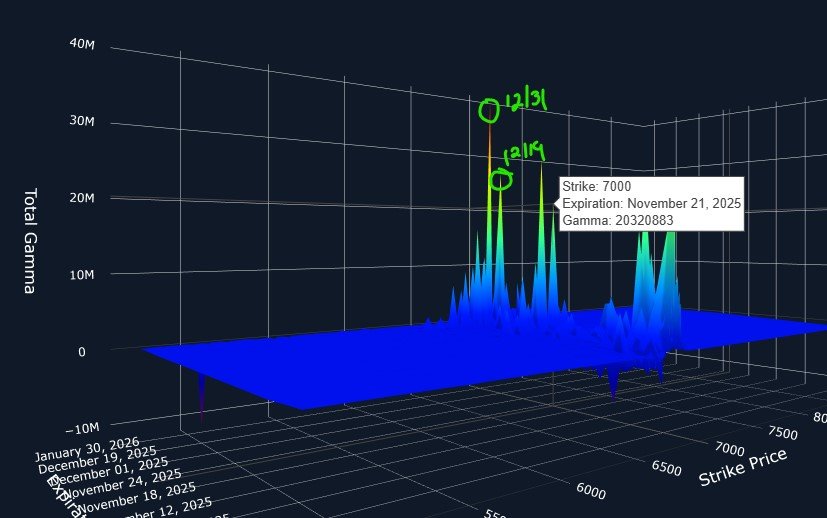

November 5 Stock Market Preview: Our warning yesterday of an increased risk of a pullback was vindicated today with a weak day for markets. With SPX 7000 still potentially looming as a target for 12/31, in contrast with a bullish VIX picture (bullish for volatility), what might come next?

Increasing Risk Of A Pullback? November 4 Stock Market Preview

November 4 Stock Market Preview: Boring day for the indices, though the VIX almost reached 19 and then retested 17 on the downside, holding as of now. With IWM holding below the downward leaning Hull, and SPX 7000 GEX shifting yet again- away from near-term dates- can we finally get a deeper pullback?

SPX 7000 Now Or Later? November 3 Stock Market Preview

November 3 Stock Market Preview: SPX, QQQ, and IWM all show bearish signals, and the VIX showing some bullish signals, we may be at a spot where a bounce can happen. Will we see a bounce materialize, or is this the beginning of a larger pullback?

Concluding Q3 Earnings: October 31 Stock Market Preview

October 31 Stock Market Preview: Indices saw bearish follow through today, with IWM leading the pack.What likely comes next?

Cracks & Red Flags: October 30 Stock Market Preview

October 30 Stock Market Preview: QQQ held onto a positive bias all day, but the other generals are falling all around, with SPX and IWM both struggling during the afternoon of FOMC day. IWM closed below key technical support and GEX declined across the board for major indices. The VIX is also on the brink of breaching key resistance to the upside. If a pullback materializes, what might it look like? Let’s review a few parameters to watch in coming days.

Blow-Off Top Into FOMC? October 29 Stock Market Preview

October 29 Stock Market Preview: The “B” word comes to mind looking at SPX and QQQ( “Blow-off”), but IWM seems to be sitting out from the party. With FOMC tomorrow, we could see volatility in both directions. Let’s take a look at the current GEX picture heading into Wednesday’s Fed announcement.

Extreme Positive GEX, Negative Divergences: October 28 Stock Market Preview

October 28 Stock Market Preview: Divergences are starting to widen, with SPX and QQQ making new all-time highs while IWM made a lower high. We also see GEX divergences. What comes next?

Bulls Are Winning, But TIme For A Breather: October 27 Stock Market Preview

October 26 Stock Market Preview: Friday saw a bullish breach of key technical and key GEX levels, and the VIX quickly plunged into the 16s. A statistically bearish week ultimately failed for the bears, though we did see weakness for part of the week. Let’s take a look at the bullish shift as well as recognizing that we’re likely close to a reversal zone given that the VIX is already back to almost 16.

Decision Time Is Here: October 24 Stock Market Preview

October 24 Stock Market Preview: The VIX needs to bounce now as it’s about to lose both the Hull and the 9-SMA on the weekly. Fortunately for the VIX, we see indices in their upper Dealer Cluster zones, and IWM still basically where we started yesterday. What comes next as CPI is reported in the morning?

Rolling Over? October 23 Stock Market Preview

October 23 Stock Market Preview: Last night’s newsletter highlighting the increasing odds of a pullback was validated today, with a sharp intraday drop timed with a trade war headline regarding tariffs. While SPX and QQQ saw neat rebounds from the daily Hull, we have a few red flags that warrant addressing as we approach the end of the week.

Increasing Odds Of A Pullback: How Deep? October 22 Stock Market Preview

October 22 Stock Market Preview: The VIX retested the important weekly Hull Moving Average today, holding the area so far. Indices were largely unchanged, consolidating after Monday’s gains. What comes next?