Increasing Odds Of A Pullback: How Deep? October 22 Stock Market Preview

NEW PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter coude FALL2025 at checkout!

Here’s the link to tonight’s YouTube video, we take a look at a day trade we conducted today as well as analysis of the larger indices, the VIX, and some individual tickers.

As we enter VIX expiration tomorrow morning at 9AM ET, we see the VIX showing signs of an attempted reversal on the 4-hour chart, with the Hull crossing below the VIX and the latest candle indicating indecision near the lower Keltner channel.

The weekly VIX chart we’ve been watching also shows the VIX holding above the weekly Hull, maintaining the potential for a volatility rebound from the 17.69-18 area.

We see diminished volume below 17-18, potentially indicating limited interest amongst participants in lower VIX levels currently.

While monthly VIX options expiring premarket may keep the VIX somewhat near the 18 level, a break in either direction immediately following 9AM ET (or after the cash session opens) may be indicative of momentum into the end of the week.

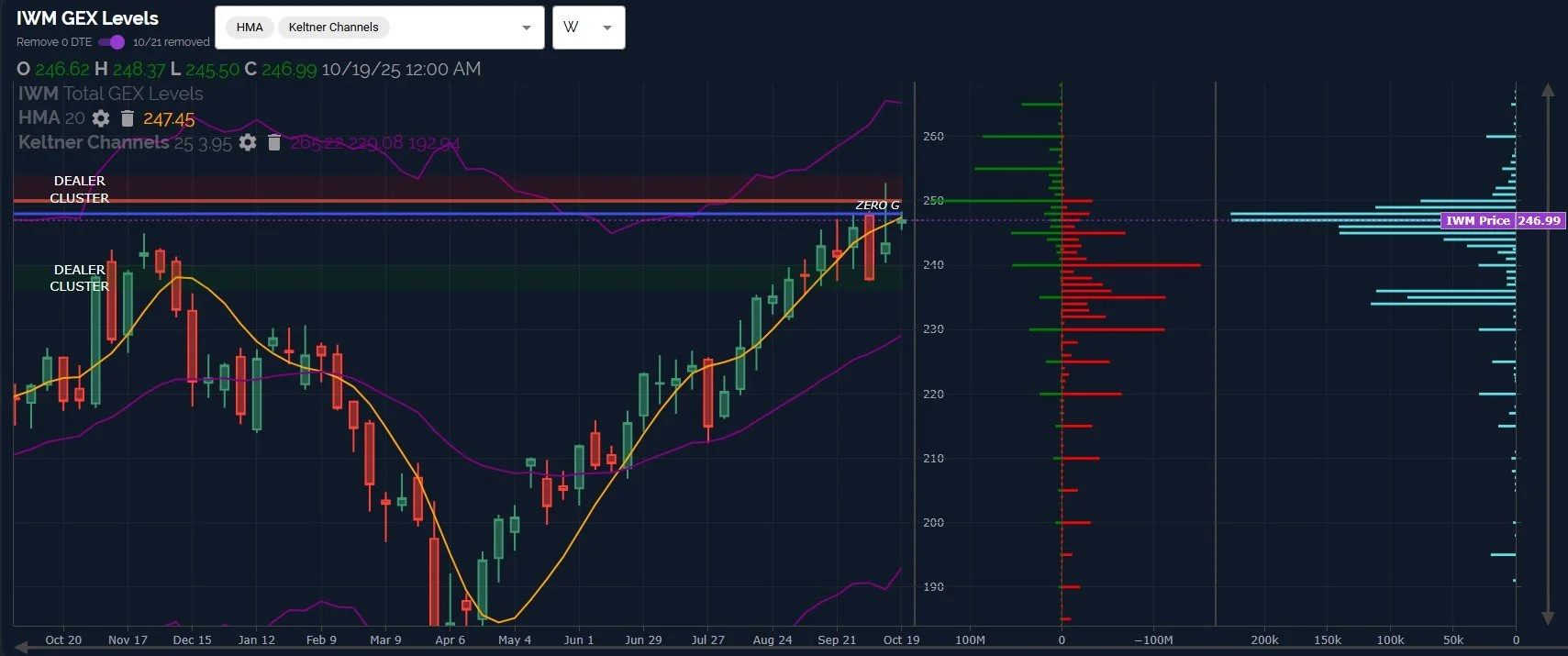

IWM continues to appear fairly bullish on the daily charts, but the weekly chart reveals an important line-in-the-sand just overhead at 247.45, the weekly Hull. IWM has remained below this line for 2 weeks prior, so IWM really needs to turn this line into support (and furthermore, the GEX cluster at 250) in order to have more confidence in a bullish break toward 260+.

Remaining below 248 increases the risk of a drop toward the larger negative GEX clusters at 245 and 240, and we still see heightened daily volume below 240, along with net GEX remaining negative.

SPX remains stretched above the daily Hull far enough to view a move back toward the line as a high probability event, though bulls can have a little more confidence as the Hull is starting to turn higher again.

Will SPX be able to test levels below 6650-6700? The verdict is still out and the burden is on the bears to prove that the potential shift in trend lower has legs.

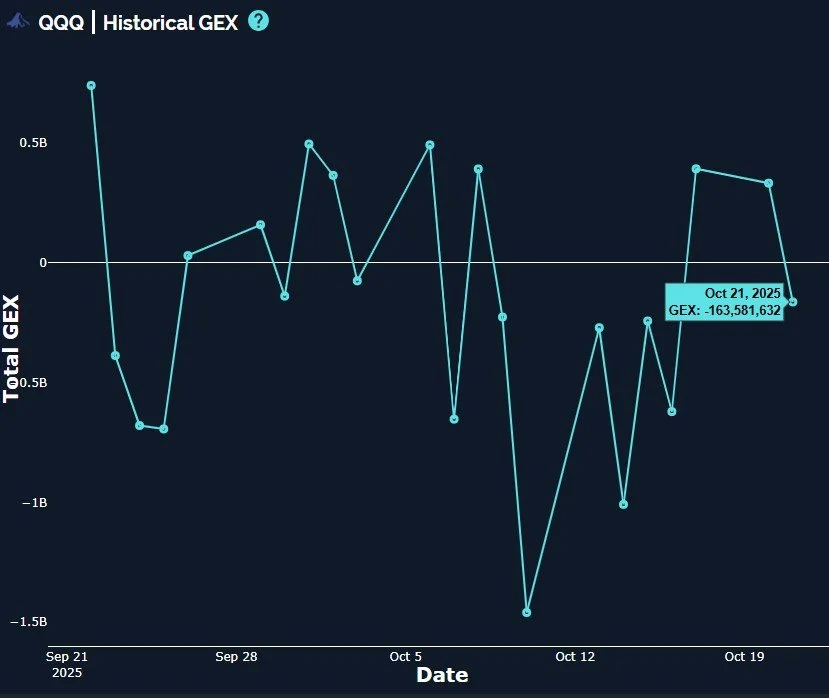

QQQ saw GEX decline for the 2nd day in a row, now dipping back into negative net GEX territory.

While negative, we don’t view QQQ’s net GEX reading to be negative enough to indicate a solid trend, but rather a volatile neutral zone, characteristic of many periods this year despite the underlying uptrend.

QQQ also remains quite stretched above the Hull, so a drop back toward 603-604 or even lower toward 600 would not be surprising. We see futures slightly lower after hours following the NFLX earnings report, and we have TSLA Wednesday after hours, so a number of potentially influential earnings reports lie ahead.

Join us in Discord tomorrow and we’ll share some of our observations as we get indications from GEX on a 0 DTE basis!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.