Rolling Over? October 23 Stock Market Preview

NEW PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter coude FALL2025 at checkout!

Here’s the link to tonight’s YouTube video, check it out if you have a few minutes!

Pullbacks are rarely pleasant, but we were happy to see that the signals we warned about just yesterday resulted in immediate fulfillment, even though the intraday picture was less clear this morning.

While SPX and QQQ neatly held the test of the daily Hull Moving Average, potential cracks are starting to emerge on the weekly chart, with SPX rejecting the move above the weekly Hull at 6719 for the 3rd week in a row.

6700 continues to be a very important GEX area with large positive and negative clusters at that price, so fittingly, SPX rebounded to close mere pennies below 6700, leaving a question mark around where we may see the open on Thursday.

Remaining below 6700 opens the door to 6500 potentially, while retaking 6700 introduces a pathway toward 7000, which has considerable GEX clustered at the December 31 expiry. Technically, both levels could be hit before the year is over, so we need to be open-minded toward potential pathways in coming weeks.

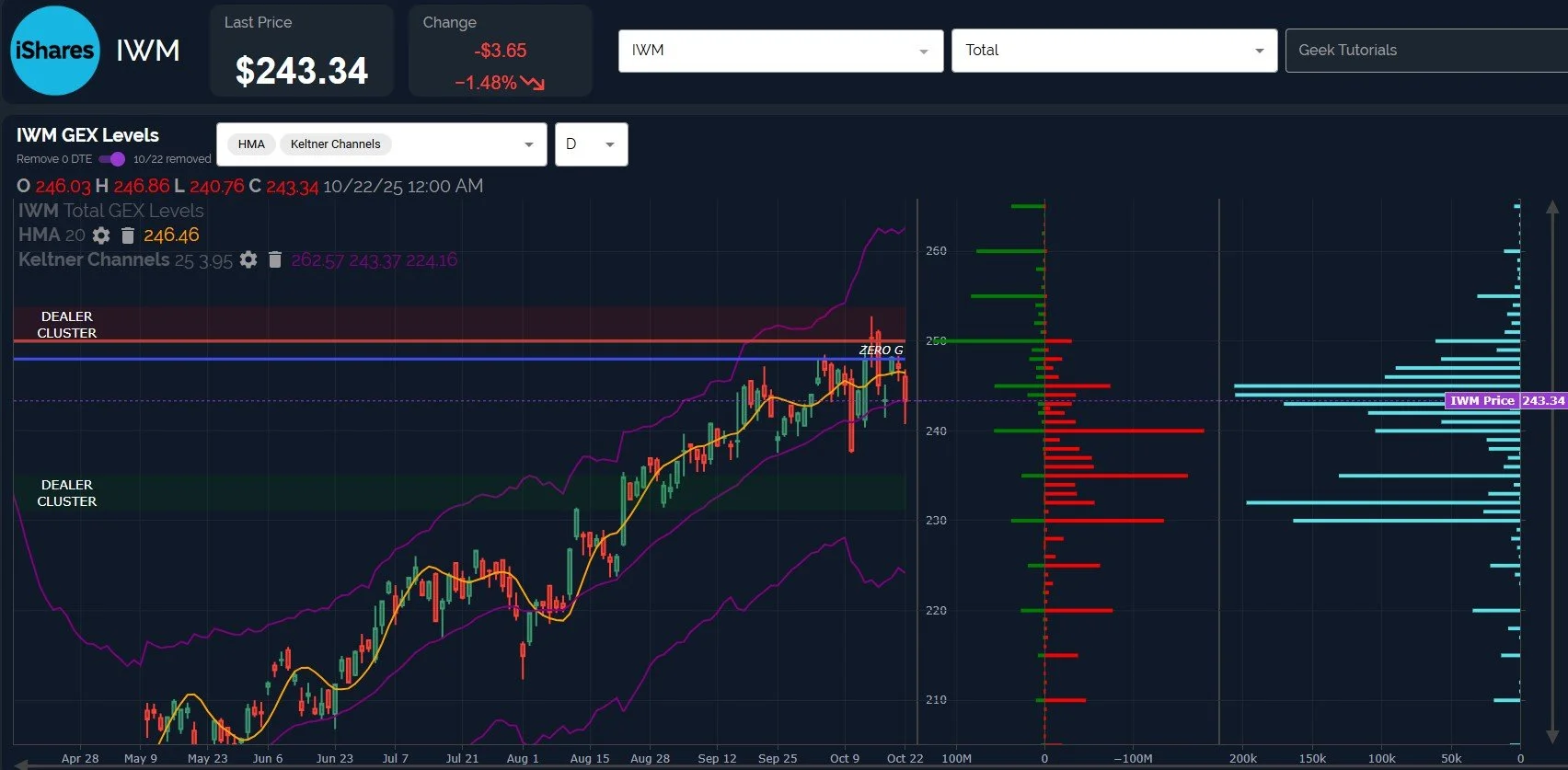

IWM is beginning to look less bullish than other indices, with the daily Hull almost rolling over again and price sharply rejecting from the line. IWM did close at the middle Keltner channel after retesting the 240-241 area, so we might see a bounce, but the burden is now upon bulls to overcome the 246-247 zone.

We’ve continued to mention the daily volume in the low 230s, and volume continues to be outsized at those strikes, also coinciding with meaningful GEX.

A trip to 230-235 appears to be a good potential buying opportunity, if it happens, so we’ll be monitoring the situation as it unfolds.

The VIX weekly chart continues to show a potentially bullish move for volatility, holding the Hull at 17.76 and moving higher.

The daily chart shown below also reveals the importance of the Hull and the Keltner channels, bouncing almost perfectly off of the middle Keltner while almost reaching the Hull at 21.12.

We said we wanted to see what would happen upon a bounce to 20-22, so the initial move was rejected. The counterpoint to this rejection is a continuation of higher lows, very high option volume at the 47.5 strike, and the bearish signs flashed by the major indices today.

Unless we see a more dramatic shift in total GEX across the board, we still view pullbacks in the indices as buying opportunities, and that means further VIX spikes toward 25 or higher may coincide with good buying opportunities looking ahead.

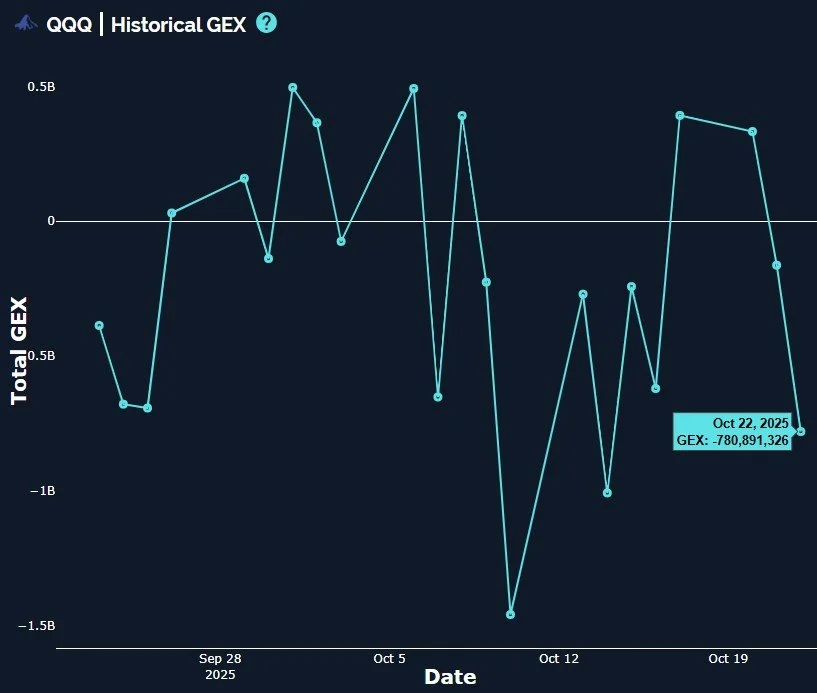

QQQ still holds above the weekly Hull (barely), the sole bullish holdout for the moment. Given that GEX is even more negative for QQQ than for SPX, I’ll assume the more bullish price action is tied to retail traders and earnings hopium, though we will have to see how the divergence plays out.

QQQ’s close places it just above the Hull at 604.81, with the low marking a retest of the 600 area, a very important GEX area.

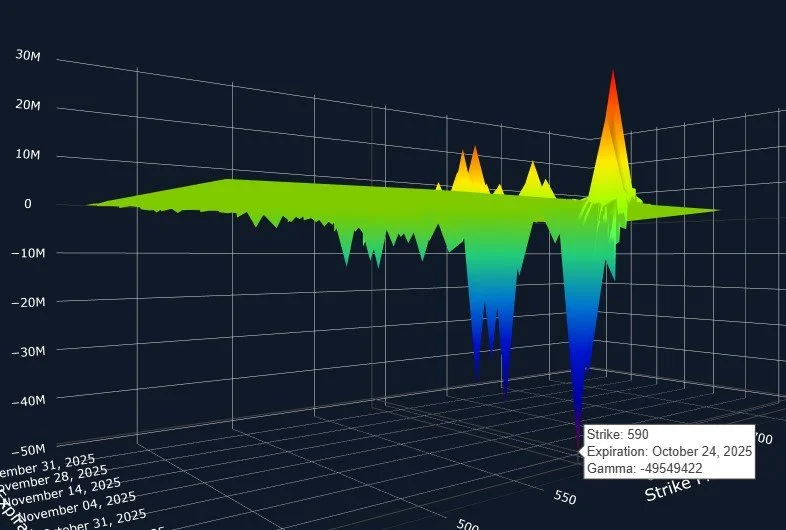

QQQ’s net GEX continues dropping for the 3rd day in a row, today marking the largest increase in negative GEX over a 2-day period since October 8-10.

QQQ’s largest GEX clusters expiring Friday are now 590 and 597, with 615 on the positive side following in 3rd place. I interpret this to imply higher odds of a close below 600, but there’s a non-zero chance QQQ pulls a rabbit out of the hat and makes it to 615, so don’t write it off completely.

Thanks for joining us and we look forward to engaging with you more as we share daily observations in Discord!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.