Decision Time Is Here: October 24 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout!

In tonight’s YouTube video, we cover the major indices as well as GLD and COIN, so check it out if you have a few minutes!

Today saw an unusual display of confidence by volatility sellers, just as we are heading for tomorrow’s delayed CPI report.

The VIX fell almost 7%, closing just below the weekly Hull Moving Average and just above the 9-period SMA.

VIX bulls will want to see the VIX wick back above the Hull to close out the week with yet another candle above the weekly Hull, a consistent theme since August.

A close below the Hull and the 9-SMA could imply another push by indices to all-time highs, so this is a pivotal area.

We still see very little GEX below 15, which has been the case virtually all year, so we’re yet again approaching an area where downside may be limited for the VIX, barring a big shift in the VIX regime to sub-15 levels.

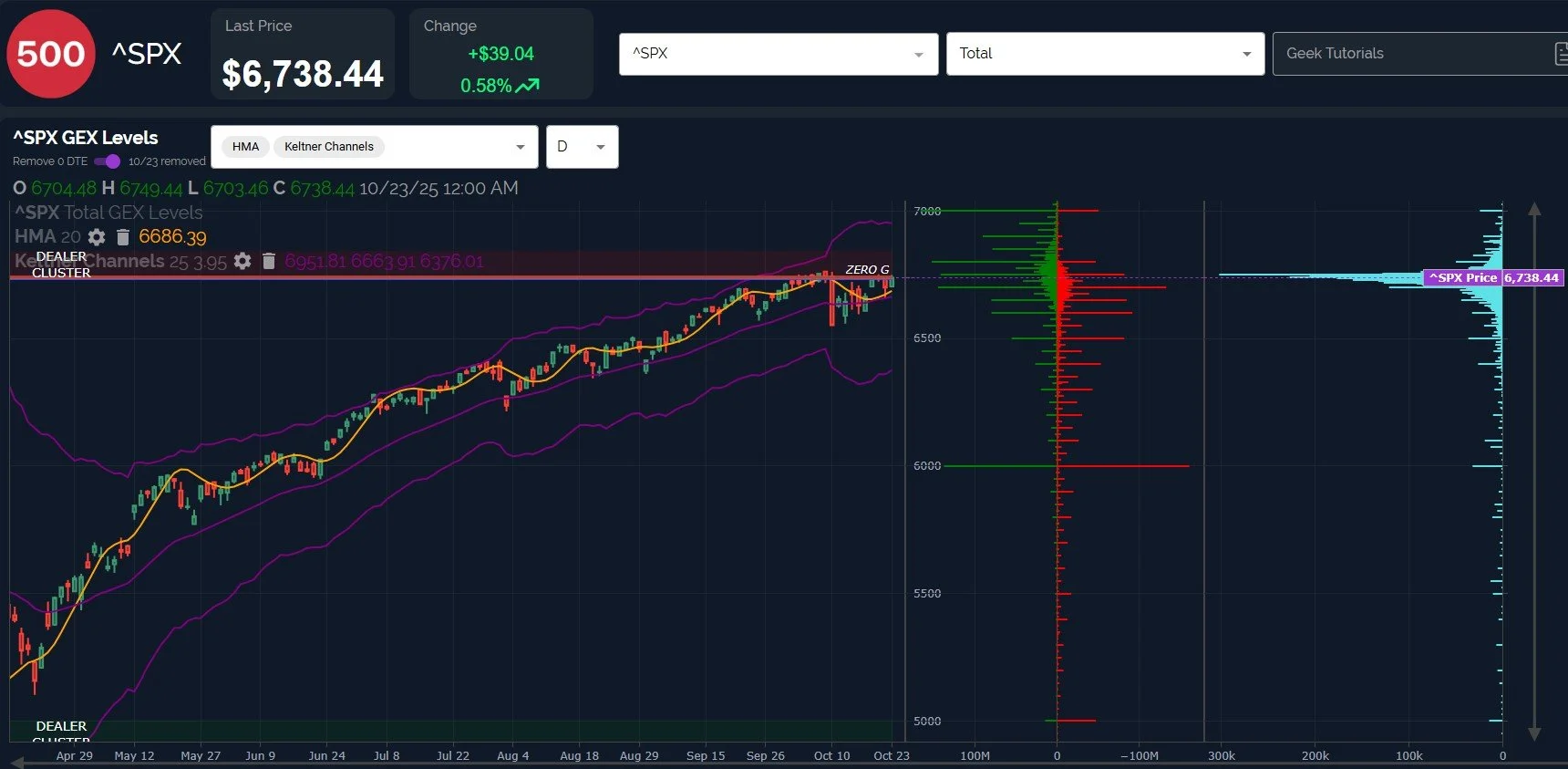

SPX technically looks like it has potential to rally, holding the daily Hull and regaining positive GEX territory.

The technical counterpoint would be that we may be seeing what amounts to a bear flag coming off of the big red candle 2 Fridays ago, and we still haven’t overcome the previous high at 6764.

Bringing GEX back into the picture, net GEX is barely positive, and we are already in the upper Dealer Cluster zone, meaning we could see dealer behavior shift into “sell mode” or further sideways consolidation until the GEX picture shifts again.

6750 and 6800 remain significant levels that may prove to be resistance areas.

A loss of the 6700 area again as well as the Hull at 6686 raises the odds of further downside, but until then, we respect the choppy uptrend and we won’t become interested in shorting without further evidence that another move lower is in the works.

Similar story for QQQ: Holding the Hull, unable to overtake highs (for now), and actually, today’s high was lower than yesterday’s high.

QQQ can certainly reach 615-620 and we would still be within the upper Dealer Cluster zone.

A loss of 606 and especially 600 will increase the odds of continuation lower.

IWM is now painting a more concerning short-term picture. While we mentioned this yesterday, we now see today’s retest of the Hull acting as resistance.

It’s entirely possible for IWM to overtake the Hull, and it wouldn’t be surprising to see this happen premarket tomorrow, so both possibilities of heading higher to 250 or rejecting here and heading toward 235-240 may begin with a gap in either direction with CPI being reported.

GEX slightly improved today, but it’s still net negative for IWM.

Let’s end the newsletter with a reminder of the bearish seasonality for this week and the fact that QQQ and SPX are in their upper Dealer Cluster zones with the VIX having already been crushed this week: An argument can be made that the risk tomorrow is still to the downside.

We will look at the opening GEX picture and share it in Discord for those who can find their way into the server (link below)!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.