Bulls Are Winning, But TIme For A Breather: October 27 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout!

In tonight’s YouTube video, we analyze what just happened with major indices as well as covering a few of the Magnificent Seven names, so check it out if you get a chance!

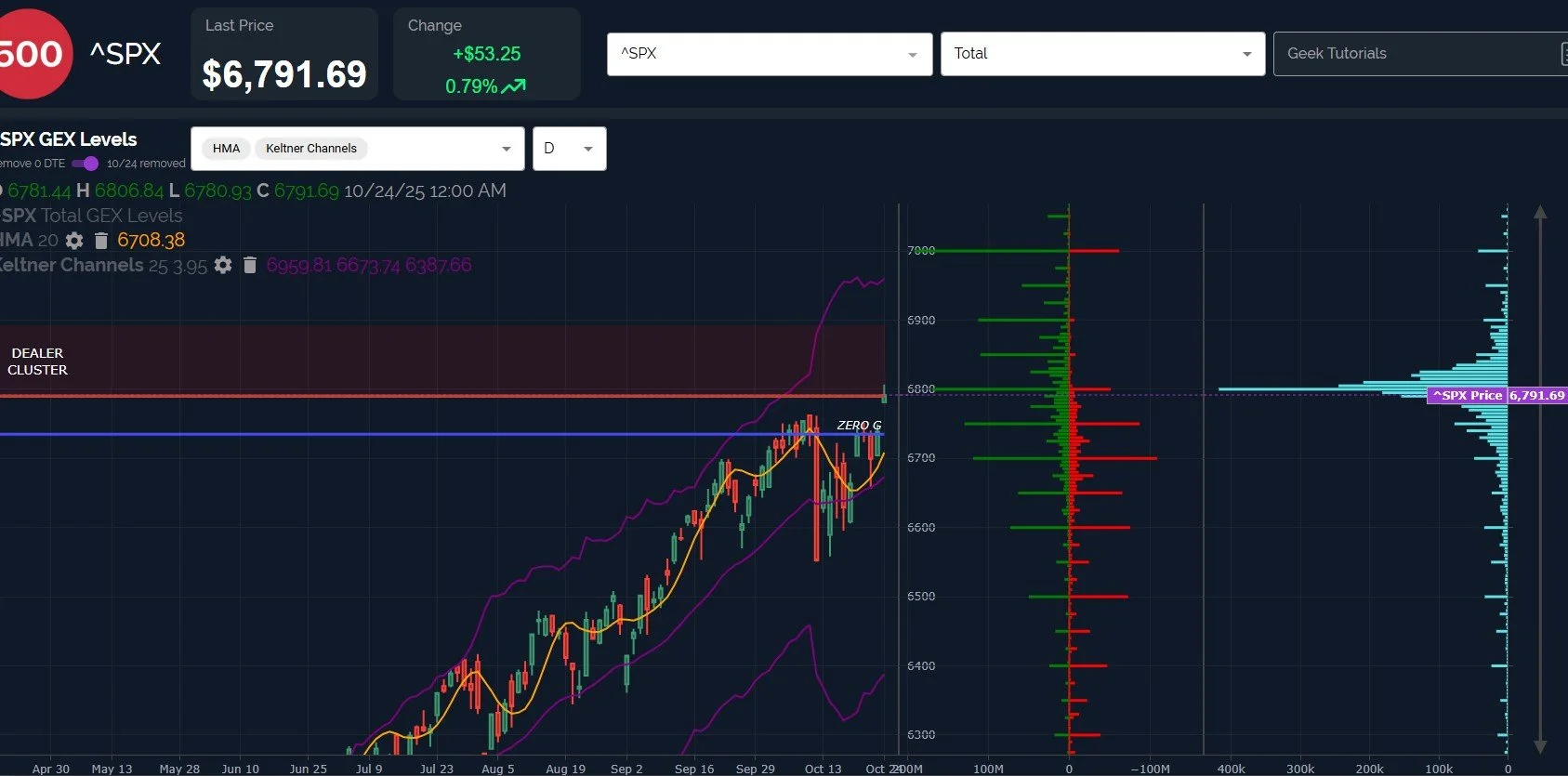

Friday saw a big gap up following CPI, and SPX was able to mostly maintain that gain, finally reaching the 6800 level we’ve mentioned recently as a possible target if SPX was able to recapture 6750.

Amazingly, we see substantial GEX now at 6850-6900, so SPX can climb deeper into the upper Daler Cluster zone, which shifted higher with Friday’s move.

Big positive and negative GEX still existst at 6700, making 6700 a continued line in the sand to watch for positive or negative bias.

Looking at the historical net GEX picture, Friday’s close saw SPX net GEX close at the highest reading since 10/8. 10/8 was two days before a big drop, by the way. Will big positive GEX act as a contrarian signal this time as well? We will likely find out soon.

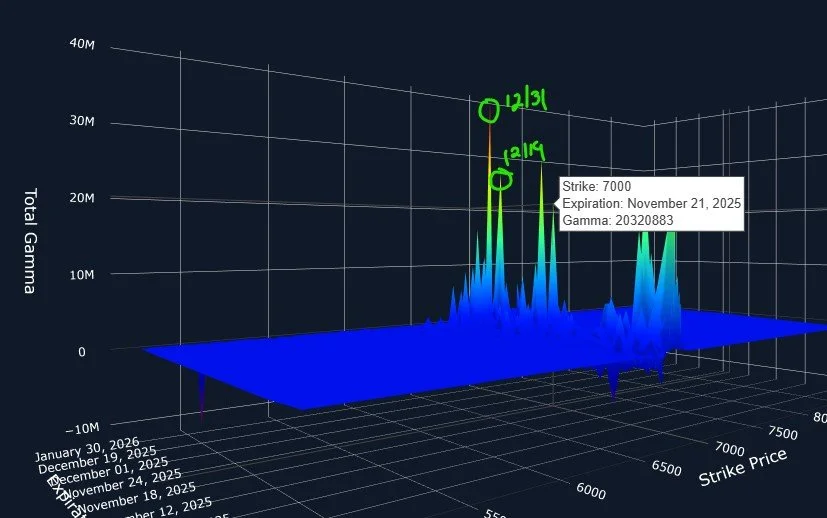

We see a notable shift in SPX GEX clusters looking toward year end, with 7000 now represented in meaningful GEX quantity at the November 21, December 19, and December 21 expirations.

This shift certainly raises bullish possibilities of a tag of 7000 as soon as a month from now, but we also have reliable prior guideposts in the form of the 4-hour Keltner channels saying that indices are right now at a point of consolidation. Will it matter this time?

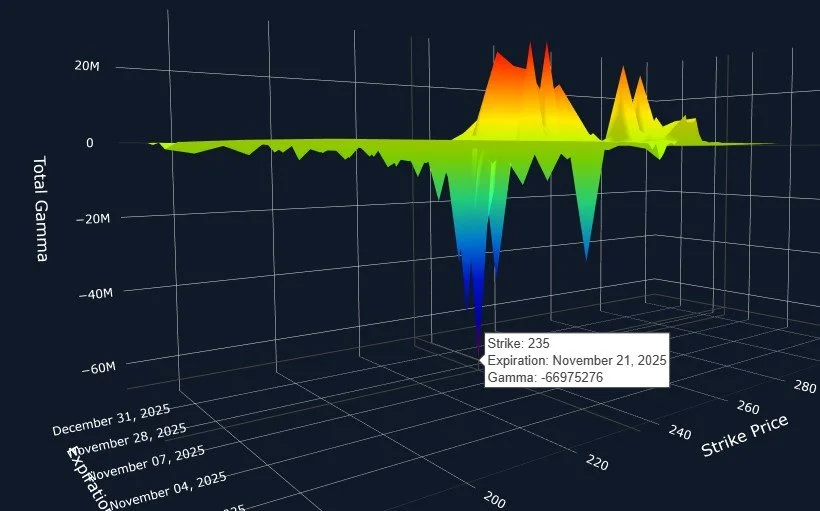

We mentioned that it wouldn’t be surprising to see IWM gap up above 250, which it did, but of course IWM faded to close just under the big 250 GEX cluster.

The Hull Moving Average is still quite far away from the current price, raising the odds of price meeting that average in some way, whether the Hull begins rising or price drops back down.

IWM still seems to paint a more bearish picture, with 235 representing the largest negative GEX cluster looking out a month, almost 15 points below the current price.

235-240 are still at risk below 250, though tonight’s futures action seems to raise the odds that IWM overtakes 250 in the morning.

While the VIX closed below the Hull and the 9-period SMA, which is bullish for indices, we want to be watchful of the VIX 15-16 area, which appears to have a lot of negative GEX associated with those strikes and makes it less likely that we dip beyond those slightly lower levels.

A cursory glance at the last years worth of big red weekly VIX candles reveals at least part of the following week is likely to see further downside pressure on the VIX, though the downside seems to be diminished when the Hull is in an uptrend, so this may be an interesting week in both directions.

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.